There are many ways to start saving and investing, but what is the best way and how can you get started? In this article, we take a look at the money app Plum which allows you to both save automatically and choose to invest your money. We look at how Plum* works, its key features and how it compares to other money apps.

What is Plum and how does it work?

Plum* is a savings and investment 'robot' for your phone that analyses your spending and automatically saves your money for you, so you don't have to. Plum is designed to make saving money seem less of a chore and easier by allowing us to spend on 'things we want, rather than things we need'. Originally Plum worked using a Facebook messenger chatbot but has since developed into stand-alone iOS and Android apps.

Plum was founded by Victor Trokoudes and Alex Michael, two Cypriots living and working in the UK, who decided to challenge each other to save. This, in turn, resulted in Alex coming up with an algorithm that monitored his spending, putting aside the amount he could afford to save each month. This process allowed him to automate the savings process without having to alter his spending habits.

Plum works by linking to your bank account (it supports all major UK banks) and analysing your spending and transactions to work out the best amount to put away every week. You determine how much you want Plum to save and can ask it to stop saving at any time. To sign up to Plum you need to be a UK resident, aged 18+ and have a UK current bank account.

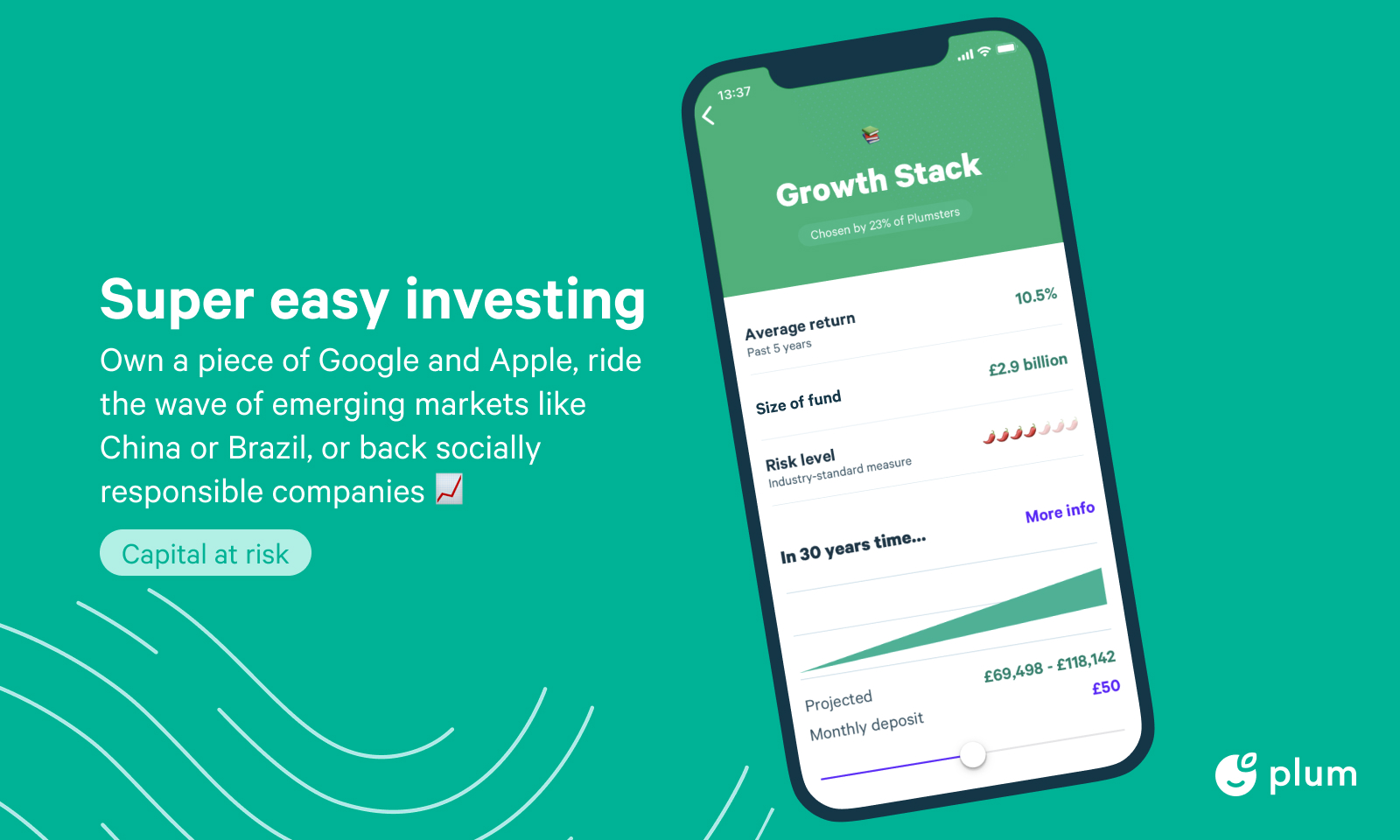

With Plum not only do you have the opportunity to build up a savings pot, but you can also invest your savings for a small monthly fee.

Get 5.01% (AER Variable) with the Plum Cash ISA

Earn 5.01% (AER Variable) with the Plum Cash ISA

- Easy Access Cash ISA

- Rate includes a Plum Bonus of 1.22% AER (variable)

- T&Cs and eligibility criteria apply

- Plum account required

Plum features

- Get £5 cashback* with an active Plum account after 90 days - must have a minimum of £100 held in a Primary pocket, Interest pocket, Plum Card pocket or Investment account for at least 90 days. Additional T&Cs apply.

- Automatic deposits using Artificial Intelligence (AI) - Plum uses AI to analyse your spending and set aside an affordable amount each month

- Savings Pockets - in addition to your primary pocket you can open a pocket that pays interest. Money can be withdrawn from the Primary Pocket instantly. Easy Access Interest Pockets (provided by Investec Bank plc) can be withdrawn the same working day by 3pm

- Plum Interest - Earn up to 4.66% interest on your savings with Plum Interest. Money deposited in Plum Interest is held in the BlackRock ICS Sterling Government Liquidity Fund and offers a rate close to the Bank of England base rate. More information on Plum Interest can be found here.

- Plum Cash ISA - Get up to 5.01% interest AER (Variable) via a Plum Cash ISA. Includes a bonus rate of 1.22%.

- Option to invest your money - invest in a Plum Stocks and Shares ISA or a General Investment Account where your Capital is at risk

- FSCS protection - your money saved in an Easy Access Pocket is protected by the Financial Services Compensation Scheme

- Roundups - save by rounding up last week's transactions to the nearest £1

- Weekly depositor - set an amount you wish to set aside each week and Plum will automatically deposit this for you to help you achieve your savings goals sooner

- Invest from £1 - open an investment account with Plum from as little as £1

- Payday saving - choose a set amount to save or invest every time you get paid

- 52-Week Challenge - take part in the 52-week challenge and set money aside every week starting with £1 and increasing by £1 each week (subscription users only)

- Rainy Day feature - Plum will set aside or invest money every time it rains (subscription users only)

- Privacy mode - show your friends how Plum works without sharing your personal account details

- Adjustable moods - change how much you automatically set aside each month with adjustable moods ranging from 'Shy' to 'Beast Mode'

- Bills tracker - When analysing your spending if Plum notices you may be being overcharged for a financial product it will notify you and help you switch

- Link multiple accounts - Plum allows you to link more than one bank or credit card

- Overdraft savings - If you regularly use your overdraft Plum allows you to save whilst you are in your arranged overdraft. This feature has to be turned on as it isn't an automatic feature

- Save for retirement - Plum allows users to save for retirement with its Self Invested Personal Pension (SIPP). You can also consolidate your other pensions in one place, which means your Capital is at risk

- Plum card - spend money fee-free abroad on your Visa prepaid debit card and only pay Visa’s daily exchange rate (Premium users only)

Plum Cash ISA review

Plum launched a Cash ISA* on the 20th March 2024 and currently offers a rate of 5.01% AER (Variable). The rate includes a Plum Bonus of 1.22% which is applied for the first year. The Plum Cash ISA permits you to transfer in from an existing ISA, however, transfers in will not be eligible for the 1.22% Plum Bonus, meaning the rate will be set at 3.79% AER (Variable).

The Plum Cash ISA rate will be cut to 2.5% if either of the following apply:

- Your balance drops below £100

- You make more than 3 withdrawals

Plum accounts

Plum offers three plans and they are summarised in the comparison table below:

*Variable annual rates are correct as at 02/01/2025

Saving with Plum

Plum* helps you to save by using its algorithm and artificial intelligence to analyse your spending to set money aside automatically. You can decide how much money you deposit with Plum based on the moods shown in the image below as per Plum's website (the standard saving setting for Plum is 'Normal'):

You can change your mood in the app or via the 'Brain' section of the app. Plum will analyse your spending and move its calculated deposit amount to your Plum account every week. If you want to withdraw money from your Plum account you can also do this via the app. If you request to withdraw money from your instant access primary pocket it should be in your bank account within 30 minutes. If you request to withdraw money from an interest pocket before 3pm you are likely to receive it the same day, however, if you request to withdraw money after 3pm you may not receive it until the next working day. All of Plum's accounts allow you to take advantage of its clever automatic algorithm that allows you to deposit money without needing to remember. However, if you wish to set savings goals or take part in the 52-week and Rainy day challenges you will need to upgrade to a Plum Pro or Premium account. The 'Naughty rule' feature is available on Plum Premium accounts and when enabled, users can choose to save between £1 and £10 each time they spend at a certain retailer. The feature is designed to both lessen the guilt when you spend on non-essentials but it can also work as a deterrent too.

Where are my savings kept?

Funds are kept in 'pockets' and you can choose between a 'primary pocket' which provides instant access to your money or an 'easy-access interest pocket' where you'll need to request a withdrawal before 3pm to receive it on the same day. Primary pockets do not pay any interest and the money is held as e-money with Plum and so is not protected by the Financial Services Compensation Scheme (FSCS). The Plum Easy-Access pockets are provided by Investec Bank plc and pay up to 4.70% AER interest (depending on the Plum plan you are on). Plum's Easy Access Interest Pockets are protected by the FSCS.

Plum Savings Pockets Summary

We provide a useful table below which explains which pockets are available, as well as the main features.

| Plum Primary pocket | Plum Easy Access Savings (Basic accounts) | Plum Easy Access Savings (Pro accounts) | Plum Easy Access Savings (Premium accounts) | Plum 95 days Notice pocket | |

| Plum account cost (monthly) | Free | Free | £2.99 | £9.99 | £9.99 |

| Interest paid | 0.00% | 3.74% AER | 3.89% AER | 4.38% | 5.20% |

| Account type | Instant access | Easy access | Easy access | Easy access | Notice account |

| Notice Required* | No notice required | Before 3pm for same day withdrawals | Before 3pm for same day withdrawals | Before 3pm for same day withdrawals | 95 days |

| FSCS protection |

*If requested before 3pm on business days it may be completed the same day

Investing with Plum

You can invest in a Stocks and Shares ISA or a General Investment account with Plum from as little as £1. Set how much you want to invest and Plum will automatically do this for you. With a Plum investment account, you can deposit and withdraw money as little or as often as you would like (withdrawals can take between 5-7 working days). Bear in mind that your capital is at risk when investing.

Plum provides a choice of 17 investment funds that you can invest in with varying levels of risk as shown below. These are administered by a number of investment providers and include the extremely popular Vanguard Lifestrategy fund range. The table below shows some of these funds alongside the 5-year total return as at 30/01/2024. Where the number is green it means that the fund outperformed the average of its peer group. Where it is red it means that it underperformed. A "n/a" means that the fund has not been in existence for five years. The latest performance figures and yearly breakdowns for each fund can be found in the key investor information document on the Plum website. If you have a Plum Premium subscription account - charged at £9.99 a month - you can benefit from 9 additional funds exclusive to Premium account holders only. More information on these funds can be found on the Plum website.

| Investment type | 5-year return | Risk level | |

| Tech Giants | Technology shares | 191.40% | High |

| Socially Conscious | Socially responsible companies | 2.21% | High |

| Balanced ESG | Diverse asset mix based on ESG criteria | N/A | Average |

| Growth ESG | Shares of global companies selected for ESG track record | N/A | Average |

| Rising Stars | New companies in Asia & Africa | 33.44% | High |

| American Dream | Shares of the 500 largest public companies in the USA | 98.22% | Average |

| Best of British | Shares of the 100 largest public companies in the UK | 37.18% | Average |

| European Essentials | Shares of the large and mid-size companies in Europe | 61.73% | Average |

| The Medic | Healthcare, Pharmaceuticals & Biotechnology companies | 56.13% | High |

| Slow & Steady | 20% shares and 80% bonds (Vanguard Lifestrategy) | 6.39% | Low |

| Balanced Bundle | 60% shares and 40% bonds (Vanguard Lifestrategy) | 29.63% | Average |

| Growth Stack | 80% shares and 20% bonds (Vanguard Lifestrategy) | 43.26% | Average |

(Correct as of 30/01/2024)

Remember: You can hold as many stocks and shares ISAs as you like across multiple providers, however, you can only contribute the current tax-year allowance into one stocks and shares ISA with one provider and so make sure you check before you commit to a PlumISA

Plum Interest

Plum launched Plum Interest in September 2023 where customers can get a variable return of up to 4.66% on their money. The account is an investment account but offers easy access to your money with 1 business-day withdrawals.

There is no minimum deposit amount required with a Plum Interest account and your money is protected but the FSCS. It is worth remembering, however, that Plum Interest is an investment account and so your capital is at risk.

Money held in a Plum Interest account is held in the BlackRock ICS Sterling Government Liquidity Fund which tracks the Bank of England base rate. Plum says with Plum Interest, your money is held in an 'interest-earning fund holding government-backed assets, making it low-risk with stable returns'.

Plum Interest fees

If you open a Plum Interest account you will be charged 0.25%. This includes a 0.15% fee charged by Plum and an additional 0.10% annual fund management fee charged by BlackRock. The Plum fee is waived if you're a Premium subscriber. The following table provides an example of the charges on a Plum Interest account.

| Investment amount | Plum service fee (0.15%) | BlackRock Management fee (0.10%) | Total fee (0.25%) |

| £500 | £0.75 | £0.50 | £1.25 |

| £1,000 | £1.50 | £1.00 | £2.50 |

| £5,000 | £7.50 | £5.00 | £12.50 |

Plum Self-invested Personal Pension (SIPP)

Plum launched a Self-invested Personal Pension (SIPP) to help you to prepare for retirement. The Plum SIPP is offered by Plum Money which has appointed Quai Investment Services Limited (QISL) to act as the Plum SIPP product provider and your money is covered by the Financial Services Compensation Scheme (FSCS). You can choose to consolidate existing pensions into a Plum SIPP or start a new Plum Pension altogether. When you need access to your money in retirement, Plum allows you to withdraw your money from your pension as needed while leaving the rest invested, a process often referred to as pension drawdown or flexi-access drawdown.

You can contribute to a Plum Pension via regular contributions from your Plum auto-deposits that can be increased or reduced to suit your budget. You can also make one-off contributions to the Plum pension from your connected bank account or your Plum Balance.

When investing in the Plum SIPP you can choose from three investment fund types:

- Target Retirement Date Fund - this fund changes what it invests as you approach retirement age starting with higher-risk investments and changing to lower-risk investments as you near your retirement date. The funds are provided by Vanguard.

- Global Equity - this fund invests in a range of worldwide company shares and is provided by Legal & General.

- Future Planet - according to Plum this fund invests in 'shares of companies that meet positive environmental, social and governance criteria' and it is provided by Legal & General.

Should I invest with Plum?

It is important to remember that any type of investing comes with a certain level of risk meaning it is possible to get back less than you put in.

If you invest in tech and growth funds with Plum your money is held in an investment account with Saveable LTD, which is FCA regulated and your money is FSCS protected. If you invest in other funds with Plum you also have FSCS protection.

Plum Card

Premium Plum subscribers can order a free Plum card which can be loaded from your primary pocket or linked bank account. Plum Ulta and Premium subscribers can use the Plum card anywhere that Visa is accepted benefitting from fee-free spending while abroad, with customers only paying Visa’s daily exchange rate. The Plum card can take up to 10 working days to arrive and is dispatched by Royal Mail.

If you are looking at other prepaid debit cards or ways to spend money abroad fee-free check out our article, 'The best app-only bank in the UK'.

How much does Plum cost?

The cost of Plum varies depending on the account you choose. The most basic version of Plum is free and allows you to take advantage of the AI deposit features. However, if you want to benefit from more budgeting features or you would like to invest you will need to upgrade to either Plum Pro or Premium at £2.99 or £9.99 a month.

How much does it cost to invest with Plum?

If you choose to invest with Plum you will need to pay a minimum of £2.99 for the Plum Pro account. There is also an annual fund management and product provider fee which is on average 0.48%. This consists of a product provider fee of 0.45% and a fund management fee that ranges between 0.06%-0.90%. The exact fees payable will vary depending on the investments you choose and the Plum plan you have.

Plum SIPP fees

The fee for a Plum SIPP is 0.45% a year which is broken down into a 0.35% administration charge and a 0.10% custody service charge. The fee is payable at the end of the month and is deducted from your Plum SIPP balance. In addition, a fund management fee is charged, ranging from 0.21% - 0.30%, depending on the fund you choose to invest in.

Is Plum safe to use?

Plum is authorised and regulated by the Financial Conduct Authority to carry out payment services activities as a Registered Account Information Service Provider, under the Payment Services Regulations 2017.

If you choose to hold your money in an instant-access primary pocket then it is held as e-money. Plum uses an e-money provider that maintains a specific UK bank account and so it says your money is protected by the E-Money Safeguarding Rules. It is important to note that money held in an instant-access primary pocket or on a Plum Card is not protected by the Financial Services Compensation Scheme (FSCS).

However, if you choose to hold your money in an easy-access interest pocket or with an investment account, then your money is protected by the Financial Services Compensation Scheme (FSCS).

Plum reviews

Plum is rated as 'Excellent' on Trustpilot scoring 4.0 out of 5.0 stars from almost 7,000 reviews. 75% of users rate it as 'Excellent', with most commenting on how great it is at helping them to save money and great customer service. 13% of users rated it as 'Bad' with some users complaining about how long it takes for their money to transfer back into their account.

Alternatives to Plum

Plum vs App-only banks

Starling Bank* and Monzo are app-only banks that can help you to save with round-up spending. When you spend with Monzo and Starling you can opt to round up your change, putting it into a savings pot. By setting up automatic saving you save every time you spend and while it may not seem like much, it quickly adds up. Chase Bank is another app-only bank that offers round-up savings and you can also benefit from 5% interest on your round-ups.

For more information read our Monzo, Starling and Chase Bank reviews.

Plum vs Chip

Chip* allows you to save automatically by using open banking to analyse your spending habits. Chip works in a similar way to Plum in that it saves your money for you and moves it into your Chip account. You can also choose to invest with a ChipX account but this comes with a £5.99 fee every 28 days.

Like Monzo and Starling Bank you can set savings goals and track your progress to achieving those goals. Chip is FCA regulated and your savings are stored with partner banks and are therefore FSCS protected.

For more information on Chip, read our Chip review.

Plum vs Moneybox

Moneybox is another savings app that allows you to invest the money you put away. Moneybox helps you to save by rounding up your spare change and you can invest the money you save into a variety of savings products such as a Stocks and Shares ISA, Stocks and Shares Lifetime ISA, Pension, Junior ISA, General Investment Account, Socially Responsible Account, Cash Lifetime ISA, Cash ISA, Simple saver or 32 or 95 notice account.

For more information on Moneybox, read our Moneybox review.

How does Moneybox compare to Plum?

In the following comparison tables, we compare Plum and Moneybox saving and investment accounts.

Plum investments vs Moneybox investments

| Plum* | Moneybox | |

| Minimum investment | £1 | £1 |

| Monthly fee | £2.99 | £1 |

| Platform fee | 0.45% | 0.45% |

| Fund provider fees | 0.06% - 0.90% | 0.08% - 0.88% |

| Investment types | Stocks and Shares ISA, General Investment Account, SIPP | Stocks & Shares ISA, Stocks & Shares LISA, Pension, Junior ISA, General Investment Account |

| FSCS protection | ||

| FCA registered |

Plum savings vs Moneybox savings

(scroll to view full table)

| Cost | Notice Required | Interest paid | FSCS protection | FCA registered | |

| Plum Cash ISA | FREE | 1 day | 5.01%¹ | ||

| Plum Easy Access Savings (Basic) | Free | 1 day | 3.74% | ||

| Plum Easy Access Savings (Pro) | £2.99/£4.99 | 1 day | 3.89% | ||

| Plum Easy Access Savings (Premium) | £9.99 | 1 day | 4.38% | ||

| Plum 95 day Notice pocket | £9.99 | 95 days | 5.20% | ||

| Moneybox Cash ISA | Free | Instant | 5.00%² | ||

| Moneybox Simple Saver | Free | 1 day (Currently closed to new customers) | 3.50% (Can be boosted to 4.50% by opening a qualifying account) | ||

| Moneybox 32 day Notice account | Free | 32 days | 4.50% | ||

| Moneybox 95 day Notice account | Free | 95 days | 4.80% |

¹ The Plum Cash ISA includes an introductory bonus rate of 1.22% for the first 12 months.

² The Moneybox Cash ISA includes an introductory bonus rate of 0.55% for first 12 months.

Pros and cons of Plum

Pros of Plum

- Automatic deposits

- Invest from £1

- Easy to set up

- Can adjust to save more or less money

- FCA regulated

Cons of Plum

- Money in a primary pocket isn't protected by the Financial Services Compensation Scheme (FSCS)

- Investing charges are expensive if only investing small amounts

- Have to pay to get some features that other apps offer for free

Summary

Overall, Plum* is a useful tool for those who have trouble saving and I like the feature that allows you to change how much you want to deposit each month by selecting your mood. Plum is regulated by the FCA and any money held in savings (i.e. not in your primary pocket) or investments funds are covered by the FSCS. If you want to compare it to other personal finance apps you can do so in our article, The best money apps you should have in 2024.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - Plum, Starling, Chase, Chip