In this independent Moneyfarm* review I look at how Moneyfarm invests money, Moneyfarm's charges and fees as well as Moneyfarm's performance and portfolio returns. As one of the most widely quoted investment experts in the national press I walk you through my review of Moneyfarm in stages. I suggest you read the entire review as it includes key observations and analysis of Moneyfarm's proposition, particularly around charges and performance. If you want to jump to specific parts of this review then you can do so by clicking on the links below.

- How does Moneyfarm manage its portfolios?

- See a personalised Moneyfarm portfolio

- Moneyfarm performance and returns

- Moneyfarm vs Nutmeg (including comparison of charges and performance)

- Moneyfarm customer reviews

- Conclusion

1 minute summary - Moneyfarm review

- Invest from as little as £500

- Invest in a number of products including a Stocks and Shares ISA, Junior ISA, Pension and general investment account

- Management fees ranging from 0.25%-0.75%

- Management fees reduce as you invest more

- Choice of actively managed, fixed allocation or socially responsible portfolios

- Additional investing options including share trading and access to money market funds via its Liquidity+ service

- Moneyfarm Fee-free Offer: Open a Moneyfarm Stocks and shares ISA, Junior ISA, Pension or General investing account and get Fee-free investing for a year*

Moneyfarm offer

Because Moneyfarm investments may be suitable for some readers (read full review below), I have highlighted an exclusive offer for MoneytotheMasses.com readers.

No management fees (Exclusive offer) – Fee-free investing for 12 months

Moneyfarm will run your money fee-FREE for a year* if you open a Stocks and Shares ISA, Junior ISA, Pension or general investment account with a minimum amount of £500 and no obligation to set up a monthly direct debit.

In the interests of transparency, MoneytotheMasses.com receives a small fee from Moneyfarm if you utilise the offers. However editorial independence is paramount to MoneytotheMasses.com and in no way is this review or my views ever influenced by third parties. I have included a link to Moneyfarm at the foot of this article which you can use and MoneytotheMasses.com will not receive any payment from your referral.

Who is Moneyfarm?

Moneyfarm is an interesting proposition for those trying to find the best investment ISA or pension to invest in. After successfully running money for investors in Italy since 2011, Moneyfarm launched in the UK back in 2016 following the rise in demand for investment ISAs, robo-advice, cheap stocks and shares ISAs and pensions for beginners. That's because historically, investing was the preserve of the wealthy but the rise of investment fund platforms changed that. The UK market has since been looking for a cost-effective investment platform for beginners (and experienced investors) that can deliver good investment performance with minimal input from the investor.

Based upon its operation in Italy where the firm originates from, Moneyfarm certainly has a good pedigree for successfully investing client money online. In December 2021, Moneyfarm acquired Wealthsimple's book of business, welcoming 16,000 customers as it passed £2bn in assets under management. This makes it one of the largest digital wealth managers in Europe. Moneyfarm is regulated by the Financial Conduct Authority in the UK. In December 2022, Moneyfarm acquired digital pension provider and pension consolidation specialist Profile Pensions.

Moneyfarm minimum investment amount

Moneyfarm's minimum investment is £500. If you decide to invest £500 or more with Moneyfarm, you can do so via our fee-free offer* meaning Moneyfarm will waive its management fee for the first year.

If you have at least £500 to invest you could consider Nutmeg as an alternative. It will also waive its management fees for the first 12 months (see our Nutmeg review for full details). If you want to invest less than £500 have a look at our Wealthify review, which lets you invest from as little as £1 in an ISA, Junior ISA, general investment account or pension.

How does Moneyfarm investment management work?

The following summarises how Moneyfarm works. Moneyfarm will:

- help you assess the level of investment risk (and therefore potential loss) you are willing to take

- build a diversified portfolio for you (so your eggs are not all in one basket)

- keep costs as low as possible (as these eat into your returns) which means using passive investment funds and exchange-traded funds known as ETFs

- maximise your investment returns by strategically investing your money

- manage, monitor and review your portfolio

You can start investing with Moneyfarm* via an ISA, general investment account, Junior ISA or a pension within 10 minutes thanks to its slick online interface and/or Moneyfarm app. This is quite an achievement compared to other investment platforms where the user experience is far clunkier. Having said that rather than take Moneyfarm at its word I actually tested this 10 minute claim and in fairness it does hold true. In fact, you can just have a dummy Moneyfarm portfolio created for you, with no compulsion to invest, in about 3 minutes.

One important distinction between Moneyfarm and other robo-advice firms is that you are designated an Investment Consultant who can offer guidance.

In my opinion, this is hugely underplayed by Moneyfarm in its marketing. Having the ability to talk to an Investment Consultant who can provide guidance (not advice) is attractive to those investors who want access to low-cost discretionary management but with the possibility of a human touch if required.

Moneyfarm offers regulated advice to consumers via its algorithm which selects a portfolio for you, so its customers are afforded the greater level of consumer protection that comes with regulated advice, over that which execution-only robo-advice propositions provide.

When it comes to investing, Moneyfarm offers the following four products:

Moneyfarm Stocks & Shares ISA

- Investing in a Moneyfarm Stocks & Shares ISA* allows you to invest tax-free with the flexibility to withdraw or transfer funds whenever you want (No fees payable for up to 12 months – exclusive offer for Money to the Masses readers)

- You can also transfer existing ISAs into it

- To invest your money Moneyfarm states it uses your savings goals, appetite for risk and other factors to build a personalised portfolio

- Invest in more than one of its portfolios within the same ISA

- Choice of portfolios including actively managed, fixed allocation or socially responsible

- Choice of 7 investment tiers of varying risk levels

Moneyfarm Junior ISA

- You can invest up to £9,000 per year/per child in a Moneyfarm Junior Stocks & Shares ISA* (No fees payable for up to 12 months – exclusive offer for Money to the Masses readers)

- You can also transfer existing Junior ISAs into it

- Invest an initial £500 and a regular commitment of £10 per month

- Friends and family can contribute via the 3rd party contribution tool

- Your child must be under 18 and living in the UK

- The money can only be withdrawn once your child turns 18 and they will have full control over the funds

- The Junior Stocks and Shares ISA will convert to a regular Stocks and Shares ISA when your child turns 18

- Invest in more than one of its portfolios within the same ISA

- Choice of portfolios including actively managed, fixed allocation or socially responsible

- Choice of 7 investment tiers of varying risk levels

Moneyfarm General Investment Account

- The Moneyfarm General Investment Account* works in the same as the Moneyfarm Stock & Share ISA but without the tax benefits (so all income and growth is taxable) or annual contribution limits

Moneyfarm Pension

- The Moneyfarm Pension* allows you to invest for your retirement while receiving tax relief on the contributions paid into the pension (No fees payable for up to 12 months – exclusive offer for Money to the Masses readers)

- Moneyfarm invests your money via a recommended portfolio which is based upon your savings goals, appetite for risk, planned retirement date and the amount you have to invest

- Moneyfarm can also facilitate employer contributions, which can be from a client’s limited company

Moneyfarm ‘find, check and transfer pension service

- Moneyfarm offers a ‘find, check and transfer*‘ service through its sister company Profile Pensions, where its team will help you to find any old or lost pensions. If you wish, you can then combine them all into one, new personalised plan. It previously charged a fee of 1% for this service which was taken from your pension when you transfer, however, this was scrapped in September 2024. Make sure that you check your existing pension for any guaranteed benefits or penalties before you transfer.

- You can of course initiate a pension transfer to Moneyfarm yourself should you wish and there is no fee for doing so.

How does Moneyfarm manage its portfolios?

Over the course of the past few years I have held a number of meetings with Moneyfarm in order to assess how it invests money, including a meeting with Richard Flax, the Chief Investment Officer who is in charge of the investment team. I've also anonymously opened an account with it online.

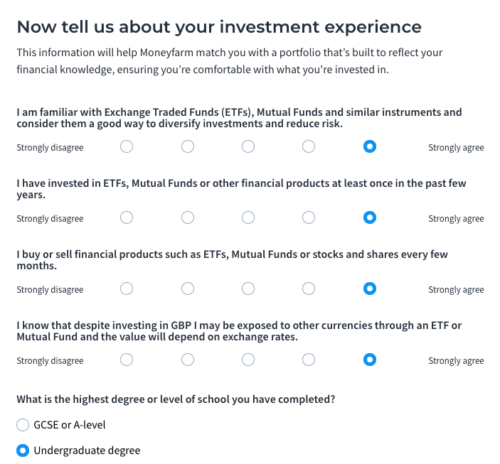

Moneyfarm initially assesses your risk profile using its own in-house risk assessment, as opposed to an external third party offering such as Finametica. The screenshots below are the summary of the questionnaire and the answers that I gave when registering (click to enlarge).

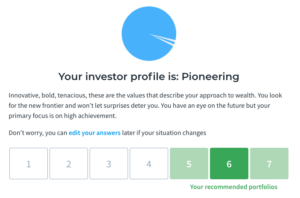

Once you've answered the questionnaire you will be presented with the following screen that will give you your recommended portfolios, one in dark green and others in lighter green (The darker green being the favourable recommendation based on your answers).

At this stage, Moneyfarm used to present the breakdown of the corresponding portfolios on screen but you are now encouraged to continue to a full registration, but you don't have to. If you are interested in seeing the asset allocation of your recommended portfolio then you can instead click to go back to the dashboard. Alternatively, you just check the portfolios on Moneyfarm's website, as it is easily accessible information. It is important to highlight at this point that this is an actual recommendation, or in other words, Moneyfarm is providing you with regulated advice on the suitability of the portfolio it recommends. This distinction is important as some robo-advice firms operate on an execution-only basis, which means you ultimately select the portfolio to invest in and all the risk lies with you. Because Moneyfarm is making a formal recommendation the advice has to adhere to strict FCA guidelines. That means each year Moneyfarm reviews the suitability of your portfolio and recommends whether it remains suitable or whether you need to change portfolios (i.e. to take more or less investment risk). This recommendation is based upon any changes in your profile.

The asset mix of your portfolio takes into account your risk profile, the amount you plan to invest and how long you wish to invest for. You may also have the choice of taking less or more risk than your recommended portfolio's default position. If you opt to take more or less risk then it alters the portfolio asset mix.

Moneyfarm's portfolio asset allocations are based upon volatility targeting for each level of risk. Volatility is a measure of how quickly markets or an asset move up and down. This is slightly different to risk. To help understand this think of volatility as like the waves in a stormy sea while risk is the event that you drown. They are two different things. Yet clearly as volatility increases the risk rises.

There is a lot of debate about whether volatility is a good measure for assessing risk. However, I have carried out extensive research as part of my DIY investment service 80-20 Investor which shows that it is a valid tool for managing risk. By contrast most investment platforms assess risk based on generic assumptions i.e that all bond funds are low risk. Yet that view is flawed. Ask anyone who lost a sizeable amount of money when the bond market sold off at the end of 2016 whether bond funds are low risk or not. The point is that risk is relative.

So I view it as a positive that volatility is part of Moneyfarm's risk management process. For each portfolio Moneyfarm targets volatility which means that if assets become more volatile then their place in the portfolio will be reviewed. So theoretically a low risk portfolio should remain low risk even if investment markets undergo a fundamental shift which alters the asset's risk level (as per the bond example above). On top of this Moneyfarm rebalances its actively managed portfolios – i.e. makes changes to make sure the asset allocation has not deviated from the desired mix as a result of market moves – roughly every 3 months (annually for fixed allocation portfolios). Again, this is a sensible period of time as it is short enough to ensure unwanted risks don't creep into the portfolios but long enough to avoid excessive costs from over-trading.

One of my biggest criticisms of most managed Stocks and Shares ISA funds and pension funds is that the managers do not back their convictions. The best performing Stocks and Shares ISAs and pensions in the long term are those that do not simply track the market or just replicate their peers. To outperform you need to occasionally invest in unpopular assets or avoid others that are unattractive. Moneyfarm invests using ETFs which track a given index or asset price. What became clear when grilling its investment analysts is that Moneyfarm will make investment decisions based on its research. For example, Moneyfarm has tended to avoid investing in commercial property (due to it being illiquid) which should have fared the company's portfolios well during 2016 when that market devalued in the wake of the Brexit vote. Moneyfarm has also previously avoided investing in commodities and has even used currency ETFs to hedge its currency exposure (as it did ahead of the Brexit vote).

Moneyfarm chose not to chase performance in the equity rally of 2017 by unnecessarily increasing the investment risk it was taking. This meant that its portfolios held up well in the subsequent stock market correction in the spring of 2018. This period in the stock market was interesting as a lot of robo-advice firms came under increased scrutiny. Some investors expected their robo-advice firms to react to the stock market sell-off in order to limit their losses. During this period Moneyfarm's investment committee did review the situation and concluded there was no need for a knee-jerk reaction, which proved the right call in the end. The point is that behind the scenes there is a lot of analysis and decision making going on, but it isn't communicated as well as it could be to clients. This is a criticism that could be levelled at most robo-advice firms. A decision to leave a portfolio unchanged is still a decision and should be relayed as such.

Moneyfarm's investment process and risk management is refreshing and at least gives it the opportunity to outperform the market in the future. For me this is important and I'm not sure why Moneyfarm does not make reference to it externally. Many investment companies simply compete on price (i.e try and tempt consumers with claims of being the cheapest) at the expense of trying to maximise investment returns. That's far from desirable and you'd be better off just buying a simple tracker fund.

As an aside, my suggestion to anyone investing using ETFs is to try and stick to physical ETFs if possible rather than synthetic or sampled ETFs. Physical ETFs actually buy the assets they track rather than use financial instruments to replicate the moves in the targeted asset's price. Sampled ETFs track the chosen index asset less closely than one that physically holds the asset in question. For example if you only buy shares in a sample of the companies that make up the FTSE 100 then your investment performance will differ from that of the index. Synthetic ETFs also introduce something called counterparty risk which means there is a potential for investment returns to not materialise. In short, if you are looking for a low-cost Stocks and Shares ISA that invests in ETFs then go for one that favours physical ETFs. Moneyfarm is one such provider. However, since December 2017 Moneyfarm has started to use non-physical ETFs where necessary but it remains the exception rather than the rule. It certainly doesn't use leveraged ETFs (these are ETFs that amplify returns and losses by using borrowed money). It does manage currency risks by buying currency-hedged ETFs where it deems it appropriate.

See a personalised Moneyfarm portfolio

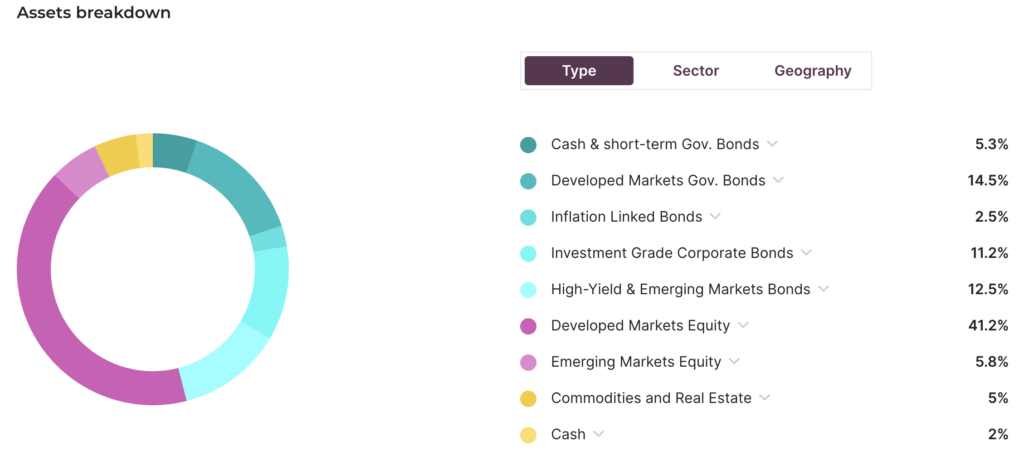

As mentioned above the good news is that you can build a bespoke portfolio for free using Moneyfarm's portfolio tool without committing to the service. Registering is free and there is no obligation to contribute any money. The tool suggests a portfolio with an asset mix dependent on how long you want to invest for as well as your risk profile (as determined by Moneyfarm's risk questionnaire). The image below shows you what you can expect to see. This level of transparency can only be a good thing.

Moneyfarm standard allocation – Medium risk (Portfolio 4)

Below I've summarised how a typical Medium risk actively managed portfolio is currently invested assuming a five-year investment term. As I mentioned above, you can see a more personalised portfolio in less than five minutes by registering on the Moneyfarm site. The numbers in brackets were the portfolio positions at the start of 2017 to give you an idea of how Moneyfarm altered its asset allocation over time.

| Asset | Moneyfarm Medium risk actively managed portfolio 4 (over £50k invested) |

| Cash & short-term Gov. Bonds | 5.30% (16.97%) |

| Developed Markets Gov. Bonds | 14.50% (5.64%) |

| Investment Grade Corporate Bonds | 11.20% |

| Inflation Linked Bonds | 2.50% |

| High-Yield & Emerging Markets Bonds | 12.50% (21.29%) |

| Developed Markets Equity | 41.20% (51.84%) |

| Emerging Market Equity | 5.80% |

| Cash | 2.00% (3.75%) |

| Commodities and Real Estate | 5.00% |

It is interesting to note that Moneyfarm is now investing in Commodities and Real Estate, asset classes it had previously avoided. However, the only way to assess how successful a firm has been at investing money is by looking at the past performance. I analyse Moneyfarm's returns later in this article.

Moneyfarm ethical allocation – Medium risk (Portfolio 4)

Below is an example of how a typical medium risk socially responsible investing portfolio is invested.

| Asset | Moneyfarm Medium risk portfolio 4 (over £50k invested) |

| Cash & short-term Gov. Bonds | 8% |

| Developed Markets Gov. Bonds | 10% |

| Investment Grade Corporate Bonds | 18% |

| Inflation Linked Bonds | 7% |

| High-Yield & Emerging Markets Bonds | 8% |

| Developed Markets Equity | 41.8% |

| Emerging Market Equity | 5.2% |

| Cash | 2% |

Moneyfarm Thematic Investing

In early 2023 Moneyfarm launched ‘Thematic Investing', allowing investors to gain exposure to ‘Megatrends' via 4 growth themes. The themes are titled Technology, Sustainability, Society and Multi-trend and investors can choose the themes that are best aligned with their values, adding them to a new or existing portfolio.

A total of 20% of the overall portfolio can be invested in a chosen growth theme or selection of growth themes. Moneyfarm describes this as a ‘core/satellite' approach to investing, with the core part of an investor's portfolio being made up of low-cost index funds and ETFs. The satellite part of the portfolio is the investor's choice of growth themes, which are targeted, high-growth investments that align with broader long-term trends.

It is worth noting that investors will need a minimum of £10k in their investment account in order to access one of Moneyfarm's four growth themes and there is no additional cost in order to access them. We cover Moneyfarm's fees in detail in the next section.

We've provided a summary below of the sectors that are included in Moneyfarm's four growth themes.

| Technology | Sustainability | Society | Multi-trend |

| E-commerce | Circular economy | E-commerce | E-commerce |

| Electric vehicles | Blue economy | Esports | Semiconductors |

| Clean energy | Clean energy | Global infrastructure | Global infrastructure |

| Artificial intelligence | Clean water | Gender equality | Circular economy |

Moneyfarm Share Investing

Moneyfarm Share Investing allows you to buy and sell UK shares, ETFs and UK Mutual Funds for £3.95 per trade, with Bonds costing £5.95 per trade. Currently, this service is only available via an ISA share trading account or General Investment Account. It charges a currency conversion fee of 0.70% and there is a yearly custody fee of 0.35% (capped at £45).

Moneyfarm Liquidiy+

Liquidity+ invests in a range of money market funds which are mutual funds that invest in short-term, low risk debt securities such as government bonds and certificates of deposit. It is typically aimed at investors with a low-risk profile and with a time horizon of 2 years or less. Investors can start with as little as £500 and money can be withdrawn at any time without penalty. There is a flat management fee of 0.35% (including VAT) plus underlying fund costs of 0.10%.

What are Moneyfarm's fees?

Moneyfarm has a simple one-fee structure, meaning investors will pay one management fee across the whole investment portfolio. So, for example, if you invest £75,000 in its actively managed portfolios, you will pay a total fee of 0.60% across the whole portfolio. This simplified fee structure means that investors are rewarded with lower fees as they invest more.

It is possible, however, to have these fees waived in the first year via this exclusive Moneyfarm offer*. We provide a breakdown of the fees for investing with Moneyfarm below, including its actively managed, fixed allocation and socially responsible portfolios.

Moneyfarm actively managed portfolio fees

| Investment amount | Management Fee |

| £500 – £10,000 | 0.75% |

| £10,001 – £20,000 | 0.70% |

| £20,001 – £50,000 | 0.65% |

| £50,001 – £100,000 | 0.60% |

| £100,001 – £250,000 | 0.45% |

| £250,001 – £500,000 | 0.40% |

| Over £500,000 | 0.35% |

Ongoing fund fees average 0.20%

Moneyfarm uses passive investments known as exchange-traded funds (ETFs). This is the cheapest way to invest as most funds run by fund managers (known as active funds) sold via major fund platforms have fund charges of between 1.5-2.5% which is on top of the fee charged by the investment platform. Moneyfarm's own research (which I haven't verified) suggests that it is almost 1.2% cheaper than investing via Hargreaves Lansdown, almost 3% cheaper than using a wealth manager and 4.8% cheaper than investing with a financial adviser. Personally, I wouldn't overplay these figures but they are indicative. The main takeaway is that Moneyfarm is certainly a cheap way to invest.

Moneyfarm fixed allocation portfolio fees

| Investment amount | Management Fee |

| £500 – £100,000 | 0.45% |

| £100,001 – £250,000 | 0.35% |

| £250,001 – £500,000 | 0.30% |

| Over £500,000 | 0.25% |

Ongoing fund fees average 0.15%

In September 2022, Moneyfarm* announced the launch of its fixed allocation portfolios. As with its actively managed and socially responsible portfolios, customers can choose from a total of 7 portfolios of varying risk levels.

Moneyfarm's fixed allocation portfolios are built using historical data, based on the assumption that historical market behaviour will repeat itself over the long term. This differs from actively managed portfolios that are forward-looking and are regularly adjusted as markets fluctuate.

Moneyfarm's fixed allocation portfolios do not receive any active intervention and are only rebalanced once a year to ensure that the portfolio allocation doesn't deviate too far from its investment model. This hands-off approach allows Moneyfarm to offer fixed allocation portfolios at a lower cost, as demonstrated in the table above.

Moneyfarm socially responsible portfolio fees

| Investment amount | Management Fee |

| £500 – £10,000 | 0.75% |

| £10,001 – £20,000 | 0.70% |

| £20,001 – £50,000 | 0.65% |

| £50,001 – £100,000 | 0.60% |

| £100,001 – £250,000 | 0.45% |

| £250,001 – £500,000 | 0.40% |

| Over £500,000 | 0.35% |

Ongoing fund fees for ethical portfolios average 0.21%

In addition to its actively managed and fixed allocation portfolios, Moneyfarm* offers a total of 7 socially responsible investing (SRI) portfolios that prioritise environmental, social and corporate governance factors, often referred to as ESG. The portfolios are built in the same way as the actively manage portfolios with Moneyfarm selecting the best-in-class ETFs, however, they are further optimised for things like environmental risk, CO2 intensity, the avoidance of controversies and many other similar metrics. Additionally, there is a layer of negative screening, meaning that companies involved in burning fossil fuels or operating in arms production or distribution are automatically excluded.

In terms of fees, you will pay the same management fee irrespective of whether you are investing in a classic actively managed portfolio or ethical portfolio, however, the ongoing fund cost is marginally more expensive averaging 0.21%, compared to 0.20% for its regular portfolios. That being said, ongoing fund fees of 0.21% for an ethical portfolio is incredibly cheap, especially when you compare it to other digital wealth managers such as Nutmeg (0.31%). Again, the fee payable is applied to the whole portfolio, so on a £75,000 investment, you will be charged a management fee of 0.60%.

Moneyfarm Share Investing fees

Customers can gain ‘early access' and trade shares at £3.95 per trade. Below we summarise the fees for Moneyfarm's Share Investing service.

| Fee Type | Fee |

| Annual management charge | GIA – N/A

ISA – 0.35% |

| UK shares, ETFs and UK Mutual Funds | £3.95 per trade |

| Bonds | £5.95 per trade |

| Currency conversion fee | 0.70% |

Moneyfarm Liquidity+ fees

Below we summarise the fees for Moneyfarm's Liquidity+ Investing service.

| Fee Type | Fee |

| Annual management charge | 0.30% (including VAT) |

| Underlying fund charge | 0.10% |

Moneyfarm ‘find, check and transfer' service fees

Moneyfarm offers a ‘find, check and transfer' service. It is designed to help those who have either lost track of old pensions or who simply wish to bring all of the pension together into one simplified pension pot. It previously charged a fee of 1% for this service, however, the fees were scrapped in September 2024, meaning those wish to use the service can now do so for free.

Moneyfarm’s portfolio performance

Moneyfarm has been investing money across Europe for a number of years and has a seven year track record of doing so in the UK. If you register with Moneyfarm (which doesn't mean you have to invest as you can just play with it for free) you can gain access to its latest UK performance data going back as far as January 2016 as well as its own projected future returns. The table below summarises Moneyfarm's performance from 1st January 2016 to 1st July 2024 assuming you invested less than £50,000.

| Portfolio | Moneyfarm Portfolio 4 (Medium to Risk) |

| Actual Moneyfarm return since launch on 1st January 2016 to 1st July 2024 | 55.40% |

To give this some context, a typical pension or investment fund, available on other investment platforms, with a similar medium risk investment mix (also known as an active fund) returned 38.20% over the same period. If you compare Moneyfarm's investment performance with other passive investment solutions it has performed well. But if you consider the Moneyfarm performance versus the equivalent Vanguard Lifestrategy Equity fund then Moneyfarm's medium risk portfolio has tailed by around 2%. Of course, bear in mind that Moneyfarm provides a human overlay to manage risk while Vanguard's proposition is purely passive and tracks the market.

However there are few caveats to add, firstly the timeframe analysed in the table above is only seven years, so isn't exhaustive. Also investment markets at the start of 2016 plummeted yet the first few days of Moneyfarm's performance shows that it didn't lose any money. This may be purely down to its investment management but it is most probably indicative of it not being fully invested in the market after the portfolio's launch which therefore marginally boosts its performance figures. Having said that there is no denying that the performance is extremely good and it performed well across the Brexit vote and the stock and bond market wobbles following the US election in November 2016.

However in 2017 Moneyfarm's performance, along with other tracker based propositions (such as Vanguard's), was less spectacular making 6.68%, slightly lagging actively managed funds. This reflects its more cautious approach in 2017 after such a strong equity rally so it didn't capture all of the upside, as demonstrated in our Moneyfarm vs Nutmeg comparison table below. However, Moneyfarm did perform well across the market sell-off at the back of 2018 which is a feather in its cap.

To sum up, Moneyfarm has a refreshing approach to managing its portfolios and its investment performance has been solid and is comparable to (but probably more cautious than) Nutmeg, its biggest competitor.

Moneyfarm vs Nutmeg

Nutmeg is the most well-known online investment manager with significant brand awareness among the public. To all intents and purposes, it is a direct competitor to Moneyfarm as they both provide low cost managed ETF portfolios with a focus on consumer ease of use. So as an alternative to Moneyfarm I compare the two side by side below:

Charges: Moneyfarm vs Nutmeg

The table below compares the fees charged by Moneyfarm and Nutmeg on their actively managed portfolios. As mentioned earlier, Moneyfarm has a simple one-fee structure, meaning investors will pay one management fee across the whole investment portfolio. So, if you invest £260,000 in its actively managed portfolios, you will pay a total fee of 0.40% across the whole portfolio, as opposed to different fees for different portions of your portfolio as per Nutmeg. This makes Moneyfarm very cost effective for investors with large portfolios.

| Investment amount | Moneyfarm managed portfolio fee | Nutmeg managed portfolio fee |

| £0 – £10,000 | 0.75% | 0.75% |

| £10,001 – £50,000 | 0.70% | 0.75% |

| £20,001 – £50,000 | 0.65% | 0.75% |

| £50,001 – £100,000 | 0.60% | 0.75% |

| £100,001 – £250,000 | 0.45% | 0.35% |

| £250,001 – £500,000 | 0.40% | 0.35% |

| Over £500,000 | 0.35% | 0.35% |

Interestingly Nutmeg reduced its management fees in 2018 to those stated above in order to be comparable to Moneyfarm, however, Moneyfarm subsequently altered its fee structure again in 2022. Make sure you check Moneyfarm's charges list here* (Scroll down to view).

| Investment amount | Moneyfarm fixed allocation portfolio fee | Nutmeg fixed allocation portfolio fee |

| £0 – £100,000 | 0.45% | 0.45% |

| £100,001 – £250,000 | 0.35% | 0.25% |

| £250,001 – £500,000 | 0.30% | 0.25% |

| Over £500,000 | 0.25% | 0.25% |

Moneyfarm launched its fixed allocation portfolios in September 2022 and the fees are the same as Nutmeg for those investing less than £100,000 or over £500,000.

Performance: Moneyfarm vs Nutmeg

Moneyfarm launched at the beginning of 2016 at a time when investment markets were plummeting. Moneyfarm's performance figures in early 2016 suggest it didn't lose any money and as explained earlier, this was likely as a result of not being fully invested in the market. It is therefore fairer, when making a comparison, to look at the performance in 2017, 2018, 2019, 2020, 2021, 2022 and 2023.

As you can see, Moneyfarm's more cautious approach meant that it lagged behind Nutmeg in 2017 (when stock markets rallied), but then outperformed Nutmeg in 2018 when stocks markets struggled. In what was a strong year for both, Moneyfarm slightly outperformed Nutmeg once again in 2019 but lagged in 2020 when equities markets rebounded from the pandemic-induced sell-off. However, Moneyfarm subsequently outperformed Nutmeg once again in both 2021 and 2022. Read our full Nutmeg review for a detailed breakdown of performance and charges, including how you can get your first £20,000 managed for free with Nutmeg.

| Investment | 2017 Performance | 2018 Performance | 2019 Performance |

2020 Performance

|

2021 Performance

|

2022 Performance

|

2023 Performance

|

| Moneyfarm (medium risk profile 4) | 6.20% | -4.50% | 11.70% | 2.90% | 8.80% | -9.00% | 9.00% |

| Nutmeg (portfolio 5) | 7.10% | -5.90% | 11.10% | 6.20% | 7.50% | -13.20% | 8.70% |

Who should consider Moneyfarm investments?

Having grilled Moneyfarm over how it runs money and assessing its online tools and data then Moneyfarm is well suited for:

- Those who want a designated human investment consultant (not offered by other robo-advice services) and the possibility of an initial investment review

- People who also want a discretionary investment service at a low cost

- Those who want to invest at least £500, the same minimum investment amount as Nutmeg. Those looking to invest smaller amounts may wish to look at Wealthify which has a minimum investment amount of £1

- Those who want flexibility. Moneyfarm has no exit fees and so is good for those wanting to keep their future options open by avoiding any lock-ins

- Those looking to get a better potential return on investments, with minimal input in terms of time or knowledge

- Those looking to invest via a managed Stocks and Shares ISA, pension or general investment account

- Those wanting to invest in ETFs without having to overcome the minefield of what to invest in

- Those who want their fees to reduce as they invest more

What protection is there from Moneyfarm going bust

- Moneyfarm is authorised and regulated by the Financial Conduct Authority

- Clients' money is held separately to Moneyfarm's own funds

- Your investment is eligible for protection under the Financial Services Compensation Scheme up to £85,000

Moneyfarm customer reviews

Obviously I have gone to great lengths to formulate a thorough and balanced review of Moneyfarm. Yet it is also interesting to consider consumers' own experiences. A number of MoneytotheMasses.com readers have spontaneously sent me positive views on the service. In addition Moneyfarm has a Trustpilot score of 4.4 out of 5.0 from over 1,300 reviews, rating it as ‘Excellent'. Below is a sample of some of the trustpilot reviews:

- ‘Great for new investors, intuitive platform, and fantastic customer service' – James B

- ‘Very clear website and good telephone advice' – Elizabeth D

- ‘Great service and info before investing' – John

- ‘Excellent service and commitment' – Lynn F

- ‘Excellent platform, with a very valid and reliable consultancy service'. – Davide D

Conclusion

- If you are looking for a simple, no-hassle passive method of investing in the stock market, with a portfolio tailored to your risk profile and savings goals, then Moneyfarm* is definitely a service to be considered.

- If having a designated human Investment Consultant whom you can reach out to is important then Moneyfarm is the only robo-advice service that I know of that offers this service.

- Moneyfarm's portfolio performance has been good, although this is not necessarily indicative of future returns obviously. However, if you want a slick, low cost, easy way to invest with a potential for a decent return then Moneyfarm is certainly worth considering.

- On the other hand if you want to take a more hands-on investment approach that empowers you to make your own DIY investment and fund decisions then have a look at my 80-20 Investor service.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses – Moneyfarm