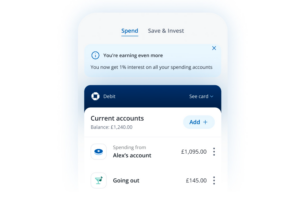

Digital bank Chase has announced that from 24th April 2023, new and existing customers will earn 1% interest (AER/Gross) on all current account balances. Chase currently pays 3.1% AER interest on its saver account, 5% AER interest on its Round-Up account and 1% cashback on everyday spending. This latest announcement means that Chase customers can now earn small amounts whether they intend to use the account to spend, save or simply hold money in their account.

Digital bank Chase has announced that from 24th April 2023, new and existing customers will earn 1% interest (AER/Gross) on all current account balances. Chase currently pays 3.1% AER interest on its saver account, 5% AER interest on its Round-Up account and 1% cashback on everyday spending. This latest announcement means that Chase customers can now earn small amounts whether they intend to use the account to spend, save or simply hold money in their account.

Shaun Port, managing director for everyday banking at Chase said “At a time when many need their money to stretch further, we've created a fuss-free option for customers to help them earn a little bit extra on their everyday banking. Earning interest on money held in your current account can get your money working harder, and is a smart way of earning interest on your salary before your mortgage, rent or bills leave the account."

In this article we explain how the interest is calculated, when it is paid and how it compares to other banks including digital alternative Starling.

How much interest can you earn with Chase Bank

Chase Bank pays interest whether you hold money in its current account, saver account or via its 'round-up' feature. We provide the current rates of interest payable for each type of account below.

| Account Type | Interest payable |

| Current account | 1% AER/Gross (Variable) |

| Saver account | 3.1% AER (3.06% Gross) |

| Round-Up | 5.0% AER (4.89% Gross) |

When does Chase pay interest on current accounts?

Chase allows customers to open up to 20 separate current accounts via its app and all current accounts will attract interest at 1% AER/Gross (variable). The interest is calculated daily and is paid at the start of each month.

Is there a minimum deposit and is the interest on current accounts capped?

There is no minimum deposit and the amount of interest that can be earned is uncapped.

How does it compare to other high street banks?

Below, we have compared the interest payable on the Chase current account with the best interest-paying current accounts on the high street. While Chase pays a lower amount of interest on current account balances, the interest payable is uncapped and there are no minimum monthly deposit requirements.

How does it compare to Starling?

Below, we have compared the interest payable on the Chase current account with Starling and Kroo, two alternative digital banks that pay interest on current account balances.