Episode 325 - On this week's podcast I discuss Fibonacci numbers and how they can be used to judge when to get in or out of the stock market. I also talk about the 'safe account' scam including what to look out for and how to make sure you don't become a victim. Finally, Money to the Masses junior staff writer Bronte joins the show to talk about her favourite board games that can help children understand money.

Join the MTTM Community group, a friendly community that allows like-minded listeners to ask questions and chat.

Fibonacci numbers and investing, safe account scams & best money board games

You can also listen to other episodes and subscribe to the show by searching 'Money to the Masses' on Spotify or by using the following links:

Transcript - Episode 325

Below is an abridged transcript of this podcast episode and includes timestamps. The people featured in this episode are Damien Fahy, Andy Leeks and Bronte Carvalho.

Fibonacci numbers and investing

Damien Fahy 02:43

Fibonacci numbers are a series of numbers, whereby the two preceding numbers when added together result in the next number. Here is the beginning of the Fibonacci sequence:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144…

If you look at two numbers in the series that are next to each other, and you divide one by the former, then something called the golden ratio starts to occur. So if you divide 3 by 2, (three follows two in the series) and then repeat the exercise further and further along the series your answers start to head towards a ratio of 1.61803 and that's called a golden ratio. Which is a magical number in mathematics.

Examples of Fibonacci numbers in nature

What makes Fibonacci numbers so fascinating is that they appear in the real world. The petals on a flower often follow Fibonacci numbers. So for example, lilies have 3 petals, you can find flowers with 5, 8 or 13 petals. Daisies have 13 petals. And so this is a phenomenon that you see all over the place including in the spirals on a pineapple and in the shape of a hurricane. Other examples include the shape of galaxies and the way branches grow on trees.

If you imagine a tree trunk growing up, that's the first number in the sequence (i.e. 1), then it will divide, so you might get to the next level up and have two branches. If you imagine that whenever a branch divides only one of the subsequent branches divides again. So if you go up a tree from the tree trunk you've got two branches and then the next level up you will have three branches. The next level up, you will have five branches in the tree etc. This is a Fibonacci sequence.

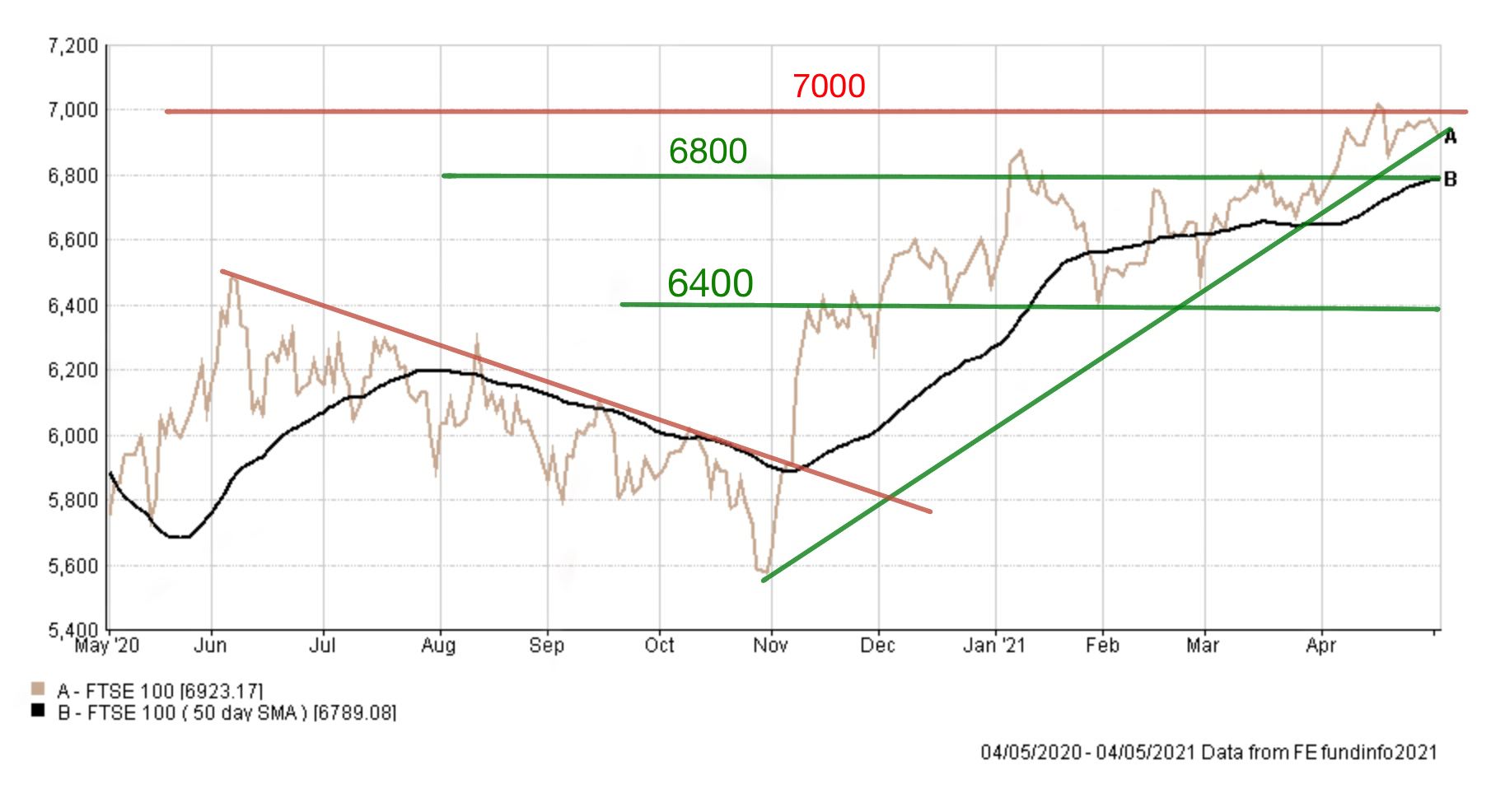

Now, what is interesting is that if you look at a chart of a share price or a stock market index the movements seem random. But you can observe levels in a rising market, for example, where the index comes back to, after it has fallen for a short period of time, before it might turn around and start to head up again as buyers enter the market. You may notice that the turnaround occurred at the same price level as it had done so previously. That's a support line.

Or you might find the market rallies towards a certain number, say 4200 on the S&P 500, time and again before it turns around and starts to fall away. This is called a line of resistance.

Lines of support and resistance exist in the stock market and you can find them by just simply drawing lines using a ruler and a chart. It works best if you've got at least three points that you can put along the ruler that join up so you can draw a line, as shown in the chart of the FTSE 100 below. Support lines are in green, resistance lines are in red.

Now, these lines aren't set in stone forever as they change as the market moves up and down. They are also quite difficult to pin down. However, you can use Fibonacci numbers to help find them.

Fibonacci ratios, Fibonacci retracements & Fibonacci extensions

So we know what Fibonacci numbers are, but you can also calculate something called Fibonacci ratios.

If you start to divide Fibonacci numbers that are next to each other you get a percentage of what that will typically be 61.8%. If you decided to get a number, and you divided it by one that came two positions later in the sequence, then you would get a number that's equal to roughly 38.2%. Then if you get a number and you divide it by a number in the Fibonacci sequence that is three spaces to the right, then you'd get 23.6%.

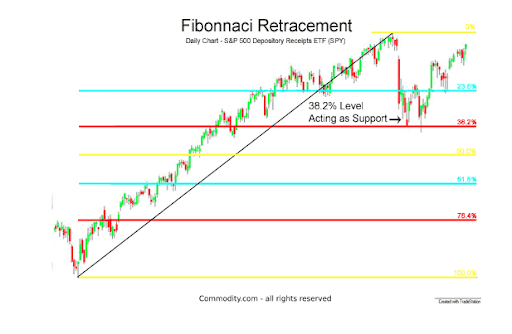

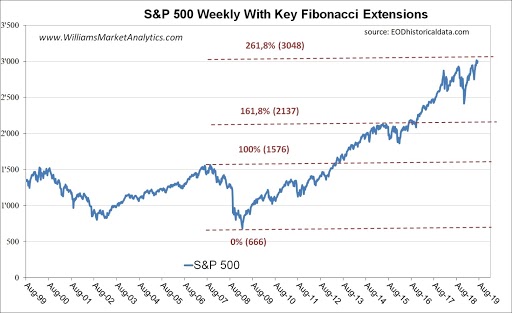

So these ratios are consistent all the way through the sequence. Where these ratios become interesting is they can predict or seemingly predict where markets might start to turn and sell-off, or where they might rebound (i.e predict lines of support and resistance as shown in the chart at the foot of the page).

So somebody might decide to use Fibonacci ratios to help them decide when to get back into a market that's had a retracement or pullback. There are two trading tools based on Fibonacci which traders use, one of which is called Fibonacci retracement that helps predict when a short term change of direction will end (i.e a fall will end) and then the market turnaround and continue on its underlying direction of travel (i.e upwards).

Fibonacci extensions are a technique/tool that uses the Fibonacci ratios once a retracement has ended (i.e a market pullback) to predict the size of a subsequent move in the underlying direction of travel (i.e. higher). It can be used to predict a price point at which to get out.

We don't really know why Fibonacci ratios work when trading, there is likely to be an element of “self-fulfilling prophecy” whereby it seems to works because everyone thinks it will. Ultimately it is the application of a mathematical sequence to trading that does seem to have some success. Some people swear by it. Others think it’s a load of rubbish.

But one thing if you use Fibonacci retracements or extensions when you're trading or investing they tend to be more reliable when used in conjunction with other technical analysis indicators such as other support lines that you have derived without using Fibonacci numbers. (Further resources and links to videos explaining Fibonacci retracements and extensions can be found at the foot of this transcript).

Andy Leeks 18:52

Okay, so moving on to scams next. And this has been highlighted in a recent bit of research where 50% of the people who are asked about this potential scam haven't heard of it, but they also wouldn't know how to identify it if they're presented with it. So what is it we're talking about here?

What is a safe account scam?

Damien Fahy 19:08

A safe accounts scam is typically where you get a call from a person usually claiming to be from the police or your bank and the phone number may even appear to be from your bank as well. Don’t forget that fraudsters can make their phone numbers or text messages appear to be from your bank, even though they're not. This is known as spoofing.

The person calling you may tell you that your savings have been compromised by a scammer and you, therefore, need to transfer the money to another "safe" account that they (supposedly your bank) have created in your name to prevent your savings from being stolen.

The victim, not wanting to lose their life savings, will then move their money across to the safe account that they think their bank has set up for them.

In fact, the person on the phone is a fraudster/scammer. They're in fact getting you to move money to an account that they control. And as soon as you do that, the money will be gone. And you've unfortunately lost your savings.

This scam doesn’t have to happen in just one call either. It can take a series of calls for people to be convinced to move their money. In this instance what happens is that in the initial conversations the scammers may ask you for personal information such as your date of birth, which they will then subsequently use when they make further contact with you, as part of a fake verification process “before the call can continue etc...”. Of course, by then you've forgotten that you actually gave them the information in the first place.

According to research by KIS Finance, 48.3% of people have never heard of this type of scam or wouldn't know how to identify it. So the message from this part of the podcast is to be aware of anything like this and don't move your money across to a supposed safe account.

Tips to avoid being a victim of a safe account scam

- your bank will never call you out of the blue and ask you to move money to another account. If someone does, it's not your bank.

- If you're ever worried about someone that rings you up, call your bank back, but don't use the number that the person on the phone has given you. Instead, use the number on the back of your bank card. Also, make sure you use a different phone to make the call if you received the call on a landline. The reason I say this is because sometimes the fraudster can remain on the other end of the phone line. You then pick the phone back up, start dialling away, and actually, they're still there sitting quietly and then pretend to answer your call.

- Trust your gut. If you are unsure, terminate the call and call your bank back independently as described above to double check.

Best board games to teach kids about money

Damien Fahy 25:53

So that brings us to our third piece on the podcast this week. And I'm pleased to welcome Bronte to the show, our newest recruit at Money to the Masses towers. Welcome to the show.

We've done some pieces on previous podcast episodes about teaching children about money (go back to Episode 266 and Episode 230) but what Bronte is going to do today is highlight a couple of board games that will help children learn about money. So Bronte, what's your first one? I'm guessing Monopoly is on the list?

Monopoly Junior

Bronte Carvalho 28:02

Yeah. First of all, all of these are readily available from retailers and they're super affordable and accessible. Plus they're all under £20.

The first one I picked out was Monopoly Junior. So this is aimed at ages 5-8 and it's for two to four players. This one has 4.8 stars out of five on Amazon and is one of the highest-rated children's board games on Amazon. So the aim is pretty much like the original, you buy up as much of the board as possible so that you can charge rent to people as they go around the board. But it's simplified to make it more kid-friendly. So it's a fast and fun version of the original. Also, they've changed it so you don't buy streets and instead you buy pet stores, candy stores, video game arcades etc. So it's just a little bit more suited to kids. It's less about property and more about things they might be interested in.

Buy it Right

Bronte Carvalho 29:36

So another one is called Buy it Right. So this one's for ages 5-10. It's for two to four players and this one has 4.6 out of five stars on Amazon, so still really high. And the aim of this game is you move around this board buying goods and filling up your little trolley and you have to add and subtract the prices of things as you go through. So this is really good for practising mental arithmetic with children and there are also three different skill levels. So for example, if your child is younger, you might want to start with the easiest skill level so that the mathematical problems are relatively simple. So the skill level can be adjusted to suit the developmental stage. Someone on Amazon said that their daughter has dyscalculia, which is the mathematical version of dyslexia. So basically, it can be quite difficult to comprehend mathematics. And they said that the game was particularly good at getting their child with dyscalculia to understand the concept of money.

Money Bags

And then my final game is called Money Bags. So this is for a little bit of an older age group, it's six to 10 years old, for up to 4 players again. This game also has 4.6 stars out of five on Amazon. And the aim of this game is to earn pocket money by going around a board and landing on a square. And each square has a task on it, such as setting the table and that would be worth 20p. But then in order to collect the money you would earn from completing that task, you spin this spinner, and the spinner will tell you which coins you cannot collect from the bank. So for example, it might say the task is worth 20p, but you're not allowed to use 20p coins to collect it from the bank. So the child would have to, for example, maybe get two 10p coins or four 5p coins. It encourages that mental arithmetic, but also an understanding of the different tiers of how money adds up. I love that.

Pop to the Shops

Damien Fahy 31:32

I love that too Bronte because I think one of the issues we've talked about on the podcast previously is that children don't see adults using money. I very rarely use money, I tend to use a card. So I love the idea that a game is teaching children to not only recognise coins but how to use them in change.

You’ve just reminded me of a game we play at home called Pop to the Shops and my kids love it. The simple premise of the game is for up to four players, including children as young as five, to travel around a very simple board with a shopping list of things you've got to buy. There are different shops to go to and you have to use the correct change using pretend coins. It's a very simple game and it's quite easy to play. And actually, as an adult, it's not a bad game, because one of the issues you do have with some games is that they're good for kids, but they're a little bit tedious for us adults when we play them. So before we wrap up on this piece, Andy, I know you've been waiting in the wings with a game that you like.

Big Money

Andy Leeks 33:17

Yeah, that's right. We've been playing a fun game for the family and it's to do with money as well. It's called Big Money. It's for 2-5 players and we've played it lots and lots especially over lockdown. It's become the go-to game primarily because it's one of those games similar to what Bronte mentioned earlier, where it can be done and dusted in 30 minutes. Now there's something about a game as a parent, where you can guarantee an end within 30 minutes that is quite appealing. So this is for ages 8+.

But actually my seven-year-old daughter understands it perfectly well. So I would say it's probably really for ages six and up. The game is effectively a cross between Yahtzee and Monopoly. So it's a similar Monopoly theme, where you get a chance to buy assets and hold on to them and charge people rent. But there is an element of risk versus reward. Do you buy the assets? Do you hold on to the money that you earn from rolling your dice?. Once the bank has run out of money the game ends, you count up your money to work out the winner, but assets are no longer worth anything. It's all about the money. So it's quite an interesting concept for the children to understand about actually spending money and that's one of the problems I have with my eldest daughter. She's a brilliant saver but she really struggles to spend money and we noticed in this game she is definitely one of the ones that hold on to their money, doesn't buy the assets and hopes to have enough money at the end. As a game it’s an interesting concept. It's about £18 on Amazon. It's rated 4.6 out of 5.

Resources:

Fibonacci retracements and extensions explained

Click to enlarge images