It can be a laborious task when it comes to trying to find the best deal on car insurance. Honcho promises to shake up the way people compare and buy car insurance by getting providers to 'bid' for your business.

Gavin Sewell CEO of honcho said: “It’s been a long time in the making and words can’t describe the level of excitement that can be felt around honcho HQ now that the service is live to the public.

“Honcho is one-of-a-kind and will be revolutionary for drivers of all ages. However, we’re especially keen to see the benefits to young motorists who, for so long, have struggled to acquire fairly priced policies – with many paying 149% more than the average driver".

What is honcho?

Honcho describes itself as the 'first-ever reverse auction marketplace for car insurance' but explicitly states it is not a price comparison website. It wants finding the cheapest car insurance deal to be simple and stress-free and claims you can get the best deal by playing 'hard to get'. At the moment honcho only offers car insurance but it is looking to launch a range of other insurance products later on in the year.

Honcho uses a 'reverse auction' process, which means that auction roles are reversed and insurers have to bid to get your custom (instead of the other way around). Honcho says this means that the buyer is put first and as a result car insurance costs go down as the number of bids increase.

How does honcho work?

Honcho works by getting insurance brokers to bid against one another in an effort to drive down the overall cost to the consumer insurance offers. Honcho says that there are no hidden charges or commissions and that it is completely transparent about how it makes money. Honcho is currently free to use for all customers.

You don't need a smartphone to use honcho as it also has a web service. To get started you need to:

- Create an account - you can either sign up with Facebook or via an email address

- Fill in your personal details including name age, occupation

- Fill in car details such as mileage, where it is stored etc - this information is stored in your 'garage'

- You can then 'Get Bids' for your car insurance quote

How does honcho make money?

With honcho being free to the end-user and completely transparent regarding commission, how does it make money?

Honcho charges insurers £1 to be able to bid for your custom. So if 5 insurance companies bid to provide your car insurance honcho would receive £5. Honcho only charges the companies once per bid cycle (28 days) but they will be charged again if you want another quote after the 28 days.

Honcho vs Comparison sites

In order to see if honcho's new service is as good as it sounds, I decided to test it out to see what my cheapest car insurance quote would be.

Honcho's aim "is to reduce insurance costs for all – and especially for young drivers aged 17-24, who typically fork out £1,177 or 149% more than the national average (ABI, 2018) on annual car insurance fees."

My quotes as of September 2019 are as follows (I also get a more up to date quote, see below):

I did two quotes, both within the 17-24 age range and with the same vehicle.

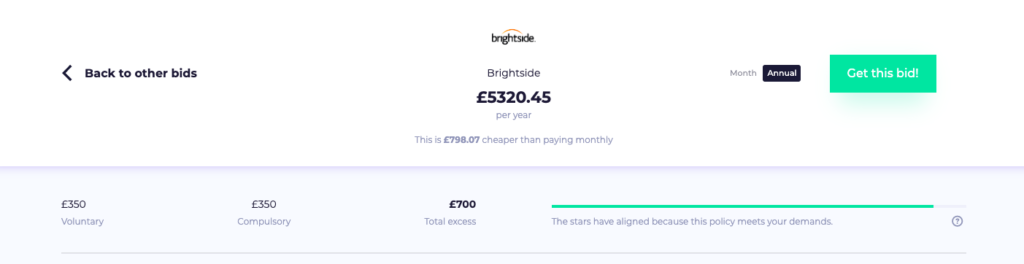

Quote 1:

- 22 year old male

- 13 year old Audi A3 s line used for social, domestic and pleasure driving

- 8,000 miles a year

- Fully comprehensive, including legal cover and courtesy car

- £700 excess

Price: £5,320.45 - Annual premium (Brightside insurance)

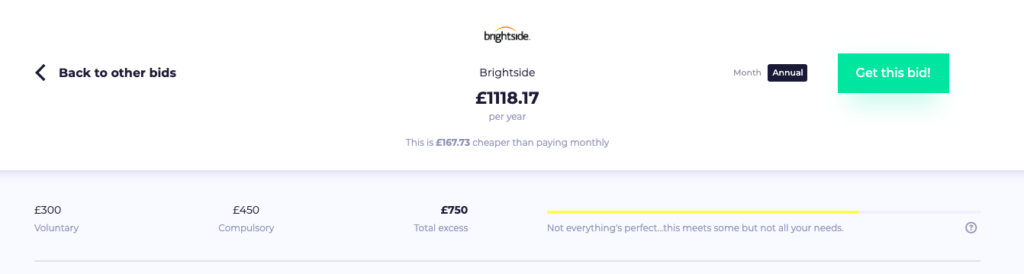

Quote 2:

- 24 year old female

- 13 year old Audi A3 s line used for social, domestic and pleasure driving

- 8,000 miles a year

- Fully comprehensive, including legal cover*, courtesy car

- £750 excess

Price: £1,118.17 - Annual premium (Brightside insurance)

*not included in the final quote price

As you can see from the quotes, they are still relatively expensive, especially the first quote. On both occasions Brightside insurance bid for my custom 3 times but there was only one price showing. I received no other bids from any other insurance providers.

Here is my quote from February 2020:

Quote 1:

- 24 year old female

- 13 year old Audi A3 s line used for social, domestic and pleasure driving

- 8,000 miles a year

- Fully comprehensive, including legal cover*, courtesy car

- £750 excess

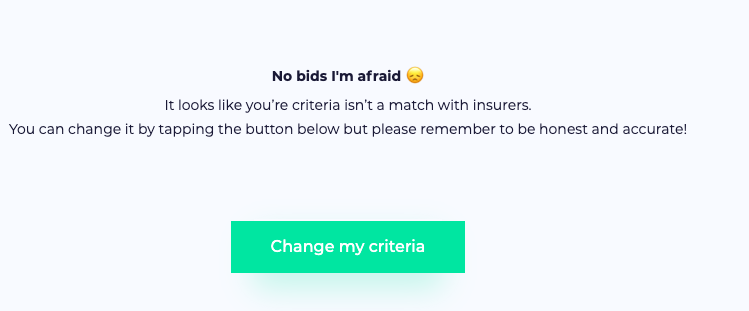

Price: No Bids

As you can see from the quote I entered exactly the same information as I did back in September 2019 however this time I didn't match with any insurers at all.

So how do my honcho quotes compare to comparison site quotes such as confused.com and Compare the Market?

I used the second quote I received in September 2019 as a comparison and I received 70 results using Compare the Market. The cheapest quote was £676.18 and the most expensive was £2,741.64. Out of the 70 results, 38 were above my honcho quote of £1,118.17 and the remaining 32 were below.

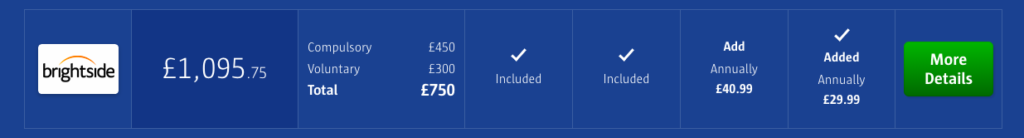

Overall, I think Honcho has an interesting concept and could work with time, but as it only currently offers 9 car insurance providers on its panel (none of which are particularly well known), it will struggle to challenge the top comparison sites. Not only that but the quote I received for Brightside insurance via honcho was more expensive than the Brightside quote I received via Compare the Market, despite entering the exact same information. The more expensive honcho quote also required me to add motor legal cover for an additional £29.99 and didn't include any no claims bonus protection or personal accident cover. The cheaper Compare the Market quote had added the £29.99 annual cost of the motor legal cover into the £1,095.75 quote and also included no claims bonus protection and personal accident cover.

I decided to revisit Honcho a little under 6 months after my initial review, in light of them being a new name in the car insurance comparison world, however, I was unable to get a single quote, which was hugely disappointing.

Summary

Honcho will hopefully improve with time as it expands its offering, but for now you'd still be better off getting cheap car insurance quotes via the more traditional comparison sites.