NatWest Rooster Money* launched in 2016 with the mission to 'educate, motivate and empower' children financially. NatWest Rooster Money is a pocket money app that allows both children and parents to manage pocket money from the same account.

NatWest Rooster Money has a variety of tools for children of all ages, ranging from 3 - 17 years old, so children can start to learn about money from a young age. This article reviews the pocket money app NatWest Rooster Money explaining how it works, how much it costs, and how it compares to other pocket money apps such as GoHenry* and Osper.

NatWest Rooster Money key features

- Free NatWest Rooster Money card subscription - NatWest Group customers can get the Rooster Card subscription free as long as they retain their account. To be eligible for the offer you must be 18+, have mobile or online banking and with child(ren) aged 6-17, available for up to 3 free Rooster Card subscriptions per household. Other fees may apply, T&Cs apply.

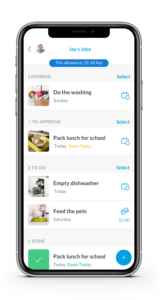

- Smartphone app - Parents and children can access the NatWest Rooster Money app from a smartphone device to keep track of pocket money at all times

- Star Chart - Reward children for good behaviour from the age of 3 with the virtual star chart

- Set Goals - Set Goals that children can work towards and track their achievements

- Virtual Money Tracker - Track your child's money and spending habits virtually without real money

- Pots to manage money - Children can set aside money with the 'Spend', 'Save', and 'Give' pots

- Budgeting tools - Children can gain a better understanding of money with the budgeting and saving tools

- Set and manage chores - Set chores and reward your children with an allowance or stars for completing tasks (subscription required)

- Visa prepaid debit card - The Rooster Card, a contactless prepaid visa debit card, allows your child to spend their allowance online and in shops (subscription required)

- Multiple parents/guardians - More than one parent/guardian can be added to the app (there is a 2 parent limit for the free account)

- Set recurrent payments - Allow your child to pay you regularly - e.g. for a magazine subscription - from their allowance (subscription required)

How does NatWest Rooster Money work?

NatWest Rooster Money* is a pocket money app that allows you to teach your children about money and give them financial independence whilst still having control over their finances.

Setting up an account is easy, you need to provide your full name and an email address and then create a password. You will be asked how your children refer to you - e.g. mum or dad - and which country and currency you would like to use on the app. You will then be asked which aspect of NatWest Rooster Money you are most interested in - e.g. the Star Chart or the Rooster Card - but you do not have to choose this in order to sign up.

Once signed up, you can play around in the app to see what features you do and don't like, and then upgrade to a premium account at a later date if desired.

After you have created an account, you will be asked to add children to the app. You will need to provide your child's name, date of birth, and gender. You also have the option to input your child's pocket money allowance and whether they receive this weekly, fortnightly or monthly.

Initially, any children you create will be automatically set up with a Virtual Money Tracker account, which is the free version of the NatWest Rooster Money app. You will have the option to upgrade to the Rooster Card account. For more information on the different accounts available with Rooster Money, see below.

(click to enlarge images)

NatWest Rooster Money account types

NatWest Rooster Money has two different accounts that allow you to track your child's money. We have summarised them in the comparison table below.

What are the different NatWest Rooster Money accounts?

| Virtual Tracker | Rooster Card^ | |

| Age range (years) | 3+ | 6-17 |

| Annual cost | Free | £19.99 (1 month free) |

| Monthly cost | Free | £1.99 (1 month free) |

| Star Chart | Yes | Yes |

| Track money virtually | Yes | Yes |

| Schedule allowance | Yes | Yes |

| Money pots | Yes | Yes |

| Educational resources | Yes | Yes |

| Child login | Yes | Yes |

| Chore tracker | No | Yes |

| Interest rate setter | No | Yes |

| Unlimited guardians | No | Yes |

| Set regular payments | No | Yes |

| Real money deposits | No | Yes |

| Prepaid debit card | No | Yes |

| Flexible parental controls | No | Yes |

| Debit account details | No | Yes |

^Currently only available in the UK

NatWest Rooster Money Virtual Tracker

- Free

- Suitable for children aged 3 years and over

- Virtual pocket money tracker

- Reward chart

- Spending and saving pots

- Child login

- 2 parent/guardian logins

The Virtual Money Tracker account is the free version of the NatWest Rooster Money app. It is suitable for children from 3 years old and allows you to virtually track your child's pocket money. This means that no physical money is loaded onto the app, but if you give your child a regular allowance, you can keep track of how much you give them within the app.

If the child spends, saves or gifts some of their allowance, this can also be updated in the app so both you and the child can track how much pocket money has been spent or saved. You also get access to a virtual reward chart, but to use this, you'll need to set the child's currency to stars. You can then set goals for your child to work towards and reward them with stars for good behaviour to help them to achieve their goal.

NatWest Rooster Money Rooster Card

- £19.99 per year or £1.99 a month (1-month free trial or free for eligible NatWest Group customers)

- Suitable for children aged 6 - 17 years old

- Virtual pocket money tracker

- Reward chart

- Spending and saving pots

- Child login

- Unlimited parent/guardian logins

- Chore tracker

- Set an interest rate on your child's money

- Recurring payments

- Prepaid contactless Visa debit card

- Spending limits

- Instant notifications for both parent and child

- Freeze/Unfreeze the card in-app

- Secure online card details for one-time transactions

The NatWest Rooster Money Rooster Card is a prepaid contactless Visa debit card that allows your child to spend and manage their own money whilst allowing you to oversee the account via the app. A Rooster Card allows parents to set daily, weekly, and monthly spending limits, as well as ATM and single transaction limits.

The debit card can also be used abroad for free, as long as transactions are kept below £50. Any transactions over the £50 limit will be charged a 3% fee. As well as getting a Rooster Card, you can also benefit from the same features included with the Virtual Money Tracker account.

The Rooster Card is issued by National Westminster Bank Plc pursuant to a license from Visa Europe.

How much does NatWest Rooster Money cost?

You can choose between three NatWest Rooster Money accounts - the free account or the two different subscription accounts. In the below table, we summarise the subscription fees and any fees associated with a Rooster Card. You can scroll down for further detail on the account limits.

| Fees | |

| Virtual Tracker | FREE |

| Rooster Card annual fee | £19.99 per year per card^ (first month free) or free for eligible NatWest Group customers |

| Rooster Card monthly fee | £1.99 per month per card (first month free) |

| Creative cards |

£4.99 (one-off fee in addition to subscription amount)

|

| Spending online |

FREE (limits apply)

|

| ATM fees |

FREE (limits apply)

|

| Foreign transactions |

FREE up to £50 per month 3% fee thereafter

|

| Debit card loads |

FREE (limits apply)

|

| CHAPS transfer | £10 |

| Bank transfer OUT |

FREE (limits apply)

|

| Rooster Card replacement fee |

FREE

|

| Returning money held in account more than 12 months after subscription ended |

£5 (free up to 12 months after cancellation)

|

^Additional cards cost £19.99 each year

What are the limits on NatWest Rooster Money accounts?

Loading and transfer limits on a parent NatWest Rooster Money account

- Maximum free daily loads - 3

- Maximum free monthly loads - 10

- Minimum load amount - £2 (loads of less than £2 will be charged £0.50)

- Loads over the free limits - £0.50 per load

- CHAPS transfer loads - £10

- Maximum parent account balance (including all cards) - £10,000

- Maximum annual load limit - £10,000

- Maximum parent account load - £1,000

- Maximum parent account load per day - £1,000

- Monthly money transfers limit - 2 free money transfers a month (£0.50 transaction charge thereafter)

N.B. Rooster Cards can only be loaded by a personal account (business and Paypal accounts are not accepted).

Spending limits on a NatWest Rooster Card

- Maximum daily spend transactions - 15 (any additional transactions will be charged at £0.50 per transaction)

- Maximum weekly spend transactions - 25 (additional transactions will be charged £0.50 per transaction)

- Maximum daily spend - £1,000

- Contactless spending limit - £45

Spending abroad with a NatWest Rooster Card

- Free ATM withdrawals up to £50 per calendar month (any additional spending is charged at 3% of the transaction amount)

- Free spending abroad up to £50 per calendar month (additional spending will be charged at 3% of the transaction amount)

NatWest Rooster Card ATM withdrawal limits

- Daily withdrawal limit - £200

- Maximum daily withdrawals - 4

- Maximum weekly withdrawals - 10

Is NatWest Rooster Money safe?

Rooster Money is authorised and regulated by the Financial Conduct Authority (FCA). The money held in a NatWest Rooster Money account with a Rooster Card is ring-fenced in an account with the high street bank NatWest. The money you deposit, however, is not covered by the Financial Services Compensation Scheme FSCS should Rooster Money go bust. However, according to its website, Rooster Money says 'In the unlikely event of our insolvency, those funds are protected against claims by our creditors.'

Can NatWest Rooster Money be used abroad?

Yes. Rooster Cards can be used abroad for chip and pin and contactless transactions. You can spend a maximum of £50 abroad for free and after this, there is a 3% charge. It is also worth considering that some foreign ATMs will charge foreign transaction fees in addition to a fee for using the ATM itself.

NatWest Rooster Money customer reviews

NatWest Rooster Money is rated as 'Excellent' on the review site Trustpilot with a score of 4.8 out of 5 stars from over 2,000 reviews. 88% of customers rate the app as 'Excellent', citing the app as easy to set up and navigate. Parents also comment that the app provides great motivation for their children to complete chores and better understand money. Only 3% of customers rate the app as 'Bad', citing problems with accessing the money debited on the account and technical problems with some transactions.

NatWest Rooster Money pros and cons

| NatWest Rooster Money Pros | NatWest Rooster Money Cons |

|

|

|

|

|

|

|

|

|

|

Alternatives to NatWest Rooster Money

NatWest Rooster Money is just one of a range of pocket money apps available. In the below comparison table, we compare NatWest Rooster Money to other pocket money apps from the likes of GoHenry* and Osper, as well as junior banking from Starling and Revolut. For more information on pocket money apps and some of the free alternatives, read our article "The best pocket money apps".

The best pocket money app comparison table

| Natwest Rooster Money* | Nimbl | Osper | GoHenry* | Starling Kite | Revolut <18 | |

| Eligibility (years) | 6-17 | 6-18 | 8-18 | 6-18 | 6-15 | 6-17 |

| Cost | £19.99/year or £1.99/month (1 month free) | £2.49/month or £28.00/year (1 month free) | £2.50/month (first 30 days free) | £3.99/month for Everyday, £5.99/month for Plus, or £9.99/month for Max (30-day free trial) | Free | Free (limits apply to a free account) |

| Loading fee | Free up to 3 per day and 10 per month | Free | 50p instant loads | Unlimited free top ups with Plus and Max memberships but with Everyday membership, you get 1 free load each month and 50p thereafter | Free | Free |

| ATM fees^ | Free | Free | Free | Free | Free |

Free up to £40 per month (2% thereafter)

|

| Fees abroad | 3% transaction fee over £50 per month | £1.50 cash withdrawals, 2.95% transaction fee | £2 cash withdrawal, 3% purchase fee | Free | Free |

ATM withdrawals free up to £40 (2% thereafter)

Up to £250 per month fee-free spending

|

| Instant notifications | Yes | Yes | Yes | Yes | Yes | Yes |

|

Set spending limits

|

Yes | Yes | Yes | Yes | Yes | Yes |

| Chore tracker | Yes | No | No | Yes | No | Yes |

| Child app | Yes | Yes | Yes | Yes | Yes | Yes |

| FSCS protection | No | No | No | No | Yes | No |

^Limits apply

Summary

Overall, NatWest Rooster Money* is a great app if you are looking to teach your children about money. The free version of the account allows access to the Star Chart and Virtual Money Tracker, but the chart can easily be replicated by a simple handmade rewards chart on the fridge at home.

In addition, it may be easy to forget to update the NatWest Rooster Money Virtual Tracker allowances manually when your child spends their pocket money. Accessing the chore tracker, however, is a great way to incentivise your child to earn their pocket money and having separate logins for children allows them to track their progress on their own smart devices, further encouraging independence - though it does come at an additional cost.

The Rooster Card account offers the most benefits for a child to manage their pocket money and is a great way to allow your child to have financial independence whilst still having access to their money and control over their spending habits.

NatWest Rooster Money is slightly cheaper than other similar pocket money accounts, but there are restrictions on how much you can spend. To find out more about the different options available for your child and their pocket money, read our articles:

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - NatWest Rooster Money, GoHenry, Starling Kite