Halifax, part of the Lloyds Banking Group, has reported its first year-on-year fall in house prices since 2012. According to its data, monthly house prices remained flat for May 2023, but its annual change, calculated by comparing the current month's seasonally adjusted figure with the same month a year earlier, showed a fall of -1.0%. Property prices were recorded at £286,532 for May 23, compared to £289,099 for May 2022. With month-on-month data remaining relatively flat, the annual decline shines a spotlight on the strong growth in house prices we witnessed in 2022 and perhaps an indication that confidence in the housing market is being impacted. Looking slightly further ahead, with prices recorded as high as £294,845 for June 2022, we are likely to see a bigger fall next month, especially if monthly data remains flat. The data does still show, however, that average house prices remain £25,000 higher than two years ago and £5,000 higher than was recorded at the end of last year.

Halifax, part of the Lloyds Banking Group, has reported its first year-on-year fall in house prices since 2012. According to its data, monthly house prices remained flat for May 2023, but its annual change, calculated by comparing the current month's seasonally adjusted figure with the same month a year earlier, showed a fall of -1.0%. Property prices were recorded at £286,532 for May 23, compared to £289,099 for May 2022. With month-on-month data remaining relatively flat, the annual decline shines a spotlight on the strong growth in house prices we witnessed in 2022 and perhaps an indication that confidence in the housing market is being impacted. Looking slightly further ahead, with prices recorded as high as £294,845 for June 2022, we are likely to see a bigger fall next month, especially if monthly data remains flat. The data does still show, however, that average house prices remain £25,000 higher than two years ago and £5,000 higher than was recorded at the end of last year.

Commenting on the latest figures, Kim Kinnaird, Director of Halifax Mortgages said "With consumer price inflation remaining stubbornly high, markets are pricing in several more rate rises that would take the Base Rate above 5% for the first time since the start of 2008. Those expectations have led fixed mortgage rates to start rising again across the market. This will inevitably impact confidence in the housing market as both buyers and sellers adjust their expectations, and latest industry figures for both mortgage approvals and completed transactions show demand is cooling. Therefore further downward pressure on house prices is still expected".

Halifax isn't the only lender to release monthly house price data, in fact, Nationwide's house price data has been recording a year-on-year decline for the last three months, with May's figures indicating an annual fall of -3.4%, the biggest fall for 13 years. Below we have provided house price data from the last three months for both Halifax and Nationwide.

Halifax House Price Index - March to May 2023

| Halifax House Price Index | May 2023 | April 2023 | March 2023 |

|

Monthly change in house prices |

0.0% | -0.4% | 0.8% |

|

Annual change |

-1.0% | 0.1% | 1.6% |

|

Average price |

£286,532 | £286,896 | £287,880 |

Nationwide House Price Index - March to May 2023

| Nationwide House Price Index | May 2023 | April 2023 | March 2023 |

|

Monthly change in house prices |

-0.1% | 0.4% | -0.7% |

|

Annual change |

-3.4% | -2.7% | -3.1% |

|

Average price |

£260,731 | £260,441 | £257,122 |

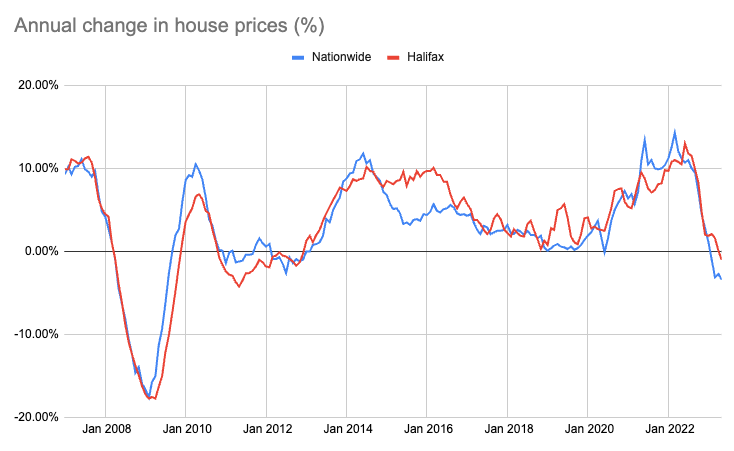

Historic annual change in house prices - 2007 to 2023

The image below provides an overview of the monthly changes in the annual house price data since 2007.

Data sources: Halifax, Nationwide

Where next for house prices?

The UK House Price Index is sourced from HM Land Registry and other government sources and is the most accurate of the various house price indices as it is calculated based on completed sales, both for cash sales and those with a mortgage. Whilst it gives a clear picture of what is going on in the housing market, there is a lag in the data being published with March 2023 being the latest figures available. Average completed sales have been falling steadily in recent months and while the annual change remains at 4.1% for March, we are likely to see this fall once April and May's figures are released. The following table shows the data from the UK House Price Index from January to March 2023.

UK House Price Index - January to March 2023

| UK House Price Index | March 2023 | February 2023 | January 2023 |

|

Monthly change |

-1.2% | -1.0% | -1.1% |

|

Annual change |

4.1% | 5.5% | 6.3% |

|

Average house price |

£285,009 | £287,506 | £289,818 |

Looking further ahead into 2024, The Office for Budget Responsibility (OBR) recently published a property forecast alongside the Spring Budget, predicting house prices to fall 10% in 2024 when compared to their high in the fourth quarter of 2022. It stated that "Low consumer confidence, the squeeze on real incomes, and mortgage rate rises" would be the contributing factors to further falls in house prices. For further insight and analysis on house prices, check out our regularly updated article 'What is going to happen to UK house prices?'.