What is Moneybox?

Have you ever wondered what to do with that spare change rattling around your wallet? What if you could save or invest it? Moneybox has come up with a digital solution. Its app will round up purchases you make on your card to the nearest pound and put the spare change in a savings or investment product. For example, each time you buy your morning coffee for £2.50, Moneybox will round that purchase up to £3 and put away the 50p in your selected product. It also has a feature to boost these round-ups by doubling the amount saved (so from 50p saved to £1 in this example) if you so wish. The idea is that these small bits of change eventually combine to turn into pounds and earn interest, generating savings while you spend.

In this independent Moneybox review, we explain how the app works, highlight its main features and reveal how its savings and investment features compare to the rest of the market.

1 minute summary - Moneybox investment app review

- Moneybox is an app that lets you save and invest your money from as little as £1.

- The app allows you to round up your spending meaning you can easily save or invest your spare change.

- Savings options include a Cash ISA, Cash Lifetime ISA, Simple Saver, 32 day notice account and a 95 day notice account

- There are several investing options to choose from including a Stocks and Shares ISA, Lifetime ISA, General Investment Account, Pension, Junior ISA and Socially Responsible Investing account.

- Moneybox provides a good all-round option for those looking for a simple way to save and invest.

- A cheaper alternative to Moneybox is AJ Bell Dodl*. It offers investors many of the same features at a lower monthly cost. It also pays 4.84% (AER variable) interest on cash held in its ISA and LISA accounts. You can read more in our independent AJ Bell Dodl review.

Moneybox features

- Open an account from £1 – open a savings or investment account from as little as £1

- Range of investment accounts – choose to invest in a Stocks and Shares ISA, a General Investment Account, Stocks and Shares Lifetime ISA, Junior ISA or a Socially Responsible investing account

- Good choice of savings accounts – choose to save in a Simple Saver, 32, or 95-day notice account. Also offers a choice of Cash ISA and Cash Lifetime ISA

- Plan for retirement – consolidate your pensions into a Moneybox Personal Pension

- Mortgage advice – get a mortgage with the help of Moneybox mortgage advisers

- Earn interest – earn interest on your savings

- Round up spending – round up your spare change into your savings and investments

- Useful Tools & Calculators – take advantage of handy tools such as the house deposit calculator and ISA time machine

- Regulated by FCA – Moneybox is registered with the Financial Conduct Authority

- FSCS protection – money saved or invested with Moneybox is protected up to £85,000 by the Financial Services Compensation Scheme

How does Moneybox work?

You must be at least 18 years old to open an account with Moneybox. You will also need a national insurance number if you want to open a Stocks and Shares ISA, Lifetime ISA or personal pension.

There is a separate app if you wanted to open a Junior ISA on behalf of a child or a relative who is under 18.

You can read about plenty of the Moneybox features on its website but you will need a smartphone to use the service. This is because you have to download an app that then links to your bank accounts.

Once downloaded, you need to sign up with your name, email, set a password and enter your phone number and date of birth. Moneybox will then get you to verify your email and create a five-digit PIN for extra security. The first task is to decide the type of account you want your spare change to go to. You can click on handy question marks to read articles addressing issues such as which account is best and the Moneybox support team is contactable between 9am and 5.30pm, 7 days a week.

Once you decide on the type of account, you can select how to add money, such as through a deposit, round-ups or a combination of both. You can start with as little as £1. Users are presented with a list of banks they can link with the app. Most are included and you will need to authorise Moneybox to access your account. If you already have your chosen bank’s app on your phone you will be redirected to automatically establish the connection, otherwise, you will need to enter the account details manually. Once connected, you will need to set up a direct debit so your money can be sent from your bank to the chosen Moneybox product.

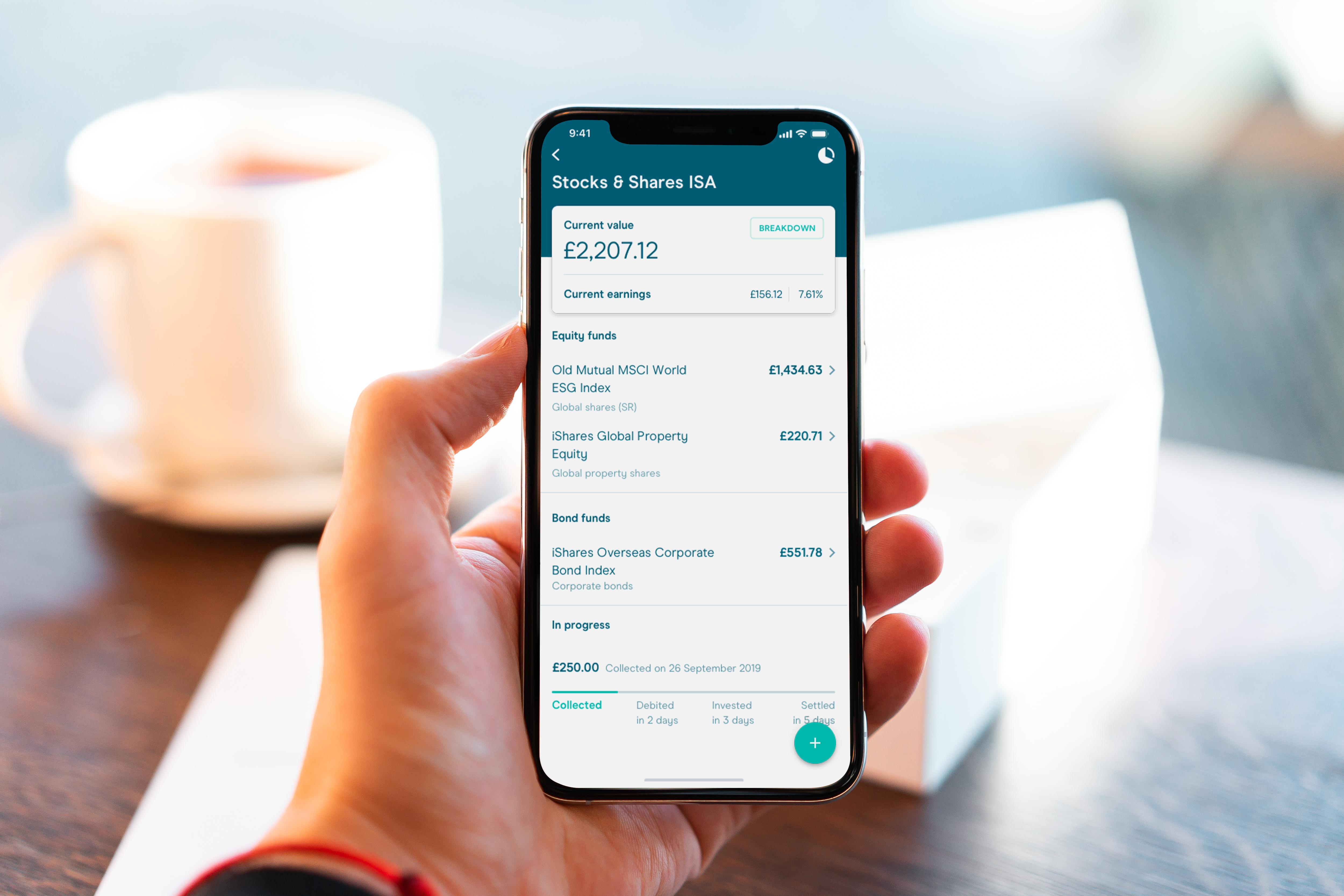

Users can view their spending and what their transactions can be rounded to within the app, where you will also be able to make deposits. You can even round up credit card spending as Moneybox simply calculates what the round-up will be when monitoring your spending across any bank or credit card accounts you connect to the app.

Round-ups and deposits are combined into a weekly savings total that is collected from your nominated linked bank account each Wednesday at midday and debited into the Moneybox product early in the following week. Transactions will be rounded up automatically after two days but you can change the settings to do this manually and choose which transactions to round up anytime during the week.

You can set up several Moneybox products under one account so you could have your spending and round-ups spread across a savings product as well as an ISA and pension. Moneybox supports the following banks for round-ups:

- American Express

- Bank of Scotland

- Barclaycard

- Barclays

- First Direct

- Halifax

- HSBC

- Lloyds

- M&S Bank

- MBNA

- Monzo

- Nationwide

- NatWest

- RBS

- Revolut

- Sainsbury's Bank

- Santander

- Starling

- Tesco Bank

- TSB

- Ulster Bank

- Virgin Money

- Yorkshire Building Society

The important thing to note is that the round-up is taken via direct debit from your nominated bank account, even if the tracked spending occurred elsewhere (i.e. on your credit card).

Saving with Moneybox

Moneybox Cash ISA

Moneybox launched its Cash ISA in September 2023 allowing customers to earn tax-free interest on up to £20,000 of savings each year. It currently offers an interest rate of 5.00% AER which includes an additional introductory bonus rate of 0.55% for the first year. To open a Cash ISA with Moneybox, you'll need to deposit a minimum initial amount of £500. If your account balance falls below £500 then a lower interest rate of 0.75% AER will apply.

Moneybox Simple saver

Moneybox launched its simple saver in early 2021 and offers an annual equivalent rate (AER) of 3.50%. Interest is calculated daily and paid into your account each month. The product is provided by Santander International, so benefits from the Financial Services Compensation Scheme protection if the provider goes bust, keeping your money safe.

Withdrawals are limited to one per calendar month and are paid into the nominated bank account the next working day.

Moneybox Boosted simple saver

Moneybox customers can get a boosted rate of up to 4.50% AER (variable) with a ‘qualifying' Moneybox account. Moneybox customers qualify for this rate if they either have a balance above £0 in a qualifying Moneybox account (which includes a Cash ISA, Stocks & Shares ISA, Lifetime ISA, Junior ISA or Personal Pension) or if they have a Reward Savings Account that hasn’t been cancelled.

32-day notice account

A newer addition to Moneybox savings accounts is the 32-day notice account. Savers can put money away for a minimum of 32 days and can benefit from an annual equivalent rate of 4.50%. Interest on this account is paid monthly and is calculated daily and you can deposit as little as £1. The product is provided by Investec, so benefits from the Financial Services Compensation Scheme protection.

You will have to wait 32 days to access the money once you have made a withdrawal request, which is something to consider before depositing your money.

95-day notice account

Savers could put their spare change into a 95-day notice account offering an annual equivalent rate (AER) of 4.80%. Interest is calculated daily and paid into your account each month. The product is provided by Investec, so benefits from the Financial Services Compensation Scheme protection if the provider goes bust, keeping your money safe.

You will have to wait 95 days if you want to make a withdrawal on the Moneybox savings account, which can be a long time if you need cash immediately.

Moneybox Cash Lifetime ISA

Alternatively, Moneybox offers its own cash Lifetime ISA for those saving to get on the property ladder or for those saving for their pension. The Moneybox Lifetime ISA lets you save your spare change while you benefit from tax-free returns as well as the government’s Lifetime ISA bonus of 25%, paid monthly. Moneybox’s Lifetime ISA offers a rate of 4.80% AER which consists of an interest rate of 3.80% AER and an additional introductory bonus rate of 1.00% for the first year. The Moneybox cash Lifetime ISA is covered by the Financial Services Compensation Scheme (FSCS). You can save up to £4,000 each tax year and get the 25% government bonus, totalling an additional £1,000. For a roundup of the best Cash Lifetime ISA rates, check out our article ‘Best and Cheapest Lifetime ISA providers‘. The best Cash Lifetime ISA rate on the market right now is AJ Bell Dodl* which is currently paying 4.84%.

There are some limits with the LISA compared with just using the notice account. The LISA is only available to those aged 18-39 and those who are using it to buy their first home or save for retirement. You can use the Lifetime ISA to buy a house up to the value of £450,000 anywhere in the UK but must have had the account open for at least one year. If you need to withdraw money for any reason other than your first home or retirement, you’ll pay a government charge of 25% on any sum you withdraw.

If you signed up for a Moneybox Cash LISA on or after 17th August 2020 then the account is provided by Moneybox in partnership with a number of banks including Santander, HSBC and Clydesdale. If you signed up before 23rd April 2020 it is provided by OakNorth bank and if you signed up between 23rd April 2020 and 17th August 2020 it is provided by Investec. All of Moneybox's partner banks are protected by the FSCS. For more information on Lifetime ISAs, check out our article ‘Lifetime ISAs explained'.

Moneybox savings accounts comparison table

The below comparison table summarises the different savings accounts available to open with Moneybox.

| Rate | Charges | Features | |

| Cash ISA | 5.00% | No charges |

Save up to £20,000 each tax year

The rate includes a 0.55% introductory bonus rate in the first year. |

| Simple saver | 3.50% | No charges |

Interest calculated daily and paid each month. Only one withdrawal allowed each month

|

| 32-day notice account | 4.50% | No charges |

Interest calculated daily and paid each month. Notice of 32 days is required for withdrawals.

|

| 95-day notice account | 4.80% | No charges |

Interest calculated daily and paid each month. Notice of 95 days is required for withdrawals.

|

| Cash Lifetime ISA | 4.80% | None, but there is a 25% government charge on any withdrawals if not using the account to buy your first home or for your retirement. |

Save up to £4,000 each tax year and get the 25% government bonus.

The rate includes a 1.00% introductory bonus rate in the first year. |

Investing with Moneybox

Moneybox has a number of investment options. You can invest your round-ups or one-off amounts in a Stocks and Shares ISA or Lifetime ISA, a General Investment Account, Pension, Junior ISA or Socially Responsible Investing account.

You need to be 18 to open any of the accounts and all have different features but invest in a range of tracker funds.

Stocks and Shares ISA

You can invest your full ISA allowance, currently up to £20,000, in a Moneybox Stocks and Shares ISA. Your round-ups can be invested and grow tax-free in a cautious, balanced or adventurous portfolio, depending on the level of risk you are prepared to take. Moneybox doesn’t provide advice so you will need to read the descriptions of each portfolio and the key investor information documents to understand what you are investing in and how risky it may be. For more information on Stocks and Shares ISAs, check out our article ‘Are Stocks and Shares ISAs really worth it?'. There is even a Junior ISA version so you can build up a tax-free pot from your change that your child can access at age 18. For more information on Junior ISAs, check out our article ‘Best Junior Stocks and Shares ISAs'.

Lifetime ISA

This works similar to a Stocks and Shares ISA as your round-ups go into one of the chosen portfolios. However, only those under 40 can open an account, although you can continue contributing until you are 50. You can also only invest up to £4,000 a year and will receive a 25% bonus from the government (up to £1,000). You are limited to using the product to purchase your first home or when you retire. If you need to withdraw money for any reason other than your first home or retirement, you’ll pay a government charge of 25% on any sum you withdraw.

General Investment Account

You can invest in one of the portfolios through a General Investment account. Unlike the ISA, the returns aren’t tax-free but you can put more away, subject to a £85,000 weekly limit.

Pension

Moneybox users can put their round-ups towards their retirement and combine their old pensions into one pot. For more information on the Moneybox SIPP and its new pension consolidation service read our article.

Moneybox investment accounts comparison table

The below comparison table summarises the different investment accounts available to open with Moneybox.

| Stocks & shares ISA or Lifetime ISA/General Investment Account/Junior ISA/SR investing account | Pension |

|

£1 monthly subscription fee 0.45% annual platform fee Fund costs range from 0.08% to 0.74% 0.45% currency conversion fee (GBP to USD and vice versa) when buying or selling US stocks from the UK Ongoing fees for the socially responsible fund are higher than the standard global shares fund (0.20% compared with 0.10% per year) |

No monthly subscription fee Annual platform fee of 0.45% up to £100,000 and 0.15% over £100,000 Fund costs range from 0.12% to 0.63% 0.45% currency conversion fee (GBP to USD and vice versa) when buying or selling US stocks from the UK |

|

Fee is waived for the first three months ISA is limited to annual contribution allowance, currently £20,000 Investors can put a maximum of £85,000 per week into the general investment account |

Pension is subject to annual and lifetime contribution limits |

How much does Moneybox cost?

You will not be charged any fees for saving in a Moneybox saving account.

If you choose to invest with Moneybox you will be charged a £1 monthly subscription fee which is free for the first 3 months. Even if you have multiple investment accounts with Moneybox, the monthly subscription fee will not exceed £1. In addition to the monthly subscription fee you will also be charged a 0.45% platform fee on investment accounts. This fee is charged monthly but accrued daily. You will also have to pay fund provider fees which can range between 0.08%-0.74%. Moneybox also charges a currency conversion (FX) fee of 0.45% (GBP to USD and vice versa) when buying or selling US stocks from the UK.

If you have a Moneybox pension you will not be charged a monthly subscription fee but you will have to pay an annual platform fee of 0.45% on balances up to £100,000 and 0.15% on balances over £100,000. Fund provider fees will also range from 0.12%-0.63%.

Moneybox mortgage advice

Moneybox has teamed up with the Mortgage Advice Bureau to launch a free mortgage advice service that is fully accessible via the Moneybox app. It is currently available to all Moneybox users. Moneybox mortgage advice gives first-time buyers, those looking to remortgage and those looking for their next home access to deals from over 90 lenders.

Mortgage applications can be completed within the Moneybox app and the service will be free to all Moneybox users.

How does Moneybox manage its portfolios?

ISA, Lifetime ISA and General Investment account investors are offered a choice of three portfolios from Moneybox, made up from a mix of low-cost tracker funds.

There is a cautious, balanced and adventurous portfolio that you can choose based on your attitude to risk and return. The portfolios use a number of tracker funds including Fidelity Global Shares, iShares Global Property Shares ESG, iShares Overseas Corporate Bond Index, iShares Overseas Government Bond Index and Legal and General Cash Trust. The allocation to each of these funds is set depending on whether you choose the cautious, balanced or adventurous portfolio and you can also alter it yourself and more information on the fund you can invest in can be found on the Moneybox website. Once you have chosen your preferred portfolio, you have the option to customise your allocation, effectively building your own bespoke portfolio. You can access Moneybox's range of 36 tracker funds and ETFs and 20 US stocks.

The Moneybox pension invests round-ups slightly differently. It has four options for you to invest in. These are the Fidelity World Index Fund, Old Mutual World ESG Index fund, HSBC Islamic Global Equity Index Fund or the BlackRock LifePath fund, which changes the balance of investments as you get closer to your retirement date. Moneybox has also introduced 7 more tracker funds you can invest in. Funds are selected on the basis of cost, how well the fund tracks its index and the reputation of the fund provider. This is reviewed annually, and, if necessary, adjusted at the end of each calendar year.

Moneybox’s portfolio performance

How does Moneybox perform?

Moneybox launched in 2016 so it hasn’t built a long-term track record just yet. The app has, however, tracked how £1,000 invested in 2014, followed by contributions of £50 a month, would have performed in its portfolios up to the end of 2023. It states that £1,000 invested in its cautious portfolio would be worth £8,319.52, the same amount invested in its Balanced portfolio would have returned £11,434.90 and its Adventurous portfolio would be worth £12,287.45 with the same amount invested. In the table below we have summarised the annual return of each portfolio over the last 5 years as well as the average return since 2014.

Moneybox portfolio performance – 2019 to 2023

| Average Annual Return (Since 2014) | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Moneybox Cautious Portfolio | 3.5% | 5.3% | -5.2% | 4.2% | 3.3% | 6.7% |

| Moneybox Balanced Portfolio | 8.8% | 12.6% | -8.6% | 17.8% | 7.3% | 18.6% |

| Moneybox Adventurous Portfolio | 9.9% | 14.4% | -9.3% | 22.6% | 7.4% | 21.4% |

Is Moneybox safe?

Moneybox is regulated by the Financial Conduct Authority so must follow rules on transparency and treating customers fairly. Customer details are kept secure and banking logins are not stored by Moneybox and it is a third-party provider of Open banking technology. This means that if you use the round-up feature your bank details are kept safe and are never shared with Moneybox.

If you choose to invest then your money is of course at risk, as with any investment, from stock market fluctuations. But there is still Financial Services Compensation Scheme protection of up to £85,000 if a fund or savings account provider goes bust.

If you are unhappy there is also the option of complaining to the Financial Ombudsman Service once you have been through Moneybox’s complaints procedure.

Moneybox customer reviews

Moneybox has more than 1,000,000 customers so there is plenty of scope for reviews and good and bad experiences. Moneybox is rated 4.4 out of 5.0 from almost 2,400 reviews on Trustpilot, the majority, 80% rank the app as excellent. Users cited how easy it was to set up and use and how it has been a great introduction to saving and investing.

The app has received some negative reviews, with 10% rating it as bad and 2% as poor. Most gripes appear to be over how long it takes for money to be invested and some individual issues over the timing and value of withdrawals.

Alternatives to Moneybox

Moneybox vs AJ Bell Dodl*

AJ Bell Dodl* is a specialist investment app provided by online investment platform AJ Bell. It offers a Stocks and Shares ISA, Lifetime ISA, Pension and General Investment Account and investors can choose from 8 ready-made portfolios as well as 37 funds and 29 themed funds. Investors can also choose from around 80 UK and US stocks, compared to just 20 with Moneybox.

Investors are charged a £1 monthly fee to invest with Moneybox, on top of its platform fee of 0.45%. AJ Bell charges a platform fee of just 0.15%, without the need to pay a monthly subscription fee, however, it does have a minimum fee of £1 per month per product. Additionally, AJ Bell Dodl pays 4.84% (AER variable) interest on any cash held in its ISA and LISA accounts.

Read our AJ Bell Dodl review to find out more about what Dodl has to offer.

Moneybox vs Nutmeg

Robo wealth manager Nutmeg is more geared toward investors than savers. You can open a General Investment account, Stocks and Shares or Lifetime ISA, Junior ISA or a Self-Invested Personal Pension. It uses exchange-traded funds and offers a range of portfolios linked to your attitude to risk. Nutmeg goes slightly further than Moneybox as users must complete a questionnaire that determines their risk level rather than having to decide for themselves. You can also set a goal and time horizon with the investment accounts on Nutmeg and track how well you are following it.

Nutmeg’s minimum investment is higher than Moneybox. You will need £500 to open an ISA, general investment and pension pot or £100 for the Lifetime ISA or Junior ISA. Nutmeg also offers a wider range of risk ratings and a greater choice of portfolios but you could end up paying higher fees depending on how much you are investing. Fees for Nutmeg’s fixed allocation account are 0.45% up to 100k and 0.25% beyond that, with an average investment fund cost of 0.21%. Its fully managed offering charges 0.75% up to £100,000 and 0.35% beyond that with an average fund cost of 0.24%.

Our article Nutmeg vs Moneybox gives a more detailed comparison between the two services. Read our Nutmeg review to find out more about what Nutmeg has to offer.

Moneybox vs Moneyfarm*

Moneyfarm operates in a similar way to Nutmeg and again is more geared towards investors rather than savers. It is a robo-adviser and will suggest a range of portfolios of exchange-traded funds based on your answers to a questionnaire that assesses your attitude to risk. It offers a Pension, ISA and General Investment account but there is no Lifetime ISA option.

Starting a Moneyfarm account is more expensive than the £1 minimum on Moneybox. You will need £500 as a minimum to start a Moneyfarm ISA, investment account or pension and you will also have to set up a direct debit of £100 a month. Moneyfarm's management fees range from 0.25% – 0.75% with a 0.21% underlying fund fee and a 0.10% market spread fee.

Our article Moneybox vs Moneyfarm gives a more detailed comparison between the two services. Read our Moneyfarm review to find out more.

Moneybox vs Plum*

Plum is more similar to Moneybox as it is geared towards saving as well as investing. You can download the app and Plum will regularly analyse your transactions and identify your regular income and expenditure before calculating an affordable amount to put aside for you automatically. This is transferred into a protected virtual bank account so like Moneybox, it is a way to build savings autonomously.

Saving with Plum is free and you can also earn up to 4.92% interest via its Cash ISA and up to 4.38% interest if you open a free Easy Access pocket. There is also an option to invest in an ISA for a £2.99 monthly fee and an average fund management and provider fee of 0.67% (this consists of a 0.45% management charge and provider fees ranging from 0.13%-0.88%). Plum offers 26 funds to choose from with varying levels of risk and over 3,000 stocks.

Read our Plum review to find out more.

Pros and Cons of Moneybox

Pros of Moneybox

- Great for beginners

- Save as you spend

- Quick and easy to set up

- Opportunity to earn rewards

Cons of Moneybox

- Investing spare change can take a long time to see any benefit

- Can be expensive

- Unable to move money between accounts

Summary

The Moneybox app is user-friendly but there is little help when it comes to your actual reasons for investing, which would usually help dictate how much you need to save and the way to do it, another reason to consider a robo-adviser such as Wealthify or Nutmeg. There is also an annoying restriction that doesn’t let you move money between accounts and you need a separate app for a Junior ISA.

Moneybox is a great introduction to saving and investing, however, investing small amounts means it will take a long time to see a decent return and the fund charges will be pretty hefty until you are putting away a more significant sum. Those looking to invest via a simple app may want to consider AJ Bell Dodl* as it not only works out cheaper, but there are a wider range of funds and shares to invest in. Wealthify is another worthy alternative if investing in an ISA as it does not have a minimum investment and does not charge a monthly fee. If you are new to investing then you should check out our article ‘The best stocks and shares ISA (& the cheapest fund platform)'.

Moneybox is easy to set up and use and will get you used to different financial products as well as the useful habit of putting money away regularly. However, this shouldn’t be relied on as your sole or long-term saving or investment source, especially if you are only putting away small amounts. Those looking for the good savings rate on their Lifetime ISA may want to look at AJ Bell Dodl*, which, at the time of writing, is offering a rate of 4.84%.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers – Moneyfarm, Plum, Dodl