In this independent Profile Pensions review, I take a look at pensions advice specialists Profile Pensions including the services it offers, how much it costs, who it might be good for and the alternative options available.

In this independent Profile Pensions review, I take a look at pensions advice specialists Profile Pensions including the services it offers, how much it costs, who it might be good for and the alternative options available.

What is Profile Pensions?

Profile Pensions is a UK based pensions advice and consolidation service that provides services both online and via telephone. It employs around 70 staff with almost 400,000 customers signed up to the service. It says that it is "on a mission to make Britain better off in retirement by giving everyone the right pension plan to suit their individual circumstances". On the 8th December 2022, Profile Pensions was acquired by Moneyfarm.

Profile Pensions features

- Receive a free, impartial, whole-of-market pension recommendation

- Pension tracing service that will track down old and missing pensions. There is a 1% fee for this service

- Pension consolidation service that will combine all old pensions into one pot

- Pay an 'all-in' fee of between 0.82%-0.86%

- Receive ongoing whole-market advice ensuring you are invested in the best pension plan

How does Profile Pensions work?

Profile Pensions provides independent pensions advice to its customers either online or via telephone. It is not tied to any pension provider meaning customers have access to the whole of the pensions market. Profile Pensions offers a fairly straightforward signup process which we explain below.

Profile Pensions sign up and recommendation

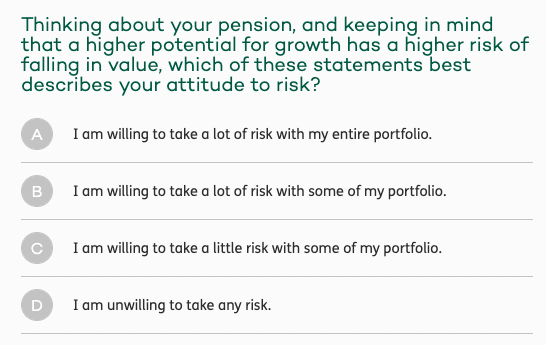

You can sign up for an account by entering your email and a password. You'll be sent a one-time verification code which you will need to enter to finish the signup process. You'll then need to complete an initial questionnaire so that Profile Pensions can understand your personal situation and retirement goals.

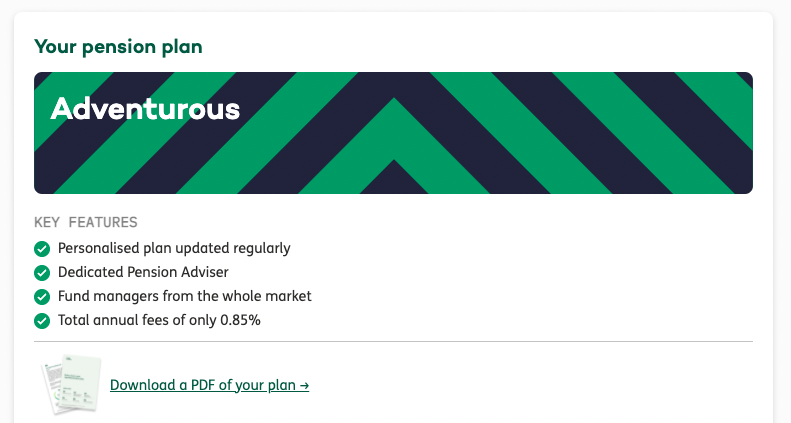

You will then be provided with a recommendation that aims to maximise the expected value of your pension based on your age and risk profile. You can even see a list of the funds Profile Pensions recommends and how much to put into each. There is no obligation to take things any further (i.e. add money) and it is free to see this recommendation and in theory, you could take that information and do what you wish with it.

Profile Pensions says that it looks at more than 40,000 funds from the likes of Vanguard, Blackrock, Legal & General and HSBC. If you prefer, you can speak to a pension adviser over the phone to discuss your recommendation.

Profile Pensions pension tracing and transfer service

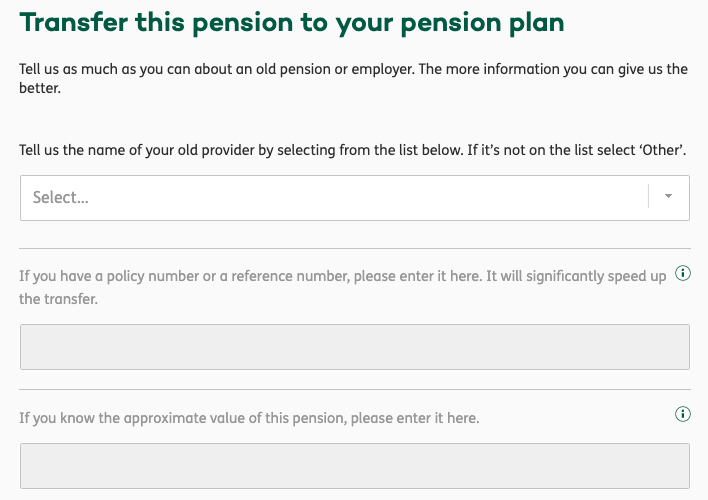

If you have any existing pensions you would like to transfer to Profile Pensions, you'll need to add the details of your existing pensions that you wish to transfer. If you don't have the exact details then the pension tracing team at Profile Pensions will try to track down your old pensions on your behalf and will be in touch to let you know if they have been successful. It is worth noting that there is a 1% fee if you decide to use its 'Find, check and transfer' service.

Having previously used a pension consolidation service myself, I was interested to see how much work actually went into hunting down old pension plans. Was it simply an automated search based on the information provided via the dashboard or was there a dedicated team behind it? When I put this to the then CEO Jordan Mayo, he assured me that any pension that isn't found using the automated system search will get allocated to a member of the team that is an expert at hunting down old pensions. This human overlay combined with the latest technology and up to date data has seen the team handle over 100,000 pension enquiries.

However it must be pointed out that it is possible to trace lost pensions yourself, for free, using the Government's Pension Tracing Service. The tool will tell you who to contact when trying to track down your lost pension. You can search for a workplace pension, a personal pension or a civil service, NHS, teacher or armed forces pension.

Assuming, that Profile Pensions helps you find your lost pensions, the final step is to complete the pension transfer. You'll be able to see who your pension is invested with, the funds that you have chosen as well as the fees you will be charged. Profile Pensions will continue to monitor your pension to ensure it is invested in accordance with your retirement goals.

Profile Pensions is not a pension provider and so it does not hold customer funds. Pension funds are initially held with Aegon, a platform that manages £800bn assets from over 20 countries.

Does Profile Pensions offer pensions transfer advice?

No. While it is able to offer impartial, whole-of-market investment advice, it cannot make a recommendation on whether you should complete a pension transfer or not. So, while the pension investment advice that you will receive as a Profile Pensions customer is both impartial and whole-of-market, the decision on whether you should transfer your pension is ultimately down to you. This is not unusual and is the same process adopted by other pension tracing specialists such as PensionBee, MoneyBox and Penfold (see the "Profile Pensions alternatives" section later). If you are unsure as to whether you should seek advice with regards to your personal pension, read our article "Do I need a financial adviser to cash in or transfer my pension?"

What type of pensions can I transfer with Profile Pensions

Profile Pensions can only help transfer pensions that are 'defined contribution', sometimes referred to as 'money purchase' pension schemes. A defined contribution pension is a pension pot that builds based on how much is put in. Profile Pensions cannot transfer a 'defined benefit' pension, sometimes referred to as a 'final salary' pension scheme. Those looking for advice on transferring a defined benefit pension scheme should seek specialist advice. You can read more in our article "Should I transfer my final salary pension?".

Is there a minimum investment amount with Profile Pensions?

There is no minimum investment amount with Profile Pensions meaning you can open an account and get a recommendation without any financial commitment. If you are happy with your recommendation and you wish to invest in a pension then there is a minimum regular personal contribution of £10 per month and this can be amended at any time through the Profile Pensions dashboard. It is worth noting that if you are transferring a pension to Profile Pensions there is no requirement to make additional monthly contributions.

Profile Pensions charges and fees

Profile Pensions does not charge a fee for any initial advice that you receive, however, if you use its 'Find, check and transfer' service then a 1% fee applies. Profile Pensions charges an annual management fee between 0.82% and 0.86%, depending on the pension you are invested in. The fee is all-inclusive which means that it covers the management charge, fund charge, ongoing charges and any ongoing advice to ensure that you are invested in the best pension for you. This means that it is competitively charged when compared to other similar services.

Is Profile Pensions safe?

Profile Pensions is not a pension provider and so does not hold any customer funds. All money is held with the pension providers that Profile Pensions recommends and so you should check that each pension provider you hold money with is protected by the Financial Compensation Services Scheme (FSCS).

It is worth remembering that as with any investment, there is the risk that they can go down as well as up so make sure that you are comfortable with the level of risk you are taking. If you are unsure then it would be wise to seek independent advice. Read our article "Where to get free financial advice"

Additionally, as it provides advice, Profile Pensions is registered with the Financial Conduct Authority (FCA) and is covered by the FSCS in the event that it gives misleading advice, provides negligent management of investments or conducts fraud or misrepresentation. This means that customers may be entitled to a reimbursement of up to 100% of an investment up to the £85,000 limit.

Profile Pensions customer reviews

Profile Pensions is rated as 'Excellent' on independent review site Trustpilot from over 2,500 customer reviews scoring 4.5 out of 5.0. Positive reviews cite helpful advice from its pension advisers and a professional service. Of the negative reviews, some state that there have been delays when using its pension tracing service.

Profile Pensions alternatives

Those seeking a like-for-like alternative to Profile Pensions would perhaps be better off speaking to an independent financial adviser who has access to the whole of the market and so can make an independent recommendation, which can also include advice on whether consolidating your pensions is a good idea or not. Our article "10 tips on how to find a good financial adviser" may provide some help.

Profile Pensions provides pension investment advice and recommendations unlike other pension tracing and consolidation services (such as PensionBee, Penfold and Moneybox) where money is invested directly in one of their own tailored pension plans on an execution-only basis. That being said, those looking for a low cost, app-based solution would be wise to check them out. Each has a number of tailored plans suited to different risk styles and some even allow you to invest your spare change into your pension each week.

Profile Pensions vs PensionBee vs Penfold comparison

| Penfold | PensionBee | Profile Pensions | |

| Annual cost | 0.40% to 0.88% | 0.50% to 0.95% | 0.82% to 0.86% |

| Minimum Investment | £0 | £0 | £0 |

| Find and consolidate old pensions | |||

| Ethical investing option | |||

| Access to whole-of-market investments | |||

| Personalised initial recommendation | |||

| Ongoing personalised investment advice |

Profile Pensions vs PensionBee

Like Profile Pensions, PensionBee helps savers to locate and consolidate all their old pensions into one place. Once consolidated, investors can choose whether or not they wish to continue making contributions. Unlike Profile Pensions, PensionBee does not provide pension advice and so you are restricted to seven diversified portfolios and its charges range from 0.50% to 0.95%. Investors are free to switch portfolios at any time but have to do so without guidance. Read our independent PensionBee review.

Profile Pensions vs Moneybox

Again, similar to Profile Pensions, Moneybox has a dedicated team that will help trace your old pensions for free. Moneybox is primarily a savings app that lets you save or invest your ‘spare change'. Money can be put into a number of savings and investment accounts, including a SIPP. There is currently a choice of four funds and fees for the SIPP are 0.45% for investments up to £100,000 and 0.15% above that. There is also a fund provider fee of 0.12% to 0.63%. Unlike Profile Pensions, Moneybox does not provide pension advice. Moneybox states "We're not able to give any financial or investment advice. Whether and how to invest your money is entirely your decision and you will need to monitor your own investments in the app". Read our independent Moneybox review.

Profile Pensions vs Penfold

Penfold has a 'Find my pension' tool that can help locate existing workplace pensions and works in a similar way as Profile Pension's pension tracing service. Penfold is a pension provider and offers both private and business pensions. It offers four different types of private pension including a lifetime pension plan where the risk level automatically adjusts over time, a standard pension plan where customers can choose one of four risk levels, a sustainable pension plan and finally a Sharia compliant pension plan. Penfold charges a fee of between 0.75% and 0.88% although that drops to between 0.40% and 0.53% if investing more than £100,000. Penfold, unlike Profile Pensions, does not provide pension advice and so the decision whether to invest and in which portfolio rests solely on the investor (i.e execution-only).. Read our independent Penfold review.

Profile Pensions Pros and Cons

Pros

- Simple sign up process

- Impartial, whole-of-market advice service

- Free pension tracing and consolidation service

- You can see the pension investment recommendation without having to commit to transferring or taking out a pension

Cons

- You may end up paying a higher fee than if you invested directly with the recommended pension provider

- Money is not handled directly by Profile Pensions and so pension switches can take some time

- Profile Pensions states that "Although, we will endeavour to identify any exit fees or guarantees worth more than £50 we cannot guarantee to find all exit fees and guarantees and we do not check certain policies considered very low-risk".

Summary

Profile Pensions is likely to appeal to those who do not have the time or inclination to manage their own investment decisions. The 'all-in' fee of between 0.82%-0.86% is low when compared to other solutions such as seeking advice from a qualified Independent Financial Adviser (IFA). That being said, an IFA is able to provide a wider range of advice, taking all aspects of your financial position into consideration, including any protection products such as life insurance, any savings or investments you have and even your mortgage.

If you are simply looking for your pension to be managed on your behalf and remain invested in line with your financial goals and at the lowest cost, then Profile Pensions might be a suitable service to invest your pension, especially if you want someone to recommend the underlying investment portfolio to you. You can even see the pension portfolio recommendation, for free, that Profile Pensions would recommend. All you have to do is register and there is no commitment to take action or invest.

There are, however, cheaper alternatives that can do a similar job but without providing regulated investment advice. PensionBee and Penfold* both offer pension plans with an element of lifestyling - an investment strategy that automatically switches your pension into lower risk funds as you get closer to your planned retirement age. However, both services are classed as execution-only which means the decision of which portfolio to invest in rests solely with you.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - PensionBee, Penfold