Click play on the media player below to listen to Episode 57 of the MoneytotheMasses.com podcast

You can listen to other episodes of the podcast by using the media player below.

You can also subscribe via iTunes

Transcript: MoneytotheMasses.com podcast No.57

Here are your hosts, Damien Fahy and Andy Leeks.

Andy: Hello, and welcome to episode number 57 of the Money to the Masses Podcast with your resident expert as always, Damien Fahy, and me, Andy Leeks. Damien, welcome back. How are we doing?

Damien: I'm good this week. I've had a lot going on. We're slightly rushed in the production of the podcast this week, aren't we? It's my fault. I've had crises occurring in my life, I think it was last week I joked about the rain coming through the ceiling on my head as there are people converting my loft.

Andy: Yeah.

Damien: Well, that actually occurred and completely soaked everything.

Andy: Oh dear.

Damien: Because we had torrential rain, as probably many people in this country did, but it was a day where they decided to take the old roof off and put the new one on, as it has to be all done in one go. Well, it inevitably didn't run smoothly and I came home to find my bed completely wet, where water had been coming through the ceiling.

Andy: Yeah, you sent two text messages out. One to me saying, "I can't do the podcast," and the other one, I can't repeat on this podcast, because it was to the builder!

Damien: But we got there in the end.

Andy: Yeah, I'm feeling a bit under the weather this week. Only one of these man colds, but I'll get over it. So apologies if I sound a little bit nasal this week. But what have we got coming up on this week's show?

Damien: We got a few pieces actually that we're going to try and squeeze in. We always squeeze in quite a bit. I want to talk a bit about investing. It'll be something on a particular statistic that people should look out for on funds in this kind of volatile environment. I'm also going to quickly mention something about a banking scam to avoid and a new brilliant service that I like. If you like magazines, then this service is for you. And we're also going to talk about another thing to do with banks, namely bank withdrawals.

Banking scam to avoid

So we'll kick off with the first one, which is about banks. I've seen this in the press recently. There's been a new banking scam to do with text messages to look out for. What the scammers do is send you a text message seemingly from your bank telling you to ring a particular number stated in the text message claiming it's about some ominous transaction on your account. So they are trying to get people worried and they'll ring up. But what's quite clever, and I say clever as you have to admire their ingenuity is that the text message number will match the one that exists for your bank. Yet the text is clearly not from your bank but from the scammers.

Andy: Right.

Damien: So when you go in to the text message stream on your phone, with all the real text messages from your bank, the scam text message will drop in there. So you'll look at it and think, "Well, that's definitely from First Direct," or whoever you bank with because it's in the same stream. So the tip from this short piece is that if you do get a text message from your bank then get your debit card out of your wallet, flip it over and ring that number. Don't go call through on a number you get in a text message.

Andy: Yeah, scary stuff. Okay. Good warning. Thank you. What have we got next?

Damien: The second quick piece I want to mention is about bank withdrawals. If you want to pay a builder or place a deposit on a car there are times when you need to go to your bank and draw money out, a large sum, more than just £50. You might want to withdraw a couple of thousand pounds for example.

Andy: Yeah.

Damien: Now I don't know if you know this, there is actually a limit on how much you can take from your bank. Despite the fact you give your bank your money, and it's your money and you should be able to access it whenever you want if it's a current account, the reality is that you probably can't.

I actually came across this recently myself, when I went to withdraw some cash out from my bank. If you have a sum that's probably larger than £1,000 or £2,000 pounds you can't just walk into a bank and withdraw it even though you think you can. Some banks may allow you, other banks may have different policies. The reason I'm bringing it up is because there was a big story that actually hit The Guardian this week highlighting the problem.

The Financial Ombudsmen was asked whether banks are allowed to have limits on withdrawals and the answer is that they are not. Yet the reason why you might not be able to get your money out is just because the limits are done at branch level, and so if you want to have £5,000 in £50 notes, for example, that branch might not actually have enough money in the branch to facilitate your transaction. I don't really know how this has never come to light. As I said, I encountered it recently, and I don't know why people haven't realised that you can't just withdraw as much as you want from your bank account.

The Guardian did in fact go to every bank in the High Street and found out what each bank's policy is on allowing people to make withdrawals. Almost all of them claim there was no actual defined limit. However, if you wanted to take out more than say £2,000-£5,000 on a given day, you would need to give them notice and ring up and either book an appointment, or tell them that you needed to withdraw this amount.

Andy: Okay.

Damien: So I just wanted to bring that one up, because clearly there's a general assumption from everybody, that if you do want to withdraw your own money, which you're entitled to, out of your bank, and it's going to be more than say £2,000, then you're more than likely not going to be able to do that immediately, that's just the way the banking system works.

So the tip there is if you do want to do it, you have to ring up the main customer service number, so they can arrange it in advance

Money tip - Clever way to save money on magazine subscriptions

Right. Let me do the next piece. This one is a money tip, and it's a service I've come across which I think is awesome. Andy, do you read magazines at all?

Andy: Do you know what? It's quite sad. Nowadays with the advent of the iPhone and the digital apps and everything else, I read less and less, especially magazines. I used to love it when I was growing up. That used to be the thing I used to save my pocket money for and used to buy MATCH Magazine, and FHM, and Loaded, and Men's Mag. All those kind of things, but no, nowadays...

Damien: You were trying to think of one there that wasn't a dodgy mag.Well there is a new service that's come out that...do you know what Spotify is?

Andy: I do, yeah.

Damien: For those of you who don't know what Spotify is it's basically a streaming service of music, so rather than you own albums you pay £10 a month to be able to pretty much access most of the music that exists out there. You don't own the music yourself, but you can download it offline for short periods of time, and it’s absolutely exploded. I like it because I never used to buy CDs, but now I really do listen to Spotify all the time, every day, and I've got into music and therefore the music industry is getting money from me that they previously wouldn't.

But the reason I mentioned Spotify is because there is now an equivalent for the publication industry in magazines and it's called Readly, so R-E-A-D-L-Y. The way it works is that you pay subscription of £9.99 a month and you get unlimited access to hundreds of magazine titles that you would see in the shop. So magazines like FourFourTwo, Enemy, HELLO!, OK!, Heat Magazine, Moneywise, Time Out, Top Gear, Entrepreneur, the list goes on. You imagine, photography magazines, all those things you see in WHSmiths or wherever you go, lots of them are now on this service. And you pay £9.99 a month, you can read all of those magazines and download them onto say your Android, or your iPhone, or iPad and you get unlimited downloads, but you also can use more than one device. So you can have up to five devices registered under one account, and you can have different profiles.

So in your house, say you had multiple people who wanted to use this service, they can have their own profiles, much like Netflix does.

Andy: Yeah.

Damien: And they can therefore see their favourite magazines and you get notifications when they come out.

So if you are a magazine subscriber, then you could save a lot of money using this service. Even if you're not currently a magazine buyer there are probably a lot of these magazines that you would read but just don't want to spend the money. I have to say I was really impressed with it. I've tried it, I've downloaded it, had a go. You can get a free one month's trial, and well, it's actually a two week trial but there are lots of offers in magazines where you can get one month free trial

So it's called Readly and I would just say to people, have a go. You get a one-month free trial, if you buy more than one magazine a month, then you're going to be spending more than a tenner anyway, and so I think it is great. I thought I'd check it out there, because I've never seen it. I've not seen it advertised. I think it's relatively new, but I think it's going to change the way the publishing industry works and I think it's only a good thing because now I'm much more likely to read magazines, whereas before I'd never buy a magazine because I was thinking they're expensive.

I'm actually more likely to pay £10 to read a broad range, because what's also good is you can search. You open the app and you can search for...let's say you had a topic and wanted to...for you, Andy, Watford Football Club, it would find any reference to Watford Football Club across all the articles and all the magazines and you can find them.

Andy: Oh, okay, because they're digitally archived?

Damien: They're digitally archived, so it's like you get them on the iPad and you flick through it just like you're reading a magazine on the iPad. And I didn't do this, somebody else did it but they searched my name on there. And you can find the magazines that I appear in on there, the money ones.

Investing: how to deal with stock market volatility

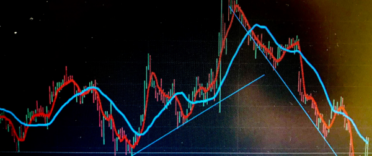

Damien: So we did a bit on scams. We did about bank withdrawals and the great new product. Now we're going to go on to investing. I don't know if you've noticed, although we don't want to date the podcast, but currently the volatility in the stock market is at levels we've not seen since the dark days of the financial crisis seven years ago, and a lot of that's to do with China growth concerns. Also the Federal Reserve may be putting up interest rates soon. So what I'm going to talk about is volatility in markets and how to reduce the impact of volatility on your portfolio. When I say volatility that means the wild up and down swings that go on in the stock markets, the big rallies and crashes. The problem with volatility is that if you don't know when you're going to want to withdraw from your investment, then you could be suddenly being sitting on a massive profit that's suddenly a massive loss, it's like being in a choppy sea. You'd much rather be in a slightly calm one.

For 80-20 Investor, my DIY investment service, if you've not had a look do check it out. Go onto MoneytotheMasses.com, the website and you'll see everything about it, which teaches you how to run your own investments.

Now, I did a big long in-depth piece for 80-20 Investor members this week about how you can reduce volatility. So you protect your portfolio when the seas are rocky, it's like having a bit of a lifeboat. There were loads of ways I showed how you could reduce volatility so that your portfolio wasn't at the whims of the market. I am not going to give you all the juicy details of that research, because that's for 80:20 Investor members, but there's one piece I wanted to talk about which will be useful for people who listen to this podcast and who do invest.

If you don’t want to stay in the market one of the things you could obviously do is start to bail out the market, hold less money in the market and have more in cash that would reduce the volatility. But you may want to stay in the market - so what can you do?

Now, there is one investment fund statistic that people should look at and that's something called ‘beta’.

Just to explain, if the stock market was to move up 10% then if a fund has a beta of 1 that means that the fund would also do the same thing. It would go up by a magnitude of 10%. Because what the beta measures the correlation of the movements in the fund and its returns against the index that it is benchmarked against - and every fund has a benchmark. If a fund manager is going to launch a fund then they need to say to people, "This is our benchmark that we're going to beat," so that people can see roughly what they're trying to do.

Now the beta is publicised for every fund and is the key indicator that shows you how the fund will likely behave.

Andy: Ok.

Damien: We talked about it before. If you have a fund that just tracks the FTSE, it will have a beta figure of one, because is it simply tracking the index exactly. Now the range of possible beta figures goes from -1 to +1. A beat of -1 would mean that the fund moves in completely the opposite direction to the market. So if the market went up, it would move by the same amount down. If the beta is zero, then it means the fund doesn't do anything in relation to that particular index.

So, you would want to pick a fund that isn't particularly correlated to the markets what are going. It would mean the fund can forge its own path but does move in the same general direction. So it's still going up, but it isn't going to be all over the place, swinging around when markets have a wobble. That mean that you want to look for is a fund that has a beta value that's relatively low.

If you go for a fund with beta of 0 it would have no correlation at all as stated earlier. But if you go for a fund with a beta between 0.7 and 0.5 then when the markets are dancing around all over the place, the fund is going to be doing moving up and down to a much lesser extent. It won't be buffeted around as much. So therefore the volatility, the bouncing up and down is going to be reduced.

Andy: How do you find that figure?

Damien: It will be on some of the fund fact sheets. You can find them if you Google a fund's name or use a service such as Morningstar or Fidelity which show the beta figures for funds. I don't think Hargreaves Landsdown shows a fund's beta figure. I was looking on there to try and find it, but gave up. Even if you find it, it's unlikely that you will be able to screen and find funds with low betas. I did that for the 80-20 investor members, so if you would like to see the low beta funds for all the top sectors such as Japan, U.S., UK, European markets, then do a free trial of 80-20 Investor and you'll see them.

So that's my tip. If there's one investment fund statistic to look at, then beta's an important one. Because there is a volatility figure that funds sometimes and that does obviously tell you about the volatility but beta does tells you how the fund movies in relation to the particular index it tracks. Which is more important.

Andy: Yeah.

Damien: So before I finish on this, I just want to chuck in another tiny thing.

There is another fund statistic you might see somewhere called R-squared. It sounds like you're back at school with a bit of algebra, but R-squared is a number that goes up to one. If R-squared is near one then that means that the index that is tracking is basically spot on. If it wasn't, if the R-squared figure was lower, say near zero, then what it means is the index the fund is benchmarking itself against is completely unrelated. A bit like apples and pears

So to give you a live example, let's imagine you were going to invest in a fund that invested in gold. Well the price of gold is very volatile. Whereas if that fund manager had put the benchmark as the FTSE 100 for example, then if you did the beta analysis it would actually show you they're not correlated as the beta figure would be close to zero, but that fund is still volatile. Do you see what I mean?

Andy: Yeah.

Damien: So what just watch out for that, but in nearly all instances the fund manager will pick the right benchmark because funds are grouped by their peers and by what they're investing.

So to sum up look for a beta figure below 0.7 and it means that the investment fund is not going to dance around as much and your portfolio value won't swing up and down wildly.

Do that across all the different assets, and then you'll reduce the volatility of your portfolio, but you won't have bailed out of the market, so you will still get the upturn when it comes.

Andy: Fantastic. I'm going to heed some of that advice myself.

....and finally

Damien: And do you know what, Andy? That is it for this week. I say that's it, but we have covered four pieces in a very short space. One thing I wanted to mention it in passing really, but the MoneytotheMasses.com was nominated as one of the The Best 25 personal Finance Blogs in the World by a site called Blogtrepreneur. Do you see what they've done there? They took entrepreneur and the word blog and then they mashed it together and they...

Andy: Yeah.

Damien: There are some really good sites on there. The only other UK one I think was MoneySavingExpert.com from, Martin Lewis, which I don't think really is a blog as such and you could argue that MoneytotheMasses.com is no longer a blog in the true sense, although it started as one.

So there you go. We got some recognition this week

Andy: That's incredible stuff. You're going to get invited along to some awards ceremony? Are they going to pay for the flight?

Damien: No. I think it's just a kind of..."Here's something to try and stick on your website," to promote them as much as me, so definitely not. But the other thing I was going to quickly chuck in, if you look at Facebook this week you will see I've now branded my MacBook with the Money totheMasses logo on there.

Andy: I did see a photo of it. With your Money to the Masses brand on it. Is that basically like a decal, is it a sticker that you just literally stick on it?

Damien: A company makes them, it doesn't have to be a MacBook, it could be any laptop, and it's the perfect size so you just peel it off and it sticks across it. And it's very good quality but the reason I mention it is not so some people can think, "God he's sad," but because if you see a guy with that on his laptop, then it is me, because I'm the only person who obviously has that on his laptop. I am in London quite a bit and I...

Andy: Frequent lots of coffee shops while you're tapping away.

Damien: I do when I'm between different meetings. Like this week I went to see some fund managers, and in-between those and the next meeting I was working in a coffee shop. So if you see the logo come and say hi. I'm regularly in Central London, particularly around Oxford Street or the City. I'll probably even buy you a cup of coffee.

Andy: Well, you have to let me know when you're in London, and I'll make sure I see you then, Damien. I can get a free coffee out of it.

Damien: Yeah, you're excluded, Andy. You don't count, but...

Andy: Oh, I'll tell you what I was going to update you with this week. I've been doing some filming of my own for ITV. I forgot to tell you. Did you know? Did I tell you?

Damien: No, see this makes me laugh. When I ask and you say what have you bee up to this week you forgot to mention that you've been filming for TV. So fill us in again, you did say to me, "Oh, I was down your neck of the woods filming TV." So what were you filming?

Andy: Oh, it was a piece for the ITV Tonight show. Funny enough, the same program which you have been involved with, was it last year or earlier this year?

Damien: Yeah, I did an interest rate piece. I went to York to film it

Andy: Right. When Interest Rates Rise, wasn't it? Yeah.

Damien: Yeah, and they still haven't, so it's slightly a premature piece really.

Andy: Well, yeah, same people and it was completely coincidence that they managed to get in touch with me. They're doing a piece soon on weight loss and there's going to be a special coming out. I can't say too much, because the piece hasn't come out yet, and I may get cut, so I'll look like a bit of an idiot if I do. But there's a famous presenter who's going to be presenting it. It's someone who's had weight issues in the past and someone who's a famous actress who I met for the day and we chewed the fat over weight loss issues.

So that's all I'm saying for now.

Damien: That's exciting though, Andy.

Andy: Yes, very

Damien: Was it tiring?

Andy: Not particularly tiring. I was only there for a couple of hours, but it was pouring rain outside and the way they cut these things together if you've ever been involved with TV, it's fascinating stuff. You probably experienced it yourself. They have to do various cutaways and film you from behind and in front and it's all for the same piece, but with one camera and the team know exactly what they're doing. You've got a producer there. Yeah, it's really fun to be involved with. And I think your one was more tiring, because you were interviewing people pretty much for the whole day in the scorching heat. I was inside a particularly nice Tudor building, Vicarage it was, being made nice cups of tea, so it was pretty easy for me.

Damien: See that sounds really good doing it that way round. And YES, when I did the bit before, because it was that vox-popping thing and you standing on your feet all day. if people who are new to the podcast, if you go back probably about...I don't know, probably about a year ago I did it, and we talked about it on the podcast, but standing on your feet all day interviewing person, after person after person is tiring. You might do 20 people, but the producers will probably only take snippets out of less than not half a dozen of the interviews. I admire presenters who do it all day long, because by the end of it I'd almost lost the will to live.

So it's good fun and it's an experience, but it's quite draining. So you will have to keep us posted.

Andy: Right. Shall we move on

Damien: Oh, yeah. One thing before you go, I'm about to close the 80-20 Investor competition where you could win a free trial for a year, which is worth exactly £204. So you win that. If you want to enter just go to the Facebook page. There's a sticky at the top which you have to ‘like’ which talks about the competition or you tweet the message, "I want to be an 80-20 Investor," and I will see that, because it will ping up. So last calls on the competition before I close it and I announce a winner next week.

Andy: Good stuff. Until next week then, catch you later.

Damien: Yes, bye, Andy. Bye.

Andy: Bye.

Don't forget to claim your free copy of Damien's bestselling book, "The 30 Day Money Plan: Sort Your Finances in Just 5 minutes a Day," worth 4.99. Just go to MoneytotheMasses.com/podcast to find out how.