In this article, we take a look at what the report revealed and discuss 5 different ways first-time buyers can work towards purchasing their first home.

What did the report find?

The report was commissioned by Nationwide and conducted by market researcher Ipsos MORI, with the aim to assess how the pandemic has impacted Brits' attitudes to housing.

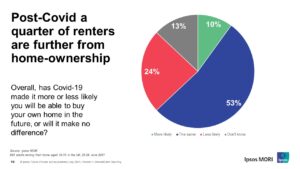

68% of private renters said that they will never afford to buy a home, with 1 in 7 believing the UK is in the middle of a housing crisis, made worse by the financial impact of COVID-19. 1 in 4 said the pandemic has pushed their homeownership dreams even further out of reach.

The proportion of Brits owning their own property has fallen significantly in the past few decades, with only 57% of households now homeowners, compared with 64% in 2003. Meanwhile, the share of households renting privately has doubled, increasing from 2.8 million to 4.5 million between 2007 and 2017 alone, according to figures from the Office for National Statistics (ONS).

Ipsos MORI’s analysis suggests that around 2 million more households would own a home if the UK had been able to maintain home ownership rates at their 2003 peak, when more than 7 in 10 households were owner-occupied.

Research by the Organisation for Economic Cooperation and Development (OECD) has shown that Brits spend the joint highest of any other country in the world on purchasing a house, with an average of 26% of disposable income being spent on the cost of a home. The figure increases considerably for those in lower-earning roles, whose mortgage or rental payments make up an average of over 40% of their post-tax income.

Data gathered by Nationwide also shows that, as of 2021, the average first-time buyer's property costs 5.6 times their salary compared to the historic average of 3.2. Most lenders now only offer an average of 4-4.5 times your annual income for a mortgage. Visit our article “How much can I borrow on a mortgage?” to find out the maximum amount you could secure from a lender.

How to get on the property ladder

Lifetime ISA

A Lifetime ISA (LISA) is a long-term Independent Savings Account (ISA) which was first introduced in 2016. Similar to an ordinary ISA, a LISA offers tax-free growth on your investment, but with the added bonus of a 25% boost provided by the government. A LISA can be used by a first-time buyer towards purchasing a property, once the account has been held for 12 months. Any property purchased must be valued at £450,000 or less and must be the first property owned - wholly or in part - by the applicant. If you withdraw the funds in a LISA for any reason other than to purchase a first property or as a retirement savings pot, you will be taxed 25% on what you withdraw, effectively removing the government bonus altogether - so make sure you are committed to the idea of buying before you set one up. Head to our article "Lifetime ISAs explained – are they the best way to save?" for more details.

Help to Buy Equity Loan

First-time buyers may be able to borrow from the government up to 20% (or 40% in London) of the purchase price of a new-build home as part of the new Help to Buy Equity Loan. You have to pay a deposit of 5% and arrange a mortgage with a lender willing to make up the full asking price. You will not be charged interest on the government loan for the first 5 years of owning your property, but interest begins from the 6th year onwards. Visit our article “What you need to know about the Help To Buy Equity Loan” for more information and eligibility criteria.

Shared Ownership

A Shared Ownership arrangement allows buyers to purchase a portion of a home while paying rent on the remaining portion. It is designed for those that would otherwise struggle to obtain a mortgage that would allow them to purchase the property outright. Most Shared Ownership schemes allow you to purchase between 25% and 75% of the property, and buyers have the opportunity to purchase additional shares of the property at any time (known as staircasing). Head to our article “What is Shared Ownership – and should I do it?” for more details and eligibility criteria.

95% LTV Mortgage

The UK government recently introduced its mortgage guarantee scheme to encourage lenders to return to offering 95% LTV products. There are now a wide range of 95% LTV products available, meaning buyers only have to secure 5% deposit to purchase a home. This scheme could be useful for first-time buyers with limited savings available for a deposit, but bear in mind that the higher LTV will make your monthly repayments higher. It might be worth waiting until you can secure a lower LTV deal by saving up more towards a deposit.

In addition, with the average UK property price at £256,000, (according to Land Registry figures), a first-time buyer would need to show they can afford a mortgage of £243,200 in order to qualify for a 95% mortgage. Based on a maximum 4.5 times annual income mortgage deal, a first-time buyer would need to be earning £54,000 a year to afford the average UK property - and for an average £600,000 home in London, you would need to earn over £126,000 a year. Head to our article “Which are the best 95% LTV mortgages – and should I get one?” for more information.

Get your costs down

The easiest way to make that homeownership dream a reality is to save as much money as possible to put towards it. Consider ways you could reduce your monthly outgoings by changing providers for utilities, mobile phones, broadband, and TV packages, and make sure you budget your income to set aside a certain amount every month to put towards a deposit. For more ways to be frugal, check out our article "25 money saving tips that could save you thousands" or our list of the best budgeting apps in the UK.