The 117th episode of my weekly YouTube show where I discuss what is happening in investment markets and what to look out for. This week I talk about the US Federal Reserve’s latest monetary policy decision and the likely impact on markets. I also talk about US and Chinese tech stocks as well as the measures that Tencent put in place to try and stop the slump in its share price.

Each show lasts between 5-10 minutes and is aimed at DIY investors (including novices) seeking contemporary analysis to help them understand how investment markets work.

Subscribe to my YouTube channel to receive my weekly analysis of investment markets or alternatively, you can listen via my weekly Midweek Markets podcast below.

Midweek Markets weekly podcast

Other ways to watch, listen and subscribe

You can listen to other episodes and subscribe to the show by searching 'Money to the Masses' on Spotify or by using the following links:

Abridged transcript - Midweek Markets episode 117

At the end of last week’s show I said the big story in the subsequent 24 hours was going to be the US Federal Reserve’s announcement of its latest monetary policy decision. While no one was expecting any change to monetary policy, but if there had been then we could have seen a market wobble.

Also much depended on the Fed’s rhetoric around inflation with some analysts even suggesting that we could see US bond yields finally start to break higher again after their recent slump.

As it turns out the meeting was a damp squib and passed by almost unnoticed as the Fed kept to its easy monetary policy course and maintained its sanguine view on inflation

If you also recall technology stocks were under pressure in the US but have since recovered their poise with the Nasdaq 100 less than 0.5% below its all-time high from last week. Following some weaker than expected employment numbers in the US it is set to break that all-time high again today.

But while US tech stocks have recovered Chinese stocks are still struggling. A rush of dip-buying investors saw the likes of Tencent bounce 10% last Thursday, but still leaving a lot of work to do to reverse the 20% drop we’d seen at the start of last week.

Yet Tencent investors can’t seem to catch a break as its share price fell another 11% on Tuesday, back near its recent lows after Chinese state media attacked the gaming industry comparing computer games to spiritual opium and demanding restrictions placed on the industry to avoid addiction among children.

Hours later Tencent announced it would limit the time children could spend playing its flagship video game Honor of Kings, which was named in the state media attack and happens to be the world’s top-grossing game over the past two years. All of this was aimed at trying to stop the slump in its share price.

It means that Chinese tech stocks are still under pressure and the divergence with the fortunes of US tech stocks continues. But it’s not all doom and gloom in Asian tech stocks. The tech-oriented South Korean KOSPI has rallied over 2.44% this week, having previously slumped alongside Chinese tech stocks.

A crash in tech stocks in South Korea has often been a precursor to weakness in US tech stocks as we saw back in January/February when the KOSPI started to break down and the Nasdaq 100 then followed. The relationship isn't infallible but it’s certainly a ray of sunshine among the dark clouds for Asian and ultimately US tech stocks.

But overall US stocks have been buoyant despite rising COVID cases due to the Delta variant however the 10 year US treasury yield still doesn’t share equity markets optimism and has now tumbled to 1.14% - a six month low over economic growth fears. Having almost wiped out the move higher as a result of the reflation trade earlier in the year. It means that economic growth concerns still linger.

The 10 US treasury yield remains an enigma to many with the consensus view that the yield should be much higher. We are back in a position where either the bond market is too pessimistic or the equity too optimistic about the economic recovery in the US. Either way it means there could be some pain ahead for one of them. Keep an eye on the 4400 level on the S&P 500 as from a technical perspective it is proving a tough barrier to break convincingly.

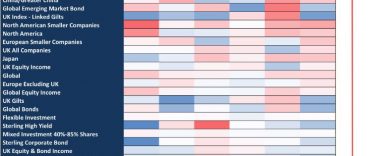

But in the UK the FTSE 250 is still just shy of its all time-high which it set last week and the pound has rallied against the dollar. Having tried and failed to break back above $1.40. Keep an eye on this level as it will prove pivotal on where the pound goes next, either higher or lower. The strength of the pound has had a major impact on portfolio returns over the last 6 weeks. A weak pound boosts the sterling value of your overseas holdings while a strong pound does the opposite.

Tomorrow the BOE announces its latest monetary policy decision so it will be interesting to see the impact on sterling. Any hint of an imminent rate rise to quell inflation could see it break that $1.40 level.

So that is it for this week. We will have a break for 2 weeks so we can see how things play out in the days and weeks ahead.