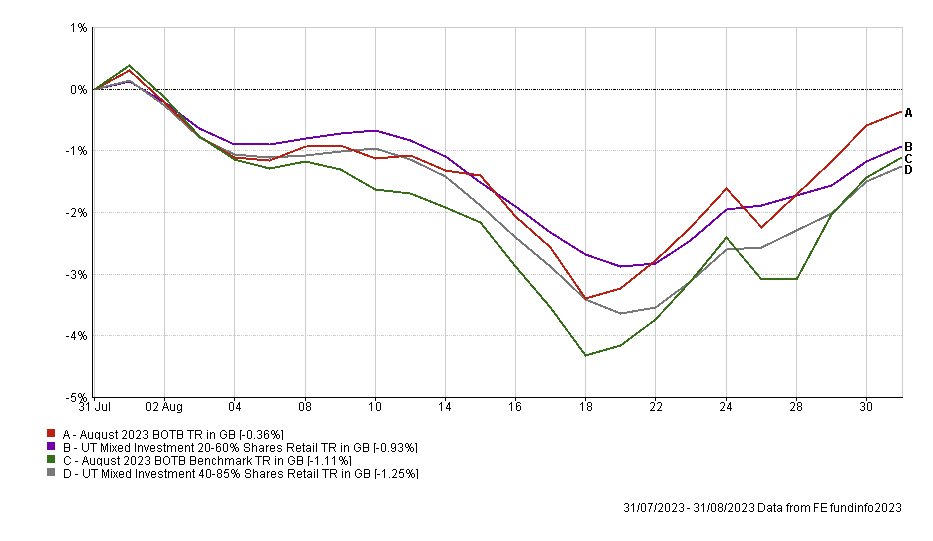

Of the 30 funds in August's BOTB, 21 funds have retained their place in September's selection, which again is higher than normal and reflects a relatively strong performance during August. The chart below shows the average performance of the BOTB during August (the red line) against a benchmark that is calculated using the respective sector averages for each fund in the BOTB and assuming the same asset mix (the green line). You can see that the BOTB outperformed its benchmark, as well the average cautious managed fund (purple line) and the average managed fund with up to 85% equity exposure (grey line).

The top performing funds in August's BOTB are shown below and once again include those funds that typically have exposure to large cap US companies.

Fund August 2023 % return Royal London Global Equity 2.2 T. Rowe Price US Large Cap Growth Equity 1.63 FTF Franklin US Opportunities 1.32 FP Carmignac Global Equity Compounders 1.29 FTF Templeton Global Leaders 1.07At the other end of the scale, European equities, emerging market equities and technology focused funds struggled - dragged lower by Chinese economic woes and a stronger US dollar.

Full article available exclusively to 80-20 Investor members.

To read the complete article, sign up for a free trial or log in below.

Start a free trial Already have an account? Log in