I've broken down this PensionBee review into sections but I suggest that you read the full review from beginning to end because, in short, I think PensionBee is suitable for certain people but not all (I explain who exactly in the full review).

If you want to jump to a particular part of this PensionBee review then use the links below.

- How does PensionBee work?

- What's the difference between the PensionBee plans

- What are PensionBee’s fees and how does it compare?

- PensionBee investment performance

- Who should consider using PensionBee?

1 minute summary - PensionBee Review

- PensionBee* can help you to find old pension pots, consolidating them into one easy-to-manage and low-cost pension plan

- Simply provide as much information as you can including your employer name, the dates you were employed and pension provider if known. PensionBee will track down your old pension and begin the process of transferring it, notifying you if they find any exit fees in excess of £10. You'll also be notified if your pension has any special benefits or guarantees.

- PensionBee has 8 plans of varying risk levels to choose from and includes both a Fossil fuel free and Sharia compliant plan

- Fees range from 0.50% to 0.95% depending on the plan you choose. Fees are halved on all investments over £100,000

- Plans can be managed online or via the PensionBee app*

Who is PensionBee?

PensionBee is authorised and regulated by the Financial Conduct Authority and has amassed 210,000 since it was launched in the UK in 2014. Based just outside of London's financial centre it is attempting to innovate the UK pension industry by making it easier for people to locate and consolidate their existing pension plans. In April 2021, Pensionbee floated on the London Stock Exchange.

What does PensionBee do?

Most UK consumers only engage with saving for their retirement when they are enrolled into their employer's pension scheme. With most adults in the UK changing employers every few years it means that they can end up having several small pension pots stuck in past employers' pension schemes. Typically people lose track of these pensions over time and forget that they even have them (or they've lost touch with the previous companies that they've worked for) when they come to retire. However, it's not just an issue at retirement. Many of these pension pots will languish in poorly performing pension funds with high charges. It is therefore important that consumers review their pension planning which includes finding and optimising their existing pension plans and consolidating them where it is appropriate. By doing so they can ensure that they minimise the impact of high investment charges while optimising investment performance and the growth of their pension pot. At present, you can trace lost pensions using the free pension tracing service but it is a long-winded process and then you are still left with deciding what to do with them.

With only 1 in 10 UK consumers seeking financial advice it means that most UK consumers are not planning for their retirement. Historically pension products have been a minefield of high charges, hidden caveats and complex legislation. However, in the last decade I've seen this radically change thanks to regulatory changes, increased competition between pension providers and technology.

PensionBee is harnessing all three of these to provide a service that will locate your existing pension pots and consolidate them into a new low-cost pension plan (I look at their charges and performance later in this article). The first thing to point out is that PensionBee does not provide financial advice. Where this becomes an issue is if you have an existing final salary pension or a pension with over £30,000 of guaranteed benefits then current pension rules stipulate that you have to take financial advice before you can transfer it. While PensionBee can facilitate the consolidation of any of your other pensions I would suggest that you speak to a financial adviser if you are unsure. If you don't have a financial adviser already then we have secured a limited number of FREE 30 minute phone consultations* with qualified financial advisers.

For those people with existing personal pensions or money purchase arrangements from past employers then PensionBee can consolidate these at no initial cost, into a cheap pension plan which is managed by a third party investment company (i.e. BlackRock, HSBC, State Street Global Advisors or Legal & General). Having grilled the founders of PensionBee, its desire to champion the consumer is central to its business. It's led to lobbying Parliament to facilitate faster pension switching (on a par with current account switching) because, despite the wave of new entrants, facilitating a pension transfer is still a time-consuming and laborious process.

It is important to point out that there is nothing to stop you from using PensionBee to consolidate your pension plans into a low-cost pension and ultimately transfer elsewhere later. PensionBee does not charge you for consolidating your pension nor does it charge exit charges. I was quite frank with PensionBee on this point but it has deliberately set its proposition up this way showing its belief in its product and services. That is probably why PensionBee's proposition has attracted over 220,000 customers in a relatively short space of time and has been scored so highly by its customers on Trustpilot.

It is worth noting that the self-employed can now take out a PensionBee plan without having to consolidate past pensions, but pension consolidation still remains PensionBee's primary focus.

How does PensionBee actually work?

When you first start with PensionBee you have to choose between one of eight plans.

What's the difference between the PensionBee plans

The only difference is the fund your pension pot will be invested in. These are:

- PensionBee Tracker (managed by State Street Global Advisors)

- PensionBee Tailored (managed by BlackRock)

- PensionBee Fossil Fuel Free (managed by Legal & General)

- PensionBee Impact (managed by BlackRock)

- PensionBee 4 Plus (managed by State Street Global Advisers)

- PensionBee Shariah (managed by HSBC Global Asset Management & State Street Global Advisers)

- PensionBee Preserve (managed by State Street Global Advisers)

- PensionBee Pre-Annuity (managed by State Street Global Advisers)

Here is a brief explanation of how each plan is managed:

The PensionBee Tracker plan invests your money in global shares, bonds and cash, following the world's markets as they move. It is described as a medium risk plan and invests in a mix of assets, including equities and bonds. The plan is managed by State Street Global Advisors and PensioBee suggests that it should be suitable for those that want a cost effective ‘set and forget' investment.

The PensionBee Tailored plan is often referred to as ‘lifestyling' in the rest of the pension industry. The further you are away from your chosen retirement age (i.e the younger you are) the more investment risk you can afford to take. That's because while riskier assets (such as shares) provide a better opportunity to make more money than safer assets (such as bonds and cash) they also carry a greater risk of falling in value. The younger you are the more time you have for your portfolio to bounce back. Conversely, the older and closer you are to retirement the less investment risk you want to take. Lifestyling automatically moves your portfolio from riskier assets to safer assets the older you get which is sensible. PensionBee's Tailored plan does just that. However the plan isn't bespoke to you as a person but rather you are placed in a version of a BlackRock Lifestyling fund where the maturity date is similar to your retirement age. Then 10 years prior to retirement the fund starts taking less risk.

The PensionBee Fossil Fuel Free plan was launched in December 2020 and is a socially responsible plan that excludes companies that violate the UN Global Compact. It excludes all companies that have ‘proven' or ‘probable' reserves of coal, gas or oil, as well as international tobacco companies and companies that manufacture controversial weapons. The plan passively tracks the FTSE All-world TPI Transition ex Fossil Fuel ex Tobacco ex Controversies index; an index designed to invest money in companies aligned with the Paris Agreement.

The PensionBee Impact plan is its newest plan, launched in February 2023. It is designed to actively invest only in companies that are intent on generating positive, measurable social and environmental impact. In order to be considered for inclusion in PensionBee's Impact Plan, companies are required to demonstrate that they’re helping to create real change by meeting the strict set of criteria laid out in the Global Impact Investing Network (GINN) framework.

The PensionBee Shariah plan is as you would expect, a plan that invests money into Shariah-compliant companies and is aimed towards people who wish to invest according to their faith and those that want to invest responsibly.

The PensionBee 4 Plus plan aims to achieve long term growth of 4% per year by actively managing your money over a range of investments. The range of assets are adjusted on a weekly basis depending on market conditions and PensionBee say that this plan could be suitable for ‘anyone who is considering accessing their pension in the near to medium term and wishes for their returns to be actively managed by experts in the meantime'.

The PensionBee Preserve plan makes short-term investments into credit-worthy companies, focusing on reducing risk and thus preserving your money. This plan is very low risk and will typically return less as a result.

The PensionBee Pre-Annuity plan invests money in bonds to provide investors with returns that broadly correspond with the cost of purchasing an annuity.

PensionBee does not provide any risk profiling or recommendations as to which plan would suit you and so it would be wise to look at each plan to see which one is likely to help you meet your investment goals. We have analysed each of the PensionBee plans and provided the current asset mix in the table below.

Asset mix of each PensionBee plan

| Asset Type | Equity | Fixed Income | Cash | Other |

| PensionBee Sharia Plan | 100% | 0% | 0% | 0% |

| PensionBee Tailored Plan (40 yr old)* | 86% | 12% | 0% | 2% |

| PensionBee Tracker Plan – Asset Mix | 80% | 20% | 0% | 0% |

| Pensionbee Impact Plan | 100% | 0% | 0% | 0% |

| PensionBee Preserve Plan | 0% | 100% | 0% | 0% |

| PensionBee Pre-Annuity Plan | 0% | 99% | 1% | 0% |

| PensionBee Fossil Fuel Free Plan | 100% | 0% | 0% | 0% |

| PensionBee 4 Plus Plan – Asset Mix | 71% | 15% | 7% | 7% |

*The PensionBee Tailored plan asset mix changes as you get older. We have used an example asset mix based on a 40 year old

Consolidating your pensions

After you have chosen your desired plan you then provide as much detail as you can about your existing pension plans you wish to consolidate. PensionBee will then begin finding your existing pension plans and will notify you if any of them have guaranteed benefits or exit penalties over £10. Assuming there are no hurdles then it will get on with the task of facilitating the transfer of your pensions into the PensionBee pension plan you've selected. Once the wheels are set in motion you don't need to do anything but all the while you are free to change your mind within 30 days.

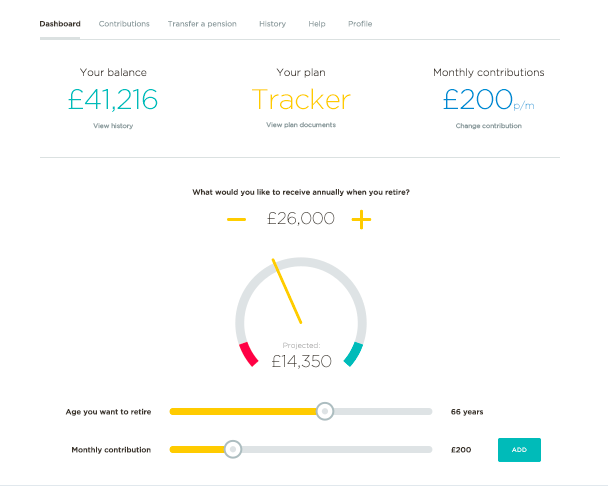

Eventually you can then manage, top-up and view your PensionBee pension online (as shown below) or via their smartphone app. The latter is particularly attractive for those who wish to make adhoc pension contributions, such as the self-employed (who in fact can now open a PensionBee pension without needing to transfer an existing pension).

What is PensionBee’s fee and how does it compare?

PensionBee's charges range from 0.50% to 0.95% a year depending on the plan you choose and it will halve the fee on all investments over £100,000 (so if you had a pension fund worth £150,000 in the PensionBee Tracker plan, you would be charged 0.50% on the first £100,000 and 0.25% on the remaining £50,000) If you click through to the PensionBee charges page* you can check the fees for each plan and they are very competitively priced, especially when compared to other pension providers such as Hargreaves Lansdown* and Nutmeg. Based on PensionBee's stated charges it would make its pension product one of the cheapest in the market.

PensionBee portfolio performance

PensionBee has a number of plans which have limited performance history so it's not possible to analyse past performance to the level that I normally would in such a review. In addition, the Tailored plan's asset mix, which determines the plan's performance, depends upon your age. However, PensionBee provides factsheets for each fund*, which give some insight into past performance where available.

However I have been able to analyse the PensionBee Tracker plan, using third-party data, and compared it against the average active managed fund and the leading passive tracker fund with equivalent equity exposure. Active funds are those run by fund managers who make judgement calls on where to invest and typically are more expensive (between 1.5 and 2.5% per annum).

Passive funds on the other hand simply track chosen market indexes and are run by computer algorithms. Therefore they are cheaper to run (as low as 0.20% per annum). PensionBee uses passive funds. There is much debate over whether active fund managers deliver the outperformance they promise, all the while making themselves huge profits from their high fees. Over the long term they don't, but over the short term they occasionally do.

The PensionBee Tracker plan invests in the State Street Global Advisors Balanced Index sub fund. The table below compares its performance over 1 year, 3 years and 5 years.

| Fund | 1yr performance % | 3yr Cumulative performance % | 5 yr Cumulative performance % |

| Typical multi-asset managed fund | -4.62 | 10.78 | 17.74 |

| PensionBee Tracker | -6.27 | 8.83 | 17.81 |

| Passive tracker benchmark | -2.43 | 18.69 | 31.89 |

For the passive tracker benchmark I used the market-leading Vanguard Lifestrategy 80% equity fund and the Typical multi-asset managed fund was based upon the sector average for the Mixed Investment 40-85% Shares unit trust sector.

The upshot is that the underlying funds used in the PensionBee Tracker fund have outperformed the typical managed fund over 5 years. However, it has underperformed the leading passive tracker fund, but then again nearly all active and passive funds have. So to sum up:

- If you are just interested in growing your pension plans the PesionBee Tracker option will interest you or possibly the Fossil Fuel Free plan if you want to invest ethically

- If you want to manage downside risks while growing your money then PensionBee Tailored or PensionBee Preserve are likely to appeal

PensionBee vs the Government’s Pension Dashboard

One of the criticisms that have been pointed in the direction of PensionBee is whether the government's planned Pension Dashboard will make PensionBee's biggest selling point of finding and consolidating pensions online obsolete. The Pension Dashboard was earmarked for a launch sometime in 2019 and was supposed to allow everyone to see where all their pension pots are, how much they are worth and their potential retirement income. We are now in 2024 and the dashboard has failed to materialise, however, it is worth remembering that even when it does launch, likely to be sometime in 2026, it will simply show information to consumers and won't allow any form of consolidation.

Of course, an individual could take the dashboard information and use other services or indeed a financial adviser to consolidate their pensions. However early prototypes have encountered issues obtaining data from pension providers as well as losing key governmental support, a result of the UK election. The upshot is that the Pension Dashboard is still a fair way off and its functionality is going to be limited.

Who should consider using PensionBee?

If you don't have a final salary pension and are looking to spring clean your existing pension pots and consolidate them then PensionBee is a viable option. This is especially true if you prioritise ease of use, acceptable fund performance and low costs over investment choice and the ability to run your own investments yourself. PensionBee is also the first pension provider to adopt ‘simpler annual statements', a government-led initiative to provide better transparency and control. In addition, the self-employed will also be attracted to the ease of use especially when it comes to topping up their pension in an adhoc fashion via the app. The self-employed can also now open a PensionBee plan without the need to transfer an existing pension across. Have a quick look at PensionBee's FAQ tab* as it covers some important considerations.

PensionBee Pros

- Low cost

- Clear charging structure

- No exit fees or lock-ins

- Simple pension consolidation process

- Decent historical investment performance

- Good customer service and user ratings

- Neat iPhone / Android app and online dashboard making managing your pension simple

- Low hassle factor

- Nothing to stop you using them to consolidate your pensions before moving elsewhere

- Provides ‘simpler annual statements' giving investors better clarity and control

PensionBee Cons

- It doesn't offer financial advice nor can it help with final salary transfers

- Each plan has one fund so what you gain in cost savings and relative performance you lose in investment choice

- The pension product does now offer the ability to withdraw adhoc amounts from your pension when you reach age 55 but it does not offer full drawdown with the ability to set up regular pension withdrawals online. Apparently it is possible to set up regular withdrawals if you call PensionBee. Any adhoc withdrawals are non-advised which means that you have to read and agree to a series of interactive risk warnings before the payment can be processed. If you want to purchase an annuity or transfer your pension pot to another pension provider in order to access full drawdown then you are free to do so. It is worth noting that if you decide to withdraw everything within 12 months of having a live balance, then PensionBee will charge a withdrawal fee of £480. So PensionBee is still best suited to those still growing their pension pot rather than those wanting to take an income from it.

What protection is there if I make the wrong decision or PensionBee goes bust?

PensionBee does not give regulated advice and as such the choice to move your pensions is yours alone. However you can change your mind within 30 days of transferring a pension to PensionBee and it will send the money back to your previous provider, assuming they will accept it, without any charge. If PensionBee was to go bust customers would get back 100% of their pension. PensionBee pensions are protected via the Financial Services Compensation Scheme (FSCS).

PensionBee Customer Reviews

Clearly, PensionBee's customers like its ethos and product. On Trustpilot it is rated as ‘Excellent' and has an average score of 4.6 out of 5.0 from almost 10,000 reviews. Below are some examples of some recent customer reviews.

‘Excellent service getting all my pension in to one easy pension can see daily how it’s all going keep in touch regularly bye emails and easy to contact bye phone calls' – Blaine

‘The set up has been easy and funds have been transferred from disparate pensions from over the years into one pot. Easy to use and hassle free' – Matthew

‘PensionBee was such a simple process for my employer and for my personal transfers. They even worked with my other providers directly on the transfers, where other companies leave the client to resolve all issues. I am really happy that PensionBee did the work for me!' – Brittney

Conclusion

If you are looking for a low-cost hassle-free way to consolidate your pension pots (excluding final salary pension) then PensionBee* is worth considering especially as it does not lock you in with exit penalties. This leaves you free to move at a future date. However, its average investment fund performance, low cost and slick app interface have clearly been integral in it gaining over 220,000 customers so quickly. If you have a final salary pension that you don't know what to do with then read my article ‘Should I transfer my final salary pension‘.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers – Pensionbee, Hargreaves Lansdown