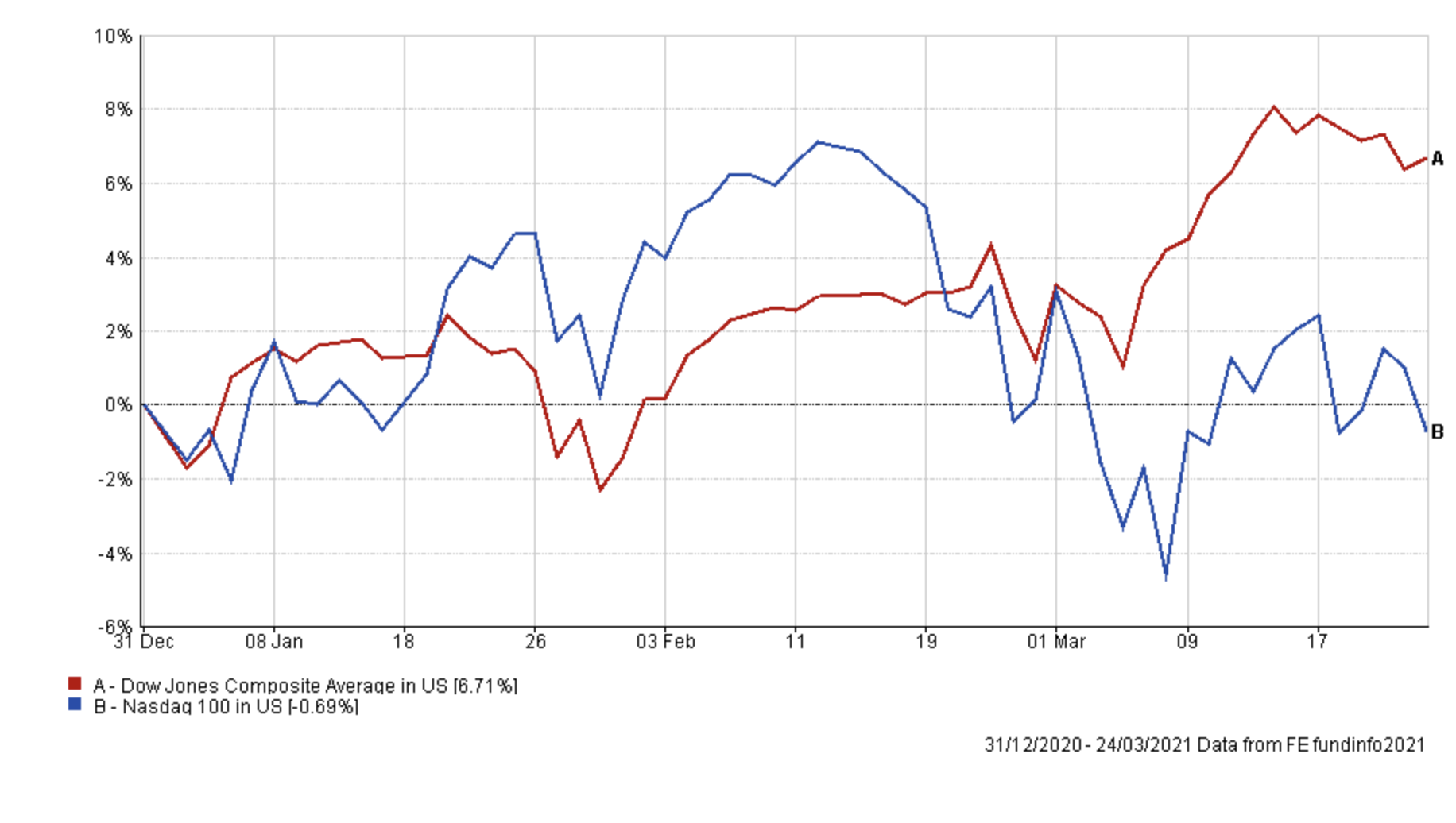

In my weekly and monthly newsletters I've written extensively on the reflation trade that has captivated markets since mid-February. Bond yields have spiked causing bond prices to tumble. Equity markets initially ignored the turmoil in bond markets but ultimately were forced to pay attention. While there have been areas of the market (large growth stocks such as technology companies) that have been hit hard by the reflation trade, other areas have fared much better. Energy stocks and financials have performed well alongside value plays (which were among last year's laggards). The chart below shows the performance of the Dow Jones so far this year versus that of the tech-heavy Nasdaq 100. It beautifully illustrates the divergence in fortunes within equity markets with the former hitting new all-time highs

Yet one of the most popular questions I've been asked of late is how can you quickly tell which funds will benefit from an ongoing reflation trade.

Full article available exclusively to 80-20 Investor members.

To read the complete article, sign up for a free trial or log in below.

Start a free trial Already have an account? Log in