I was asked the following interesting question in November's Chatterbox:

“Hi Damien, I was wondering if there’s any merit to Warren Buffett’s advice “Be fearful when others are greedy and greedy when others are fearful”? Is it possible to do a research piece looking at an investment strategy that follows this rule? Maybe using the VIX index or the CNN fear & greed index that you have written about before."

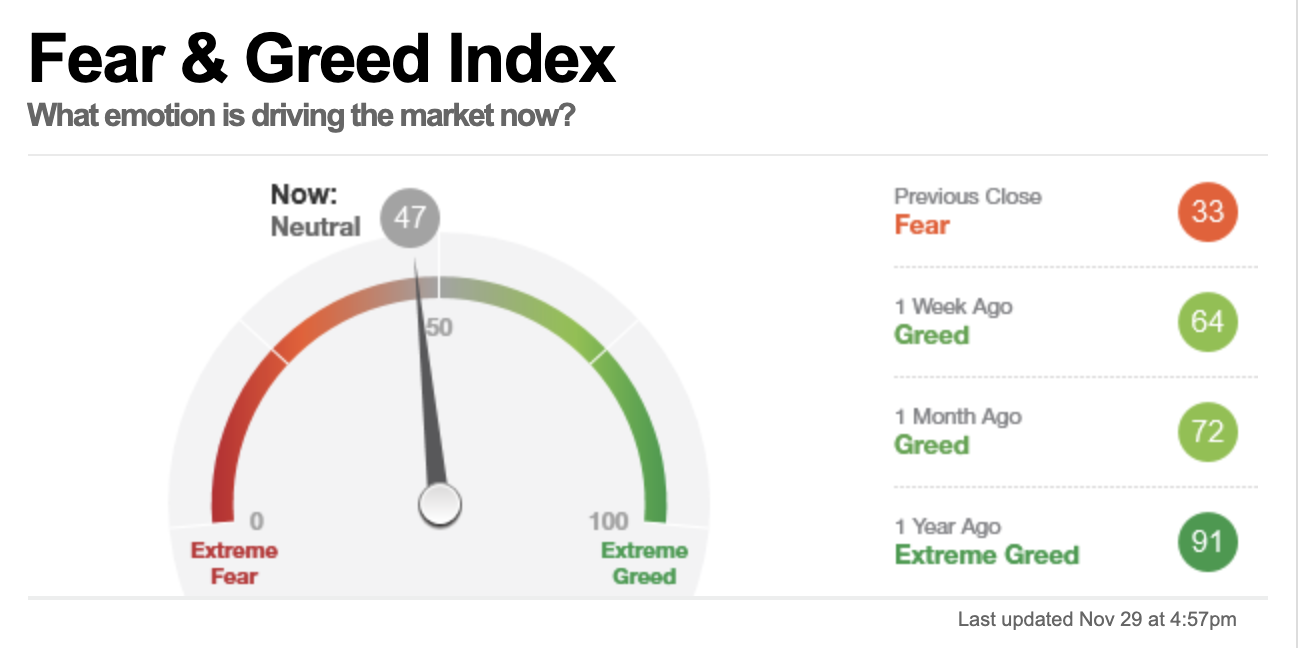

As a reminder, the CNN Fear and Greed Index is a multi-factored gauge that quantifies market sentiment on a scale from 0 to 100 - with 0 representing extreme fear as the emotion driving the market and 100 representing extreme greed. There is therefore an interesting parallel with Warren Buffet’s famous investment adage, mentioned above. The chart below shows the CNN Fear and Greed Index as of 29th November 2021:

However, there is not enough reliable historical data to determine the usefulness of using the CNN Fear and Greed Index as a market-timing tool over the long term.

Full article available exclusively to 80-20 Investor members.

To read the complete article, sign up for a free trial or log in below.

Start a free trial Already have an account? Log in