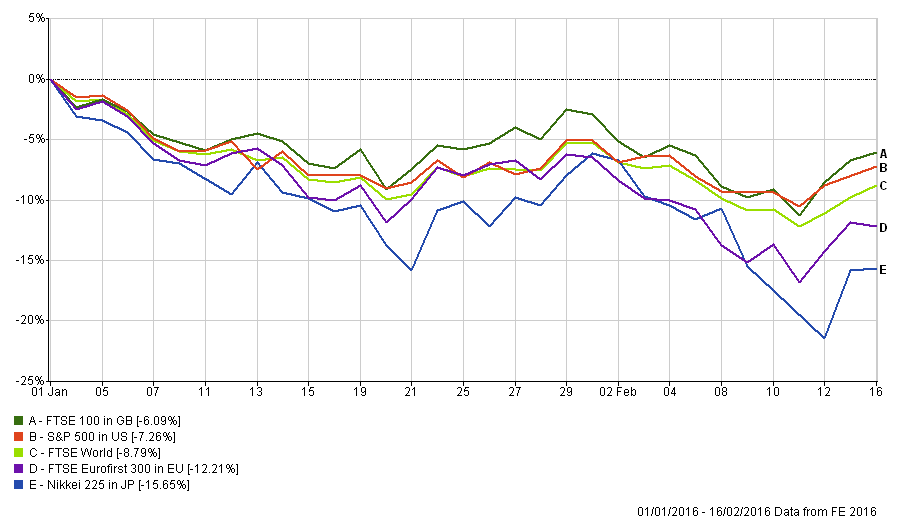

The start of 2016 has been a dismal one for investors. The chart below shows how the major developed world indices have performed year to date. At their worst they were down between 10% and 20% (click to enlarge).

Bank stocks and bonds tumble over crisis fearsWhile the sell-off was broad the latest down-leg was sparked by concerns over the banking sector (particularly in Europe) and the real possibility of another financial crisis. As I pointed out in my last weekly newsletter the catalyst for the sell-off was the central bank of Sweden moving its main interest rate on reserve deposits deeper into negative territory. Or in other words it would now cost banks money to place deposits with the Swedish central bank. Such a phenomena has many economists in a twist because their guide books don't allow for this eventuality.

Full article available exclusively to 80-20 Investor members.

To read the complete article, sign up for a free trial or log in below.

Start a free trial Already have an account? Log in