Listen to Episode 473

In this week's episode I explain the concept of the 'efficient frontier' and how it can help investors build a portfolio with the highest possible returns for a given level of risk. I also talk about the potential tax implications of pension recycling, a way in which individuals reinvest their tax-free cash or pension income back into a pension scheme. Finally, Andy explains the dangers of becoming a money mule including the consequences of getting involved in financial crime and the steps you can take if you feel you've been targeted.

Support the podcast

Remember to like, subscribe and follow us on all our socials. You can also support the Money to the Masses podcast by visiting our dedicated podcast page.

Every time you use a link on the page we may earn a small amount of money for our podcast. We only use affiliate links that give you an identical (or better) deal than going direct. Thank you for being an incredible part of our community. Your support means the world to us.

Watch the video version of the podcast below:

You can also listen to other episodes and subscribe to the show by searching 'Money to the Masses' on Spotify or by using the following links:

Listen on iTunes Listen on Android via RSS

Support the podcast!

You can now support the Money To The Masses podcast by visiting this page when making any financial decision

- Save money

- Earn cashback

- Exclusive offers for listeners

Podcast summary

1. Efficient Frontier Portfolio

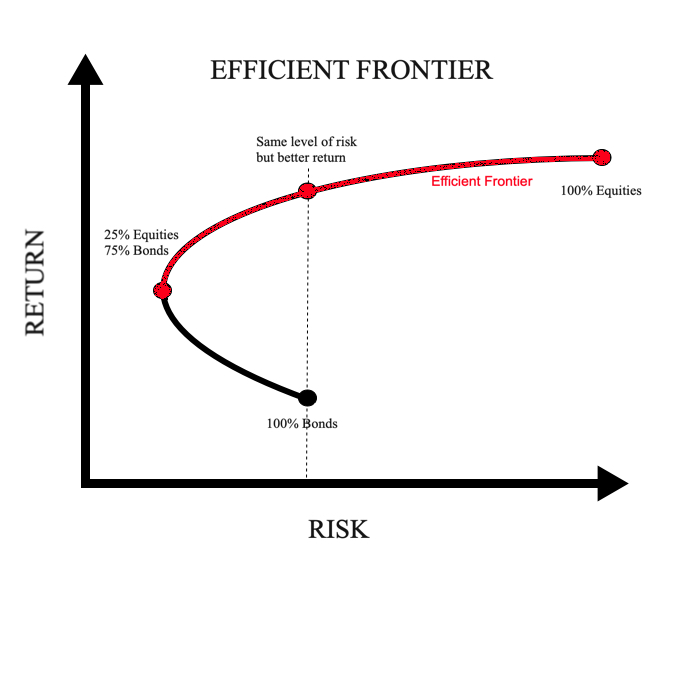

Damien discusses the concept of the Efficient Frontier, originally introduced by Harry Markowitz in 1952 as part of Modern Portfolio Theory. The efficient frontier helps investors create portfolios that offer the highest possible returns for a given level of risk.

Damien explains his analysis for 80-20 Investor members, where he used efficient frontier analysis not just on portfolios made up of equities and bonds, but also a broader range of asset classes including Asian equities, commodities, European equities, gold, and more to find the most efficient portfolios over both 5-year and 10-year periods. The optimum portfolio over the last 10 years, with approximately 80% equity exposure, produced an annualised rate of return of 7.87% over a 10-year period. To read the full research use the link in the resources section below.

2. Pension Recycling

Damien discusses pension recycling. Pension recycling occurs when someone reinvests their tax-free cash or pension income back into a pension to receive additional tax relief and create a fresh entitlement to tax-free cash. While this might seem like a legitimate tax-saving strategy, HMRC has specific rules to prevent people from gaming the system by repeatedly taking tax-free cash and recycling it for further tax relief.

Key Points on Pension Recycling:

- Intent Matters: If HMRC believes that your pension contributions are part of a pre-planned recycling strategy, you could face significant tax penalties.

- Time Frame: HMRC examines contributions made in the tax year that tax-free cash is taken, and the two years before and after, resulting in a 5-year window.

- Thresholds: If you’ve taken more than £7,500 in tax-free cash in the last 12 months and your total contributions have increased by 30% or more and the pension contributions equate to 30% or more of the tax-free cash that was taken, you may trigger the pension recycling rules

- Penalties: Falling foul of the rules can result in a tax charge of up to 70% of the tax-free cash taken.

When Pension Recycling Rules Aren't Triggered:

- Joining a new employer's pension scheme: If you start a new job and enrol in a new pension scheme, any increase in pension contributions won't be considered pension recycling.

- Windfalls: If you receive a windfall (e.g., inheritance or lottery winnings) and contribute this money to your pension, it is generally not considered pre-planned pension recycling.

- Profit-based contributions: If your pension contributions increase because they are tied to a percentage of your company's profits, and those profits increase, this won’t trigger the recycling rules.

- Contributions to a spouse's pension: If you use your tax-free cash to contribute to your spouse’s pension, rather than your own, it does not trigger pension recycling rules.

Relevance of the Money Purchase Annual Allowance (MPAA):

Damien explains that the Money Purchase Annual Allowance (MPAA) is triggered when someone starts drawing income from a Defined Contribution (DC) pension. Once triggered, the MPAA limits the amount that can be contributed to a DC pension and still receive tax relief. Normally, the annual allowance is £60,000 or the individual’s earnings (whichever is lower). However, when the MPAA is triggered, this allowance drops to just £10,000.

This is crucial for anyone who has taken benefits from a DC pension and plans to make further contributions. If the MPAA is triggered, you will only be able to contribute £10,000 annually and still receive tax relief.

3. Money Mules

The final segment of the podcast looks at the rise of money mule scams. Damien highlights how fraudsters are targeting young people, often through social media, to use their bank accounts to move illicit money.

A money mule is someone who transfers illegally acquired money on behalf of criminals, often in exchange for a small commission. The money is moved through various bank accounts to make it harder for authorities to trace it back to criminal activities.

Key Warning Signs:

- Vague job offers or schemes promising quick money, particularly through platforms like Instagram or Snapchat.

- Requests for personal bank details early in conversations.

- Pressure to act quickly or engage in transactions without clear job descriptions.

Damien warns that becoming a money mule can lead to severe consequences, including having your bank account closed, difficulty accessing financial services in the future (like getting a mortgage), and even criminal charges, including prison sentences.

He urged listeners to inform younger people of the risks and to be cautious of any offers that seem too good to be true, as they often are.

Episode 473 quiz questions

Test yourself to see how much you remember from his week's episode.

- What is the annualised rate of return for the optimum portfolio over the last 10-years, based on Efficient Frontier Analysis?

- A. 4.71%

- B. 5.87%

- C. 7.87%

- D. 8.50%

- What could happen if someone falls foul of HMRC’s pension recycling rules?

- A. Loss of pension benefits

- B. A fine of 50% of the amount recycled

- C. A tax charge of up to 70% of the tax-free cash

- D. No penalty

- Pension recycling limits the additional tax relief available when:

- A. You exceed a contribution of £60,000

- B. Tax-free cash or pension income is reinvested into a pension

- C. You inherit a pension fund

- D. You receive employer contributions

- If you use tax-free cash to fund your spouse’s pension, does it trigger pension recycling rules?

- A. Yes

- B. No

- C. Only if the amount exceeds £7,500

- D. Only if your spouse is over 65

- How does a money mule help criminals?

- A. Moving illicit money across accounts

- B. Managing day-to-day business expenses

- C. Creating fake accounts for fraudulent purposes

- D. Organising personal savings accounts

Answers

- C. 7.87%

- C. A tax charge of up to 70% of the tax-free cash

- B. Tax-free cash or pension income is reinvested into a pension

- B. No

- A. Moving illicit money across accounts

Resources

Links referred to in the podcast:

- MTTM Deals Page

- Using Efficient Frontier Analysis to find the optimum portfolio

- Sign up to the Money to the Masses Newsletter