What is Penfold?

Penfold* describes itself as "Clear, uncomplicated and jargon free". It has no minimum initial investment amount, allows flexible contributions and offers a free pension consolidation service allowing customers to easily transfer existing pensions across. Penfold promises a pension that can be set up in under 5 minutes and allows you to top up, change, or pause your payments at any time - instantly and online through its app or website.

Penfold offers two types of service for its customers. It offers a workplace auto-enrolment scheme* aimed at employers as well as a personal pension* aimed at individuals and those who are self-employed.

Engage, attract and retain the best talent with Penfold's user-friendly company pension

- Dedicated 1-2-1 account manager with payroll support

- Track contributions, opt-outs, payments

Penfold auto-enrolment workplace pension scheme

Penfold's workplace pension scheme* provides a bespoke auto-enrolment workplace pension offering employers an alternative to the government's own Nest auto-enrolment scheme. It is currently offering a free consultation* which includes a private demonstration with a pension expert. In addition, employers receive benchmarking data to see how their scheme compares to other similar businesses, guidance with choosing the optimum contribution levels as well as engaging webinars, onboarding sessions and guides.

Consolidate your existing pensions with Penfold for free

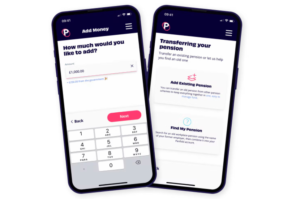

Penfold* offers a free pension consolidation service enabling you to find and consolidate your existing pension pots. So, rather than having to dig up old paperwork from 20 years ago, Penfold will handle the transfer for you and carry out all of the administrative work. The service is almost identical to the one offered by PensionBee, a provider we have recently reviewed and whose consolidation service we have tried and tested. To get the most out of the service you will need to provide some basic details, such as the pension provider, dates and employer name (if employed at the time). Failure to provide these basic details could either slow down the transfer or even result in them being unable to locate the pension altogether.

How does Penfold's personal pension work?

You can open a pension with Penfold either online or by downloading its app. Users start by entering their email and choosing a password, followed by providing some personal details. You are then ready to set up your account and pick an investment plan to decide how your savings will be put to work. Knowing how much to save into a pension is a big deal as the more you put in, the larger your retirement pot could be. But you may also need that money more immediately especially if your income fluctuates.

Penfold offers a link to a tool that can help you decide how much to save. It asks for your age and how much you will be investing to calculate what your pot could be worth at your state retirement age. The calculator will also tell you how far off your portfolio is from an ideal pot assuming you would need to earn around two-thirds of your working income during retirement. You can play around with the calculator to see how changing the contributions affects the final portfolio.

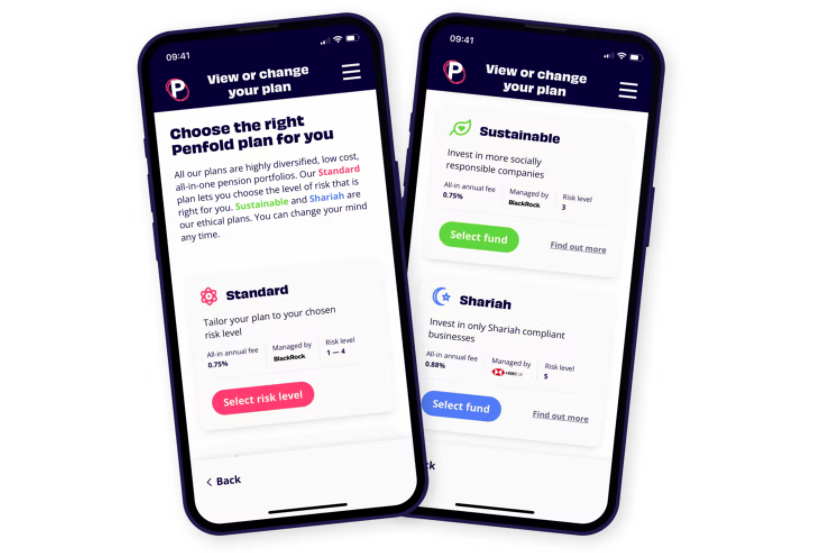

Once you are happy with how much to contribute you can pick one of its four investment plans; 'Standard', 'Lifetime', 'Sustainable' or 'Shariah'. The standard, lifetime and sustainable investment plans plan are managed by Blackrock using its MyMap funds that spread your money across a wide range of BlackRock’s iShares passive tracker funds. These funds correspond to a mix of stocks, bonds and other alternative assets such as real estate across the world. Penfold also has a Shariah compliant fund that is managed by HSBC.

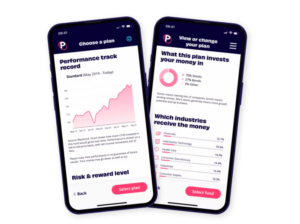

Choosing the right investment plan can be tricky as you need to take enough risk so your retirement pot grows but you don’t want to take too much and risk losing your savings. Penfold offers four different risk levels in its standard investment plan, each providing a different level of risk. The plans range from Level 1 which provides the lowest risk and is designed for those that are closer to retirement age, up to Level 4 which provides the highest risk and is designed for those that have at least 20 years until they retire and so can afford to make up for any short term losses along the way. Level one has the lowest exposure to riskier assets such as equities (Stocks & Shares), with level 4 having a much higher exposure. When you select a plan, the anticipated growth, volatility and suitability for certain is explained and if you want to know more information about the funds and underlying portfolio you can click on the information button on each plan.

Before agreeing to put money into one of the plans there is a risk acceptance box to read and you must tick to state that you understand and accept the risks. Penfold says there are four main things to be aware of and they are:

- your capital is at risk

- Penfold is not a financial adviser

- exchange rates affect growth

- early withdrawals impact returns

Each warning has a dropdown box with more explanation.

Your pension can then be officially set up and you can make your first contributions once you provide some additional legal details, such as your national insurance number, citizenship details and employment status. Penfold helps arrange your pension, which is operated by Gaudi Regulated Services and the underlying funds are run by Blackrock (or HSBC for Shariah compliant investments). Contributions are flexible and can be paused or changed at any time through the app or website.

Penfold will ensure you get tax relief on your contributions automatically and the performance of your pension can be monitored from your own dedicated dashboard and you can change your investment strategy whenever you like.

Is there a minimum investment amount with Penfold?

There is no minimum investment to start a pension. You can stop or pause contributions at any time so you could make one-off top-ups or not contribute anything at all. This provides more flexibility if your income is unpredictable and you have good or bad months as you can put more away when you are doing well and less when things are tougher.

Who is Penfold for?

Penfold was originally designed with the self-employed in mind meaning freelancers, sole traders and limited company directors can all open accounts. Limited company directors can also make 'employer' contributions, which usually count as a company expense and would, therefore, reduce your corporation tax bill. Penfold has since expanded its offering to offer workplace pensions as well as private pensions for individuals.

Penfold features

- Flexible contributions - Stop, pause, increase or decrease contributions at any time

- Contributions calculator - Penfold helps you choose how much to save

- Consolidate pensions - Penfold will trace and combine your old pensions into its product for free (although your old providers may charge exit fees)

- No paperwork - The application is fully automated online but you can speak to an expert through 'live chat' or on the phone

- Understand where your pension is invested - Investors can see exactly where their pension is invested using Penfold's 'Explore your pension' feature. The service gives investors complete visibility allowing them to sort by category and business type. It even allows investors to vote at AGMs.

Penfold charges and fees

Penfold charges an 'all-in' fee which includes its administration charge and fund manager fees. We explain the fees for each of its investment plans below.

Penfold standard investment fees (4 risk levels)

- £0 - £100,000 - 0.75%

- Over £100,000 - 0.40%

Penfold sustainable investment fees

- £0 - £100,000 - 0.75%

- Over £100,000 - 0.40%

Penfold standard lifetime investment fees (Uses 'lifestyling' to reduce risk as you get older)

- £0 - £100,000 - 0.75%

- Over £100,000 - 0.40%

Penfold sustainable lifetime investment fees (Uses 'lifestyling' to reduce risk as you get older)

- £0 - £100,000 - 0.75%

- Over £100,000 - 0.40%

Penfold shariah investment fees

- £0 - £100,000 - 0.88%

- Over £100,000 - 0.53%

Is Penfold safe?

Penfold is regulated by the Financial Conduct Authority to arrange pensions. That is an important distinction as the experts at its contract centre can answer questions and provide guidance, however, they cannot give financial advice. Penfold still has to follow rules on treating customers fairly and keeping client money separate. Client money is held in a Lloyds Bank account before it is invested in funds managed by Blackrock, both of whom are regulated by the FCA.

The Penfold Pension is operated and administered by Gaudi Regulated Services Limited, which is also regulated. If something happened to Penfold, your pension would still exist, and Gaudi would get in touch to explain how you manage it in the future if the Penfold online portal was to cease to exist. Penfold is also protected by the Financial Services Compensation Scheme, so if something happened to Penfold, Gaudi and BlackRock, your money is guaranteed by the government up to £85,000.

Penfold customer reviews

Penfold is rated as 'Excellent' on independent review site Trustpilot from over 1,200 reviews scoring 4.4 out of 5.0. Reviews cite how easy it is to set up and the high level of customer service.

Penfold vs PensionBee vs MoneyBox vs Nest comparison

| Penfold | PensionBee | MoneyBox | Nest | |

| Minimum Initial Investment amount | £0 | N/A (have to transfer in to open a pension) | £0 | £0 |

| Minimum contribution | No minimum | No minimum | No minimum | £10 |

| Number of plans | 5 | 8 | 4 | 6 |

| Cost / Fees | 0.40% to 0.88% | 0.50% to 0.95% | 0.45% on balances up to £100,000, 0.15% on balances over £100,000. Plus provider costs of 0.09% to 0.88%. | 1.80% charge on contributions plus 0.30% annual management charge |

| ESG Investment | ||||

| Flexible contributions | ||||

| Consolidation Service | ||||

| FSCS Protection | ||||

| Drawdown |

*Nest charges 1.8% on contributions

Penfold vs PensionBee

PensionBee’s focus starts on helping savers locate and consolidate all their old pensions in one place. After this, you can make as many or as few contributions as you like into its scheme, similar to Penfold. Users get a wider range of plans with PensionBee and can choose from seven run by different fund managers. Its charges range from 0.50% to 0.95% so it could be cheaper or more expensive than Penfold depending on the plan you choose. PensionBee also has a calculator showing what your pot could be worth based on different levels of contributions. Read our independent PensionBee review.

Penfold vs Moneybox

Moneybox is a popular app that rounds up your spending and lets you save or invest the ‘spare change'. Money can be put into savings accounts and also a SIPP. There is a choice of just four funds and fees for the SIPP are 0.45% for investments under £100,000 and 0.15% for above that. There is also a fund provider fee of 0.09% to 0.88%. Moneybox will also help consolidate old pensions. Read our independent Moneybox review.

Penfold vs Nest

Nest is the government-backed National Employment Savings Trust (NEST) that was set up when the government first introduced auto-enrolment to ensure that there was a scheme that all employees could be entered into. NEST also offers a self-employed option that lets you contribute as often as you like at a minimum of £10. NEST charges 1.80% on each contribution and has an annual management charge of 0.30%. Penfold also offers its own auto-enrolment workplace pension scheme* which it describes as 'engaging and efficient'. Read our independent Nest review.

Penfold Pros and Cons

Pros

- Fast setup - Open a pension and choose an investment plan within five minutes

- Flexible contributions - Stop, pause, increase or decrease your contributions as your income fluctuates

- Low cost - There are no adviser fees to pay for arranging the pension and you can access a range of tracker funds that are traditionally cheaper than actively managed products

Cons

- Not advice - Penfold is only regulated to arrange your pension, so while you can get guidance from its contact centre, there is no help if you have wider complex financial planning needs.

- Low level of contributions - Having the flexibility to stop or limit your contributions is useful but it is worth remembering that your retirement pot will end up pretty small if you don’t invest enough.

Conclusion

Penfold* provides a flexible and low-cost way to start a pension. Income can be unpredictable when you are self-employed so Penfold's flexible investing approach, allowing investors to easily adjust how much they contribute is especially useful.

It may be hard to work out how much you should be contributing without the help of an adviser as a pension is just one product. An adviser can take a more holistic look at your finances and provide cashflow tools that estimate how much retirement income you may require as part of a wider financial planning process that looks at all your assets, savings and your goals.

If you have a pot you wish to consolidate, then it would be wise to check out PensionBee, as the costs and features are similar. If you are comfortable setting and monitoring goals yourself and have an idea of how much you are willing to contribute and what you will need when you retire then Penfold could be right for you, especially if you have old pension pots that you could consolidate.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - Penfold