(Note: If you are considering getting into buy-to-let or already are a landlord then I suggest you take advantage of this FREE buy-to-let mortgage consultation*).

Is buy-to-let a good investment?

There was a time when buy-to-let investment was very popular, with many people remortgaging their main residence to finance the purchase of a buy-to-let property. As we recovered from the financial crisis and property values were on the rise, together with the leverage obtained by way of a mortgage, buy-to-let investments were booming. In 2014, concerned that the buy-to-let sector was fuelling house-price inflation, the government began a phased introduction of new rules on the taxation of income from residential rental properties.

The phased introduction of these new tax rules ended in April 2020, by which time you could no longer deduct any of your mortgage expenses from rental income to reduce your tax liability on a rental property. Instead, landlords would receive tax credit based on 20% of the mortgage payments which is less generous for higher-rate taxpayers.

Despite the changes to taxation, a buy-to-let property can still be a good investment as long as you understand the following points:

Instabilty

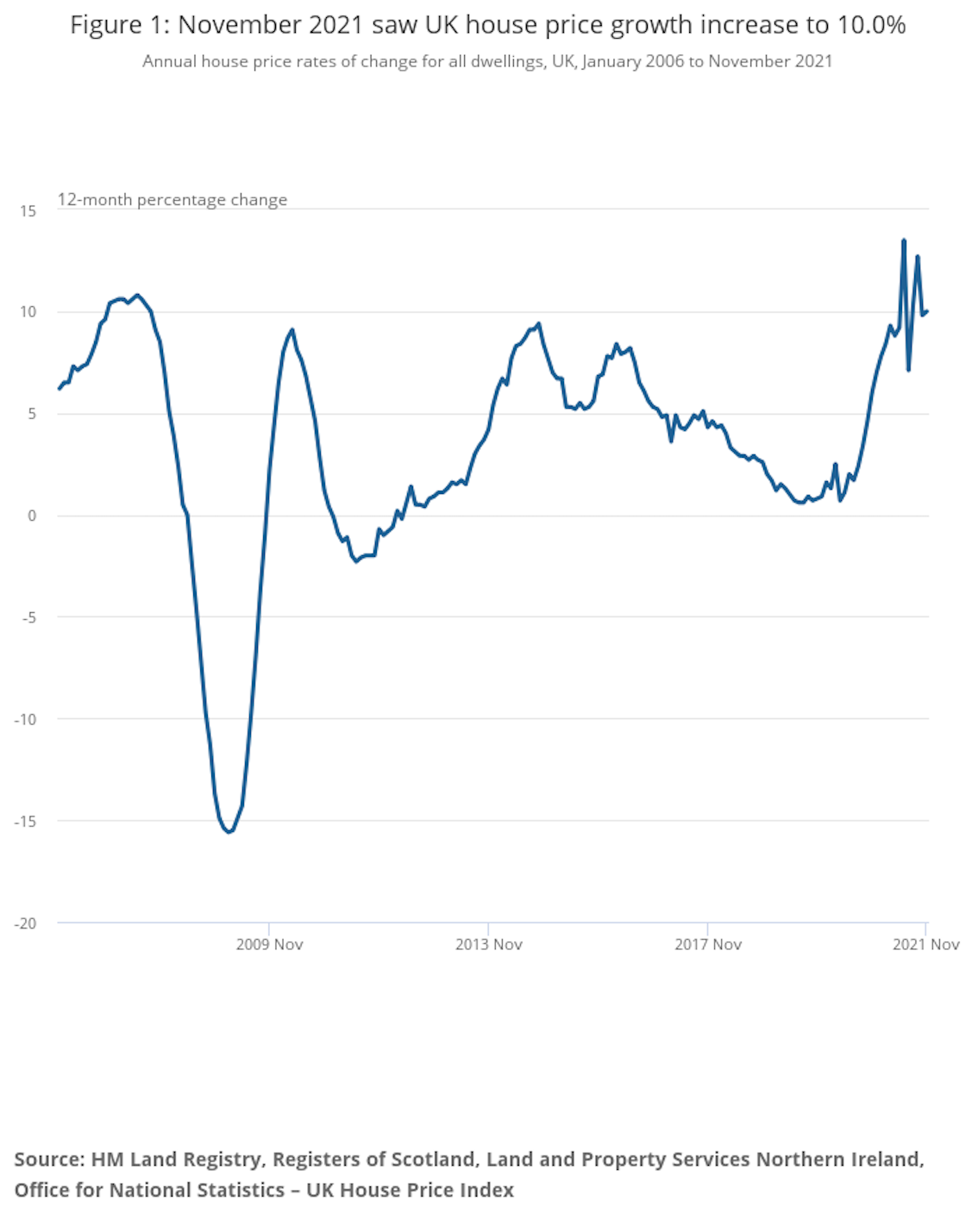

It can be easy to forget that property prices do not just go up all the time. There have been periods when property prices have fallen, as well as longer periods when prices have just moved sideways. The interest in buy-to-let investment tends to peak when property prices are in a period of growth and investors are in danger of viewing it as a 'get-rich-quick' opportunity. Like all investments, buy-to-let is a long-term project which can provide income and growth.

At the present time, rental yields are high due, partly, to the inability of many first-time buyers to obtain a loan to purchase a property of their own. A sizeable deposit is now required by lenders to secure a mortgage, which is beyond the reach of many would-be-purchasers. This will not always be the case and a time will come when tenants will be thin on the ground resulting in falling buy-to-let rents.

Cyclical nature of markets

Both property prices and buy-to-let rental yields are cyclical, so you need to view this investment as a long-term one. If you are the type who wants to jump in and out of investment in the pursuit of profit, buy-to-let is probably not for you. Property is not a liquid asset and trying to offload your investment in times of trouble may result in you making an overall loss. The period from putting a property on the market to completion of the sale can be several months.

The graph below shows the house price percentage inflation since Jan 2006 to Nov 2021. This graph indicates perfectly how the growth in the value of houses is not just a straight line but fluctuates quite dramatically over time, driven by economic or other factors. This graph shows clearly both the impact of the financial crisis in 2008 and the house price rise driven by the removal of Stamp Duty in 2020.

Void periods

It is unrealistic to assume that your buy-to-let property will be let out at all times. The rental market is fluid with tenants changing properties quite regularly due to family or work issues, so you will need to finance your buy-to-let property during these periods. Also, read my article "Rent guarantee insurance - what is it? And is it worth buying?"

What returns can I expect?

Yield

The return on your buy-to-let investment is called the rental yield and is dependent on a number of factors - type of property, location, market conditions and condition of the property.

Gross yield

The gross yield of a buy-to-let property is the annual rent divided by the purchase price, expressed as a percentage.

The table below shows the average rental yield in 2021 for various locations in the UK:

| Region | Average rental yield |

| London | 2.83% |

| South East | 3.27% |

| South West | 3.70% |

| West Midlands | 3.85% |

| East Midlands | 3.80% |

| East | 3.41% |

| North East | 3.46% |

| North West | 4.69% |

| Yorkshire and the Humber | 4.56% |

| Wales | 4.31% |

| Scotland | 4.54% |

Net yield

The net yield is the annual rental income on your buy-to-let property, minus costs such as mortgage payments, repair costs, fees and void periods divided by the purchase price, expressed as a percentage. Gross rentals yields in the UK are running at around 3.5%, but the net yield can be a lot less if your costs are high or you experience long void periods. Cheaper buy-to-let properties will provide a better annual yield and I recommend that you look for a rental yield in the region of 130-150% of your mortgage payments.

But as I've mentioned, the location of your buy-to-let property will influence your return.

Will you need a mortgage to purchase your buy-to-let property?

If you are not fortunate enough to be able to finance the full buy-to-let purchase price with your savings then you will need to secure a buy-to-let mortgage or a remortgage on your current property. You will require a minimum deposit of 25% purchase price to secure a buy-to-let mortgage. Remember the higher the deposit you can put down on your purchase, the better buy-to-let mortgage deal you can secure.

I suggest you take advantage of this FREE buy-to-let mortgage consultation to find out how much a lender will lend to you and to secure the best deal.

What are the costs involved?

Initial costs

Substantial resources are required to purchase a buy-to-let investment property. Firstly, if requiring a mortgage, a lender will likely require you to fund a deposit of 25% or more before they will consider your loan application (more on this below). In addition, there are the usual costs involved in a property purchase - survey fee, stamp duty, legal costs, mortgage admin fee and insurance.

Letting costs

Once you have purchased your buy-to-let property there are further costs involved before you earn any return on your investment. You will need to clean the property and carry out any repairs, purchase furniture, appliances and equipment your tenant will expect. In addition, you will need to pay for a Gas and Safety report to comply with legislation. If you are letting privately then there will be advertising costs, or instead, you can pay the fees for a letting agent to find a tenant. There are also fees involved in carrying out an inventory, drawing up a tenancy agreement and obtaining references.

Running costs

Some buy-to-let properties cost more than others to maintain depending on the age, condition and other responsibilities, such as lifts in apartment blocks. The single biggest cost is likely to be your mortgage repayments and at present mortgage rates have risen considerably so it is clear to see that you need to make allowances if there are further significant rises over the coming years. You will also need to insure the property and its contents, plus it is wise to consider public liability insurance and rental insurance. If the property is leasehold you will also have to pay an annual ground rent and service charge.

What are my responsibilities as a landlord?

If you are planning to become a buy-to-let landlord for the first time then you need to be aware of your legal responsibilities regarding any properties that you are offering to let.

Here are your main responsibilities detailed under the various categories.

Electricity - Electrical Equipment (Safety) Regulations 1994

-

Electrical supply and appliances within a property must be 'safe'.

-

All electrical appliances must be checked at regular intervals for defects (e.g. frayed wiring, poorly fitted plugs). Although there is no statutory checking procedure or timescales, it is strongly recommended that an annual check is carried out by a qualified electrical engineer, records of the checks should be kept and available for inspection if required.

-

Any unsafe items must be removed from the property prior to offering it for rent.

-

It is advisable to fit smoke alarms to all properties and include these in the annual check to ensure they are working.

Gas - Gas Safety (Installation and Use) Regulations 1998

-

All gas appliances and associated pipework and flues should be maintained to ensure they are safe to use. An annual inspection by a qualified Gas Safe gas engineer is now a requirement by law.

-

A Gas Safety Record (GSR) must be kept with the dates of inspection and any defects identified. This record must be provided to the tenant upon signing the tenancy agreement.

-

A gas appliance with an open flue must not be installed in a bedroom.

-

Where a gas meter is installed in a meter box the tenant should be supplied with a suitably labelled key to the box.

-

After work is carried out on any appliance, a specified series of safety checks must be carried out by a qualified Gas Safe gas engineer.

-

Instructions on how to operate all gas appliances must be provided to the tenant.

-

Any gas appliance that is known to be faulty or wrongly installed must not be used and should be repaired or removed immediately.

-

All gas appliances require ventilation to work correctly and safely, so care must be taken to ensure vents and air bricks are not blocked.

-

Failure to comply with the safety regulations above is a criminal offence and could result in a large fine or even imprisonment.

Furnishing - Furniture and Furnishings (Fire and Safety) Regulations 1993

-

All beds, mattresses, headboards, scatter cushions, pillows, stretch or loose covers for furniture, children's furniture, garden furniture must carry the appropriate labels for fire compliance.

-

The regulations do not apply to furniture manufactured prior to 1950, bedclothes, loose covers for mattresses, curtains, carpets, sleeping bags and cushion covers.

Tenants deposit

-

Any tenant's deposits must be paid into a government-approved tenancy deposit scheme within 30 days of receipt.

-

Failure to comply could result in a financial penalty of up to three times the amount of the deposit.

Penalties

If any buy-to-let landlord flouts the above regulations then they leave themselves vulnerable to any, or all, of the following courses of action:

-

Fine

-

Imprisonment

-

Civil damages claim by a tenant

-

Potential manslaughter charges

-

Invalid insurance

-

Criminal record

If you are a buy-to-let landlord you may consider letting your property to a group of students as this can produce considerably more income than letting to a single person or a family. However, before you embark on this course of action you need to make sure you understand the laws covering 'houses of multiple occupancy' (HMO).

What is an HMO?

An HMO is any house or flat that is occupied by two or more households, is used as their main or only residence and where basic facilities such as kitchen, bathroom or toilet are shared. A household could be a single person, members of the same family living together or partners living together.

An HMO is regarded as a person's main or only residence if :

-

it is their only residence

-

they are living there as a full-time student in further education

-

the accommodation is used as a refuge from domestic violence

-

it is occupied by migrant or seasonal workers

-

it is occupied by asylum seekers partly or fully funded by the National Asylum Support Scheme

Do HMOs need a licence?

HMOs must be licensed if they have three or more stories or are occupied by five or more persons forming two or more households. Local councils have the power to extend these rules to other properties.

What are the requirements to obtain a licence?

The local council must look at the following factors:

-

the suitability of the property for the number of occupants

-

the suitability of the facilities within the property

-

the suitability of the landlord or managing agent to manage the property

-

the general suitability of the managing arrangements

The local council must also set conditions in relation to the facilities in the property to ensure the safety of furniture and gas and electrical installations.

Are there any penalties for a landlord not applying for a licence?

It is a criminal offence to manage a HMO without a licence and if convicted a landlord can be fined up to £30,000

Are there any penalties for a landlord breaching the terms and conditions of a licence?

It's a criminal offence for a landlord to have more occupants than the licence allows and they can be fined up to £30,000 by the local council, or an unlimited fine if taken to court. If the conditions of the licence are breached then the landlord can be fined up to £5,000.

How to be a successful landlord?

If you are contemplating investing in a buy-to-let property there are some key areas you need to address to guarantee a successful outcome to your investment.

Decide your strategy

If you are considering investing in your first buy-to-let property then you will need to decide your investment goals and the strategy you are going to adopt. A business plan needs to be created, well ahead of your initial investment, covering the following areas:

-

How much money are you going to invest in your buy-to-let and will you purchase the property with cash or will you require a mortgage?

-

What is the purpose of the buy-to-let investment, do you want to create a monthly income, capital appreciation, or both?

-

How many properties do you want in your buy-to-let portfolio, are you looking to build a portfolio of properties or just stick with one?

-

What type of buy-to-let property are you going to choose for your investment (houses, apartments, student lets or even commercial properties) ?

-

What is your exit strategy when you eventually need to realise your buy-to-let investment? When and how is this going to happen?

Do your research

-

The motto 'never invest in something you don't understand' was never truer than with buy-to-let. Research, research and then do more research

-

Understand the properties and the locations that will give you the best yields on your buy-to-let investment

-

Understand the problems that can arise in owning a buy-to let property and the timescales in realising your investment when the time comes

-

If you know somebody who has invested in buy-to-let properties then talk to them about their experiences, both good and bad

Choosing the right property

-

Find out what areas are best for buy-to-let rental property yields

-

Do you want a buy-to-let property ready to let or are you prepared to do some work in bringing a property up to rental standard?

-

Do you want to invest in a buy-to-let property close to your home or are you prepared to look elsewhere for the best potential yield?

-

Talk to estate agents about the best buy-to-let properties to buy from their point of view and local knowledge

-

Always buy a buy-to-let property on the basis of rental yield not on the basis of whether you would live in it yourself

Decide what tenants you are going to accept

-

Will you allow tenants with children, pets or who are smokers to rent your property?

-

Will you allow those on benefits to rent your property?

-

Will you let to students?

-

Will you vet the tenants yourself, or will you use a letting agent?

Management company

-

Will you manage the buy-to-let property yourself or are you going to use the services of a letting agent? Read my article "Being a landlord: Using a letting agent vs doing it yourself" for more information.

-

If you use a letting agent, will they manage everything or just the job of finding a tenant and do you know the costs involved?

-

If you are managing the buy-to-let property yourself, do you have a maintenance person or company who can deal with any emergency call-outs?

Do your sums

-

Understand the full cost of buying, such as stamp duty, solicitor fees and any mortgage fees, prior to making your first purchase

-

Understand the ongoing costs such as mortgage payments, insurance costs, maintenance costs, letting agent fees and potential void periods

Understand the legal issues

-

There are legal responsibilities that a buy-to-let landlord must adhere to with serious consequences if ignored

-

Any income or profits from buy-to-let are taxable so read this article for more - "Guide to income tax from a rental property"

Shop around for the best mortgage

-

If you require a mortgage to purchase your buy-to-let property then shop around to get the best deal. First of all, use this calculator to work out how much a lender is likely to lend to you

-

Then source the best deal yourself or employ the services and knowledge of a professional mortgage adviser to ensure you get the best buy-to-let mortgage deal.

Further Reading

- The 27 point checklist of a successful buy-to-let landlord

- Buy-to-let tips: The 8 things that can kill your buy-to-let investment

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - VouchedFor, Habito

Great guide and very thorough. I’ve never seen the graph of gross yields before. Is that average across the UK?

Yes it is