Moneyfarm is one of a new breed of robo-advisers which manages clients' investments in a low-cost and simple to understand manner. It achieves this by using exchange-traded funds (ETFs). While it uses passive investments, the Moneyfarm investment portfolios are managed on a discretionary basis (i.e. Moneyfarm makes the investment decisions for you) via an investment team which provides a tactical oversight. Unlike some other robo-advice firms Moneyfarm also provides online restricted financial advice when you choose a portfolio.

Moneyfarm is one of a new breed of robo-advisers which manages clients' investments in a low-cost and simple to understand manner. It achieves this by using exchange-traded funds (ETFs). While it uses passive investments, the Moneyfarm investment portfolios are managed on a discretionary basis (i.e. Moneyfarm makes the investment decisions for you) via an investment team which provides a tactical oversight. Unlike some other robo-advice firms Moneyfarm also provides online restricted financial advice when you choose a portfolio.

In order to provide an independent Moneyfarm pension review, I not only registered for an account online but have also visited their offices to see how their Chief Investment Officer and his team invest clients' money. As one of the most widely quoted investment experts in the national press, this was always going to be a key consideration of mine when reviewing Moneyfarm's pension product.

I also want to make you aware that because the Moneyfarm pension may be suitable for some readers (read full review below), I therefore secured an exclusive offer for MoneytotheMasses.com readers that means if you invest in a Moneyfarm pension you pay no management fee for the first 12 months*.

In the interests of transparency, I receive a small fee from Moneyfarm if you utilise the offers. However editorial independence is paramount to MoneytotheMasses.com and in no way is this review or my views ever influenced by 3rd parties. I have included a link to Moneyfarm at the foot of this article which you can use and MoneytotheMasses.com will not receive any payment from your referral.

How does a Moneyfarm pension work?

Moneyfarm* builds and manages a pension portfolio for you that aims to meet your retirement goals. The product is a target date pension, which means your portfolio is regularly rebalanced by Moneyfarm to maximise your investments and keep track of your financial goals based on your chosen retirement date and risk attitude.

Each Moneyfarm pension is created by offering online regulated investment advice and a discretionary management service. Rather than having to make time on the phone or to visit a financial adviser in their offices, the whole Moneyfarm process is managed online.

All you have to do is answer an online questionnaire that will help determine your risk appetite by assessing your goals, time horizon, financial situation and attitude to risk. Before your portfolio is set up you will also need to give an indication of how long you want to save for, i.e when you want to retire.

You will then be recommended a portfolio of exchange-traded funds (ETFs) built and run by its team. You don’t need to worry about the funds you choose or particular regions or sectors as this is all managed as part of the discretionary management service.

Once you have been recommended a portfolio based upon your user profile this recommendation is reviewed at least annually by Moneyfarm. On each anniversary you will receive an alert to update your profile and risk questionnaire if you haven't done so during the year. Moneyfarm will then tell you whether your current portfolio is still suitable or whether you need to change to one of the other six portfolios in order to reduce/increase the investment risk you are taking.

The combination of using a target-dated pension alongside financial advice means that as you approach retirement Moneyfarm will naturally recommend that you take less investment risk ahead of you accessing your pension. This de-risking is referred to as 'lifestyling' within the financial planning world. While there is a manual (rather than discretionary) element to Moneyfarm's process in that you have to accept their new recommendation, it is a form of lifestyling nonetheless and it is a big positive from my viewpoint. You can transfer existing pensions into a Moneyfarm pension for free or alternatively, you can use its 'find, check and transfer' service where it will help you trace any old or lost pensions and consolidate them into one plan. Previously, it charged a 1% fee for this service, taken from the pension after the transfer is complete, however, this was scrapped in September 2024.

How does Moneyfarm invest your pension?

At Moneyfarm, your pension is built with exchange traded funds (ETFs) to keep your investments low-cost and transparent.

All Moneyfarm users, whether via its general account, ISA or pension, are assigned a portfolio based on a level of risk. But before you are given your portfolio, Moneyfarm needs to get an idea of the type of investor you are.

It uses a questionnaire (as shown below) that assesses your risk aversion, income and financial situation as well as other psychological characteristics that influence your relationships with investments, such as your attitude to risk and reward and losses.

Once you've answered the questionnaire you will be presented with the following screen that will give you your recommended portfolios, one in dark green and others in lighter green (The darker green being the favourable recommendation based on your answers).

You can retake the questionnaire if you are unhappy with the result. At this stage, Moneyfarm used to present the breakdown of the corresponding portfolios on screen but you are now encouraged to continue to full registration. If you are interested in seeing the asset allocation of your recommended portfolio then you can simply check this on Moneyfarm's website, as it is easily accessible information. You can build a portfolio for free yourself using Moneyfarm's portfolio tool without committing to the service. Registering is free and there is no obligation to invest any money.

There is plenty of debate over active and passive management, but Moneyfarm has made that choice for you as all its portfolios are made up of exchange-traded funds, covering a mix of asset classes, regions and sectors depending on your level of risk.

There are advantages to ETFs as they are lower in cost compared to actively managed funds so more of your money goes towards returns and they are fully transparent so you know where your money is invested. There is a downside though as you will only ever track an index that an ETF is replicating, rather than beating it, which an active fund manager aims to do (although admittedly seldom does). The whole Moneyfarm service is managed and tracked online but you can also speak with Moneyfarm’s investment consultants to discuss your options if you need to.

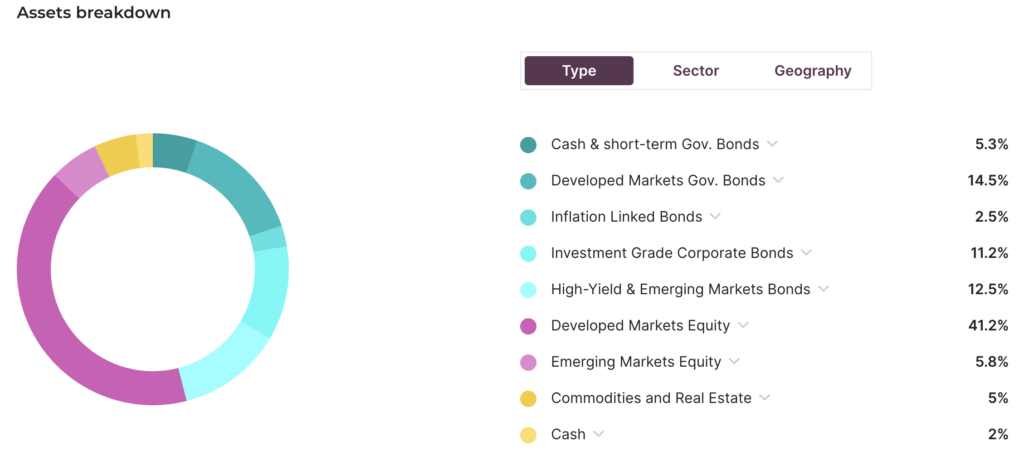

After the questionnaire, you need to set up your contributions and retirement date. You will be able to see how each portfolio is set up (an example is shown below), what your likely returns could be based on, how much you are planning to save and your risk level. This will help you decide if you need to invest more or adjust how much risk you want to take. All these details can be changed at any point.

As mentioned earlier, your portfolio and suitability will be reviewed annually by Moneyfarm so you can assess if it is still on track to meet your goals - much in the same way that a financial adviser does.

Once you are happy with your portfolio, you can invest money or transfer an existing pension across to Moneyfarm (more on this later). Once your money is invested into your chosen portfolio then Moneyfarm will manage the portfolio and select the underlying ETFs. The portfolio is rebalanced 3-4 times a year to minimise costs with the investment team providing the tactical oversight on their quantitative investment models. The investment committee meets monthly, although the team continually evaluates the portfolios. My sense from discussions with their Chief Investment Officer is that Moneyfarm place as much emphasis on risk management as they do with optimising returns. While this was a slight drag on Moneyarm's portfolios in 2017's equity market rally it meant that its portfolios held up well during the stock market sell-off in the spring of 2018. Later in this article I look at Moneyfarm's performance in more detail.

Does Moneyfarm’s pension have a minimum investment amount?

Moneyfarm used to have a minimum investment of just £1, which made it a pretty attractive way to start saving for your retirement. But in July 2018 it changed this to a lump sum of £500 and in February 2020, the minimum was increased once again, this time to £5,000. In August 2021 Moneyfarm reduced its minimum investment amount once again, back to £500 and with no requirement to set up a monthly direct debit. The initial investment can either come from yourself, a pension transfer, or from your employer if you can persuade your boss to contribute.

Beyond this, Moneyfarm lets you set your own contributions, subject to its minimum, explaining that the minimum investment of £500 helps to diversify your risk.

Remember, the more you regularly invest – while not breaching the annual and lifetime pension allowance - the more you are likely to benefit from pound cost averaging, hopefully boosting your profits and retirement savings.

Can an employer pay into a Moneyfarm Pension?

Employers can also contribute to a Moneyfarm Pension for their staff. You will need to request a form from Moneyfarm and get it completed to set up the contributions.

Moneyfarm pension transfers

You can transfer pensions from other providers to Moneyfarm, including from SIPPs and workplace pension schemes, so long as you haven’t started to take income from them.

It is also worth checking your old pensions for certain benefits, such as annuity rate guarantees, as it may then be worth holding onto them. The only type of pension you can’t transfer to Moneyfarm is a defined benefit scheme (also known as a final salary scheme). For more information on transferring a final salary scheme read our article 'Should I transfer my final salary pension?'

Moneyfarm find, check and transfer service

Moneyfarm also offers a ‘find, check and transfer*‘ service through its sister company Profile Pensions, where its team can help you to trace and consolidate old and lost pensions. Once found, you can decide whether you want to combine them into a new, personalised Moneyfarm pension plan. Moneyfarm makes it clear that it is your responsibility to ensure that you check your existing pensions for any guaranteed benefits or penalties that may apply before you complete the transfer. If you already know how to locate your existing pension pots then you can of course initiate a pension transfer to Moneyfarm yourself and there is no fee for doing so.

Moneyfarm pension drawdown - what happens to my Moneyfarm pension when I retire?

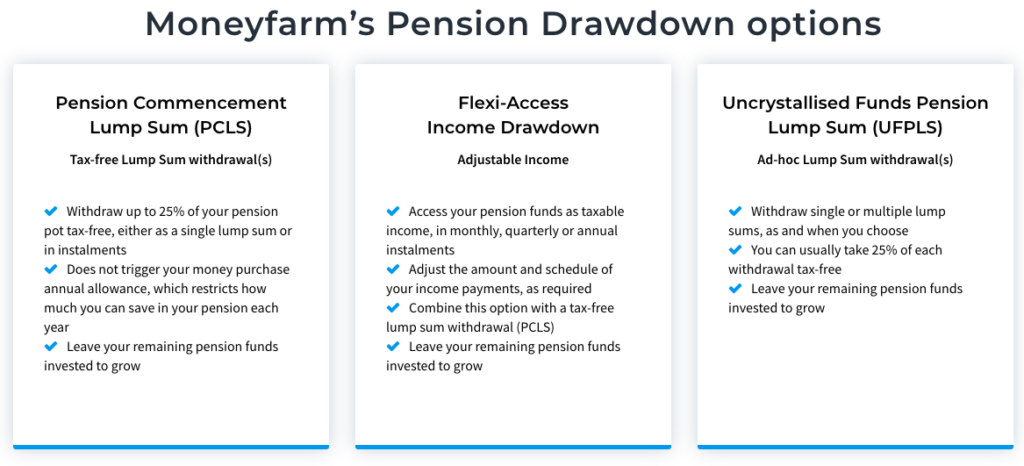

Moneyfarm doesn’t just help you build up your pension savings, it also helps when you enter retirement. You can start withdrawing your funds from age 55, or older, using Moneyfarm pension drawdown. This is a form of income drawdown that lets you keep some of the money invested while withdrawing a set amount each month. Moneyfarm doesn’t charge any extra for income drawdown beyond its usual platform and fund fees, while other pension providers or platforms may have setup costs or extra admin charges. Click to enlarge the image below to see Moneyfarm's pension drawdown options.

The reality is that Moneyfarm does not yet have an income portfolio, again like most robo-advice firms, which would ideally suit a pension in drawdown. So instead you would need to withdraw lump sums from your pension pot in retirement. This isn't ideal as it can mean having to encash a larger percentage of your pension in a falling market if you want to maintain the level of income being taken, in terms of pounds and pence. However, there is nothing stopping you moving your money to another provider at this point and building your own income portfolio.

Another retirement option is taking an annuity, however, Moneyfarm does not provide this so you would have to transfer your funds to a new provider. Moneyfarm doesn’t charge any exit fees so you would be able to do this, or even find a different income drawdown provider, at no extra cost other than what the new provider charges.

Moneyfarm pension charges and fees

Moneyfarm fees are the same across all its accounts (pensions, ISAs and general investment account) and if you have multiple portfolios such as a pension and ISA you would pay just one platform fee. Moneyfarm recently introduced a new charging structure that simplified its charges and we summarise the fees in the table below.

Moneyfarm fees for actively managed portfolios

| Investment amount | Management Fee |

| £500 - £10,000 | 0.75% |

| £10,001 - £20,000 | 0.70% |

| £20,001 - £50,000 | 0.65% |

| £50,001 - £100,000 | 0.60% |

| £100,001 - £250,000 | 0.45% |

| £250,001 - £500,000 | 0.40% |

| Over £500,000 | 0.35% |

Crucially, the fee you pay as a Moneyfarm customer is now based on the total value of your portfolio. For example, if you were to invest £75,000 you would pay a total fee of 0.60%, plus any underlying fund charges.

Moneyfarm fees for fixed allocation portfolios

| Investment amount | Management Fee |

| £500 - £100,000 | 0.45% |

| £100,001 - £250,000 | 0.35% |

| £250,001 - £500,000 | 0.30% |

| Over £500,000 | 0.25% |

As with the actively managed portfolios, the fee you pay as a Moneyfarm customer is based on the total value of your portfolio.

Moneyfarm pension performance

Moneyfarm launched in the UK in 2016 so has almost eight years of performance data. We've listed the performance data for each of the portfolios below so that you can see the total return since 2016 as well as the annual average return.

| Portfolio (Risk level) | Total return since 2016 | Annual average return |

| Portfolio 1 | 2.8% | 0.3% |

| Portfolio 2 | 20.6% | 2.2% |

| Portfolio 3 | 42.1% | 4.2% |

| Portfolio 4 | 55.4% | 5.3% |

| Portfolio 5 | 67.9% | 6.3% |

| Portfolio 6 | 84.0% | 7.4% |

| Portfolio 7 | 106.7% | 8.9% |

Correct as at 01.08.24

Check out our Moneyfarm review where we look at the robo-adviser’s pension performance in more detail versus Nutmeg, the most well-known robo-adviser.

Moneyfarm pension* vs Nutmeg pension vs Wealthify vs PensionBee

Moneyfarm’s closest robo-pension rivals are Wealthify, Nutmeg and PensionBee. All start from similar places, asking users about their retirement goals, but differences emerge when it comes to the minimum investment and choice of portfolios and service you end up with.

The lowest minimum investment of the three is Wealthify, you can start your retirement savings for just £1 compared to £500 with Nutmeg and Moneyfarm. PensionBee doesn’t have any minimum but you can only get one of its portfolios by transferring existing pension savings. You can read our separate Wealthify review, Nutmeg review and PensionBee review for more information.

There is plenty of variety in Moneyfarm’s seven portfolios, whilst you get five with Wealthify and eight with PensionBee. However, you get ten portfolios with Nutmeg.

All four providers offer low-cost ETF or tracker fund portfolios. Like Moneyfarm, Nutmeg has two main fee structures. Its fully managed portfolios (comparable to Moneyfarm's actively managed investment portfolios) are proactively managed to protect against losses and boost returns. The simpler fee structure at Nutmeg charges 0.75% up to £100,000 and 0.35% beyond that. It also offers fixed allocation portfolios, designed to perform without intervention. These charge 0.45% up to £100,000 and 0.25% beyond. Nutmeg’s portfolios have a fund fee which averages 0.21%.

Wealthify charges a simple flat annual fee of 0.60%, irrespective of how much you invest. PensionBee’s charges depend on the portfolio as well as how much you invest, with fees coming down on amounts above £100,000. For pensions under £100,000 you'll pay annual fees of 0.50%-0.95%, depending on the portfolio. The costs are halved on values above £100,000.

All allow transfers from other providers and PensionBee’s service also helps you locate your pension, however, it doesn't charge a fee for this service. The Wealthify service works along similar lines to Moneyfarm but has lower entry costs at £1 rather than £500. Nutmeg also has a £500 minimum investment, but you will get a wider choice of portfolios.

Conclusion

Moneyfarm is now one of the more established names in the robo-adviser space. Its performance data only stretches back to 2016, compared with the ten-year track record that you can get with Nutmeg. As shown in our wider Moneyfarm review (which also looks at the ISA product) Moneyfarm has performed well in comparison with Nutmeg, only slightly underperforming them since inception.

The Moneyfarm platform is easy to use and the setup process is fast. There is plenty of choice in the seven portfolios, giving you exposure to a broad range of assets and while you can start by investing an initial amount of £500. Additionally, you can earn invest in a Moneyfarm pension fee free for 12 months via this offer*.

If you are looking for a simple, no-hassle passive method of investing, with human oversight, with a portfolio recommended to suit your risk profile and savings goals, then Moneyfarm is definitely a service to be considered.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses - Moneyfarm