According to official data from the Office for National Statistics, house prices in the UK rose by a further 0.8% in December, bringing the annual increase to 10.8%. The average property ended the year valued at £274,712, having increased by just over £27,000 in 2021.

According to official data from the Office for National Statistics, house prices in the UK rose by a further 0.8% in December, bringing the annual increase to 10.8%. The average property ended the year valued at £274,712, having increased by just over £27,000 in 2021.

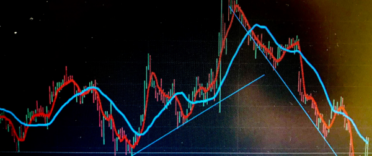

It continues a sharp upward trend in house prices since June 2020, when the government's measures to support the housing sector during the pandemic, which included waiving Stamp Duty Land Tax on properties up to £500,000, led to greatly increased activity. There is speculation now over whether there is likely to be a house-price correction in 2022.

What does the latest house price data show?

Looking at the regional variations, the strongest annual house price growth was in Wales, which saw a 13% increase. In England, meanwhile, the greatest price rise in 2021 happened in the South West, with an increase of 13.6%. London saw the slowest growth, with a rise of just 5.5%, on average.

House price change by region in England

| Region | Average price December 2021 | Annual change % since December 2020 |

|---|---|---|

| East Midlands | £235,004 | 12.1 |

| East of England | £339,502 | 11.7 |

| London | £521,146 | 5.5 |

| North East | £147,214 | 5.9 |

| North West | £200,172 | 10.2 |

| South East | £380,237 | 12.6 |

| South West | £314,037 | 13.6 |

| West Midlands | £238,238 | 11.5 |

| Yorkshire and the Humber | £196,877 | 9.8 |

Source: ONS

Statistics for the year showed that there was an estimated 100,110 transactions on residential properties with a value of £40,000 or greater in December 2021. This was down 20% on December 2020, suggesting that activity in the sector is beginning to slow.

Is now a good time to move house?

The UK House Price Index is the most accurate of the house price indices available for the UK market as it is based on Land Registry information on completed sales. However, there is a lag in when the information is reported, which means the figures for December are the most recent available. Although we have yet to receive confirmation, there is general consensus that we are likely to see a cooling in the housing market in 2022. This is based on a number of key factors:

- Inflation is driving up the cost of living, which could impact the affordability assessments by lenders, meaning they may not be prepared to lend at high income multiples

- The Bank of England has put up interest rates twice in the past 3 months and is widely anticipated to do so again later in the year. This is making new mortgages more expensive

- As the government has now removed additional support for the sector, there is no further incentive to move. Indeed, many people who would have perhaps considered moving this year may have chosen to move in 2020 or 2021 instead because of the tax break available

For regularly updated commentary on what is happening to house prices in the UK and whether now is the time to move, read our article "What is going to happen to UK house prices?". You may also find our analysis of remortgaging in 2022 useful.