Bupa was founded in 1947 and was the result of seventeen British provident associations joining forces to provide private healthcare to the whole of the UK. Initially offering private healthcare to individuals and businesses, Bupa expanded to include privately-run Bupa hospitals, which went on to be sold to Spire Healthcare in 2008.

Bupa remains a prominent and well-respected name in the health insurance industry and continues to serve over 2 million people in the UK as well as many more customers worldwide.

In this article we take a look at Bupa health insurance, explaining the benefits, the cost and whether it is worth it. You can also receive £100 cashback* when you buy your health insurance policy (offer ends 31st January 2025).

1 minute summary - Bupa health insurance review

- All Bupa policies include mental health cover, cancer cover and NHS cash benefit

- You only have to pay for the first child you include within your cover and all other children can be included at no cost

- Access to over 270 hospitals on the Bupa ‘Essential' hospital list, over 1,100 on the ‘Extended' hospital list and over 1,300 hospitals on Bupa's ‘Extended + London' hospital choice

- Extensive diagnostics included with Bupa's ‘Comprehensive' health insurance policy

- Basic dental cover with all health plans

- Excess can be from as little as £100

- Bupa ‘Comprehensive' health insurance plan is rated 5 stars by independent financial comparison service Defaqto

- Get an instant online quote* and receive £100 cashback when you take out any private healthcare policy – Offer ends 31st January 2025

What is health insurance?

Health insurance is a personal insurance product that provides you with a cover that will pay for certain medical needs privately if the policyholder requires it. For those who wish to skip NHS queues and access private healthcare, health insurance can provide access at a monthly premium.

Health insurance is an increasingly complex product thanks in part to the increasing number of insurance companies that have entered the market. Competition has helped to drive prices down and to stay ahead, insurers have had to develop innovative features and additional benefits, resulting in a far more comprehensive product. As policies become more complex, it becomes more and more difficult to compare the products online and so we explain later in this article the very best way to buy health insurance to ensure you are getting the best policy at the best price.

Focusing more on Bupa's health insurance, let's take a look at some of the key benefits.

How does Bupa health insurance work?

Bupa offers individual health insurance, couples health insurance, family health insurance and business health insurance. Couples receive a 5% discount and there is a 10% discount for family cover. For the purpose of this article, we will focus on individual health insurance. For family health insurance, check out our article ‘Which is the best family health insurance policy that covers my children?'.

Bupa health insurance plans

Bupa offers a choice of two key health insurance plans:

- Treatment and Care Plan

- Comprehensive Plan

The Treatment and Care cover is designed for those who are happy to be diagnosed by the NHS but would prefer to seek treatment privately. With a treatment and care policy, your scans and consultant appointments would be carried out by the NHS as normal however the policy would then kick in if any treatment is required.

Bupa's Comprehensive policy goes further in that it provides diagnostic tests and scans, out-patient consultations as well as post-treatment tests, scans and consultations. The ‘Treatment and Care' health insurance plan is cheaper than the Comprehensive plan. The table below shows what is covered under each of Bupa's health insurance plans.

Up to £100 cashback on Bupa insurance

Our partner Howden Life & Health will help tailor insurance and policy benefits to suit you, your family and your budget

- Talk to an expert that understands Bupa

- Tailor Bupa to suit your budget & maximise benefits

- Compare all the top UK providers

- Free advice with no obligation to purchase

Bupa Treatment and Care cover vs Bupa Comprehensive cover

| Health cover features | How it works | Treatment and Care Cover | Comprehensive Cover |

| Out-patient consultations | Pays for consultation fees up to the level of your selected outpatient cover | No | Yes |

| Diagnostic tests | Pays for hospital or clinic charges incurred in working out what is wrong | No | Yes |

| Diagnostic scans (MRI, CT, PET) | Pays for specific scans used to work out what is wrong | No | Yes |

| Hospital treatment | Pays for the cost of eligible treatment and care as an out-patient or in-patient | Yes | Yes |

| NHS cash benefit | £50 per night paid for in-patient treatment if you are treated under the NHS (up to 35 nights) | Yes | Yes |

| Mental health cover | Pays for mental health treatment from a consultant, psychiatrist or therapist (limits apply) | Yes | Yes |

| Out-patient therapies | Pays for therapies including physiotherapy, osteopathy and others (limits may apply) | Yes | Yes |

| Post diagnostic tests | Pays for tests and the interpretation of the results of these | Yes | Yes |

| Post diagnosis out-patient consultations | Pays for consultant’s fees after diagnosis | Yes | Yes |

| Post diagnostic scans | Pays for MRI, CT & PET scans after initial diagnosis | Yes | Yes |

| Post-treatment out-patient consultations | Pays for the consultation fees after you have had your treatment | Yes

For up to 6 months after treatment |

Yes |

| Post treatment tests | Pays for any tests required after treatment | Yes

For up to 6 months after treatment |

Yes |

| Post treatment scans | Pays for MRI, CT & PET scans after treatment | Yes

For up to 6 months after treatment |

Yes |

| Cancer cover | Pays for eligible treatment including surgery, chemotherapy, radiotherapy and bone marrow/stem cell transplants. | Yes | Yes |

| NHS cancer cover cash benefit | Pays a cash sum for stays as an in-patient under the NHS as well as various treatments carried out under the NHS | Yes | Yes |

How much does Bupa health insurance cost?

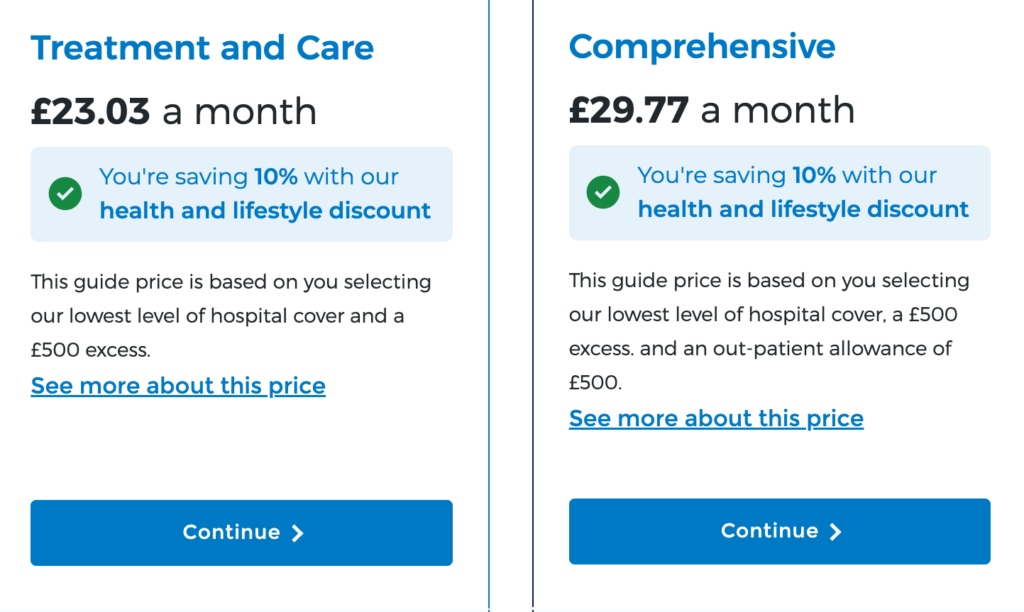

It depends on several factors and includes (but is not limited to) your health, age, smoker status, location and what type of cover you are after. A healthy, non-smoking 30-year-old person would pay between £23 and £31 for basic health insurance, with the ability to include additional cover options which we explain in more detail below. You can qualify for a 10% health and lifestyle discount on the full cost of your Bupa health insurance plan as long as you have not been treated for pre-diabetes or diabetes in the last 2 years and have a body mass index (BMI) of between 18.5 and 24.9.

Monthly cost of Bupa health insurance

| Age of insured person | Monthly premium for Bupa ‘Treatment and Care' health cover^ | Monthly premium for Bupa ‘Comprehensive' health cover^ |

| 30 years old | £23.03 | £29.77 |

| 35 years old | £25.50 | £33.15 |

| 40 years old | £31.28 | £39.29 |

| 45 years old | £37.98 | £46.41 |

| 50 years old | £47.06 | £57.34 |

^ The monthly premiums are correct as of 7th January 2025 and are based on health insurance cover that assumes that you choose the lowest level of hospital cover; you will pay an excess of £500 and no optional extra benefits are included. The Comprehensive cover quotes include an outpatient allowance of £500. All prices are quoted on the basis that the insured person is a non-smoker.

The quotes above indicate the very basic cost of Bupa health insurance cover and you may wish to explore extra benefits as well as a higher outpatient allowance as well as a more extensive hospital list. You may also wish to add your partner to your health insurance policy as well as your children.

You can get a tailored Bupa health insurance quote and compare this against other health insurance providers by speaking to an independent health insurance specialist*. They will be able to access quotes from every single insurance company and so are best placed to find you the most comprehensive cover for the lowest premium possible. Additionally, you'll qualify for £100 cashback if you take out a new healthcare policy before 31st January 2024.

Choosing the NHS cancer cover option can be cheaper but is not available online so you will need to speak to Bupa or the health insurance specialist. We did this and found that choosing NHS Cancer cover plus would only reduce the monthly cost of the cover by around £1 but this could vary for others.

Bupa health insurance – key benefits

When choosing your health insurance you will want to know where Bupa health insurance stands out and there are several key benefits covered by a Bupa health insurance policy including:

- Cover more mental health conditions than any other leading UK insurer

- Cover includes therapies and mental health cover as standard

- Health advice is available 24 hours a day, 7 days a week

- Access to breakthrough cancer drugs and treatment

- Live video GP consultations via the app

- An annual Bupa dental appointment and up to £300 towards some dental treatments

Bupa health insurance – extra benefits

Bupa covers a selection of additional benefits that are included with your health insurance policy whether you choose the ‘Treatment and Care’ or the ‘Comprehensive’ option. These additional benefits include:

- Out-patient therapies

- Treatment at home

- Home Nursing

- Private ambulance

- 24-hour medical helpline

- Bupa Digital GP access

Bupa health insurance flexible options explained

Like most health insurance plans, a Bupa health insurance policy has some flexible features that allow you to tailor the cover to what you need and the price you wish to pay. These include the excess you pay, the hospital network you will have access to, the level of cancer cover and limits to your outpatient payments. We explain each of these options and how they work with a Bupa health insurance policy below.

Bupa health insurance excess

Most health insurance providers allocate an excess which the policyholder pays in the event of a claim. The excess amount that you choose will be the amount that you will be required to pay towards the cost of your medical care before Bupa covers the rest. Bupa's health insurance cover applies the excess in each year of your policy. This means that you only have to pay the excess once in a year even if you were to make multiple claims in that same year. However, should your claim run over a year, an excess would have to be paid in each year of the claim.

Bupa health insurance offers you a choice of excess amounts that you should select based on what you would be happy to afford to pay towards your medical needs in the first instance. The higher your chosen excess amount, the lower the monthly premium that you will pay for your health insurance so it will also help you to select the best value for money.

Bupa health insurance excess amount options

- £0

- £100

- £150

- £200

- £250

- £500

- £1,000

- £2,000

Excess amount options for £1,000 and £2,000 must be requested over the phone as these are not available online.

Bupa health insurance cancer cover

Although cancer is covered under both the ‘Treatment and Care' and ‘Comprehensive' health insurance contracts with Bupa, you can choose an NHS Cancer cover plus option.

Bupa Full cancer cover

If you select this option, which is automatically included if you quote online, you will receive the following:

- No financial or time limits

- Access to eligible breakthrough drugs and treatments

- Full cover even if your cancer comes back

- Specialist support every step of the way

Bupa NHS Cancer cover plus

If you select this option you will need to be treated by the NHS if you are diagnosed with Cancer. Then, if eligible, you could receive private treatment through Bupa if the radiotherapy, chemotherapy, drug therapy or surgical operation you need to treat your cancer is unavailable on the NHS. It is important to note that a waiting list for NHS treatment will not necessarily prompt Bupa to offer private treatment under this option.

Although selecting full cancer cover will cost you more, we have only selected this option in our cost analysis as there was hardly any cost saving by opting for the limited NHS Cancer cover plus.

Bupa health insurance hospital lists

Hospital lists indicate where you can have treatment, tests, scans and consultations that will be covered under your health insurance plan. Bupa health insurance policies offer a choice of three lists that offer varying degrees of access to hospitals around the UK. Although it can be difficult to predict the hospitals you may need access to in the future, the lists provide an array of hospitals that you should check for practicality. It can be wise to ensure that hospitals in your vicinity are included on the list that you select.

Essential access

- Access to 274 hospitals

Extended choice

- Access to 1,157 hospitals

Extended choice with Central London hospital access

- Access to 1,386 hospitals

The ‘Essential access’ hospital list is the cheapest option; ‘Extended choice' hospital access will cost a little more and the ‘Extended choice with Central London hospitals' will cost you the most.

Bupa Out-patient cover

Out-patient cover which is only available with Bupa's Comprehensive health insurance policy is designed to cover an appointment at a hospital or clinic where you don’t require a bed or need to stay overnight. Bupa offers health insurance customers a choice of different levels of cover for outpatient needs. It can be used for consultations, minor diagnostic tests such as X-rays, blood tests, ultrasounds and therapies. Once you have exceeded the annual out-patient limit, you would need to fund further private tests, consultations and therapies as an out-patient yourself unless you have chosen the Full Out-patient cover that provides unlimited cover and is also the most expensive option available.

The out-patient benefit amount will affect your monthly premium and can be selected from the following four options:

£500 Out-patient cover

- Covers consultations, diagnostics and tests up to £500

£750 Out-patient cover

- Covers consultations, diagnostics and tests up to £1,000

£1,000 Out-patient cover

- Covers consultations, diagnostics and tests up to £1,000

Full Out-patient cover (No limit)

- Covers unlimited consultations, diagnostics and tests.

Bupa ‘pay as you go' healthcare

Bupa offers a ‘pay as you go' healthcare service that allows access to private healthcare without the need for a health insurance policy. Customers can purchase physiotherapy, dental and various private GP services with treatment available throughout the UK.

What is not covered on a Bupa health insurance policy?

Bupa is not unlike most other health insurance policies in that there are occasions where the insurance will not cover you and these include:

- Health screenings and routine tests

- Experimental drugs which are not licensed

- Accident and emergency admissions

- Eyesight correction that is not due to an acute condition

- Sleep related disorders

- Weight loss

- Allergies, allergic disorders or food intolerances

This is not an exhaustive list of what is not covered but it is fair to say that unless your condition is acute and the treatment that you require is proven and eligible for cover, you should not expect your health insurance to cover the cost of it.

As with all health insurance providers, Bupa will not pay any claims arising from pre-existing conditions. This means that if you apply on a moratorium underwriting basis, they will not pay a claim for any condition or injury for which you have sought advice or treatment in the 5 years before joining – claims usually prompt the insurer to check your medical history through your medical records. If you are continuing your health insurance cover from an employer's Bupa health insurance scheme or indeed from health insurance that you currently have with a different provider, it can be possible to continue the health conditions that you are covered for but you should speak with a specialist health insurance adviser to understand the advantages and disadvantages of each option.

To understand more about how health insurance is underwritten, check out our article “How to compare the best private health insurance companies“.

Is Bupa health insurance worth it?

This is a tricky one to answer because the answer will be different depending on exactly who is asking the question. If you can easily afford the premiums and do not like the idea of being put on a waiting list then there are obvious benefits to taking out health insurance. Don't forget that you can tailor the cover to your own needs, meaning you are covered for the things that matter most to you; you don't have to just go for the most expensive option.

Pros and cons of buying health insurance

Pros of buying health insurance

- Quicker access to consultations, scans and treatment

- Specialist referrals at your request

- You may be able to get access to medication or treatment not available on the NHS

- You can cover all your children for the cost of your first child to be covered

Cons of buying health insurance

- Cover can be expensive and the cost increases as you get older

- Does not cover chronic conditions such as diabetes, heart disease, high blood pressure and some cancers

- Existing medical conditions are usually not covered

Where can I buy the cheapest Bupa health insurance policy?

The best way to buy Bupa health insurance is to speak to an independent health insurance specialist as they will be able to guide you through the decision-making process, ensuring that you understand the options and recommend the best policy for your circumstances. Not only that, a specialist has access to the whole of the market so will be able to recommend an alternative policy that may be cheaper or one that provides more comprehensive cover.

Another thing an independent health insurance specialist can do is help with the application forms and they can chase the application on your behalf, meaning you'll often be covered far quicker.

We have partnered with one of the UK's leading private health insurance specialists* to provide you with not just the cheapest, but the most comprehensive policies to suit your budget. All you need to get started is to click on ‘Get health insurance quote'*. You can choose to build your quote or request that an adviser calls you back. You'll also qualify for £100 cashback if you decide to take out a private healthcare policy. Offer ends 31st January 2025.

Bupa health insurance summary

Bupa's name is synonymous with health insurance and it has an excellent reputation for good reason. It has received over 28,000 reviews on Trustpilot, scoring 4.3 out of 5.0, officially rating it as ‘Excellent'. While customers who gave Bupa 5 stars cited the customer service they received at the claim stage, those who have rated it 1 star have said that it was time-consuming and confusing. Having written lots of health insurance reviews and articles on health insurance, this is perhaps the biggest criticism and is why you should consider getting advice before you purchase.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses –Howden Life & Health