In short I feel that the service that Howden Life & Health provides would benefit anyone looking for the best health insurance policy, whether they are buying their first policy or perhaps looking to save money or improve the benefits on their current private health insurance plan. In fact I have personally used and vetted the advice and services of Howden Life & Health (under its former name Assured Futures) for my own family and continue to use their services each year to ensure I am getting the best health insurance policy for my budget. The advice and guidance that Howden Life & Health provides is free and its expertise in the market ensured that I was able to get the right policy for my family, not an easy task due to my pre-existing medical conditions.

I was so impressed with the service that Howden Life & Health provides that I secured a £100 cashback offer* for our readers, payable on every new healthcare policy (Offer ends 31st January 2025). The following review highlights the benefits, including the pros and cons of using a health insurance broker.

- How does Howden Life & Health work?

- Would you be better off using a comparison site?

- How much does Howden Life & Health charge?

- Pros and cons of using Howden Life & Health

What is Howden Life & Health?

Howden Life & Health (previously known as Assured Futures) is an independent insurance broker that specialises in providing tailored advice on Health and Life insurance products. Its expert advisers can provide personalised quotes over the phone as well as offer expert independent advice on the best health insurance policies for individuals and businesses. Additionally, the Howden Life & Health online portal can provide instant quotes for individuals as well as offering a digital solution for partner companies and websites.

How does Howden Life & Health work?

There are three ways to get in contact with Howden Life & Health. Customers can choose to get an instant online quote, request a callback or they can call Howden Life & Health for free. All three options qualify for the £100 cashback offer*, payable on every new private healthcare policy until 31st January 2025. We explain each of the options in more detail below:

Option 1 - Instant online quote from Howden Life & Health

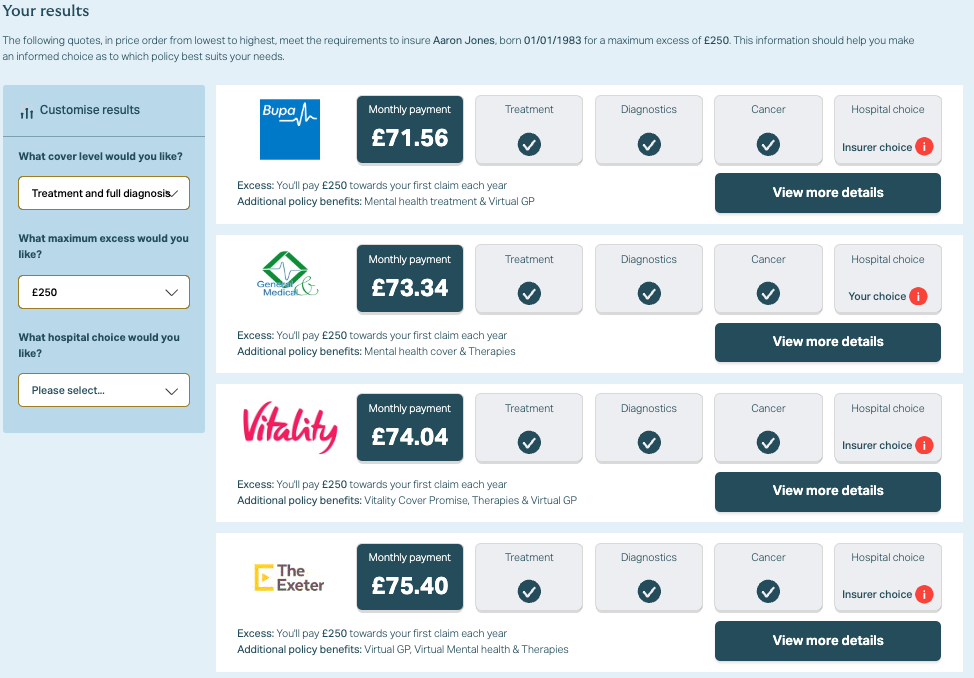

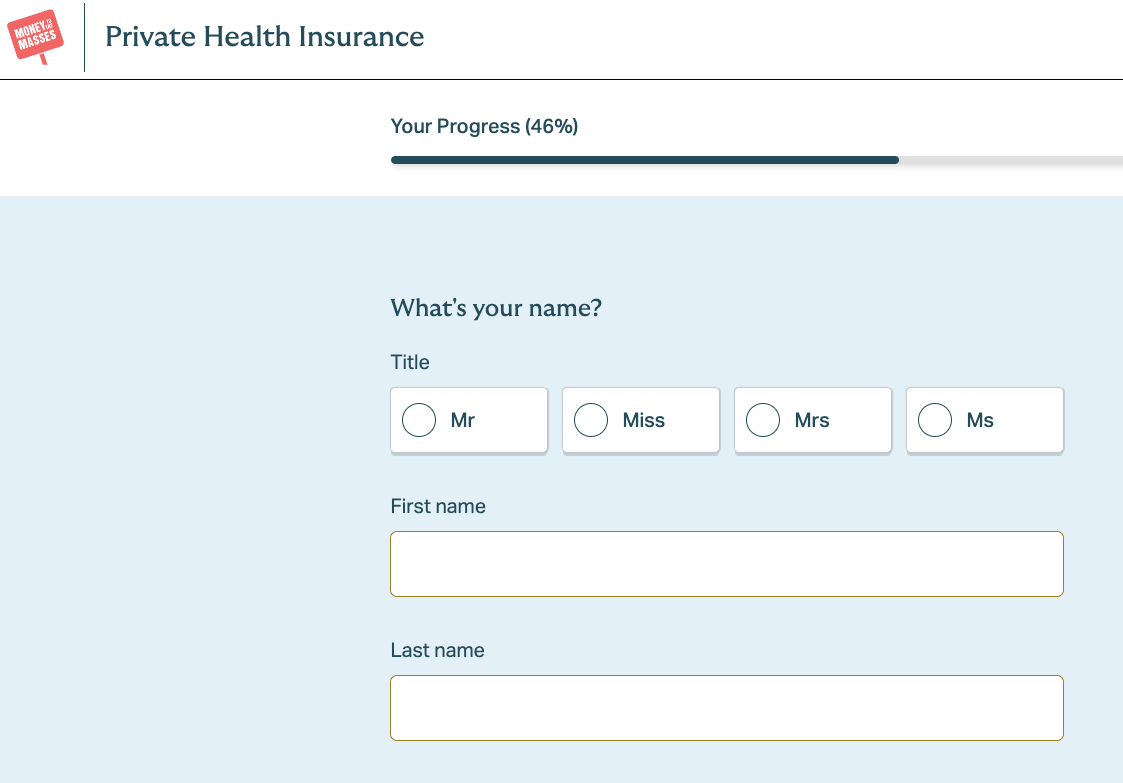

The quickest way to get a quote from Howden Life & Health* is to request an instant online quote. You'll need to submit some personal information including your name, address, age and smoker status. You'll also need to choose your preferred policy excess amount (the amount you have to pay to the insurance company if you make a claim) as well as the amount of cover you require. Once submitted, you'll be provided with a list of insurers, sorted by monthly premium, from cheapest to most expensive. You can read more about each health insurance policy by clicking on "More Details" or alternatively, you can simply apply for the policy you like the look of by clicking on "Apply now". Howden Life & Health makes it easy to amend the quotes by providing a simple drop-down at the top of the page allowing users to amend the type of cover and excess. Customers are also reminded that they can call Howden Life & Health at any stage to receive free and impartial advice.

Getting an instant online quote from Howden Life & Health is quick and easy and is perfect for those who have an idea of the type of cover they need and who just want to compare the cost of the best health insurance policies.

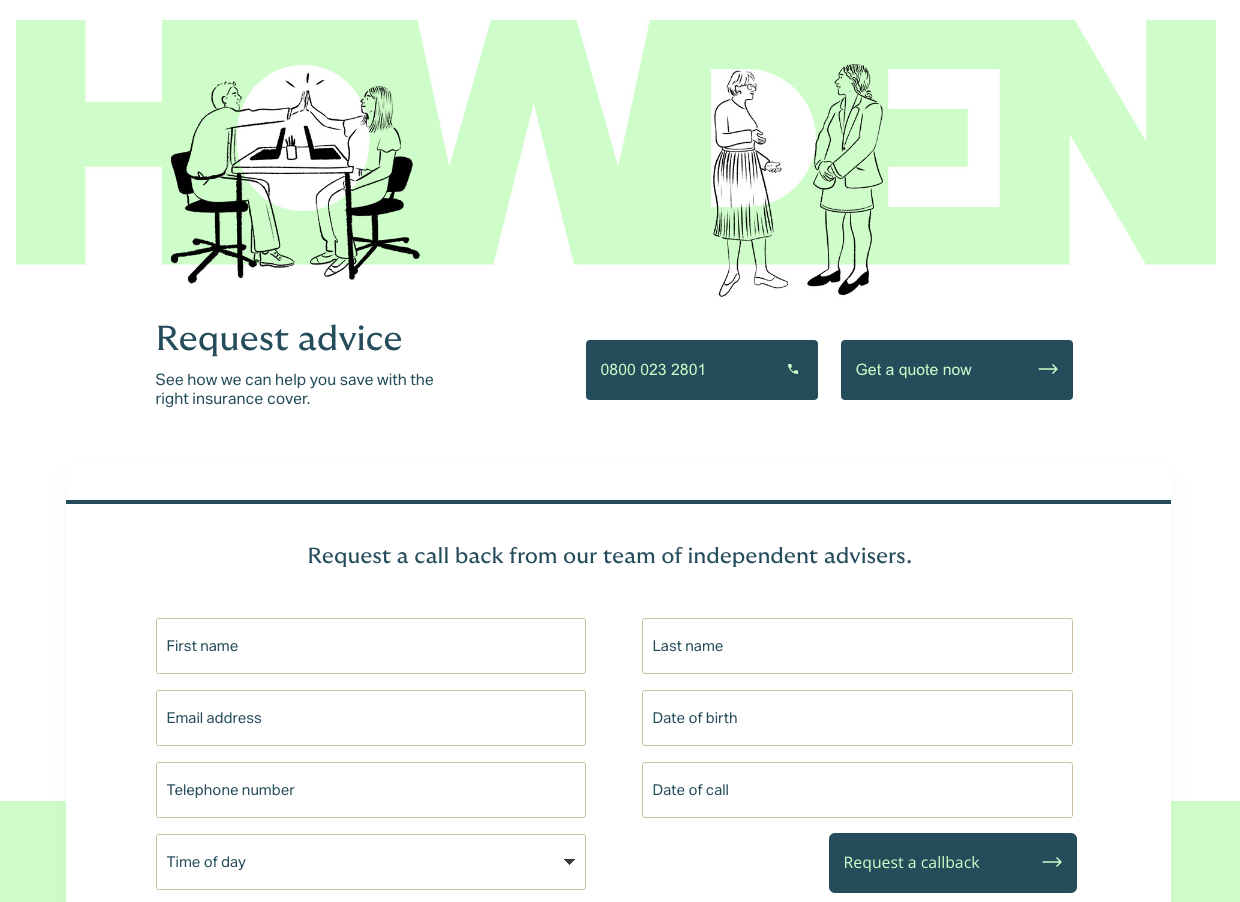

Option 2 - Request a callback from Howden Life & Health

Customers can choose to receive a callback from Howden Life & Health* at a time that is convenient for them (which is the option that I took). This option is best for most people as they'll benefit from free and impartial advice from a qualified expert. Customers are able to tailor a quote to suit them and even get quotes to match a specific budget.

Option 3 - Call Howden Life & Health for free

Rather than waiting for Howden Life & Health to call you, you can call Howden Life & Health* and speak to a qualified health insurance expert for free at a time that suits you. This is the best option if you prefer to speak to someone straight away.

Would you be better off using a comparison site to get health insurance quotes?

Online comparison sites are a good starting point as they can give you an insight into how much health insurance is likely to cost per month. Most comparison sites allow you to alter the amount of cover and the policy excess but it can be difficult to compare the benefits of each policy side by side. Health insurance is a complex product and there are lots of things to consider, including the policy type, how you would like the policy to be underwritten, which hospitals you would like access to and whether you wish to include additional benefits such as mental health cover. In my experience, it is best to speak with an independent expert who can explain the options clearly and provide a recommendation that is in line with my needs, budget and takes into account my medical history.

How much does Howden Life & Health charge?

Howden Life & Health does not charge a fee for its service meaning the advice and recommendation you receive is free and there is no obligation to take things further. If you do decide to take out a policy, then Howden Life & Health may receive a commission fee from the insurance provider, however, it is important to note that the commission fee has no impact on the premium you pay. It is also worth noting that Howden Life & health has a price guarantee meaning they can guarantee to match any quote you receive elsewhere - so you have nothing to lose by calling them. Also there is no obligation to purchase a policy even if you do contact them. In fact there is nothing to stop you contacting Howden Life & Health, receiving the free advice and then purchasing your health insurance elsewhere. However it will not be cheaper to do that and in addition when it comes to the annual renewal date Howden Life & Health automatically check the market and contact you to provide advice as to whether your existing product remains the most cost effective and suitable policy for you.

Pros and cons of using Howden Life & Health

Pros

- Free expert guidance and advice at outset and at every annual renewal

- Price guarantee

- Free Will for all customers

- Free annual review

- £100 cashback offer* if you take out a policy before 31st January 2025

Cons

- May miss out on some special offers as providers sometimes offer incentives for buying a policy direct

Alternatives to Howden Life & Health

Alternative health insurance brokers that provide a similar service to Howden Life & Health include Better Health and Healthplan. Both companies provide independent advice and cover all major UK health insurance providers. Alternatively, you may wish to use a comparison site such as Compare the Market or MoneySuperMarket to compare health insurance policies, however, it is worth noting that Howden Life & Health provides the advice and quotes for Compare the Market customers.

Howden Life & Health customer reviews

Howden Life & Health (under its previous name Assured Futures) scores 4.9 out of 5.0 from over 6,000 reviews on independent review site Trustpilot, rating it as 'Excellent'. 92% of reviewers rate it as 'Excellent' or 'Great' with less than 1% rating it as bad. Many of the positive reviews mention the polite and professional service they received with many noting how knowledgeable the advisers are. Of the bad reviews, some customers were unhappy with renewal premiums increasing, however, Howden Life & health were quick to respond and offer alternative solutions.

Summary

Howden Life & Health* is a great option for anyone interested in saving time searching as well as cutting the cost of their health insurance premiums. Crucially, the service is free and impartial meaning you'll be offered the very best health insurance policy on the market, tailored to your specific budget and needs. Another benefit of using Howden Life & Health is that you'll receive a free annual review when it is time to renew your health insurance policy. Health insurance premiums increase as you get older and policies change over time meaning you may be better off switching to an alternative policy or provider. Howden Life & Health will notify you if this is the case and help with the process of switching health insurance plans.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the service. The following link can be used if you do not wish to help Money to the Masses - Howden Life & Health