How does the Hargreaves Lansdown platform work?

It is simple to set up a Hargreaves Lansdown account (an ISA, SIPP or trading account) and this will provide access to all their investment options, excellent research and a range of tools and calculators. Alongside the various types of investment accounts mentioned above, you can open an Active Savings account, which will let you maximise the amount of interest you receive on your savings. However, the Active Savings account cannot be used within a Hargreaves Lansdown Stocks and Shares ISA, SIPP or a general investment account.

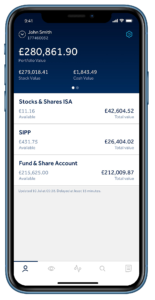

It takes around 10 minutes to set up a Hargreaves Lansdown account* and you'll need your national insurance number and your bank details handy. The Hargreaves Lansdown website is clear and easy to use with access to a variety of excellent investment guides. Hargreaves Lansdown offers one of the best iPhone and Android apps of all the investment platforms and you can also manage your investments online or via a tablet such as an iPad.

What can you invest in using Hargreaves Lansdown?

With Hargreaves Lansdown, you can invest in the following:

- Over 3,000 funds

- Shares listed on the UK, Canadian and European stock exchanges

- Corporate and Government bonds

- ETFs

- Investment trusts

- Venture Capital Trusts (VCTs)

Investment choice is one of the key advantages Hargreaves Lansdown has over nearly all other investment platforms out there. Hargreaves Lansdown doesn't restrict your investment choice and offers access to over 3,000 funds as well as a cash management service (called Active Savings).

While most DIY investors will usually only invest in funds (unit trusts), in my experience, most will eventually want to invest in ETFs and Investment trusts as well. These are usually cheaper yet not widely available on most other fund platforms. In addition, Hargreaves Lansdown is a stockbroker too which means that it offers the ability to buy and hold individual shares on its platform.

My advice to anyone looking to choose the best investment platform is to ensure they have access to sufficient investment choices. It doesn't explicitly cost you any more to have access to such a wide range.

Think of it like food shopping in a large supermarket versus a small corner shop. The former can offer products to all its customers thanks to the benefit of economies of scale, regardless of how much each individual customer buys. The same goes for fund platforms and Hargreaves Lansdown is the UK's leading fund platform provider.

As well as a wide investment choice Hargreaves Lansdown also gives its platform users access to a range of investment tools. These include the ability to set stop-loss and limit orders, receive real-time share alerts and manipulate interactive charts. Again most other investment platforms do not offer these.

What products does Hargreaves Lansdown offer?

Hargreaves Lansdown Stocks and Shares ISA

The Hargreaves Lansdown Stocks & Shares ISA* offers an easy to manage, tax-efficient way of investing in a range of assets along with some handy investment tools. Hargreaves Lansdown's Stocks & Shares ISA allows you to choose from a range of ready-made portfolios or make your own investment choices to maximise your investment returns.

Hargreaves Lansdown Junior ISA

The Hargreaves Lansdown Junior Stocks & Shares ISA* allows you to save for a child's future in a tax-efficient environment ring-fenced until the child reaches the age of 18. In our roundup of the best Stocks and Shares Junior ISAs the Hargreaves Lansdown Junior ISA was deemed the best for tools and functionality. In March 2023, Hargreaves Lansdown removed all fees for its Junior ISA product making it the cheapest Junior Stocks and Shares ISA on the market.

Hargreaves Lansdown Lifetime ISA

The Hargreaves Lansdown Lifetime ISA* allows those saving for a deposit on their first property to take advantage of an annual 25% bonus on contributions from the Government. If you want to know more about how the Lifetime ISA works then Hargreaves has produced a free easy to understand Lifetime ISA factsheet. Hargreaves Lansdown is one of the few providers to offer a Lifetime ISA that allows you to save Cash as well as invest in Stocks and Shares. It is great for flexibility and features in our 'Best and Cheapest Lifetime ISAs' roundup. In March 2023, Hargreaves Lansdown reduced the fees on its Lifetime ISA product. For funds, it now charges 0.25% on the first £1m, 0.10% on £1m to £2m and there is no charge on fund values over £2m. It charges 0.25% on shares, capped at £45 per year.

Hargreaves Lansdown Fund and Share account

With its wealth of investment tools, news & live share prices Hargreaves Lansdown share trading service* is a low-cost simple way of trading in the stock market. The Share dealing service can be accessed via the Hargreaves Lansdown ISA and SIPP which sets it apart from many other investment platforms. Or you can access the share dealing service via the Hargreaves Lansdown Fund & Share Account*, which is Hargreaves Lansdown's version of a general investment account, in which case there is no platform fee charged by Hargreaves Lansdown. The HL Fund and Share account therefore provides a low-cost flexible investment account to deal, manage and hold a wide range of investments.

Hargreaves Lansdown SIPP

Hargreaves Lansdown offers a comprehensive service if you are either looking to start planning for retirement or close to retirement and want to control your investments and understand your options. The Hargreaves Lansdown SIPP* is an award-winning self-invested personal pension that allows investment in a full range of assets including funds, ETFs and stock & shares giving clients full control over their retirement planning.

Hargreaves Lansdown Ready-Made Pension

The Hargreaves Lansdown Ready-Made Pension is managed by its sister company, Hargreaves Lansdown Fund Managers Ltd and may be a good option for those who want more control over where their pension is invested but do not have the time or expertise to make investment decisions themselves. Hargreaves Lansdown's ready-made pension is designed for those who are comfortable with a medium-high investment risk and who are happy to lower that risk as they reach their intended retirement age. Fees for its ready-made pension start at 0.75% which includes a 0.45% account charge plus a management fee of 0.30%. You can read more about its ready-made pension in our article 'Hargreaves Lansdown launches ready-made pension plan – How does it compare?'.

Hargreaves Lansdown Active Savings

Hargreaves Lansdown Active Savings* was launched in the summer of 2018. It is a cash service that helps consumers get a better rate on their savings. Hargreaves Lansdown is the only investment platform to offer such a service. Once you sign up you can choose the savings product with the best savings rate at a click of a button and the account is automatically opened and your money deposited. When the fixed term comes to an end (i.e after 1 year) you can then move your money to a new fixed-term savings account at a click of a button and with no form filling. Additionally, Hargreaves Lansdown now provides access to cash ISAs through the Active Savings service. You can read more in our 'Hargreaves Lansdown active savings review'.

Hargreaves Lansdown Online VCTs

In November 2024, Hargreaves Lansdown launched a range of 5 online Venture Capital Trusts (VCTs)* from providers Blackfinch Group, Calculus and Octopus Investments. The minimum investment is £10,000 and investors can qualify for an 'Early Bird' discount of up to 2% on applications submitted before 5pm on 17th December 2024. VCTs invest in small, unlisted companies and are considered high-risk investments due to their volatility. These type of investments should only be considered by experienced investors with larger portfolios looking for long-term investments. We explain more about VCTs in Episode 361 of the Money to the Masses podcast.

Hargreaves Lansdown key features

- Hargreaves Lansdown Wealth Shortlist - The Wealth Shortlist is a selection of funds that Hargreaves Lansdown believes has the best potential within their respective sectors. The shortlist currently has a list of 69 funds and we look at its past performance later in this review.

- Fund Finder - The fund finder allows investors to search for a particular fund by sector, unit type, fund type, provider and more.

- Ready-made actively managed portfolios - Hargreaves Landown's actively managed ready-made portfolios allow investors to choose one of four portfolios of varying risk levels. The funds are managed by Hargreaves Lansdown's in-house fund managers and it is their job to ensure the portfolio/funds match the investor's chosen risk level. These include the HL Cautious Managed, HL Balanced Managed, HL Moderately Adventurous Managed and HL Adventurous Managed fund.

- Ready-made multi-index portfolios - Hargreaves Lansdown also offers four multi-index portfolios, providing a cheaper ready-made alternative. Index funds are designed to track the movements of various stocks, bonds and investment markets around the world. They are a popular form of passive investing, an investment strategy that aims to match the performance of whatever index it is tracking, as opposed to an active investment strategy, which aims to beat the relevant benchmark.

- Interest on cash - Hargreaves Lansdown pays interest on cash held in its Stocks and Shares ISA, Junior ISA, Lifetime ISA, SIPP and Fund and Share account. For the latest rates, check out our article 'Investment platforms paying the highest interest rate on cash'

- Foreign Currency Exchange - You can transfer more than 40 different currencies to more than 120 countries with Hargreaves Lansdown's foreign currency exchange service either online or over the phone.

- Spread Betting and CFDs - Hargreaves Lansdown provides access to Spread Betting and CFDs through its partner IG. These types of products are designed for active and experienced investors.

- News, Insights & Research - A newsfeed providing easy access to the latest Hargreaves Lansdown articles and market data insight. A new feature that has been designed to help investors stay up to date with the latest investing topics and personal finance news.

- Cash ISA - Hargreaves Lansdown allows you to pick and choose Cash ISA rates from a range of banking partners all through one online account. It means you can easily switch between banks as your needs change or when your fixed rate matures.

- Online VCTs - Invest in a choice of 5 Venture Capital Trusts (VCTs). Minimum investment £10,000.

Free tools and investment advice offered by Hargreaves Lansdown

Hargreaves Lansdown offers a selection of free tools and guides to help investors make the most of their investments. The following is a selection of the best on offer and can even be used by non-clients:

- Pension calculator - one of my personal favourites where you can find out how much your pension may be worth when you retire

- ISA calculator - find out what your ISA could be worth in the future

- Guide to SIPPs - straightforward easy to read guide on SIPPs

- Investor's guide to ISA's - find out how to save time, tax and money with an ISA

Hargreaves Lansdown fees

Below we list the fees when investing with Hargreaves Lansdown

Hargreaves Lansdown Fees for ISAs and SIPPs

The below annual platform charges apply to the Hargreaves Lansdown ISA and SIPP.

| Amount invested | Annual charge by Hargreaves Lansdown |

| £0-£250,000 | 0.45% |

| £250,000 - £1 million | 0.25% |

| £1million - £2 million | 0.10% |

| Over £2 million | 0.00% |

Hargreaves Lansdown Fees for Junior ISAs

In March 2023, Hargreaves Lansdown scrapped all fees for its Junior ISA making it one of the cheapest Junior Stocks and Shares ISAs in the UK.

| Amount invested | Annual charge by Hargreaves Lansdown |

| £0-£250,000 | 0.00% |

| £250,000 - £1 million | 0.00% |

| £1million - £2 million | 0.00% |

| Over £2 million | 0.00% |

Hargreaves Lansdown Fees for Lifetime ISAs

In March 2023, Hargreaves Lansdown reduced the fees on its Lifetime ISA. The following annual platform charges now apply.

| Amount invested | Annual charge by Hargreaves Lansdown |

| £0 - £1 million | 0.25% |

| £1million - £2 million | 0.10% |

| Over £2 million | 0.00% |

Hargreaves Lansdown share dealing fees

Annual Fees

| Details | Annual charge by Hargreaves Lansdown |

| Shares held in an ISA | 0.45% capped at £45 per year |

| Shares held in a SIPP | 0.45% capped at £200 per year |

| Shares held in a Lifetime ISA | 0.25% capped at £45 per year |

| Shares held in a Junior ISA | No charge |

| Shares held in a General Investment Account | No charge |

Dealing fees

| Deals made in previous calendar month | Cost per deal |

| 0-9 | £11.95 |

| 10-19 | £8.95 |

| 20+ | £5.95 |

Hargreaves Lansdown online VCT fees

| VCT | Initial Provider Charge | Hargreaves Lansdown Discount | Net Charge | Ongoing Charge | Hargreaves Lansdown Dealing Fees |

| Blackfinch Spring VCT¹ | 5.5% | 3.0% | 2.5% | 2.50% | £50 |

| Octopus AIM VCT | 5.5% | 2.5% | 3.0% | 2.56% | £50 |

| Octopus AIM VCT 2 | 5.5% | 2.5% | 3.0% | 2.60% | £50 |

| Octopus Apollo VCT¹ | 5.5% | 2.5% | 3.0% | 3.52% | £50 |

| Calculus VCT¹ | 5.0% | 2.0% | 3.0% | 2.50% | £50 |

¹ Additional 'Early Bird' discounts apply. See Hargreaves Lansdown for more information

Hargreaves Lansdown customer reviews

Hargreaves Lansdown is rated as 'Great' on independent customer review site Trustpilot, with a total score of 4.2 out of 5.0 from over 12,000 reviews. Many of the positive reviews mention great customer service and excellent tools and research features. Some of the negative reviews mention the cost and that they can buy cheaper products elsewhere.

Hargreaves Lansdown Pros and Cons

| Pros | Cons |

|

|

Who is Hargreaves Landsdown good for?

The Hargreaves Lansdown platform is very competitively priced, particularly for investors with portfolios worth up to £100,000. For those with larger portfolios, it is sometimes possible to negotiate charge discounts on an individual basis. Regardless of the size of your portfolio, you should read through its brief guide to possible charges* to make sure you are aware of what you might be charged for, as my analysis assumes you only invest in unit trust funds. Looking at the Hargreaves Stocks & Shares ISA* and Hargreaves Lansdown SIPP*, they remain the market leaders and the addition of the Active Savings service makes Hargreaves attractive to those looking to increase the return on their cash savings too.

A viable alternative to Hargreaves Lansdown is Interactive Investor, which is cheaper for those with large portfolios (as it charges a fixed platform fee regardless of the amount invested) and like Hargreaves Lansdown, does not charge exit fees. For more analysis read our full Interactive Investor review.

I have been asked to be on an independent judge on a panel for an industry award to decide the best investment platform for consumers. In all honesty, my vote went to the Hargreaves Lansdown investment platform for many of the reasons I have outlined above. But that view is from an administrative perspective and not an endorsement of Hargreaves Lansdown's fund research. Unfortunately, as the Woodford episode (mentioned above) highlights, investment platform best-buy lists should be used with caution, irrespective of the platform you choose.

On top of that you can open an account in minutes (something other investment platforms fail at) with a debit card and start investing from as little as £25 per month. If you decide to do so here is the quickest way to open an account*. One personal tip, if you are at all unsure then start by investing a small amount with Hargreaves Lansdown (or indeed any investment platform) as you can then always increase your investment and move your existing portfolio across at a later date.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses - Hargreaves Lansdown, Fidelity, AJ Bell, Freetrade, Interactive Investor