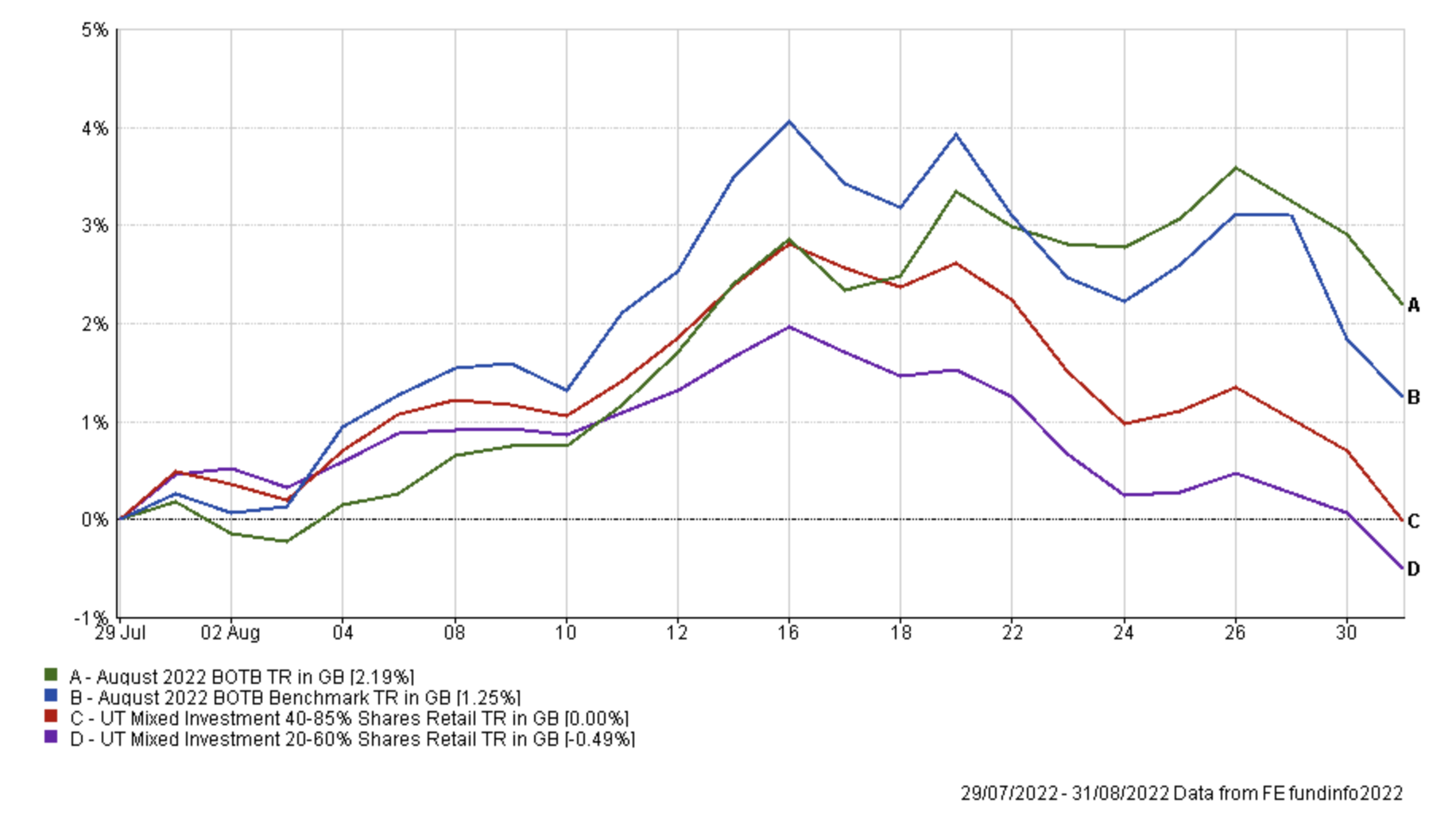

Of the 30 funds in August's BOTB, 20 funds have retained their place in September's selection after a very strong monthly performance. The chart below shows the average performance of the BOTB during August (the green line) against a benchmark that is calculated using the respective sector averages for each fund in the BOTB and assuming the same asset mix (the blue line). You can see that the BOTB outperformed its benchmark.

The chart also shows how the selection significantly outperformed the average professionally managed fund from the Mixed Investment 20-60% Shares sector and the Mixed Investment 40-85% Shares sector. The former is typically more cautious than the BOTB given its lower equity exposure while the latter tends to be more adventurous. Ironically it was the BOTB's lack of exposure to US technology stocks and bonds which contributed to the selection's outperformance as the market eventually began betting that the US Federal Reserve would become more aggressive with its interest rate hikes.

The chart also shows how the selection significantly outperformed the average professionally managed fund from the Mixed Investment 20-60% Shares sector and the Mixed Investment 40-85% Shares sector. The former is typically more cautious than the BOTB given its lower equity exposure while the latter tends to be more adventurous. Ironically it was the BOTB's lack of exposure to US technology stocks and bonds which contributed to the selection's outperformance as the market eventually began betting that the US Federal Reserve would become more aggressive with its interest rate hikes.

Full article available exclusively to 80-20 Investor members.

To read the complete article, sign up for a free trial or log in below.

Start a free trial Already have an account? Log in