Periodically I review global stock markets to see which offer good value based on historical data. The last time I did this was almost a year ago in August 2023. Since then we've seen a divergence in fortunes for stock markets globally, largely the result of the market's anticipation of a divergence in monetary policy from global central banks.

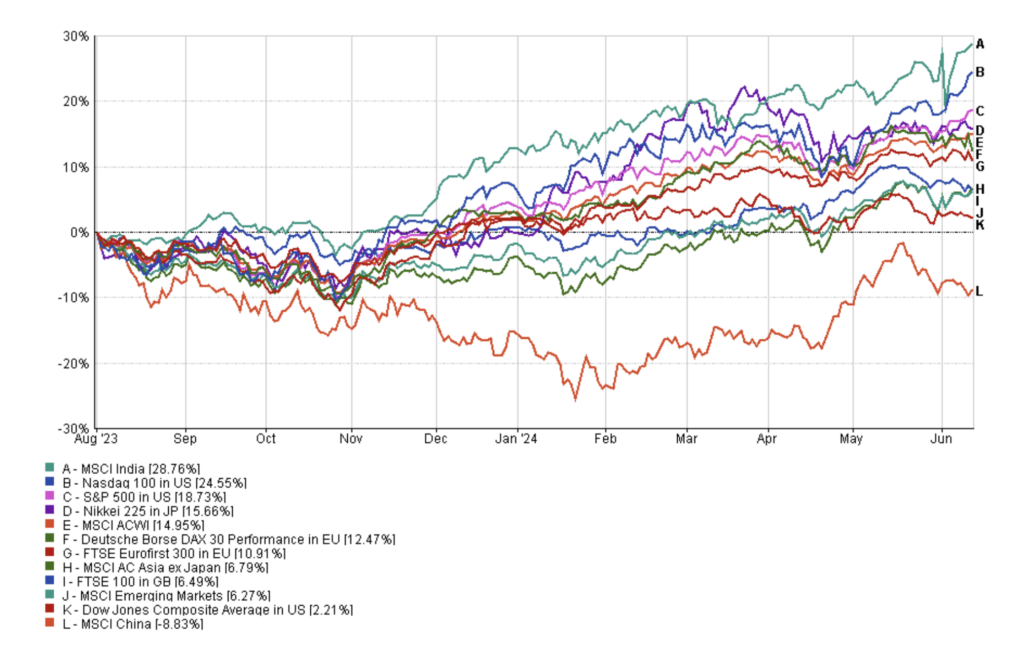

The chart below shows the performance of key stock markets since August 2023, with Indian equities and the tech-heavy Nasdaq 100 leading the way.

So how have the stock market moves affected stock market 'value' around the globe? In this article, I answer that question before going on to determine the value of individual equity sectors in the US. But first, let me recap on what value investing is.

What is 'value investing'A value investor buys shares in companies that he/she believes are undervalued by the market on the assumption that when reality catches up with the company fundamentals the share price will be revalued and they will make a profit.

Full article available exclusively to 80-20 Investor members.

To read the complete article, sign up for a free trial or log in below.

Start a free trial Already have an account? Log in