In this independent Vitality review, I review Vitality Life Insurance and Vitality Health Insurance explaining what is behind the pink brand that has become synonymous with sports events and healthy living.

I reveal how to get up to £100 cashback* for arranging your insurance and maximise the rewards and perks on offer by Vitality, including how to get the Apple Watch Series 10 for as little as £10 upfront.

I bought a Vitality Life Insurance policy, partly to test the product but also because I think it is a decent policy, especially if you heed the guidance in this article. It is a product that offers a huge range of discounts and cash rewards if you exercise and live a healthy lifestyle. The trouble is that if you blink you'll miss some valuable and sometimes free benefits that you have to opt into. So in this Vitality review, I'll show you how to maximise the benefits and perks.

Vitality's insurance options won't suit everyone and I will explain who should consider taking out a Vitality Life insurance policy and who shouldn't and how to get an unbiased comparison from across all insurers before you make up your mind.

1 min summary - Vitality Life Insurance review

- Life insurance with access to the Vitality rewards programme – discounted gym memberships, health checks, and fitness trackers (including Apple watches).

- Free coffee, discounted breaks, cashback on purchases and many more offers

- I saved £3,612 by taking advantage of Vitality's discounts, cashback and rewards in two years (see later in the article for info).

- Access the reduced rewards package from £8 per month.

- Access the full rewards package from £49.75 (Single) or £64.75 (Joint) per month.

- Vitality life insurance* – Get specialist advice and up to £100 cashback when you buy a policy.

- Vitality health insurance* – Speak to an expert and receive £100 cashback when you buy a policy. (Offer ends 31st January 2025)

Vitality cashback offer

In a nutshell, Vitality is a fantastic product but definitely suits some people more than others. You need to get the right advice from a specialist who knows the product as well as the alternative options in the marketplace. I explain who I used in the section – The cheapest and best way to get Vitality health and life insurance including how to get up to £100 cashback when you buy a policy.

If you want to jump to specific parts of this review then you can do so by clicking on the links below.

- Cheapest way to get Vitality health and life insurance

- Vitality health insurance review

- Vitality life insurance review

- How do Vitality rewards work?

- Who should consider Vitality cover?

- How much does Vitality life insurance cover cost?

- What are Vitality Insurance Payout Rates?

Who is Vitality?

Vitality is owned by a South African company called Discovery Holdings. While the name may not be immediately recognisable to UK consumers, Discovery Holdings is a huge global insurance company, boasting over 4 million customers and Vitality provides life and health insurance to over 1.7 million members in the UK. They pioneered the concept of rewarding customers for living a healthier lifestyle in South Africa. In 2007 they launched the concept in the UK with the help of Prudential by creating PruHealth and PruProtect. Following the success of these UK operations, Discovery Limited bought out Prudential's stake in the joint venture in 2014 and the brands became VitalityHealth and VitalityLife.

VitalityHealth is now one of the top 5 providers of Private Medical Insurance (PMI) in the UK while VitalityLife provides their life insurance products including the innovative Serious Illness Cover.

Trustpilot rates Vitality 4.3 out of 5 stars deeming it a ‘Great' proposition based on over 44,000 customer reviews. Vitality has also received a number of industry awards including ‘Best Protection Provider' at the Scottish Mortgage Awards 2021, ‘Best Critical Illness Cover Provider' at Moneyfacts 2020 & 2021. But most notably, Vitality won Best Private Medical Insurance provider at the Moneyfacts Awards for 9 years running between 2013 and 2021, reclaiming it again in 2023.

Currently, their adverts seem to be everywhere especially if you live in London or view sporting events where the promotions feature Vitality's mascot, ‘Stanley the Dashchund'. For the rest of this Vitality review, I will use the overarching brand name of Vitality to refer to both VitalityLife and VitalityHealth.

Up to £100 cashback on Vitality insurance

Our partner LifeSearch will help tailor insurance and policy benefits to suit you, your family and your budget

- Talk to an expert that understands Vitality

- Tailor Vitality to suit your budget & maximise benefits

- Compare all the top UK providers

- Free advice with no obligation to purchase

What products does Vitality offer?

Vitality provides customers with life insurance cover that can include serious illness cover and income protection insurance. The innovative later life cover options within Vitality's life insurance provide unique insurance provisions that you may not find elsewhere.

You can also buy Vitality health insurance which is a private medical insurance policy with access to virtual GP services as well as private inpatient and outpatient care.

Vitality life insurance

Vitality life insurance is the more straight-ahead product within its insurance range and doesn't differ much from life insurance provided by other reputable insurers. You can choose the type of cover that suits your needs and it pays out in the event that the insured person dies. If the lives insured do not die within the agreed term the policy lapses without value. Alternatively, it is possible to take out a whole of life insurance policy that pays out when you die regardless of when that occurs. Premiums for both types of life insurance policy are usually paid monthly and we explain the various types of policies further on.

The Vitality difference is felt when you add serious illness cover or income protection to your life insurance plan as these are industry-leading in the benefits offered. Particularly the serious illness cover which pays out for more serious medical conditions than any other insurer and won Vitality awards and recognition in innovation.

Vitality life insurance on its own is rated 3 stars by Defaqto but jumps to a 5-star product as soon as you add serious illness cover achieving the standard for “an excellent product with a comprehensive range of features and benefits”.

Vitality health insurance

Vitality health insurance provides access to private medical care for policyholders including inpatient and outpatient care. You will also get access to an array of therapies, helplines and virtual GP appointments providing you with a way to jump the NHS queues and take control over where and when you receive your medical care.

When it comes to pre-existing medical conditions, Vitality Health Insurance has innovated with its fully automated underwriting technology that launched this year. The technology means that more customers will be accepted through full underwriting – where you disclose your health history as part of your application so that you can be covered for some pre-existing conditions. You will find more information about this innovation in our full review of Vitality's health insurance.

Defaqto provides independent reviews and analyses of financial products and rates Vitality Health Insurance as a 5-star product which means that it is “an excellent product with a comprehensive range of features and benefits”. VitalityHealth was awarded 5 stars for its private medical insurance at the Moneyfacts Awards 2023.

If you are only interested in Vitality Health insurance and are not planning on buying a Vitality Life insurance policy, then you should check out our in-depth Vitality Health Insurance review.

Or you can simply complete a form to speak to a health insurance broker* who will talk you through the benefits of Vitality health insurance while comparing it with other policies from across the market too. You're not obliged to go with any of the options offered to you but you'll receive £100 cashback if you buy a health insurance plan this way.

Vitality life insurance explained

The Vitality Life Insurance product, in my view, is the product that most consumers will want and indeed is the product that I took out. At its heart, Vitality Life Insurance is a life insurance plan much like any other life insurance policy in the market. There are a number of different options to choose from to suit your particular needs and circumstances.

Vitality Level Term assurance

Vitality level term assurance is a term life insurance policy where the amount insured remains constant throughout the policy term and the policy only pays out if one of the lives assured dies during the policy term. This type of policy is often used to cover an interest-only mortgage or to provide a cash lump sum for your dependents in the event of your death (this is the type of policy I took out).

Vitality Decreasing Term assurance

Vitality decreasing term assurance is a type of term life insurance policy that works in the same way as a level term assurance policy except the amount of life insurance decreases to mirror the reducing balance of a repayment mortgage over the term of the policy. If you die, the policy will pay out enough money to pay off your remaining mortgage balance at the time of your death as long as your cover amount matches your mortgage balance at the outset. This makes the monthly premium cheaper.

Vitality Family Income Benefit

Vitality family income benefit is a term life insurance that also works in the same way as a level term assurance plan except the benefit is paid out as smaller regular chunks (like an income) rather than as a single lump sum. It can be cheaper than a level term assurance policy for the same value and the method of payout may be preferable for those who wish to fund living costs in case they die.

Vitality Whole of life plan

Vitality's whole of life plan is where the policy is set up to pay out in the event of the life assured's death whenever that occurs. As you can imagine this is the most expensive option.

So far none of this is unique to Vitality, as I said at its core it works the same as other life insurance policies. You can choose to set up a Vitality life insurance policy on a single life basis, joint life first death (i.e pays out and ceases when the first person dies) or joint life second death (it only pays out when both lives assured are dead). Again, all very standard.

Vitality Serious illness cover

One key difference with the Vitality life insurance plan is the ability to add Serious Illness Cover. The terminology may be unfamiliar to most consumers but Vitality is trying to innovate the Critical Illness insurance market. Ordinary Critical Illness insurance (which is most often bolted onto a life insurance plan) pays out if you are diagnosed with one of a number of named critical illnesses, such as bowel cancer. Critical Illness insurance is often expensive and some industry experts have levelled criticisms over the limited number of conditions these policies actually cover.

Vitality Life has introduced Serious Illness Cover which works in a similar way to Critical Illness Cover but the level of payout is based upon the severity of the condition diagnosed. This means that the policy can cover a far wider range of ‘critical illnesses'. For example, a typical Critical Illness policy will cover around 50 conditions whereas Vitality's Serious Illness Cover will cover up to 174 illnesses! If you opt to add Serious Illness cover to your policy (as I did) you can tailor the level to suit your budget as it doesn't have to be at the same level as the life insurance cover on your policy. Some Serious Illness Cover is better than none. I personally think it is a nice innovation which again allows greater flexibility for customers. I even extended this cover to protect my children on the policy because unfortunately, claims for children's critical illnesses have become a more common reason for a claim in recent years.

Although Vitality's 2X and 3X serious illness covers are 5-star rated by Defaqto finding these levels of the cover to be “an excellent product with a comprehensive range of features and benefits” while the 1X serious illness option is rated a 3-star product meaning that it is a product of average quality.

You can choose between 3 tiers of serious illness cover which offers a solution for a range of budgets.

Vitality serious illness cover tiers explained

| Serious illness cover level | Total number of conditions covered | Number of conditions covered for a full payout | Range of severity-based payments^ |

| Serious illness 1X | 114 | 62 | 25% to 100% |

| Serious illness 2X | 143 | 74 | 15% to 100% |

| Serious illness 3X | 174 | 74 | 5% to 100% |

^ Conditions that do not meet the definition of a condition for a full payout can still receive partial payment and each tier provides a range of partial payment options

Vitality Child Serious illness cover

You can choose to include serious illness cover for children that can pay out between £25,000 and £100,000 if your child is diagnosed with a serious medical condition.

Vitality Dementia and Frail Care Cover

Serious illness cover includes a little-known benefit that provides you with the option to continue paying your serious illness premium into later life so that you can be covered against conditions such as Alzheimer's, Dementia and Parkinson's. There are very few solutions in terms of insurance to protect against ill health in later life so this option is a unique offering that should be carefully considered.

How much does Vitality life insurance cover cost?

The cost of a Vitality Life insurance plan depends on the level of cover and type of cover you want as well as your medical history. If you have pre-existing medical conditions then this could increase the monthly premiums, just as it would with any insurance provider. Premiums remain competitive even without the discounts available through earning Vitality points. But whatever you do, do not obtain a quote directly from Vitality and the reasons for me saying this I elaborate on below.

Vitality life insurance cost summary

| Insured person's age | Monthly cost of £300,000 level term life insurance over 20 years¹ | Monthly cost of £300,000 level term life insurance with £75,000 serious illness cover over 20 years¹ |

| 30 years old | £9.88 | £24.36 |

| 40 years old | £19.08 | £48.60 |

| 50 years old | £51.03 | £115.72 |

¹The prices are correct as of 19th November 2024 and based on a person who is in good health, does not smoke, and does not participate in dangerous sports. The serious illness cover is based on 1X which covers 114 conditions

How do Vitality's rewards work?

On to the fun stuff – for me, this is the point where Vitality becomes truly revolutionary and life-changing (a strange thing to say about a financial product but I explain why it was for me later) is the reward package. As a reasonably active person who is engaged with their health, I was attracted by how Vitality could save me money on my healthy habits as well as discounts for things I spend money on for leisure.

The Vitality rewards scheme is quite convoluted so do stick with me as I explain the various perks you could enjoy as a customer.

You can start unlocking Vitality rewards at a monthly price of £12.50 per month and at £25 per month, you'll get the gym discount added – this discount, alone could cover the cost of your life insurance cover for those spending £25 or more per month on their plan and a host of extra rewards and discounts for those spending upwards of £49.75. (Based on a single person policy)

Vitality rewards summary

| Rewards | From £12.50 per month premium | From £25 per month premium | From £49.75 per month premium |

| 50% off Vitality health checks with Bluecrest health | |||

| 12-month subscription to the Headspace app | |||

| 6-month WW premier subscription for £30 | |||

| Up to 75% off Champneys Spa | |||

| 50% off Runnersneed running shoes each year | |||

| 12-month Fiit membership | |||

| Up to 40% off Polar, Garmin, Samsung, Fitbit & Withings devices including children's Garmin Vivofit | |||

| Up to 20% off Expedia.co.uk | |||

| 25% off food weekly at Caffe Nero | |||

| Discounts on selected Samsung devices | |||

| Access to up to £600 care services through SuperCarers | |||

| 50% off Gym Memberships at Virgin Active, Nuffield Health & PureGym | |||

| £5 or £10 off Mindful Chef each week | |||

| Free Caffe Nero drinks weekly | |||

| Cashback on a Peloton Bike, Bike+ or Tread when you get active with Vitality | |||

| Discounted Apple Watch Series 10 & SE | |||

| Cashback with American Express Credit Card | |||

| Up to 40% off Waitrose Good Health products | |||

| Free Cinema Tickets at Odeon and Vue | |||

| Rakuten TV downloads | |||

| Mr & Mrs Smith Hotels discounts |

Behind the flashy reward system is a pretty intelligent and generous engagement programme that cultivates and measures your health and well-being by allowing you to track and upload exercise, health checks and even mindfulness activities to build up a Vitality Status. The reward package links to your status and some benefits listed in the table above are tiered according to which level of status you achieve. Earning points moves members up the scale of Bronze, Silver, Gold progressing to the top status, Platinum which allows you to enjoy the top rate of discounts and rewards available.

Points can be earned and enjoyed by everyone named on a Vitality policy. The more points you earn (which is far easier than it sounds) the more perks you get, including cashback rewards, spa breaks and free Amazon Prime. I elaborate fully on how the reward system really works and how to get the best out of it in the next section. But perhaps the most important aspect is that by earning points you can also reduce your policy premiums by as much as 40%. However, even without a potential premium discount as a result of Vitality points, Vitality life insurance is still competitively priced against other life insurance products.

How does Vitality life insurance work – in particular Vitality points?

So how does the Vitality point scheme work? If you take out a Vitality Life Insurance policy you automatically are enrolled in the Vitality reward scheme. If you take out Vitality Life insurance and your monthly premium is over £25 you'll gain access to Vitality's 50% off gym membership, and at a monthly premium of £49.75 or more you'll unlock all rewards including the free cinema tickets, Apple Watch from £10 and free weekly Caffè Nero coffees.

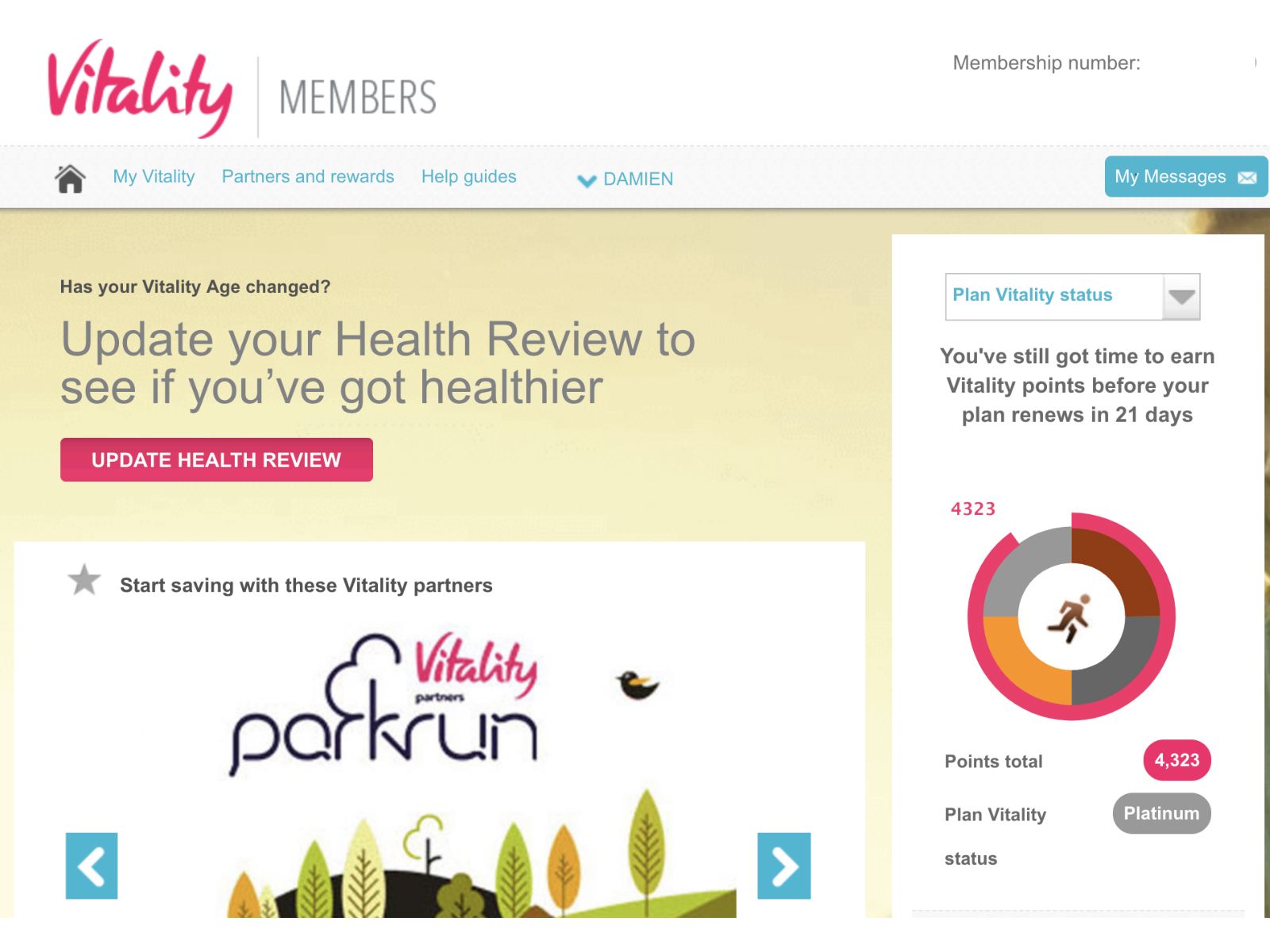

When you take out a plan you are given a Vitality status. The more effort you make to be healthy, the more Vitality points you earn, and you can increase your status from Bronze to Silver, Gold or even Platinum. The higher your Vitality status the better and greater the rewards you receive. Every member has a login area called the Vitality member zone. The screenshot below (click to enlarge) shows my member area.

You can see that I achieved the top Vitality status of platinum. That means I enjoy Vitality's healthy living discount which gives me up to 40% off my annual premiums, I can also get:

- Up to 3% cashback with the Vitality American Express credit card

- 75% off a Champney spa break

- Up to 40% discount on Waitrose & Partners Good Health products

- Up to 25% discount on Mr & Mrs Smith hotels

- Up to 50% off a monthly Gym membership (a benefit which I have taken full advantage of)

- Up to 50% off running shoes from Runners Need

The Vitality rewards I received:

If you collect enough Vitality points over a month you receive free cinema tickets (which can be used at Odeon and Vue cinemas). Not only that, so long as you hit your reward goals, you can also earn a regular-sized Caffè Nero coffee each week. Now if you have a joint policy, as I do with my wife, the points you both earn individually are combined when determining your overall Vitality status. The level of points for each status level (i.e. silver or gold is higher but not double that of a policy taken out by one person). For the weekly perks like the Caffè Nero coffee, you achieve these on your own. So my wife earns weekly points for her own coffees, as do I.

However, if you take out a life insurance policy I suggest you add your children to the policy. Adding a small cover amount of Serious Illness Cover to your policy for your children only costs a few pounds each month. However, whenever my wife and I each earn 12 Vitality points a week we both get a free Caffè Nero Coffee and so long as we do this for a month, the whole family gets a free cinema ticket too (including the children, up to a maximum of 36 tickets per year). To earn 12 points you just have to carry on your normal daily life while wearing a compatible fitness tracker such as an Apple watch or Fitbit so that it counts the number of steps you make. It's that easy. If you don't have either of those devices you can just use your iPhone's inbuilt ‘activities app' which tracks your steps anyway.

Now I don't collect my free coffee every week or even go to the cinema with the family very often despite the free tickets. However, I saved a total of £1,454.50 through the Vitality rewards scheme in one year. This doesn't take into account the fact that my wife and I also received £100 each in cashback (so a total of £200!) at our policy anniversary or the Champney Spa break we've booked.

Insights to making the most of your Vitality rewards:

The important thing to understand is that so long as you live a moderately active life (by that I mean that you do leave the house from time to time) you can achieve plenty of Vitality points to enjoy all of the benefits described so far.

The Vitality reward system is fantastic and this is coming from a guy who hadn't been to a gym for a decade. I didn't do any exercise at all. However, you'd be surprised how many steps you do in a day. If you are able to do 12,500 steps (which is easy if you are chasing around after a toddler or commuting on public transport into London) you will get the maximum number of activity points you can for that day. However, if you visit the gym you get 5 points for going and even more for the steps and activity you undertake. You can see how it's pretty easy to hit the 40 point max level (per person) each week. If you answer a few online questionnaires or have a quick health check you can get over 1,000 Vitality points straight away which means that you will leap to Silver status almost immediately.

The Vitality product is built upon clever psychology which has been shown that if you incentivise (i.e give rewards and cashback) and penalise (i.e premiums go up if you don't exercise) in tandem you are more likely to change human behaviour. This is the reason why I now go to the gym at least twice a week (a guy who never went) and enjoy it. I walk to the shops occasionally rather than drive and am a bit more health conscious. I am 46 and never felt so good. By making me more healthy I'm less likely to make a claim on the policy which is why Vitality rewards me.

Vitality American Express credit card

In 2019, Vitality introduced a Vitality American Express credit card, a fee-free credit card that offers boosted cashback, exclusive to Vitality members. You can apply for a card if you have a qualifying Vitality Health or Vitality Life insurance plan and you can earn up to 1% cashback on purchases (2% if you also have 2 qualifying insurance plans), depending on your activity level and membership status. When added to American Express's offer of 0.5% cashback on the first £10,000 you spend in 12 months and 1% on anything above £10,000, you could earn up to 3% cashback overall. Check out our Vitality American Express credit card review for more information.

Vitality Apple Watch review

One of the big marketing draws for potential Vitality customers is the ability to get a heavily discounted Apple Watch and with the new Apple Watch Series 10 now available, it is getting a lot of attention. You can qualify for the Apple Watch as long as the monthly cost of your plan is £49.75 or more on the Vitality Life insurance policy or if you have a Health insurance policy or both. The Apple Watch sits nicely alongside the incentives as it makes it much easier to track your activity and linking it to the Vitality app can make uploading your efforts simple and effortless. You can choose between the different series of watches released by Apple and customise them too.

How does the Vitality Apple Watch deal work?

Vitality currently has the Apple Watch Series 10 and SE available in various colours and sizes. You'll qualify for the Apple Watch discount if you have a Vitality Life Plan costing at least £49.75 per month or if you have a Vitality Health Plan – there's no minimum payment required on the health plan to qualify. You'll also need to pay an initial amount starting at £1 for the 40mm GPS Apple Watch SE and from £10 upfront for the Apple Watch Series 10. Once you have made the initial payment, you will be entered into a payment plan over the next 36 months where you will pay between £0.00 and £10.00 each month for the Apple Watch Series 10 and £6.00 for the Apple Watch Series SE, depending on how many Vitality points you earn. Earn less than 40 points in a month and you will need to pay £10.00 or £6.00, earn over 160 and you will not pay anything in that month. The image below shows how many points you need to earn each month to reduce the amount you pay for the Apple Watch Series 9 & SE.

Apple Watch + up to £100 cashback on Vitality

Our partner LifeSearch will help tailor insurance and policy benefits to suit you, your family and your budget

- Up to £100 cashback offer available to all new customers

- Apple Watch Series 10 from only £10 upfront with Vitality

- Apple Watch offer ends 14 February 2025

- Free advice with no obligation to purchase

How your vitality points offset the cost of the SE & Series 10 Apple Watch

| Apple Watch Series 10 monthly payments | Apple Watch SE monthly payments |

| 160+ points: you pay £0 | 160+ points: you pay £0 |

| 120 to 159 points: you pay £2.50 | 120 to 159 points: you pay £1.50 |

| 80 to 119 points: you pay £5.00 | 80 to 119 points: you pay £3.00 |

| 40 to 79 points: you pay £7.50 | 40 to 79 points: you pay £4.50 |

| 0 to 39 points: you pay £10.00 | 0 to 39 points: you pay £6.00 |

Waitrose & Partners Good Health food discount

Eligible Vitality Health and Vitality Life policyholders can earn up to 40% cashback on healthy food at Waitrose & Partners (up to £100 of food for a single plan or £200 on a family plan). Earn cashback on every Waitrose & Partners product that carries the ‘Good Health' label; the more Vitality points you earn, the better the cashback rate. You can see a breakdown of how this works below.

| Monthly Activity Points | Cashback rate for ONE eligible plan | Cashback rate for TWO eligible plans |

| 0-39 | 0% | 0% |

| 40-79 | 10% | 15% |

| 80-119 | 15% | 20% |

| 120-159 | 20% | 30% |

| 160+ | 25% | 40% |

Who should consider Vitality insurance?

Vitality life insurance and health insurance are great for those people who are already considering taking out such products but who also lead busy lives. So if you commute and walk to the office or the station you will accumulate points quickly. If you have a young family you will not only earn points just rushing around after them but also enjoy the rewards which amplify the savings. If you live in London in particular, all of the rewards are easily accessible. There are several Caffè Nero stores and you are never too far away from an eligible gym, cinema or spa. If you do like running or going to the gym you will ratchet up the Vitality points even quicker. For me, as my wife was already going to the gym, by taking out the life insurance policy we both got 40% (you can get up to 50% now) off gym membership (she was previously paying full price). The policy pays for itself via the discounts and rewards, and I'm actually better off having taken the policy out, plus I now have sufficient life insurance to look after my family.

What are Vitality Insurance Payout Rates?

If you go online and read forum posts or customer comments about Vitality the few negative comments seem to be disgruntled comments about Vitality not paying out on claims. Yet this is completely inconsistent with the independently audited industry statistics which show that Vitality Life paid out on 99% of life insurance claims in 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016 and 2015, which is above any other leading life insurance company in the UK. So the reality is that if you are going to pick an insurance company based on their claims rate then you'd choose Vitality, clearly. However, in the section titled ‘The best way to get Vitality Life Insurance‘ I explain how you can reduce the chances of you being in the 1% even further if you do need to make a claim.

Vitality Customer Reviews

Here is a sample of some of the Vitality life insurance and Vitality personal health insurance customer reviews you can find online. You will notice in particular the last two comments focus on the frustrations of dealing with Vitality directly, especially when setting up the policy. When I originally tried to take out the policy I contacted Vitality directly but grew so infuriated with their staff that I almost gave up. Fortunately, I found another way that made it so slick and easy that taking out the policy was straightforward, and I'm glad I did. I explain how you should and can do the same in the section ‘The best way to get Vitality health and life insurance‘.

- “Do it. An enjoyable experience.”

- “Excellent benefits, Sadly the range of Gyms does not cover my area”

- “The best insurance policy!!”

- “Waited 30 mins before hanging up! Impossible to get to customer services, rewards are easy to obtain but if anything goes wrong on your insurance don’t expect it to be solved instantly as they must be sitting in their office having a party or something?”

- “It's a nightmare trying to get them to get back to you on anything.”

Vitality's life insurance is rated 5 stars by Defaqto and rated ‘excellent' by Trustpilot where over 47,000 customers have shared their experience of Vitality. However, the less positive reviews generally speak about difficulties speaking to customer service representatives at Vitality. Using a broker can help you avoid the frustration that is described here.

Vitality life insurance summary – how to get the cheapest price and £100 cashback

Vitality life insurance is a fantastic product which is incredibly cost-effective and can even save you more than it costs (as it does me) if you are moderately active. However, Vitality's biggest hurdle is helping consumers fully understand the product. Vitality acquires a lot of its customers through tie-ups with employers or sports clubs whereby those who are covered by the company plan are already engaged in healthy activities.

However, trying to explain the product to consumers directly in a succinct and easily understandable way requires a level of knowledge and expertise. Unfortunately, their own advisers, who you speak to if you call them directly, can make what should be a seamless journey harder than it should be. By way of example when I first looked to take out a Vitality insurance product I called them directly, only to become frustrated by their adviser's inability to give me what I needed. I simply wanted the minimum amount of life insurance to ensure that I could benefit from the Vitality reward scheme (with discounted gym memberships etc). As I said earlier, I worked in the industry and know how underwriting works. My frustrations led me to complain.

How I arranged my Vitality life insurance

Via an industry contact, I was put in touch with an independent life insurance specialist, who is also an expert in Vitality Life insurance products. Not only were they able to quickly tailor the product to what I needed but also got the maximum amount of cover for my budget, due to the preferential rates the firm enjoys, plus I received £100 cashback.

But more importantly, if you contact Vitality directly they will only sell and advise on their own products. That means that if there are more suitable products in the market (that are not Vitality) then they won't advise you on them (plus you won't get cashback).

However, LifeSearch, the insurance specialist I used (complete this form for a callback*) will tell you whether Vitality will work for you without any form of pressure selling. They can also offer advice on the whole insurance market if Vitality doesn’t suit your circumstances and you will still get up to £100 cashback. I am a cynic and so I wouldn't recommend using them unless the service had been exemplary. Just put your contact details in the form and choose the time of day to have a quick chat.

A good independent insurance broker should not only advise you but explain how the scheme works, how you personally could get the most out of it and ultimately process your application. Any life insurance application can take time so you have to be patient but the hassle is taken out of it.

Ultimately I like the Vitality product and have recommended it to family and friends but only when using an independent specialist broker (such as LifeSearch in my case*). It is a product that should be revolutionising the industry and changing lives and Vitality seems committed to ensuring it does. I for one hope they succeed.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses and do not wish to qualify for the cashback referred to in the article – LifeSearch, Howden Life & Health