I have written many articles on the the benefits of life insurance, income protection and critical illness yet consumers still need educating on the need for and the affordability of protection insurance. Research carried out a few years ago showed that nearly half of homeowners with mortgages have no life insurance in place. That means upon their death their families could be left struggling to pay the mortgage and keep a roof over their head. A simple life insurance policy would ensure the mortgage was paid off in the event of the policyholder's death.

The myths

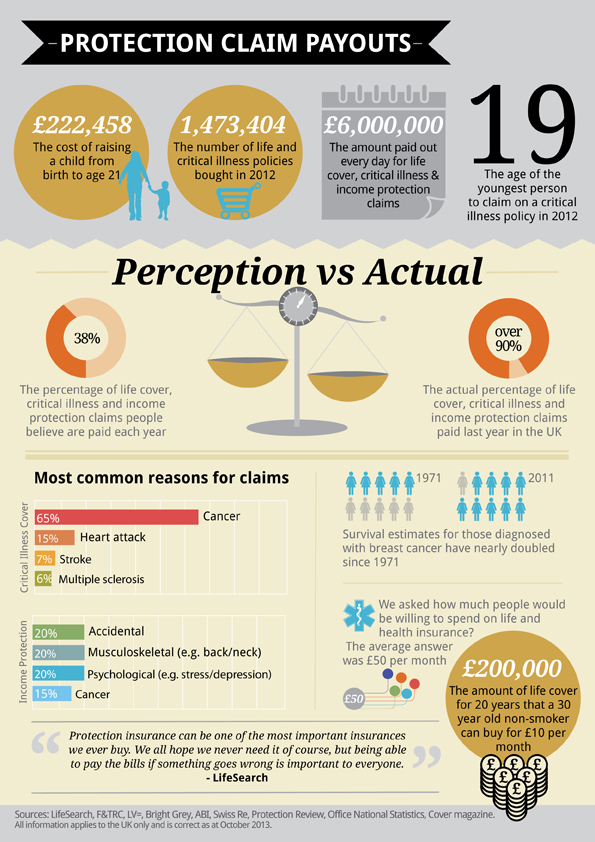

But there are lot of myths surroundings protection insurance. For example do you think the public would be more willing to buy protection if they knew that the successful claim rate under these policies was in fact over 90%, as opposed to the 38% that they believe it is. Given that, in my experience, it is perhaps one of the most cited objections to taking out protection policies I think challenging their misguided perceptions would make a difference.

Lifesearch, the life insurance broker, is doing just that and has produced an excellent infographic (see below) which highlights the reality of protection policies versus the public's perception. Have a read, of the infographic as well as the articles below and ask yourself whether you have sufficient protection cover in place, and if not why not?

FURTHER READING

- Complete guide to life insurance and how much you need

- Critical Illness cover - what is it and is it worth having?

- A guide to income protection insurance

Infographic - Protection claim payouts

90% claims paid each year is very encouraging and that people are prepaired to pay £50 a month for their cover especially when they believe only 38% of claims are actually paid out, nice graphic.