Invest in the best with 80-20 Investor

80-20 Investor’s unique algorithm finds the best funds to invest in, doing the hard work for you.

Live progress of the 80-20 Investor portfolio

80-20 Investor vs. The Market

- 93.82%

- Since inception (Aug 2014)

About 80-20 Investor

Invest with confidence

Our investments have a record of outperforming the FTSE 100. Quickly identify investment opportunities from over 2000 funds.

Complete transparency

Full access to the details, performance and transactions of Damien's personal £50k portfolio.

Learning from others

Talk to and swap tips with a friendly community of investors.

Stay ahead

Receive our regular newsletters with all the latest insight, analysis and fund selections plus receive ongoing stop loss alerts.

80-20 Investor FAQs

80‑20 Investor empowers DIY investorsto make investment decisions,

minimising effort while maximising returns.

Through screening thousands of funds, 80‑20 Investor harnesses the power

of momentum investing. To safeguard against market fluctuation,

built-in stop loss alerts can help protect investments.

What you get with 80‑20 Investor

- Exclusive weekly and monthly market insightemails

- Regular investment researcharticles

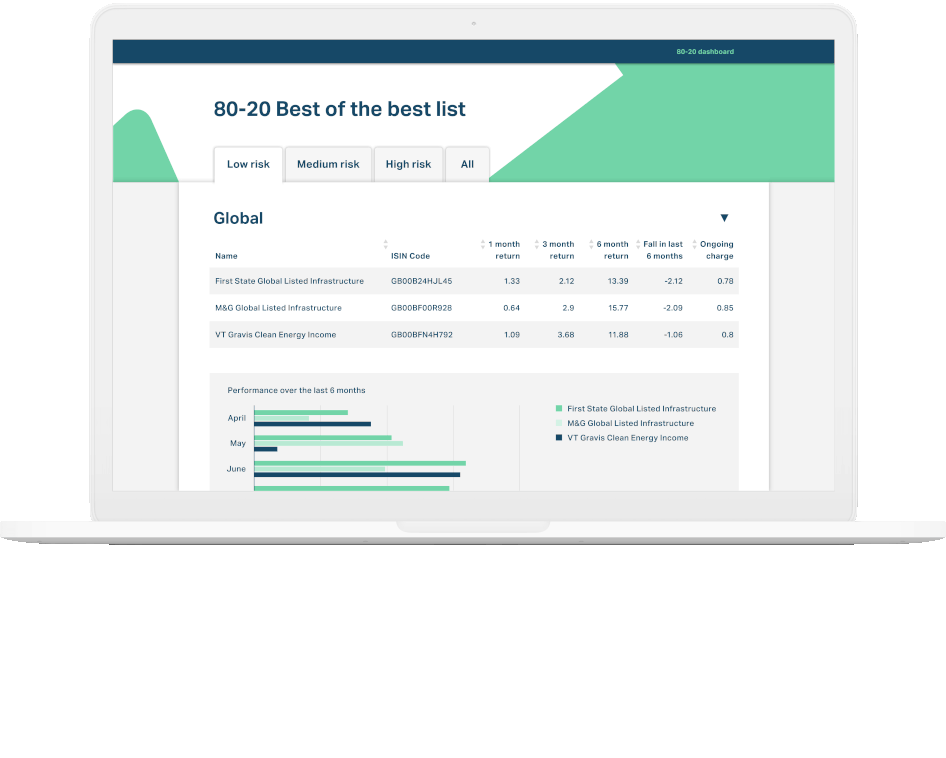

- Monthly ‘Best of the Best’ fund shortlistsplit by low, medium and high

risk - Weekly ‘Best funds by Sector’ shortlist

- Stop loss email alertsto help protect your investments

- Ability to ask questions to Damien Fahy, founder of 80‑20 Investor

- Exclusive accessto see Damien’s £50,000 portfolio and the changes he

makes - Access to ‘Chatterbox’, our online community to exchange ideas

with other investors

Do you have proof 80‑20 Investor works?

We track the performance of our fund shortlist versus the market and professional

fund managers. Unlike any otherinvestment expert or service, to prove

performance we’ve invested £50,000 of real money to show how 80‑20 Investor

can be used to successfully run your own money.

Since it’s initial investment, this portfolio has grown significantly. It

has outperformed the market, passive investing strategies and 90% of professional

fund managers.

In the first 17 monthsthe portfolio made over 11%while the market

made 2.81%.

How much money will I make?

There are no performance guarantees with 80‑20 Investor. 80‑20 Investor

empowers members to make informed investment decisions.

You should never invest more than you can safely afford to lose. The value of your

investment can go down as well as up, so you may get back less than you originally

invest.

What types of financial products are monitored by 80‑20 Investor?

Our analysis covers Unit Trusts, Investment trusts and Exchange-Traded Funds

(ETFs).

How many funds are monitored?

We analyse thousandsof unit trusts, investment trusts and ETFs. We only look

for the best opportunities for UK investors. As we are not linked to any fund

platform or stockbroker our research is truly independentand not restricted

in any way.

What is momentum investing?

Momentum investing is an optimisation strategy based on trends in the investment

environment. It is one of few approaches to consistently outperform

othersover the long term.

The key to momentum investing is identifying the latest trends, riding the best and

strongest until they’ve run their course or better opportunities arise. Due to the

time and data required to do momentum analysis, often only professional investors

and institutions have access to it.

Is 80‑20 Investor just momentum investing?

No. 80‑20 Investor is a unique algorithm which enhances the power of

momentum investing. It considers other investment factors to risk-adjust

for the best performance. The numerical analysis 80‑20 Investor

provides identifies some of the best trends to follow. Other techniques, such

as value investing, can also be effective so 80‑20 Investor provides

analysis on these too.

Does 80‑20 Investor constitute financial advice?

80-20 Investor does not constitute financial advice.

Material in email, on MoneytotheMasses.com or within 80-20 Investor and associated

pages/channels/accounts are for general information only and do not constitute

advice. As such we do not need to be regulated by the Financial Conduct

Authority.

Information provided is not intended to be relied upon by readers in making (or not

making) specific investment decisions. You should get appropriate independent advice

before making any such decisions.

For full details, see our Terms & Conditions,

Privacy Policyand Disclaimer.

How do you make an investment?

80‑20 Investor provides insight and information only. Members make the

ultimate decision and invest via a fund platform or investment broker.

Do I need to use a particular fund platform or broker?

No, as long as they don’t charge you for switching in and out of funds you can use

any fund or investment platform. The most popular investment platform used

by our members is Hargreaves Lansdown because of its wide fund choice.

What’s the minimum amount I need to invest to make 80‑20 Investor

worthwhile?

There is no minimum investment amount. As a guide, typical 80‑20 Investor

members invest £10,000+.

What are stop loss alerts?

80‑20 Investor provides stop loss alerts on our ‘Best of the Best’

selectionto help members avoid a severe market correction. If the

main share price of any of these funds falls by 5%from its monthly high, all

members receive an email. They are a trigger to do a portfolio review and

consider switching funds or into cash.

Can I pay using a debit/credit card?

You can pay directly by debit or credit card through the PayPal payment system. To do

this, you will need a PayPal account, with the money will be taken directly from

your chosen card.

We use PayPal as it has industry-leading security. We do not collect or store

members’ debit/credit card details.

How do I upgrade my subscription?

To upgrade, go to My Account and select the plan that you wish to change to. The

upgrade will come into effect when your next payment is due.

How do I cancel my account?

You cancel your account at any time. To cancel, go to My Account and select ‘Cancel

My Subscription’.

After cancelling your account you will have access to 80‑20 Investor for

the rest of your agreed term. After this, you will no longer have access to paid-for

membership areas. No money will be taken when you reach the end of your agreed

term.

How do I re-join after cancelling my account?

Login and access My Account and select the plan that you wish to sign up for. As you

will have already had a free trial, your first payment will be taken

immediately.

Reviews from 80-20 Investors

About Damien Fahy

Founder of Money To The Masses

An investment veteran of over 20 years who is routinely quoted in the financial press and has made numerous radio and TV appearances, Damien Fahy is regarded as one of the most influential individuals in UK personal finance.

Fueled by a passion to provide consumers with transparent financial guidance Damien helps over 4 million people a year since he quit the City and launched Money to the Masses.

Get our weekly news & money tips email

How this site works...

You should not rely on this information to make (or refrain from making) any decisions. Always obtain independent, professional advice for your own particular situation. Leadenhall Learning (owner of Money to the Masses, 80-20 Investor and Damien’s Money MOT) and its staff do not accept liability for any loss suffered by readers as a result of any such decisions or their use of any information on this site. See full Terms & Conditions, Privacy Policy and Disclaimer.

Money to the Masses is a journalistic website and aims to provide the best personal finance guides, information, tips and tools, but we do not guarantee the accuracy of these services so be aware that you use the information at your own risk and we can't accept liability if things go wrong.

We aim to give you accurate information at the date of publication, unfortunately price and terms and conditions of products and offers can change, so double check first. Leadenhall Learning, Money to the Masses, 80-20 Investor, Damien's Money MOT nor its content providers are responsible for any damages or losses arising from any use of this information. Always do your own research to ensure any products or services and right for your specific circumstances as our information focuses on rates not service.

Past performance is no guarantee of future results. Funds invest in shares, bonds, and other financial instruments and are by their nature speculative and can be volatile. You should never invest more than you can safely afford to lose. The value of your investment can go down as well as up so you may get back less than you originally invested.

We do not investigate the solvency of companies mentioned on our website. We are not responsible for the content on websites that we link to.

80-20 Investor tables and graphs are derived from data supplied by Trustnet. All rights Reserved.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use.

**51% of consumers could save £523.47 on their Car Insurance. The saving was calculated by comparing the cheapest price found with the average of the next six cheapest prices quoted by insurance providers on Seopa Ltd’s insurance comparison website. This is based on representative cost savings from August 2024 data. The savings you could achieve are dependent on your individual circumstances and how you selected your current insurance supplier. 51% of consumers could save £222.30 on their Home Building & Contents Insurance. The saving was calculated by comparing the cheapest price found with the average of the next fourteen cheapest prices quoted by insurance providers on Seopa Ltd’s insurance comparison website. This is based on representative cost savings from August 2024. The savings you could achieve are dependent on your individual circumstances. You could pay from £3.35 per month for Pet Insurance. Price per month for cover based on a dog, Penelope, aged 4 months, no known medical conditions, up-to-date vaccinations, and microchipped. Based on quote data provided by Seopa Ltd during August 2024. The quote price you could achieve is dependent on your individual circumstances.

Leadenhall Learning Limited (trading as Money to the Masses) is an introducer appointed representative of Seopa Limited which is authorised and regulated by the Financial Conduct Authority.

Leadenhall Learning Limited (trading as Money to the Masses) is an appointed representative of Wealthify Limited which is authorised and regulated by the Financial Conduct Authority. Money to the Masses acts as an appointed representative for the purpose of promoting Wealthify products and introducing customers to Wealthify.

Leadenhall Learning Limited (trading as Money to the Masses) is an Introducer Appointed Representative of Creditec Limited who is acting as a credit broker and not a lender and which is Authorised and Regulated by the Financial Conduct Authority (FRN: 972716)