80-20 Investor officially launched to DIY investors in January 2015. Since then 80-20 Investor has gone from strength to strength in terms of members and also in performance and the value it adds.

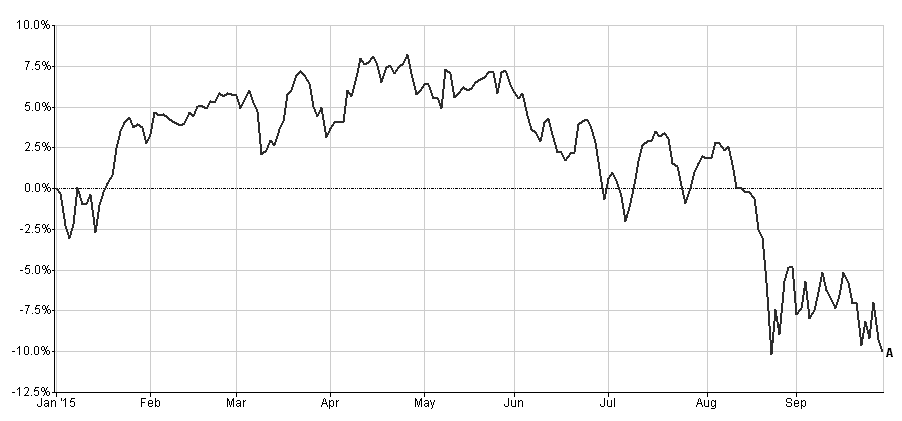

I recently highlighted how the Best of the Best Selection had outperformed during its first year. But how did the 80-20 Investor Selection fare during the recent market sell-off which saw markets globally fall by more than 10%? At the time of writing, the FTSE 100 is currently down over 16% since its April high, as shown in the chart below (click to enlarge it).

If the 80-20 Investor portfolio had managed to outperform both the market and the average managed-fund manager during such a dramatic sell-off that would be quite something, right?

80-20 Investor's outperformance during the market sell-off

We produce the Best of the Best Selection as a shortlist of the best funds highlighted by our 80-20 Investor algorithm split into high, medium and low risk categories. This shortlist is updated at the start of every month.

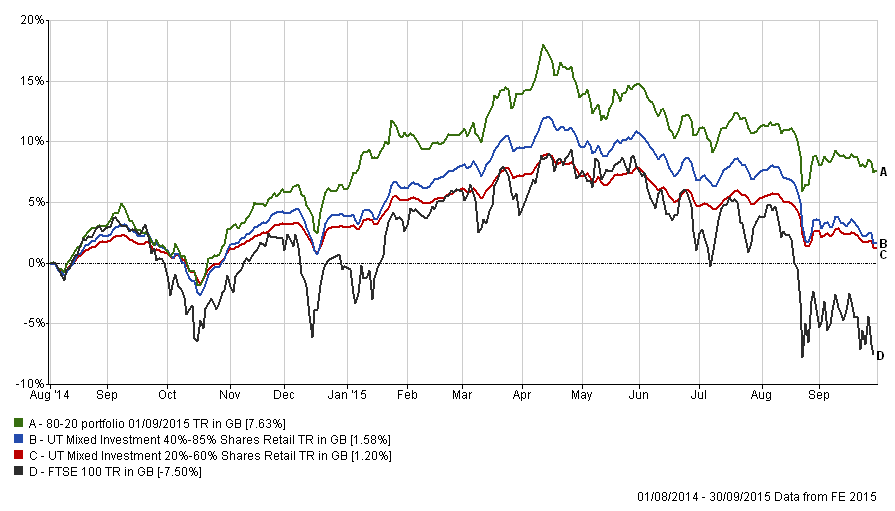

The green line in the chart below shows how a portfolio would have performed over the last year if it had been split equally between the Best of the Best Selection funds and then switched each month when each new shortlist was published. I have also charted the performance against that of the FTSE 100 (the black line) and the average balanced managed fund (red line) and the average managed fund with up to 85% equity exposure (blue line). In reality the 80-20 Investor's asset allocation typically lies between these two as it usually has 60-85% exposure to equities at any one time (currently it has an 80% exposure to equities). So they provide a good comparison of how fund managers with a similar remit have fared over the same period.

As you can see, since launch in August 2015 the 80-20 Investor portfolio has outperformed the average UK fund manager by 6.43%! Yet what is even more impressive is that the margin of outperformance has widened since the market crash started. Prior to the crash the level of 80-20 investor outperformance was 5.85%. As I mentioned above, the level of outperformance is now 6.43%

So not only has the 80-20 Investor algorithm outperformed when markets rallied but also when they crashed.

Just one of the funds helping 80-20 Investor's outperformance

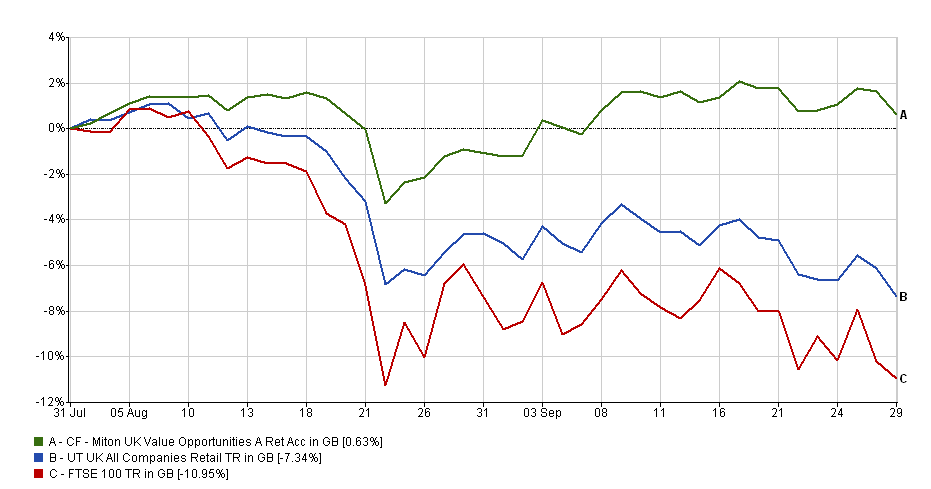

DIY investors need to realise that not all funds are equal. Occasionally even when UK equities plummet there are funds which buck the trend. One such fund, which was identified by the 80-20 Investor algorithm, that has been in the 80-20 Investor Selection throughout the market sell off is CF - Miton UK Value Opportunities.

The chart below shows how the fund has performed during the market sell-off. The green line is the performance of CF - Miton UK Value Opportunities versus its peers (blue line) and the market (red line). Click image to enlarge.

Of course it's not sensible to just invest in one fund which is why the 80-20 Investor Best of the Best Selection picks a shortlist of funds (at least 20) from which to build your portfolio.

New 80-20 Investor Best of the Best Selection out today

Today we have updated the 'Best of the Best Selection'. The new shortlist is available to 80-20 Investor members. You can view the full list of funds by claiming your free trial of 80-20 Investor. Full details of how to claim are given below.

Claim your free trial of 80-20 Investor now

You can claim your FREE 30 Day trial of 80-20 Investor here.

How 80-20 Investor will help make you a better investor:

- It's designed to help you make investment decisions in minutes (when you want) - letting you enjoy life

- It will quickly tell you exactly what funds to buy and when with clearly displayed data, based on our unique algorithm.

- 80-20 Investor will help protect your money from a severe market crash by telling you when to sell via email - NO ONE ELSE DOES THIS!

- It does not matter where your existing investments are held (be it through the likes of Hargreaves Lansdown or otherwise). Anyone can use 80-20 Investor

- You will also receive weekly & monthly newsletters

- 80-20 Investor is independent & we analyse 1,000's of investment funds every week including unit trusts, investment trusts & ETFs

- Regular exclusive research & market commentary which is regularly sought by the national press including The Times & The Telegraph

- Access to regular DIY investment lessons. Lessons learned from a career in investment research & talking to fund managers, which are built into 80-20 Investor

- 80-20 Investor members can even submit research requests. Think of it as having an investment expert in your pocket (the service is optimised for smartphones, tablets as well as laptops)

- Access to see the holdings within our £50,000 portfolio which is run live on the site so you can see how we successfully run our own money