This is a review of the Nutmeg* pension. It is best to read the review in full but if you wish to jump to a particular part of this review then you can do so via the hyperlinks below.

This is a review of the Nutmeg* pension. It is best to read the review in full but if you wish to jump to a particular part of this review then you can do so via the hyperlinks below.

In summary I feel that the Nutmeg Pension may be suitable for some readers and I, therefore, secured an offer for Money to the Masses readers that means Nutmeg will waive its management fees for the first 12 months*. Terms and Conditions apply. Cannot be claimed with any other Nutmeg offer, unless otherwise specified. On a £50,000 investment that is a saving of up to £375.

In the interests of transparency, Nutmeg has agreed to pay a small fee for new customers acquired via the asterisked links in this article. However editorial independence is paramount to MoneytotheMasses.com and in no way is this review or my views ever influenced by 3rd parties. I have included a link to Nutmeg directly at the foot of this article which you can use and MoneytotheMasses.com will not receive any payment from your referral.

- Who is Nutmeg and how does its pension work?

- How does Nutmeg invest my pension pot?

- Does Nutmeg’s pension have a minimum investment?

- Transferring an existing pension to a Nutmeg pension

- Nutmeg Pension Fees

- Nutmeg Pension Performance

Who is Nutmeg and how does its pension work?

Nutmeg is one of the oldest robo-advisers in the UK, building regulated risk-based portfolios since 2011. In a world of DIY platforms pushing active funds, it offers access to low-cost managed portfolios of exchange-traded funds that users can monitor and alter online at any time of the day.

Nutmeg initially started by offering ISAs and general investment accounts but entered the pensions world in 2015. Technically, the Nutmeg pension isn’t a SIPP as you can’t choose your own assets and it only invests in ETFs for you. But you still get all the benefits of a pension, with tax relief on contributions.

Traditionally, if you wanted to set up a pension you would need to make time to meet with a financial adviser to discuss your goals and they would usually choose which provider to use, or you could just rely on whatever your employer offered. The personal pension from Nutmeg gives you more control with an easier to use and low-cost process. Of course, it goes without saying that if you are unsure if a pension is right for you then you should always consider getting independent financial advice.

When you set up a Nutmeg pension, first you need to enter your gender and age and when you plan to retire. This may be hard to know as everyone dreams of retiring as soon as possible, but you need to have saved enough to be able to maintain your lifestyle.

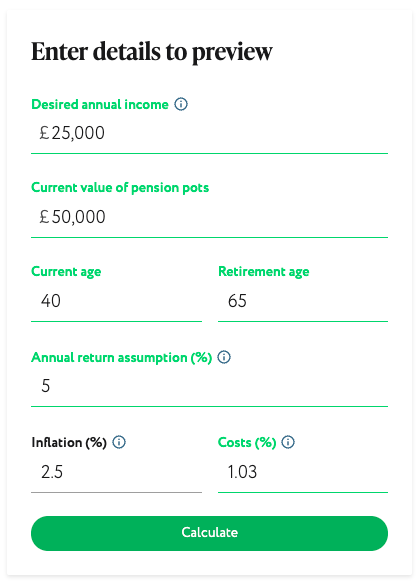

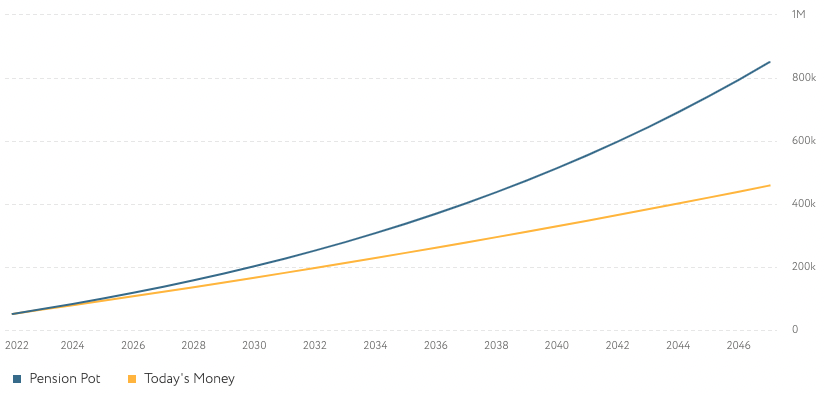

Nutmeg has a handy pension calculator (shown below) that lets you input your desired retirement income and any current pension savings to see how much you need to save and how feasible it is to reach your target by your desired age. With all this in mind you can then decide when you are aiming to retire and can even name your pension pot.

You then select how long you plan to invest for, how much you would like to pay in, either from transfers or monthly contributions, plus anything your employer will put in.

Finally, you need to decide how much risk you want to take. This can be hard to calculate, but Nutmeg aims to simplify this by offering ten risk levels, from the least risky 1 to the most risky 10. It is hard to know what a number means, so each is given a name, the lowest level 1 risk has the description “avoiding risk is a priority,” while number 5 says “I’m willing to take some (risk). Those selecting number 10 will see a message stating: “I’ll risk large losses for higher gains.”

You can play around with the calculator to see how likely you are to reach your target based on the different portfolios and contribution levels. This will let you see how much to invest and how much risk to take. You will also be shown how much the portfolio will cost as well as what assets and individual investments are in each one and how a comparable portfolio has performed over the past 22 years.

The projections will also tell you how much your pension could be worth in total when you come to retire, how much you could take as a lump sum, what an annuity could be worth and how much you will have contributed (see below).

Once all this is decided and you register, Nutmeg will then take you through a risk assessment that helps build your profile. It aims to assess your investing experience, understanding of risk and loss and your view of the stock market. Nutmeg will then recommend one of its portfolios based on your responses and deemed overall risk tolerance. You can retake the assessment if you are unsure of the conclusion.

If you are happy, you can create a Direct Debit to make regular (or ad hoc payments/contributions) to your Nutmeg pension account. Investors can choose to log in using the web dashboard or via the Nutmeg app. Additionally, investors can edit contributions, change the level of risk, investment style and even monitor the performance and check future projections.

How does Nutmeg invest my pension pot?

Nutmeg's pension has four investment styles for pensions which are fully managed, fixed allocation, Smart Alpha (powered by J.P. Morgan Asset Management) and socially responsible investment. We examine the full range of Nutmeg investment options in detail in our wider Nutmeg review.

Nutmeg keeps costs low by using exchange-traded funds (ETFs) which are cheaper than active funds and you get more transparency in terms of where your money is invested. They can track an index, such as the FTSE 100, or hold Government and corporate bonds.

The Nutmeg personal pension is invested and managed by Nutmeg, while the administrator is Embark Services Limited and the trustee is Embark Trustees Limited. But all contact you receive will be through Nutmeg.

Nutmeg's managed portfolios are diversified across different assets, regions and sectors, in accordance with your agreed risk level, and are regularly rebalanced to ensure they are on track to meet your goals. Your chosen portfolio can be changed by you at any point and Nutmeg regularly offers suitability reports so you can monitor if your attitude to risk has changed and if you are on track to meet your goals. While this may be described as robo-advice there is actually a team of real humans who meet regularly to look at asset allocation and who will make any changes needed.

This set-up is much the same as most robo-advice firms, although there are always exceptions such as Exo Investing.

Alternatively, investors can choose to invest via Nutmeg's fixed allocation portfolio. Unlike the fully managed portfolios, the fixed allocation portfolios are not actively managed, although they are rebalanced automatically to ensure there is the right balance of investments in your portfolio. As a result the fixed allocation portfolios are cheaper than the Nutmeg fully managed portfolios, explained below in our fees section. Furthermore, investors can choose to invest in the Smart Alpha portfolios (powered by J.P. Morgan Asset Management) or Socially Responsible investment portfolios.

Does Nutmeg’s pension have a minimum investment?

The minimum investment for a Nutmeg pension is now only £500, reduced from £5,000 when we reviewed the product in 2018. We commented at the time that £5,000 was high when compared to their rivals and while Nutmeg argued that the higher minimum helped to diversify the funds across a range of assets, their new strategy seems focussed on acquiring more assets.

Can an employer pay into a Nutmeg Pension?

Nutmeg will also let employers contribute to the pension which is a big positive. You will need to request details that can then be sent to your HR department. Check before transferring an existing pension as you may be entitled to additional benefits, always seek advice if you are unsure.

What happens to my Nutmeg pension when I retire?

Anyone over age 55 can start taking money out of their pension savings but your portfolio will be set up to maximise returns until up to your chosen pension age that you stated when the account was first set up. This can be changed at any point, making it a shorter or longer term.

There are a few choices when you come to retire, you could keep your pot invested, enter income drawdown – allowing you to stay invested in the stock market but make regular agreed withdrawals - or use the money to purchase an annuity. You can also withdraw 25% of your pension pot tax-free.

Nutmeg only offers income drawdown, so if you wanted to purchase an annuity you would need to transfer your portfolio to a different provider. There are no extra charges for income drawdown via Nutmeg, beyond the regular pension portfolio and fund fees, but there will potentially be income tax to pay on withdrawals as with any pension.

Transferring an existing pension to a Nutmeg pension

You don’t just have to make monthly contributions, you can also add to your pension by transferring from other providers. A Nutmeg pension transfer is free (although your existing pension provider may charge an exit fee). This can be from an old or current workplace pension, other SIPPs or personal pensions. You should check if you will be losing any valuable benefits before by leaving a provider though, such as guaranteed annuity rates. The only type of pension you can’t transfer is a defined benefit or final salary scheme.

Nutmeg Pension Fees

Fully Managed

The Nutmeg pension fees for a fully managed portfolio depend on how much you are investing. Nutmeg charges a platform fee of 0.75% up to £100,000 and 0.35% beyond that. Investors will also pay fund fees averaging 0.20% as well as market spread costs totalling 0.04% on average. Fees correct as of 15.10.24 and subject to change.

Fixed Allocation

The Nutmeg pension fees for a fixed allocation portfolio depend on how much you are investing. Nutmeg charges a platform fee of 0.45% up to £100,000 and 0.25% beyond that. Investors will also pay fund fees averaging 0.17% as well as market spread costs totalling 0.04% on average. Fees correct as of 15.10.24 and subject to change.

Smart Alpha powered by J.P. Morgan Asset Management

The Nutmeg pension fees for a Smart Alpha portfolio depend on how much you are investing. Nutmeg charges a platform fee of 0.75% up to £100,000 and 0.35% beyond that. Investors will also pay fund fees averaging 0.32% as well as market spread costs totalling 0.04% on average. Fees correct as of 15.10.24 and subject to change.

Socially Responsible Investment

The Nutmeg pension fees for a socially responsible investment portfolio depend on how much you are investing. Nutmeg charges a platform fee of 0.75% up to £100,000 and 0.35% beyond that. Investors will also pay fund fees averaging 0.29% as well as market spread costs totalling 0.04% on average. Fees correct as of 15.10.24 and subject to change.

These figures do not take into account our Nutmeg offer* where Nutmeg will waive its management fees for the first 12 months (Terms and Conditions apply). This can save someone with a £50,000 pension pot up to £375 in their first year! The saving is based on the fully managed, socially responsible investment and Smart Alpha portfolios. The saving for the Fixed Alloction portfolios would be £225.

Nutmeg Pension Performance

You can log in whenever you want to see where your pension pot is invested and how it’s performing. You will also be sent a valuation four times a year.

Nutmeg has a long track record that you can view on its website to help you make a judgement, however, past performance is no guarantee of future returns. If you want to view analysis of Nutmeg's investment performance against other robo-advice firms then read my full Nutmeg review. In general, it has outperformed a benchmark of competitors, especially with its higher risk portfolios.

At present Nutmeg's lowest risk level 1 fully managed portfolio has returned 7.9% over the past ten years. Go up a risk level and it achieved a return of 18.4% or 1.7% annually. Those on risk level 3 have seen returns of 24.1% over ten years with annualised returns of 2.2%, while level 4 is at 32.9% over ten years.

The mid-range fully managed portfolio 5 – which aims for moderate growth without extreme volatility – has returned 41.3% over ten years with annualised returns of 3.5%. You then get into the more volatile portfolios, with level 6 returning 52.8% over ten years with annualised returns of 4.3% and level 7 at 72.5% and 5.6% respectively. Level 8 has returned 89.5% over ten years with annualised returns of 6.6%, while level 9 is at 108.1% over ten years with annualised returns of 7.6%. The highest risk level 10 managed portfolio has returned 122.1% over ten years with annualised returns of 8.3%. The annualised figure is the return since inception expressed as a compound annual rate. For example, a portfolio with an annualised return of 6% corresponds to an actual return of 19.1% over three years (rather than 18% as you might expect) due to the effect of compounding. Figures correct as of 30.09.24. Performance data for other investment styles is available on the Nutmeg website. These figures refer to past performance, which is not a reliable indicator of future performance.

Nutmeg Pension vs PensionBee vs Moneyfarm

There are plenty of other robo-advisers on the market with varying minimum investments and product features. Nutmeg’s main rivals are Moneyfarm and PensionBee.

Nutmeg has the same minimum investment as Moneyfarm and PensionBee doesn’t actually have a minimum.

You get the widest choice of portfolios with Nutmeg which offers 10 fully managed portfolios, 10 socially responsible portfolios, 5 fixed allocation portfolios and 5 Smart Alpha portfolios. This compares to just seven portfolios with Moneyfarm and seven with PensionBee.

All three providers will invest using ETFs but their fee structures differ. PensionBee’s charges depend on the portfolio as well as how much you invest, with fees coming down on amounts above £100,000. For pensions under £100,000 you will pay annual fees of 0.50%-0.95%, depending on the portfolio. The costs are halved on values above £100,000. Moneyfarm investors pay between 0.35% and 0.75% depending on the amount invested on its actively managed portfolios and between 0.25% and 0.45% for its fixed allocation portfolios. There is also an average fund fee of 0.20%.

All three providers allow transfers from other providers but PensionBee’s service goes a bit further as it will also help you locate and consolidate any pension savings you may have had in the past. This makes it stand out as a decent pension consolidation service, particularly as you can only get started by making a transfer.

Conclusion

Nutmeg provides a simple to use and accessible service that lets you monitor performance whenever and wherever you want. It is an easy way for a pension investor to not have to spend much time on managing their pension, either by selecting a fixed allocation portfolio or letting Nutmeg do the legwork by building and managing your portfolio. Its charges are in line with its competitors and it has a much longer investment performance track record, generally outperforming many of its competitors (especially with its higher risk portfolios). Remember, Nutmeg will waive its management fees for the first 12 months* (Terms and Conditions apply).

Those who want to be more involved also have the option of delving deeper and looking under the bonnet to see the funds and assets their money is invested in and even to project how close they are to reaching their retirement target. Nutmeg regularly provides market updates on its strategy coupled with the ability to easily alter contributions and risk, as well as monitoring if and when your portfolio will hit its target. It is easy to see why Nutmeg has become such a large robo-adviser in the UK, especially as some of the others still don't provide a pension product.

If the Nutmeg pension is of interest then I suggest that you read our full Nutmeg review where I analyse Nutmeg's investment performance in detail and also looks at who should consider Nutmeg investments, what its customers are saying about its service.

It is important to note that as with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance. A pension may not be right for everyone and tax rules depend on individual status and may change in the future. Always seek financial advice if you are unsure if a pension is right for you. Approved by Nutmeg on 15.10.24 in relation to any factual statements about Nutmeg products and services.

*Nutmeg has agreed to pay a small fee for new customers acquired via the asterisked links in this article which helps us keep MoneytotheMasses.com free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. Please use the following link if you would prefer that MoneytotheMasses.com does not receive any payment for your referral - Nutmeg