In this month' Chatterbox I was asked the following question:

Hi Damien

Do you think that carefully selected absolute return funds can be a bond substitute/diversifier and risk reducer in portfolios? My emphasis would be on “carefully selected”! There is some evidence that some of them have done better in preserving capital this calendar year.

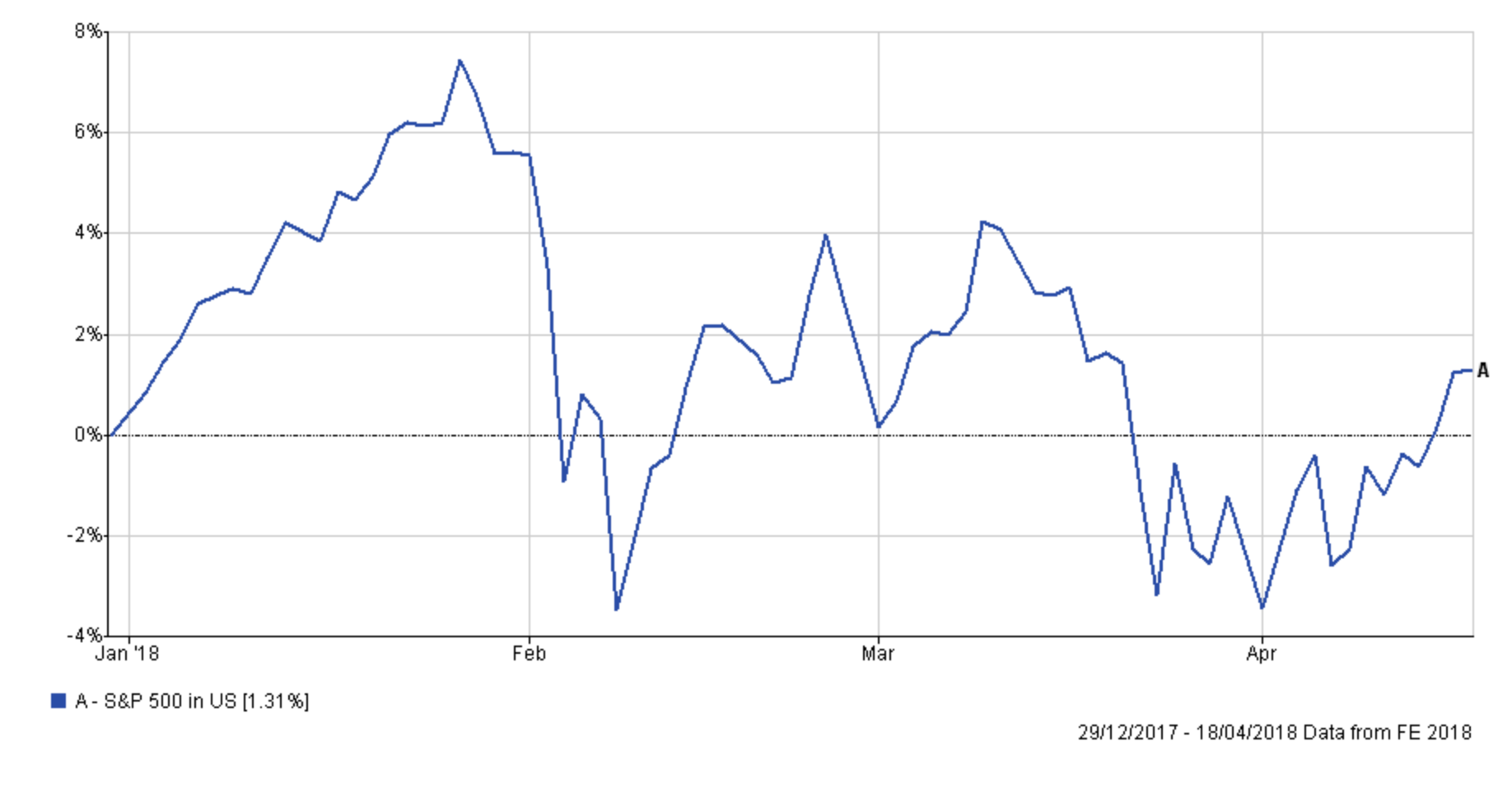

I think it is an excellent question and one which warrants further investigation to see if such funds exist. It also gives me a chance to illustrate how I might research such funds. So how do I go about it? Firstly it is worth looking at how markets have performed year to date. The chart below shows the performance of the S&P 500 since the start of the year (click to enlarge).

The second chart shows the performance of the average Strategic bond fund and the average Global bond fund over the same period.

Full article available exclusively to 80-20 Investor members.

To read the complete article, sign up for a free trial or log in below.

Start a free trial Already have an account? Log in