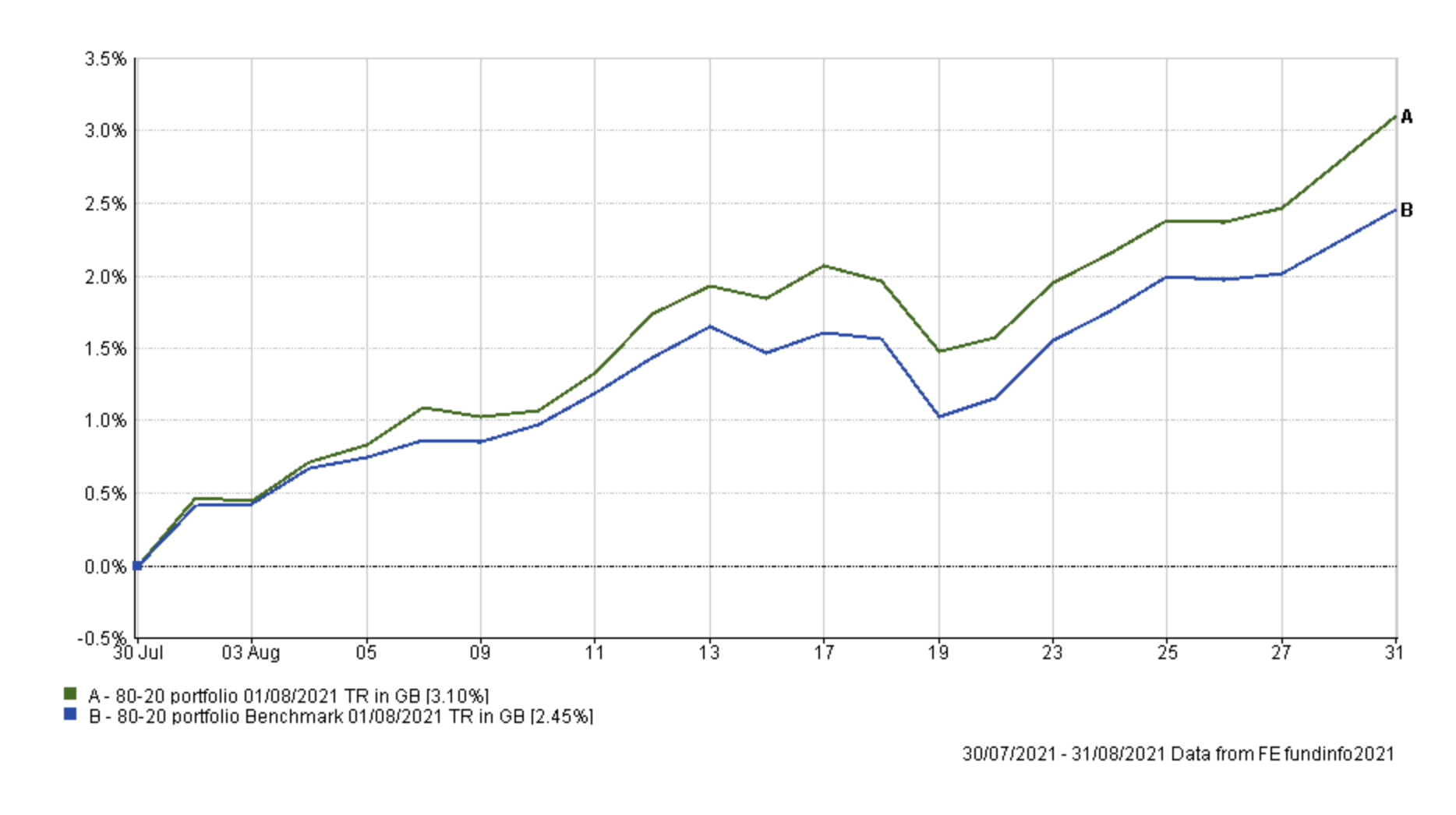

Of the 30 funds in August's BOTB, 16 funds have retained their place in September's selection. The chart below shows the performance of the BOTB (+3.1% during August) against a benchmark that is calculated using the respective sector averages for each fund in the BOTB and assuming the same asset mix. The BOTB also outperformed the sector average of comparable professionally managed multi-asset funds (which made 2.26%)

Every single fund within the BOTB selection finished in positive territory for the month of August, which is a great result. The table below shows the top performers within the BOTB for the month of August and it's pleasing to see Fidelity UK Smaller Companies in the list as I hold it in my own £50k portfolio. Liontrust India once again tops the chart.

Fund % July return Liontrust India 8.54 ES R&M UK Equity Smaller Companies 5.55 Fidelity UK Smaller Companies 5.1 ASI UK Real Estate Share 5.06 Schroder UK Dynamic Smaller Companies 4.97

The BOTB as a whole benefited from its increased equity exposure and looking at the new BOTB, the overall equity exposure has risen again from 65% to 67%, which is the highest for some time.

Full article available exclusively to 80-20 Investor members.

To read the complete article, sign up for a free trial or log in below.

Start a free trial Already have an account? Log in