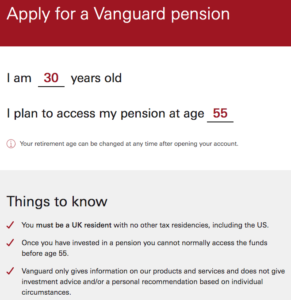

In this article we review Vanguard's SIPP, detailing the cost, minimum investment and the cheapest way to invest in Vanguard funds via a personal pension, which isn't necessarily by using the new Vanguard SIPP. You can jump straight to the section 'How to get the cheapest Vanguard SIPP.

Vanguard launched its Vanguard Investor platform in the UK in May 2017, initially offering an ISA, a Junior ISA and a general investment, with the promise of a pension product in the future and in February 2020, Vanguard finally announced the launch of the Vanguard personal pension.

What type of SIPP does Vanguard offer?

Vanguard offers two types of SIPP. Investors can choose the regular Vanguard SIPP which requires them to choose the underlying investments themselves. Alternatively, investors can opt for the managed Vanguard SIPP where the investment decisions are taken care of by its in-house team of investment experts.

Vanguard SIPP explained - The 'do it yourself' option

Choosing the regular Vanguard SIPP will mean that you handle all of the investment decisions yourself. You'll decide exactly what funds you wish to have in your portfolio and it will be up to you to decide how much you want to hold in each of those funds. While you'll be responsible for the management of your SIPP, you'll be rewarded with lower fees thanks to there being no management charge.

Vanguard Managed SIPP explained - The 'hands-off' approach

Vanguard's Managed SIPP may be a good option for those who do not have the time, experience or inclination to run their own portfolio. You'll first need to answer a few questions so that you can be matched to a portfolio that matches your attitude to risk. There are five managed portfolios available and once you have been matched, your investments will be regularly monitored to ensure your investments keep in line with your risk profile. Vanguard's Managed SIPP is designed to reduce the level of risk as you get closer to retirement. The fee for the Vanguard Managed SIPP is slightly higher than the regular 'non-managed' equivalent as investors are charged an annual management fee of 0.30% on top of the 0.15% account fee. We explain the fees in more detail below.

What are the costs of the Vanguard SIPP?

Below we break down the cost of the two different types of Vanguard SIPP on offer.

How much does the regular Vanguard SIPP cost?

The charges for the regular Vanguard SIPP are as follows:

- annual account fee of 0.15%, capped at £375.

- ongoing fund charges ranging from 0.06% to 0.78% and average out at 0.20%

How much does the managed Vanguard SIPP cost?

The charges for the regular Vanguard SIPP are as follows:

- annual account fee of 0.15%, capped at £375.

- annual management fee of 0.30%

- ongoing fund charges averaging 0.16%

Vanguard does not charge an additional annual SIPP administration fee, unlike many other SIPP providers that usually charge around £10 per month. That being said, it is not necessarily the cheapest way to invest in a Vanguard SIPP which we explain in more detail below.

What is Vanguard SIPP minimum investment amount?

The Vanguard SIPP has a minimum monthly investment of £100 or you can start with a lump sum of £500. Given that Vanguard is well-known for being low cost and is popular among both beginner and seasoned investors, I expected the minimum investment to be lower. There has been a lot of excitement surrounding the Vanguard SIPP and the higher than expected minimum investment means that some consumers looking to start saving into a pension will have to look elsewhere. Interactive Investor, for example, is one of the cheapest ways to invest in Vanguard funds (and can be cheaper than investing via the Vanguard's SIPP) but helpfully there is no minimum investment requirement. Read the section 'How to get the cheapest Vanguard SIPP below.

Alternatively, if you want the cost savings associated with using passive trackers but with someone else making the investment decisions for you then there are robo-advice propositions such as Wealthify which have a minimum contribution of just £1 on their main pension portfolios.

Does the Vanguard SIPP have any setup or exit charges?

No, the Vanguard SIPP has no setup or exit charges. Additionally, there is no annual administration fee and no charge when going into drawdown, a feature that was added in November 2020.

Vanguard personal financial planning service

Having originally launched in April 2021, Vanguard announced that it is to close its personal financial planning service on 31st May 2023, only two years after it was initially launched. Commenting on the closure, Vanguard stated '...after careful consideration, we have concluded that our clients are looking for other, more adaptable forms of financial planning from Vanguard'.

Should I invest in the Vanguard SIPP?

For a full review of Vanguard, check out our independent Vanguard Investor review, which looks at Vanguard as a platform, its products and how it compares to its competitors. Our independent Vanguard review also looks at the fees, the funds available as well as the fund performance and is an essential read if you are considering investing in the Vanguard SIPP. If you like Vanguard funds and cost is an important factor, read on as we explain how you can get a Vanguard SIPP cheaper than investing with Vanguard directly.

How to get the cheapest Vanguard SIPP

Interactive Investor* (also known as ii) is the second largest investment platform in the UK and what makes it attractive is that it operates a fixed monthly fee model, with three different service plans on offer. Most platforms charge a fee based on a percentage of your holding, with Vanguard itself charging a capped 0.15% fee. Our research shows that if you hold more than £104,000 in Vanguard funds, then investing via an Interactive Investor SIPP would actually be cheaper than investing via a Vanguard SIPP. This is because Interactive Investor charges a monthly fee of £12.99 via its 'Pension Builder' plan, meaning the maximum total fees you will pay in a given year is £155.88 compared to a maximum of £375 with the Vanguard SIPP. The other key point is that the Interactive Investor SIPP has no minimum contribution levels, unlike the Vanguard SIPP which has a minimum monthly investment of £100 or a lump sum of £500.

It is worth noting that those holding less than £50,000 in their Vanguard SIPP could technically save money by investing via Interactive Investor. In October 2023, Interactive Investor launched its 'Pension Essentials' plan, charging just £5.99 per month for those holding less than £50,000 in their SIPP. This means that it would be cheaper for investors to hold between £47,925 and £49,999 of Vanguard funds with Interactive Investor. The plan would, however, upgrade to the Pension Builder plan, priced at £12.99, as soon as you hold more than £50,000 in your SIPP.

The other benefit of an Interactive Investor SIPP* is that you have access to a wider range of investments (including ETFs, investment trusts and shares) and not just Vanguard funds (the Vanguard SIPP only offers Vanguard funds). Furthermore, if you change your mind in the future and decide that you would prefer to invest directly into the Vanguard SIPP you can do so without any exit fee.

Another, less popular but cost-effective SIPP alternative is iWeb, however, investors should be aware that it has a far more basic website that is less intuitive and you get none of the interactive tools or market insight that you get with Interactive Investor. It also charges a one-off setup fee of £100.

Vanguard Investor SIPP vs Interactive Investor SIPP

Interactive Investor* charges £5.99 per month for its Pension Essentials plan, aimed at those who hold less than £50,000 in their SIPP. Those holding more than £50,000 will pay £12.99 per month for its Pension Builder plan (regardless of your portfolio size) and investors can choose to add an ISA, trading account or Junior ISA for an additional £9 per month. Vanguard charges a fixed percentage of 0.15% (capped at £250,000, meaning the maximum is £375 per year). There is also an underlying fund charge, but the charge is the same for both Interactive Investor and Vanguard Investor. So, if you intend to invest more than £104,000 into a Vanguard SIPP, then you may as well invest in Vanguard funds through Interactive Investor's SIPP as it will be cheaper.

Of course, if you never plan to hold more than £104,000 in a Vanguard SIPP then you would be better off investing via Vanguard's own SIPP as it would be cheaper. However, one of the advantages of investing in an alternative platform such as Interactive Investor is that you are able to invest in a wider range of funds. With Vanguard you are limited to Vanguard's own funds. Additionally, investing in a SIPP using a platform such as Interactive Investor will give you access to thousands of investment trusts, ETFs and unit trusts from hundreds of investment companies, access to direct share dealing, a wider range of ethical investing options as well as no minimum investment restrictions.

Finally, it is worth noting that neither Vanguard or Interactive Investor charge for going into drawdown. Of course, you are free to transfer from one SIPP provider to another prior to going into drawdown if you want to maximise cost savings pre and post-retirement. Remember the cheapest SIPP pre-retirement is not necessarily the cheapest SIPP post-retirement.

Pros and cons of the Vanguard SIPP

Pros

- low account fee of 0.15%, capped at £375 per year

- no annual administration fee

- no setup or exit fees

- no drawdown fees

- option to choose a 'Managed' SIPP

Cons

- high minimum investment when compared to other SIPP providers

- limited to Vanguard's own funds

- investors with more than £104,000 can invest in Vanguard funds via a SIPP more cheaply elsewhere

Summary

The Vanguard SIPP is a great cost-effective pension product. However, if you like Vanguard funds and are considering investing in a Vanguard SIPP then it may be worth considering opening a SIPP with a platform such as Interactive Investor* or iWeb and we have summarised the reasons below:

- If you have £104,000 or more to invest then it will be likely cheaper to invest in Vanguard funds with Interactive Investor or iWeb than with Vanguard Investor directly.

- More choice as you are not restricted to just Vanguard funds. Via Interactive Investor or iWeb you can invest in thousands of unit trusts, investment trusts, ETFs and shares.

- No exit fee with Interactive Investor so if you ultimately decide to invest directly through Vanguard Investor then you can transfer across without penalty.

- Consider potential drawdown costs before you commit to a provider but ultimately the cheapest SIPP pre-retirement will differ from the Cheapest SIPP post-retirement (see our drawdown comparison article). It is worth noting that Interactive Investor scrapped its drawdown fees in October 2020.

In late 2019 I was personally invited into Vanguard's offices in central London in order to take an exclusive look at the Vanguard SIPP ahead of its launch. I talk more about my visit and provide an early review of the Vanguard SIPP in episode 249 of the Money to the Masses podcast. Check it out below.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses - Interactive Investor