A report released by the National Audit Office (NAO) has revealed that 60% of the buyers that used the government's Help to Buy equity loan scheme could have bought their property without the government's help. Despite being advertised as a scheme to help first-time buyers get their feet firmly on the property ladder, only 40% of those that received help would have been unable to purchase a property without it.

It was also revealed that 10% of buyers had household incomes over £80,000 and 4% had a household income over £100,000.

The scheme has previously come under criticism with many arguing that housing developers are taking advantage and using it to inflate prices and increase their profits. The country's top 5 developers, Persimmon, Barratt, Taylor Wimpey, Bellway and Redrow have sold over half of their homes using the scheme. The report issued by the NAO has said that it cannot comment on the 'longer-term effects on the property market and the net return, or cost, to the taxpayer when the very substantial portfolio of loans has been repaid.'

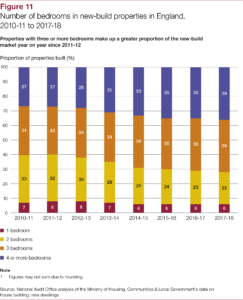

As a would-be first-time buyer myself I find these statistics incredibly frustrating. I cannot point blame to those that have supposedly 'abused' the scheme, as they are well within their rights to use the loan offered by the government. The government, however, should have put a wage cap on the scheme, as they have done so on other schemes directed at first time buyers. It became fairly obvious as new build sites popped up around the country with 3, 4 and 5 bedroom homes that the scheme was no longer designed with 'first-time buyers' in mind.

Below is a graph that shows the percentage of properties in England that were built based on the number of bedrooms they have:

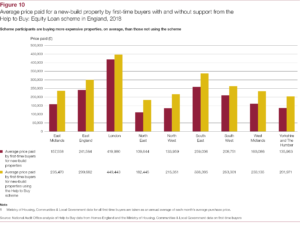

The graph below shows the cost of new builds across England with and without the help of the Help to Buy equity loan scheme. With the scheme, house prices were considerably higher.

What is the help to buy scheme?

The help to buy equity loan scheme was introduced in April 2013 to help prospective homeowners obtain a mortgage as well as to increase the house building rate in England. The scheme has been marketed at first time buyers, but it was also introduced to help those already on the property ladder to move to a bigger house.

The current help to buy equity loan scheme is only running until March 2021 and only new build properties can be purchased.

How does the help to buy scheme work?

The help to buy equity loan scheme allows homebuyers to receive an interest-free loan of up to 20% of the property's market value (40% in London). Someone applying for a 20% help to buy equity loan would need a deposit of 5%, meaning they would only need to get a mortgage for 75% of the house value (55% in London).

A help to buy equity loan is interest-free for the first 5 years and from year 6 interest of 1.75% is applied (increasing by RPI each year). Buyers have 25 years to pay back the loan in full.

Eligibility for the scheme:

- Buyers need a 5% deposit

- Must be a new build home

- Maximum of £600,000 property price (£300,000 in Wales)

- Buyers cannot own an additional property

- The property cannot be rented or sub-let after it is bought

- If you live in Wales you have to show that you cannot afford the property without the scheme

Example: For a £250,000 property, buyers would need a deposit of £12,500 to get an equity loan of £50,000 (£100,000 in London) and then a 75% mortgage on the remaining £187,500 (£137,500 in London).

When will the current help to buy equity loan cease and when will the new help to buy equity loan scheme commence?

The current scheme is only available until March 2021, but a new version will be running from April 2021 until March 2023. The new Help to Buy equity loan scheme will see two main changes:

- It will only be available to first-time buyers (although criteria and eligibility have not yet been confirmed).

- Regional caps will be introduced on the property price. London properties will remain at £600,000 but elsewhere they will be capped at 1.5 times the average first-time buyer property value.

Alternatives to the Help to Buy Equity Loan

Help to Buy ISA

A scheme introduced in 2015 to help first-time buyers get on the property ladder. Once you are ready to purchase your first home the government will boost your savings with a 25% bonus, (up to a maximum of £3,000).

Key features:

- You have to be 16+

- Must be a UK resident

- First-time buyers only

- Can only deposit £200 a month (can be opened with £1,200)

- Closing on 30th November 2019 in favour of Lifetime ISAs

Lifetime ISA

A lifetime ISA not only allows you to save for your first home but your retirement too. Similar to the Help to Buy ISA you can benefit from a 25% government bonus but can deposit up to £4,000 per year.

Key features:

- Must be aged between 18-40 to apply

- Can be either cash or stocks & shares

- Can only access the money to buy your first home or for retirement (aged 60+)

- 25% withdrawal charge if funds are withdrawn and not used for a first home or for retirement

- The property value must be below £450,000

- Cannot purchase a property within the first 12 months of opening an account

Shared Ownership

Also known as Share to Buy, Shared Ownership offers buyers the opportunity to purchase a share of a property and rent the remaining share.

Key features:

- Buyers are eligible if they are first-time buyers or used to own a home but cannot afford to buy now

- Combined household income is less than £80,000 a year (£90,000 in London)

For more information on buying a home as a first-time buyer read our first-time buyer guide.