Snoop* was founded in 2019 by former Virgin CEO Jane-Anne Gadhia and ex-Managing Director John Natalizia with the money-saving app later launching in April 2020. Snoop is an iOS and Android app that uses open banking to analyse your spending, suggesting ways to save money across a number of areas of personal finance.

Snoop combines all of your accounts in one place so you can easily see what you're spending and on which card. It also checks and notifies you if you're overpaying on bills and purchases and creates a personalised list of ways you can save money.

Snoop is designed to offer a personalised experience for each user. The app is regularly updated and uses Artificial Intelligence (AI) to learn from the actions of each of its users. In this article we look at how Snoop works, its key features and how it compares to other budgeting apps such as Emma and Moneyhub. For a full comparison to other budgeting apps, read our article, 'Best budgeting apps in the UK'.

1-minute summary - Snoop app review

- Snoop* is a slick budgeting app that uses open banking to connect to your bank accounts and credit cards to help manage your money and provides savings suggestions

- It offers a free plan although with limited features

- The paid plan costs £4.99 a month or £39.99 a year and gives access to all features including unlimited spending alerts and the ability to manually add accounts not supported via open banking

- Those looking for free alternatives could consider an app-only bank such as Starling* that provides some budgeting tools for free

- Moneyhub is a good paid alternative that offers the full range of features you'd expect from a budgeting app at a monthly subscription fee of just £1.49 following a free 6-month trial

Snoop app key features

- View all of your accounts in one place – access all of your accounts from one screen

- Tracking your bills – Activate tracking on your bills and receive reminders to switch and save money

- Create budgets – Keep on top of your monthly spending with monthly spending and category budgets

- Snoop of the day – Get a list of the best deals to save you money

- Save money on your bills – Save money on your household bills with tips within the Snoop app

- Spot unexpected price hikes – Snoop will monitor your bill payments and notify you of any price hikes and any deals that are better value

- See upcoming bills – Have a summary of paid and upcoming bills for the month

- Weekly and monthly spending summaries – know exactly where your money is going each week/month

- Spending categorisation – itemised spending so that you can keep on top of your spending

- Daily balance alerts – daily updates allowing you to spot unusual transactions

- Refund tracking – Snoop can monitor your accounts and alert you if a transaction is refunded (as you are expecting or not)

- Recommend a friend – Get £25 in Amazon vouchers for recommending Snoop to a friend

- Net financial position – see the combined total of all of your connected accounts (Snoop Plus feature)

- Custom categories – customise your spending categories to suit specific events in your life e.g. holiday or wedding savings (get unlimited custom categories with Snoop Plus)

Snoop accounts

The following comparison table highlights the different accounts available with Snoop*. If you would like to upgrade to Snoop Plus you can do so at any time within the app by looking out for the Snoop Plus logo. If you want to cancel Snoop Plus you can do so at any time.

| Snoop | Snoop Plus | |

| Monthly cost | Free | £4.99 or £39.99 a year |

| See all of your bank accounts in one app | ||

| Daily account balance updates | ||

| Automatic spending categorisation | ||

| Monthly and all time spend analysis | ||

| View spending by merchant or category | ||

| Weekly spending report | ||

| Set and track budget for monthly spending | ||

| Set and track budgets for category spending | ||

| Regular payment and subscription tracking | ||

| Weekly reminder of upcoming bills | ||

| Contract renewal reminders | ||

| Exclusive product switching deals | ||

| Daily personalised money-saving suggestions | ||

| Exclusive deals | ||

| Money guidance and insights | ||

| Unlimited custom spending categories | ||

| Manually add accounts | ||

| Track your total net worth | ||

| Track payday-to-payday spending | ||

| Create unlimited custom spending reports | ||

| Create unlimited spending alerts | ||

| Create unlimited refund alerts | ||

| Track bills by pay cycle |

How does Snoop work?

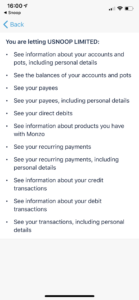

Snoop uses open banking to connect to your bank accounts and credit cards, curating savings suggestions based on your spending habits. Open banking is a secure process that allows third-party apps to access your bank account information without having access to your login details. Permissions are ‘read-only', meaning your money is never at risk.

How do I set up a Snoop account?

To set up a Snoop account you need to download the free app from the Apple or Google Play store. Once downloaded, you'll need to enter your name and mobile number, followed by the secure 6-digit code in order to verify your identity. Next, you need to enter your email address and set up a secure 5-digit PIN to access the app and you may also be given the chance to set up Face ID for the future.

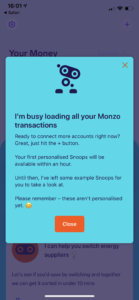

Once set up, you will need to connect to your bank/s via open banking and will be guided through the process by the Snoop app. I connected my Monzo account and you can see the process via the screenshots below.

What banks are supported by Snoop?

Snoop currently connects to most of the large high street banks including American Express, Barclays, First Direct, Halifax and NatWest. It also connects to app-only banks such as Monzo, Revolut and Starling Bank. Here is a full list of banks supported by Snoop.

How much does Snoop app cost?

Snoop* is a free app that can be downloaded on your phone via the Apple or Google Play store. There is the opportunity to upgrade Snoop to its subscription account which costs £4.99 a month (or £39.99) and you can unlock access to additional features.

How does Snoop make money?

Snoop makes money by sharing your anonymised spending data with other companies in order to identify trends. Snoop assures that your data will never be used in a way that allows you to be identified as an individual.

Like most companies, Snoop may receive a payment if you move to a product or service that has been recommended by it. However, Snoop says it remains impartial and only recommends products that are best for the customer.

Additionally, Snoop will earn money from its subscription account which charges £4.99 a month or £39.99 a year.

Is Snoop app safe?

Snoop uses open banking to analyse your spending. This means it cannot see your login information and only has access to your spending data. Snoop does not have the ability to move money from your accounts on your behalf. Snoop is registered and regulated by the Financial Conduct Authority.

Snoop app customer reviews

Snoop currently only has 60 reviews on independent review site Trustpilot. 57% of reviews are 5/5 stars with users calling Snoop a ‘gamechanger' and ‘one of the best personal finance monitoring apps out there'.

About 22% of reviews are 1-star reviews. Customers complain about the confusing way data is presented. Some are hesitant to enter their bank details into the app and talk of a lack of trust in the security of the data. We explain here why Snoop is safe to use.

Snoop also has a rating of 4.6 out of 5.0 rating on iTunes from over 4,400 reviews. Users cite features such as the ‘Snoops' (short insightful tips) as particularly useful. The poor reviews say they had problems being kicked out of the app. Another believed that the app was just pushing affiliate deals to make money.

Snoop app alternatives

Snoop app vs Emma

Snoop* is very similar to the mobile banking app Emma in that it analyses your spending, and since its release has continually improved to offer more budgeting insights on your money. Snoop now offers a host of features with its free plan that Emma users now require a subscription for, such as connecting all of your bank accounts to the app. Like Emma, it does offer a paid-for subscription plan that costs users £4.99 a month (£39.99 a year) and with this you can track your bills by your individual pay cycle and create unlimited spending categories. Emma has three subscription plans to choose from, ranging from £4.99 – £14.99 a month and users now also have the opportunity to open an investment account.

For more information on Emma, check out our independent Emma app review.

Snoop app vs Moneyhub

If you want to have full access to all of the features offered by Snoop app (or indeed Emma) then you will need to sign up for one of their paid subscriptions. However, Moneyhub is great alternative and offers an in-depth analysis of your monthly budget with a low monthly subscription fee of £1.49. New users can also benefit from 6 months free in order to get a hang of the app and how it works. Moneyhub is a cheaper alternative to some of the other budgeting app subscription plans and offers a number of key features including custom categories, spending analysis and a long-term financial forecast. Of course the best option is to download both Snoop and Moneyhub for free and see which you prefer using.

For more information on Moneyhub, check out our independent Moneyhub review.

Pros and cons of Snoop

Below, we list some of the key pros and cons of Snoop to help you make a decision.

Pros of Snoop

- Easy to set up

- Easy to use

- FCA regulated

- See all of your accounts in one place

- Insightful tips to help you save money

- Categorises your spending

Cons of Snoop

- Have to pay a monthly subscription for some features such as personalised payday tracking and unlimited custom categories

- The name ‘Snoop' may be off-putting to some due to its negative connotation

Summary

Snoop* makes it easy to see all of your transactions in one place and provides quick and easy tips on how and where you can save money. It has the added benefit of looking at your bills and suggesting how you can save money by switching providers. It is worth taking a look at alternative budgeting apps such as Emma and Moneyhub to find which one is best suited to your personal circumstances and it is also worth looking at app-only banks such as Starling* and Monzo as they also offer budgeting features and Monzo allows you to see all of your accounts within the app if you sign up to one of its subscription plans.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers – Snoop, Starling