Nutmeg Investment review

Nutmeg Investment review

I suggest that you read our Nutmeg* review in full including our analysis of Nutmeg's charges and performance. If you wish to jump to a particular part of this review then you can do so via the hyperlinks below.

The short answer is that I feel Nutmeg investments may be suitable for some readers (read full review) and I, therefore, secured an offer for Money to the Masses readers that means Nutmeg will waive its management fees for the first 12 months*. (Terms and Conditions apply. Cannot be claimed with any other Nutmeg offer, unless otherwise specified). So on a £20,000 investment that is a saving of £150 based on their fully managed portfolios.

In the interests of transparency, Nutmeg has agreed to pay a small fee for new customers acquired via the asterisked links in this article. However editorial independence is paramount to MoneytotheMasses.com and in no way is this review or my views ever influenced by 3rd parties. I have included a link to Nutmeg at the foot of this article which you can use and MoneytotheMasses.com will not receive any payment from your referral.

- How does Nutmeg manage its portfolios?

- What are Nutmeg’s fees and how do they compare

- Nutmeg performance versus its peers

- Nutmeg alternatives

- Who should consider Nutmeg investments?

1 minute summary - Nutmeg review

- Invest from as little as £500 (£100 for Junior ISA or Lifetime ISA)

- Nutmeg offers a number of products including a Stocks & Shares ISA, general investment account, Junior ISA, Lifetime ISA and Nutmeg Pension

- Choice of investment styles including fully managed, fixed allocation, thematic investing, Smart Alpha powered by J.P. Morgan Asset Management and socially responsible

- Choice of investment portfolios, each with a mix of investment assets

- Management fees ranging from 0.25% to 0.75% (Correct as of 15.10.24 and subject to change)

- Nutmeg Offer: Nutmeg will waive its management fees for the first 12 months*.

Approved by Nutmeg on 04.12.24. Terms and Conditions apply

How does Nutmeg Investment Management work?

- Nutmeg launched in the UK in 2011 and offers investors a cheaper alternative to normal wealth management services by focussing on ETFs and tracker funds that carry lower charges

- Nutmeg is a low-cost online investment platform that will manage your investment portfolio according to your risk profile. With Nutmeg's Fully Managed Portfolios*, investors can choose from any of the 10 investment portfolios available, each with a mix of investment assets.

- Nutmeg also offers a range of 10 actively managed socially responsible investment portfolios designed for investors who prefer to invest in a socially responsible way

- Alternatively, investors can choose to invest via the Nutmeg Fixed Allocation Portfolios*. Unlike the fully managed portfolios, the fixed allocation portfolios are not actively managed, although they are rebalanced automatically to ensure there is the right balance of investments in the investor's chosen portfolio

- In November 2020, Nutmeg announced the launch of 5 ‘Smart Alpha' portfolios powered by J.P. Morgan Asset Management. The portfolios are designed to maximise returns using Nutmeg's digital and technology expertise together with the additional insight and research that J.P. Morgan Asset Management can provide

- On 23rd October 2023 Nutmeg launched a new thematic investment style with three themes – Technological Innovation, Resource transformation and Evolving Consumer. Nutmeg's thematic investment style provides a globally diversified, risk adjusted portfolio with a tilt (up to 20% of equity exposure) towards your chosen theme. The majority of the portfolio is actively managed by Nutmeg's investment team, whilst the 'tilted' part of the portfolio is made up of the ETFs which will be reviewed annually.

- Nutmeg offers a Stocks & Shares ISA that can provide a simple low-cost method of investing, tailored to your personal risk profile and fully managed by a team of investment professionals. It also offers a Junior ISA, Lifetime ISA as well as a personal pension*

- Nutmeg has also offers a personal advice service providing restricted advice for its customers (see below)

How does Nutmeg manage its portfolios?

Nutmeg fully managed investment portfolios

- Nutmeg provides a choice of 10 managed portfolios each with a different mix of investment assets

- The portfolios range in risk from level 1 to 10

- Each portfolio is invested in many different types of assets, countries and industry sectors, this diversifies the risk and improves the chances of having money invested in the best places to provide higher returns

- Nutmeg regularly reviews the investments in your portfolio to make sure that your money is still invested in the places that best fit your personal investment goals and risk profile

- Nutmeg prefers to invest in exchange-traded funds which are designed to track the movement of various market indices

- It is a way of getting exposure to a pool of investments without having to purchase each one individually. Also, the costs involved with ETFs are low and they are easy to trade

Nutmeg fixed allocation investment portfolios

- Nutmeg's fixed allocation portfolios are Nutmeg's attempt to target those investors who want a cheap multi-asset tracker fund portfolio but with minimal additional costs applied for the benefit of having it managed by Nutmeg's investment team

- There are 5 set portfolios to choose from ranging in risk level from low to high

- As the name suggests the portfolio allocations are fixed, however, they are reviewed annually by Nutmeg's investment team.

- To maintain the percentage exposure the portfolio is automatically rebalanced

- The fixed asset allocation portfolios are clearly aimed at those investors who want a very low-cost hands-off way of investing in a diversified tracker portfolio

- Because the asset allocation is fixed the cost of the service is lower than Nutmeg's managed service as shown in the next section

Nutmeg socially responsible investment portfolios

- Nutmeg provides a choice of 10 managed socially responsible investment portfolios, each is weighted towards companies and bond issuers that have a stronger sustainability profile

- The portfolios range in risk from level 1 to 10

- Each portfolio is invested in many different types of assets, countries and industry sectors, this diversifies the risk and improves the chances of having money invested in the best places to provide higher returns

- Nutmeg regularly reviews the investments in your portfolio to make sure that your money is invested in line with your long-term objectives

- The portfolio fee starts at 0.75%, the same as Nutmeg's fully managed portfolios, however, the underlying fund charges are higher, averaging around 0.29% compared to average charges of 0.20% on Nutmeg's fully managed portfolios (Correct as of 15.10.24 and subject to change)

Nutmeg Smart Alpha investment portfolios

- Nutmeg provides a choice of 5 ‘Smart Alpha' portfolios where asset allocation is set and adapted by a combination of specialists at J.P. Morgan Asset Management and Nutmeg's own in-house investment team

- There are 5 portfolios to choose from ranging in risk level

- Each portfolio is invested in many different types of assets, countries and industry sectors, this diversifies the risk and improves the chances of having money invested in the best places to provide higher returns

- J.P. Morgan Asset Management and Nutmeg's own in-house investment team regularly review the investments in each portfolio to ensure that they are aligned with your long term goals

- The portfolio fee starts at 0.75%, the same as Nutmeg's fully managed portfolios, however, the underlying fund charges are slightly higher, averaging around 0.32% (Correct as of 15.10.24 and subject to change)

- Nutmeg believes that asset allocation is the single most important decision facing every investor and so by using J.P. Morgan Asset Management’s market insights and analysis, ‘smart alpha' portfolios could benefit from tactical adjustments made over time.

Nutmeg Thematic investment portfolios

- On 23rd October 2023 Nutmeg launched Thematic investing allowing investors to invest in future trends through one of three future-focussed themes. These are Technological Innovation, Resource transformation and Evolving Consumer. Nutmeg's thematic investment style provides a globally diversified, risk adjusted portfolio with a tilt (up to 20% of equity exposure) towards your chosen theme. The majority of the portfolio is actively managed by Nutmeg's investment team, whilst the 'tilted' part of the portfolio is made up of the ETFs that focus on your chosen theme and are reviewed annually. As these themes have just been launched we will explore them in more detail in the next update of this review.

What are Nutmeg’s fees?

Nutmeg's fees depend on the amount of your overall investment as shown below. Nutmeg reduced its fees in early 2017 to those stated below in an attempt to undercut their competition, which they do if you invest a large sum or opt for a fixed allocation portfolio. However, Nutmeg will run your money free of their platform fee for the first year via this offer* making it even more cost-effective and the cheapest way to invest with Nutmeg.

| Investment amount | Nutmeg Fully Managed, Thematic Investing, Smart Alpha & Socially Responsible portfolio fee | Competitor managed portfolio fee |

Nutmeg Fixed Asset Allocation portfolio fee

|

| Up to £100,000 | 0.75% | 0.70% | 0.45% |

| Over £100,000 | 0.35% | 0.50% | 0.25% |

Correct as of 15.10.24 and subject to change

In addition to the charges listed above there are underlying fund charges plus a market spread which covers the trading costs involved in making investments on your behalf. The latest figures can be found on Nutmeg's fees page*. The figures in the table above are just Nutmeg's charge for running your money. These figures do not take into account the Nutmeg offer* where it will waive its management fees for the first 12 months. Terms and Conditions apply.

Nutmeg financial guidance and advice

In November 2018 Nutmeg introduced a new personalised planning and advice service. There are now three options, which we detail in the table below. The advice that Nutmeg offers is ‘restricted advice' meaning it will only make investment recommendations on the products and services it offers.

| Advice Type | Cost | Who is the advice aimed at? | What type of advice you will receive |

| Review | £450 (inc VAT) | Only available if you have received Nutmeg advice within the last 5 years | An in-depth review of your Nutmeg financial plan plus access to free general investing guidance whenever you need it |

| Core | £900 (inc VAT) | Good if you're looking to build wealth for the future | Expert, tailored financial advice with a recommended financial plan and access to free general investing guidance whenever you need it |

| Enhanced | £1,350 (inc VAT) | For complex finances or if you're near retirement | Everything in core plus full cashflow modelling, future income and expenditure forecasting. This plan also provides free general investing guidance whenever you need it |

Nutmeg’s portfolio performance

The chart below shows the performance of each of the 10 Nutmeg fully managed investment portfolios from September 2012 to 30th September 2024 (the most recent data available at the time of writing) compared against an index of competitors for each of the risk levels. These figures relate to past performance, which is not a reliable indicator of future performance. I've colour-coded the rows red where Nutmeg's performance appears to lag its competitors and green where it outperforms.

| Portfolio | Nutmeg performance: September 2012 – September 2024 | Competitor performance: September 2012 – September 2024 |

| 1 | 11.4% | N/A |

| 2 | 28.5% | N/A |

| 3 | 37.6% | 39.4% |

| 4 | 49.3% | 39.4% |

| 5 | 62.8% | 66.5% |

| 6 | 77.6% | 66.5% |

| 7 | 102.4% | 94.3% |

| 8 | 125.8% | 94.3% |

| 9 | 153.3% | 120.0% |

| 10 | 171.1% | 120.0% |

Figures correct as of 30.09.24

There are a couple of things to point out about the performance figures. Firstly they use an assumption of the average costs incurred by a Nutmeg customer. Also the data which Nutmeg uses as indicative of its competitors is based on data provided by a firm known as Asset Risk Consulting (ARC). ARC take anonymised client return data from wealth managers across the industry and then uses it to benchmark managers such as Nutmeg. ARC only has 5 portfolios versus Nutmeg's 10 which makes direct comparison difficult. But the takeaway is that Nutmeg's investment performance excels if you opt for one of its high-risk profiles, although you should only choose a higher-risk portfolio if it is right for you, as any losses can also be greater. Later in this review I discuss Nutmeg's performance versus their biggest robo-advice competitors, Wealthify and Moneyfarm. You can check the latest performance data on the Nutmeg site*. There is also data available on the portfolio performance for other investment styles.

Who should consider Nutmeg investments?

- Nutmeg has a minimum initial investment of £500 (or £100 for a Junior ISA or Lifetime ISA)

- Nutmeg may be a suitable investment solution for anybody who wants a low-cost way to invest in the stock markets but does not have the time or expertise to make their own investment choices

- Also the analysis of their performance data would suggest those willing to take a medium level of investment risk may be particularly suitable

- In my view an ideal client would be someone who is happy to take a medium level of risk, keep their money invested for the long term and who doesn't have the time or expertise to run their investments but realises the importance of controlling costs. Although there are better performing alternatives as explained in the next section

- Nutmeg offers a restricted financial advice service that may be attractive to those that are wanting to take advice, but want to do so at low-cost

Nutmeg alternatives

Nutmeg* is the most well-established brand in the UK when it comes to managed tracker portfolios. Since it launched in 2011 it has become one of a growing band of robo-adviser propositions which have come to the market. One such robo-advice proposition, and one of Nutmeg's biggest competitors is Wealthify. Another major competitor is Moneyfarm. I compare Wealthify's charges and performance against Nutmeg's and Moneyfarm's in my Wealthify review.

If you would rather pick your investment funds yourself, rather than have someone run it for you, then as an alternative to Nutmeg you could use a fund platform such as Hargreaves Lansdown or Vanguard Investor. Read our full Hargreaves Lansdown review and Vanguard review for more information. The former is the market leader and offers the widest range of funds which can be held in their ISA, Lifetime ISA or Vantage SIPP. While Vanguard provides one of the cheapest ways to build a bespoke portfolio of tracker funds. If you like the idea of picking your own funds using a fund platform like Hargreaves Lansdown but don't know where to start then have a look at our 80-20 Investor service which empowers DIY investors to make their own investment decisions.

More about Nutmeg

In 2021, Nutmeg was wholly acquired by J.P. Morgan and now forms a pivotal role in the company's retail investment and wealth management plans outside of the United States. Nutmeg holds clients' investments with a ‘custodian bank', this is a specialised financial institution responsible for safeguarding a firm's, or individual's, financial assets. Clients' assets are therefore separate from Nutmeg assets so should not be affected if the company failed in the future. You can find out more information in Nutmeg's FAQs*. Additionally, Nutmeg is a member of the UK Financial Services Compensation Scheme (FSCS) which ensures that in the event of a failure of Nutmeg, coupled with a failure to safeguard customer assets or some other failure (such as negligent advice), the value of customer assets held with Nutmeg may be protected by the FSCS up to the limit of £85,000. Please note that none of the above removes the normal risk of losing money, which is the case with all investments.

What are customers' views regarding Nutmeg's service?

Nutmeg is rated as ‘Great' on independent review site Trustpilot and scores 4.1 out of 5.0 from over 2,050 reviews. Below are a collection of reviews from online sources including Trustpilot.

- ‘The easiest way to invest in stock, shares, bonds and without needing to spend years researching or learning the ropes yourself' – John B

- ‘Although my portfolio has not done well I have checked it against others from industry figures and it has actually done marginally better. These are horrible conditions and Nutmeg is performing as I would expect according to my risk levels' – Nick

- ‘Best thing I ever did transferring my pension to Nutmeg, it has never performed so well. I would highly recommend' – Hilary B

- ‘I can only comment on the setting up process as it's such a recent investment but I found the site easy to use and clear about costs' – Rachel

- ‘Been with Nutmeg over a year now and have got substantially better returns than I did when trying to trade myself' – James

Conclusion

If you are looking for a low-cost stock market investment service then take a look at Nutmeg. It remains one of the cheapest online investment services especially if you are looking for someone to manage your portfolio and make tactical decisions. It is even more cost-effective if you take advantage of the offer whereby Nutmeg waives its management fees in the first year*. On a £20,000 investment that would save you £150 if investing in the Fully Managed, Socially Responsible Investment, Thematic, and Smart Alpha portfolios, or £90 saving if investing in the Fixed Allocation portfolios! (Approved by Nutmeg on 04.12.24 in relation to any factual statements about Nutmeg products and services. Terms and Conditions apply).

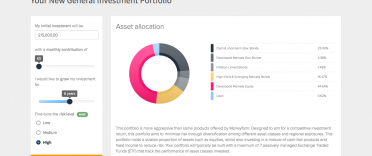

Nutmeg can build an example portfolio in just a couple of minutes so that you can easily see the projected value and costs over your chosen investment timeframe. Nutmeg also provides an additional advice service if customers require it. Overall Nutmeg gives simple easy access to investing within a Stocks and Shares ISA*, Lifetime ISA*, general investment account* or a personal pension* with a track record of providing competitive returns over time.

It is important to note that as with all investing, your capital at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax rules depend on individual status and may change. ISA/JISA/LISA and Pension eligibility rules apply. Thematic investing carries specific risks and is not for everyone. There is no guarantee that development of the trend will contribute to positive investment outcome. All Nutmeg themes, including Resource transformation, should not be considered as incorporating ESG considerations. The Resource transformation theme will likely have exposure to a variety of renewable and non-renewable materials and energy sources. Past performance is not a reliable indicator of future performance.

*Nutmeg has agreed to pay a small fee for new customers acquired via the asterisked links in this article which helps us keep MoneytotheMasses.com free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. Please use the following link if you would prefer that MoneytotheMasses.com does not receive any payment for your referral – Nutmeg