About Simplyhealth

Simplyhealth can be traced back as far as 1872, starting out as the Manchester and Salford Hospital Saturday Fund and the Leeds Hospital Fund, two not-for-profit health insurance savings schemes aimed at low-income workers. Simplyhealth was established as a brand in 2009 where it went on to acquire Denplan as well as taking a majority stake in Ocuplan. Simplyhealth is a B-Corp certified health cash plan provider that offers health cash plans that pay a cash benefit to policyholders. The payments can be used towards the cost of a number of different health treatments, therapies and hospital stays.

Simplyhealth is one of the largest providers of health cash plans in the UK and has over 1 million customers. The Simplyhealth cash plan when chosen with Level 5 benefits is a 3-star Defaqto-rated product while Levels 2, 3 & 4 receive a 2-star Defaqto rating and Level 1 of the plan is rated 1-star. Simplyhealth was awarded the "Outstanding Wellbeing Innovation 2021" award by Cover Magazine as well as the "Best Dental Benefits Provider", "Best Provider of Virtual & Remote Healthcare Provision" and "Best Healthcare Cash Plan Provider" by the Health Insurance & Protection Awards 2020.

Get the best value health insurance

Our partner Howden Life & Health will help tailor cover for you and your family.

- Compare all the top UK providers

- Up to £100 cashback for new customers

- Free Will available

- Quick free quotations

What is a Simplyhealth plan?

The Simplyhealth cash plan is not a conventional health insurance plan that pays for inpatient and day-patient treatment. If you are searching for a health insurance policy that pays for the treatment of medical conditions, you should visit our article, "Which is the best private health insurance in the UK?".

Instead, Simplyhealth offers cash plans that pay a cash benefit to policyholders. The plans aim to cover common health procedures and there are different tiers depending on the health costs you wish to cover. The tiered options mean that customers can pick and choose to create the plan that suits their individual needs.

How do Simplyhealth's Health Plan & Dental Plan work?

Simplyhealth offers a Health Plan that can include some dental benefits and a separate Dental Plan that provides only dental benefits.

Simplyhealth cover can be arranged on a single-person basis by any person aged between 18 and 115 years old for the Health Plan and between 18 and 79 years old for Dental Plan, with options to add your partner and children. Your partner must live with you and children can be added as long as they are under 18 years old, albeit at an additional cost. Simplyhealth cash plans are only available to UK residents and will only cover the cost of medical care that has been provided in the UK.

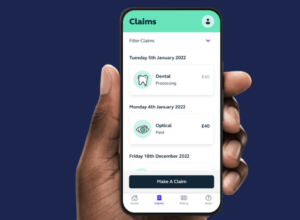

Simplyhealth policyholders can claim back the cash they spend on certain healthcare needs by presenting a receipt through the Simplyhealth app which, once authorised, can be transferred to your chosen bank account.

It is important to note that Simplyhealth does not pay your healthcare provider - you must do this in the first instance and then claim the money back through your health plan.

You are limited to an annual cashback amount per claim and there are five levels of cover available if you choose the Health Plan and four levels of cover with the Dental Plan. Simplyhealth's Health and Dental Plans are available at a set price regardless of your age or health history. We've provided a breakdown of the cost of these plans cover below, including the cost of adding additional family members.

How does Simplyhealth's Health Plan work?

The Health Plan provided by Simplyhealth gives you a choice of five levels of cover that provide tiers of benefits for the different types of claims that you can make.

All levels of the Health Plan includes:

- 24/7 GP access via the SimplyConsult app or via telephone

- Video Physio assessments that triage and refer you for care (up to 8 sessions each year)

- Telephone counselling so that you can access trained counsellors 24/7

- Wellbeing and lifestyle guidance including financial and relationship advice

What does the Simplyhealth Health Plan cover?

| Level 1 | Level 2 | Level 3 | Level 4 | Level 5 | |

| Cover type | Claim limit per person, per annum | Claim limit per person, per annum | Claim limit per person, per annum | Claim limit per person, per annum | Claim limit per person, per annum |

| Hospital admission - daily cashback up to 20 days/nights) | £0 | £20 | £20 | £20 | £20 |

| Optical - sports or everyday prescription glasses, prescription sunglasses and contact lenses | £0 | £50 | £100 | £150 | £200 |

| Dental - checkups and treatment eg: fillings, crowns, bridges, hygienist fees and gum shields | £0 | £50 | £100 | £150 | £200 |

| Therapies - chiropody, podiatry & reflexology | £0 | £50 | £100 | £150 | £200 |

| Prescription charges | £20 | £20 | £30 | £40 | £50 |

| Therapies - physiotherapy, osteopathy, chiropractic, acupuncture | £50 | £50 | £150 | £250 | £350 |

Monthly cost of a Simplyhealth Health Plan

| Cost of Health Plan | Level 1 | Level 2 | Level 3 | Level 4 | Level 5 |

| 1 person | £7.50 | £10.00 | £20.00 | £40.00 | £60.00 |

| 2 people | £15.00 | £20.00 | £40.00 | £80.00 | £120.00 |

| Each child added to the plan | £1.50 | £3.00 | £6.00 | £12.00 | £18.00 |

How does Simplyhealth's Dental Plan work?

The Dental Plan offered by Simplyhealth gives you a choice of four levels of cover that provide money back for your dental care and needs. There is no excess to pay but the cover in some instances is limited to a portion of the overall cost you pay up to the limits that we describe in the table below. You can add your partner and up to four children under the age of 18 to your Dental Plan.

What does the Simplyhealth Dental Plan cover?

| Level 1 | Level 2 | Level 3 | Level 4 | ||

| Cover type | How much of the cost is covered? | Claim limit per person, per annum | Claim limit per person, per annum | Claim limit per person, per annum | Claim limit per person, per annum |

| Dental checkups, examinations and x-rays | 100% of costs up to limits | £45 | £75 | £105 | £135 |

| Scale and polish including hygienists fees for maintenance | 75% of costs up to limits | £35 | £65 | £95 | £125 |

| Treatment including dentures, fillings and periodontal care | 50% of costs up to limits | £200 | £400 | £600 | £800 |

| Crowns, bridges, inlays and onlays | 50% of costs up to limits | £200 | £200 | £300 | £400 |

| Accident - if you see a dentist or doctor within 30 days of the event (cover is worldwide for trips of up to 28 days) | 100% of costs up to limits | £5,000 |

|||

| Emergency consultation due to pain or need for urgent treatment (cover is worldwide for trips of up to 28 days) | 100% of costs up to limits | £500

|

|||

| NHS hospital admission | Maximum of 20 day/night claims each year | £50 per day/night |

|||

| Mouth cancer | Claimable once only during your policy lifetime | £5,000 |

|||

Monthly cost of a Simplyhealth Dental Plan

| Cost of Dental Plan | Level 1 | Level 2 | Level 3 | Level 4 |

| 1 person | £11.55 | £18.90 | £27.50 | £35.20 |

| 2 people | £23.10 | £37.80 | £55.00 | £70.40 |

| Up to 4 children (cost does not change if less than 4 children are added to the plan) | £4.00 | £7.00 | £10.50 | £16.00 |

How to claim with Simplyhealth

If you have medical treatment that is covered by your Simplyhealth Health or Dental plan, you will pay for this in the first instance and then submit your receipt via the Simplyhealth app to claim the cash. Remember, you may not be covered for the total amount and will only receive an amount of cash within the limits for that particular claim. Once your receipt has been processed and your claim is agreed upon, you will be sent the cash directly to your chosen bank account.

What isn't covered by Simplyhealth?

Like most health and dental insurance plans, the Simplyhealth plans will not cover all situations that result in a medical fee. There will be instances that are not covered by the policy which include:

- Treatment that is planned before the start of your policy

- Treatment that was arranged during the qualifying period

- Treatment outside of the UK

- Treatment that has been paid for using a voucher, coupon or points

- Cosmetic dentistry procedures

Besides these general exclusions, there are specific exclusions and qualifying periods for some of the covers offered which you can find in the terms and conditions of the policy.

When can I make a claim on my Simplyhealth plan?

The Simplyhealth cash plan provides some benefits as soon as your plan is started but any treatment that was arranged before the plan start date is unlikely to be covered.

The Dental Plan will allow you to make claims for checkups and maintenance as soon as your plan starts. However, it has a qualifying period of 3 months from the start for any dental treatment that you have had or was arranged during this period. If you have not seen a dentist for two years preceding the start of your Dental Plan, you will not be able to claim against any treatment.

Simplyhealth customer reviews

Simplyhealth is rated 4.5 out of 5.0 stars on independent customer review site Trustpilot, based on over 3,600 customer reviews. The reviews are largely positive with over 75% of customer reviews awarding Simplyhealth with 5 stars. Many positive reviews mention how easy it is to make a claim via the app with speedy payouts made directly into customers' accounts. Around 10% of the reviews awarded Simplyhealth 1 star, with some experiencing issues when trying to speak to someone in customer service at Simplyhealth.

Is Simplyhealth any good?

Simplyhealth can be a great alternative to conventional health insurance plans if you simply wish to cover some or all of the cost of general medical needs. Of course, some people may be put off by the fact that you have to pay for any treatments up front before claiming back the cash that you are covered for. However, Simplyhealth tries to make this as simple as possible through its app. If you want to cover ad-hoc medical costs, Simplyhealth can be a good solution at a reasonable cost but if you want peace of mind that you could fund private medical treatment that you cannot afford to pay for, you may have to look for a full health insurance plan.

If you are unsure, you should speak to a health insurance specialist* who offers both types of health insurance so that you can understand what may and may not be covered while balancing this with your priorities and budget. We explain how to do this below.

How to apply for a Simplyhealth cash plan

The application for Simplyhealth's plan is fairly straightforward and you can complete this online directly with Simplyhealth or through a health insurance broker. The Simplyhealth application does not ask you about your health and takes no more than a few minutes to complete once you choose the level of cover you would like. To make an application you will need:

- Name

- Date of birth

- Details of additional policy members (partner, children)

- Bank account details for direct debit

Health insurance can be complex and the Simplyhealth cash plan is quite different to most health insurance policies in the market. It can be therefore extremely useful to speak with a specialist health insurance broker who will talk through all of the benefits offered by Simplyhealth to ensure these will meet your requirements. Also, they will be able to compare the plan with other health insurance policies and providers in case an alternative solution may suit your needs better.

At Money to the Masses, we have vetted the service provided by Howden Life & Health* - a leading health insurance specialist - where the advisers are knowledgeable about health insurance provided by different insurance companies. The advisers can answer your questions about what your health insurance will and won't cover as well as recommend the best cover available for what you want to spend. As a Money to the Masses reader, you'll receive £100 cashback when you arrange your health insurance this way - the offer ends on 31st January 2025.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses - Howden Life & Health