What is Habito and what does it do?

An online mortgage broker aims to modernise the advice process for getting a loan for a home. Rather than having to make an appointment to visit a bank or broker, everything is managed online, with decisions made faster and at a lower cost.

Habito* offers a full range of mortgage broking services, providing online advice for first-time buyers, those remortgaging or buy-to-let landlords. In July 2019, Habito was granted permission by the regulator to become a mortgage lender and now offers its own range of mortgages. It promises to cut through industry jargon and offer round-the-clock advice to help users apply for a home loan from anywhere in the world.

How does Habito work?

I've personally been into Habito's offices to grill them over its proposition and recommendation process and was impressed. Habito* has built technology that allows it to track and access every mortgage deal from more than 90 lenders in seconds, which amounts to an impressive 20,000 products. It does this by linking up with mortgage calculators on other lender websites and using its mortgage experts’ own market knowledge. This helps it quickly scan the market and come up with the best product for applicants to receive an agreement in principle.

Habito* says it shouldn't take you longer than 10 minutes to enter your personal information and borrowing needs, followed by a five-minute chat with a mortgage adviser either online or on the phone to confirm your requirements. You will then need to upload any required documents to Habito’s dashboard, which it sends to the chosen lender on your behalf. After this, obtaining an agreement in principle could take anything from 24 to 48 hours, depending on the case and how long it takes for you to send your documents. This would work out faster than waiting for an appointment and visiting a bank branch or mortgage broker, compiling an application and then having to send your documents by post.

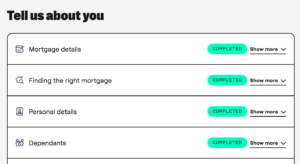

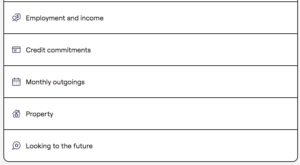

The sign-up process is pretty slick and user-friendly, with pop-up boxes that are simple to complete. Applicants need to start by registering either through social media or an email address. You must confirm that you haven’t filed for bankruptcy or been issued with a county court judgement or individual voluntary arrangement as it can’t provide products to cover these situations. Users are then asked whether they want a mortgage for house purchase or remortgage and whether they are first-time buyers, movers or seeking a buy-to-let loan.

You are also asked for details on the property you want to purchase and how much you want to borrow as well as how long for and the source of your funds such as savings or a gift. The final sections focus on your employment status, income, dependents and any assets, debt and your general spending habits.

Importantly, none of this involves a credit check so won’t harm your rating or leave a footprint on your credit report.

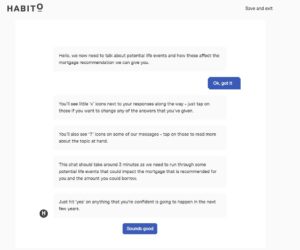

The next step is a chat with Habito’s* digital mortgage adviser to ensure you get a mortgage that fits your future plans and confirms what you have entered in the application. The mortgage adviser chatbot can be accessed 24/7 and asks questions such as whether you expect to have to pay for a significant event in the next three years, and also gets quite personal, such as asking if you are planning to have children. You are also asked whether you want a fixed or tracker mortgage rate and how long for.

The chatbot will recommend if your chosen product type is appropriate given your answers and you are then invited to set up an online or webchat with a human mortgage adviser to agree on the best mortgage product for you. This can be arranged from 9am–5pm, Monday to Friday.

Once you agree on the product you want, Habito* will apply for an Agreement in Principle on your behalf. It is only at this stage that your credit report will be accessed and a footprint left. You will need to upload scanned documents to your Habito account and your adviser will tell you what is needed. They will also keep you updated on the whole process, which can typically take two to four weeks to complete a full application.

Even once you have a mortgage, Habito says it will provide updates for when you could move to a cheaper rate.

How does Habito lend money and maintain its independence?

Habito is not just an online mortgage broker.

In July 2019 it was granted permission to become a mortgage lender and now offers a range of buy-to-let mortgages, as well as its Habito One mortgage, which offers up to 40-year fixed-rate deals, the first lender in the UK to do so. It also recently moved to offer some applicants mortgages at up to 7 times their annual income. In order to maintain its independence, Habito has formally separated its mortgage brokerage from its lending arm.

Habito also claims that its algorithms only look at the specific mortgage features and discloses the reasons for recommending a mortgage as well as displaying the runners-up, ordered by true cost. That means it won't favour its own mortgage products when making a mortgage recommendation to its customers.

In addition, Habito's advisers are paid the same commission, no matter which mortgage they recommend.

Habito services

Habito Plus

Habito Plus is Habito's 'complete homebuying service' designed to help buyers through every aspect of a property purchase. For a fixed-fee (starting from £2,000), Habito Plus includes an in-depth property survey, help with price negotiation and all of the conveyancing and legal work required to complete a property purchase. Habito says that by keeping everything in one place, the legal work and surveys can be carried out in days rather than weeks. Read more about Habito Plus in our independent Habito Plus Review.

Mortgage in principle certificate

If you are not quite ready to proceed to a full Agreement in Principle (which is an accurate estimate of how much a lender may be willing to lend you), Habito offers a Mortgage in Principle certificate. This allows you to show buyers and estate agents that you are serious about the offer you have made but it is only a basic estimate on how much you can borrow. The Mortgage in Principle is free, there is no credit check and it only takes around 5 minutes to complete.

How does Habito make money?

There is no cost for using Habito*. It makes its money from procurement fees paid by lenders in return for introducing customers to their mortgages. This is how other mortgage brokers (online and offline) work although some are now requesting a fee upfront to cover the cost of administration. Habito also offers conveyancing services from a panel of solicitors, so may also earn a commission from this.

One thing I really like about Habito is that it is open about the lenders who it works with and who it can earn money from. Yet that doesn't impact Habito's recommendation as it will still look at the whole mortgage market and, if a product that it doesn't have a commercial relationship with is the best for you, then Habito will still tell you. In this instance, it would be up to you to contact the lender directly to arrange the mortgage.

Is Habito safe to use?

Like any mortgage broker, Habito* is directly authorised and regulated by the Financial Conduct Authority (FCA), so must follow rules on treating customers fairly, and making product and service terms and costs clear. You also have the right to complain to the Financial Ombudsman Service if issues can’t be resolved.

With Habito, you upload the documents into your password-protected account and they are sent to your chosen lender. This could be seen as safer than the process typically used by a traditional mortgage broker (i.e sending documents via post or email). However, you are trusting Habito with your uploaded information and are relying on them to ensure it is secure and can’t be hacked.

Habito vs traditional mortgage adviser

Habito’s* service is provided fully online. The only human interaction is if you decide to speak with one of its mortgage experts and when you need to answer questions and upload documentation. This helps keep its costs down.

There are two types of traditional mortgage adviser and the type you choose could affect the quality of the product you are offered. Advisers in bank branches will only offer their own brand's products, which limits your choice, while mainstream brokers may either offer restricted panels of products, again restricting your options, or, like Habito, will look at the whole of market. Both also have high-street offices to pay for, so costs may be passed onto customers.

Mortgage brokers are probably closer to the Habito service, but some may charge an upfront fee just for doing your application and finding a product. A broker may offer extra value though as they could help complete the application and guide you on what type of mortgage you should opt for and the types of income and assets to declare. Habito asks all of these questions before you speak with an adviser so there is a risk of them being completed incorrectly, which could impact your application later.

Habito’s* process is faster than a mainstream mortgage adviser, as everything is managed online, compared with having to complete and send documents by post.

Habito Alternatives

Habito* isn’t the only online broker in the market and most follow a similar approach, offering a fast and free service that tracks products across the market and getting paid a procurement fee. The first brand on the scene was actually Trussle, launching in December 2015. It has a focus on fast turnaround, with a promise that you will get a decision on your mortgage within 5 days, otherwise it will pay you £100. Check out our Trussle review for more information. Another option is MortgageGym, which has a partnership with credit reference agency Experian so will be able to recommend products based on your credit score.

Habito Customer Reviews

Habito* proudly displays reviews on its website and provides a link to its Trustpilot page where you can get more detail. It has gained 4.8 out of 5 stars and is rated as 'Excellent' based on over 7,500 reviews. Trustpilot's Habito reviews include 95% of reviewers rating it 4.0 or 5.0 stars out of 5.0. Most of the reviews praise the efficiency, functionality and that it can be accessed outside of working hours. Only 4% rated their experience as bad or poor, with users in most cases facing specific issues or having complicated applications where an error has been made.

Pros & Cons of Habito

Pros

- Online so no need for appointments

- Easy to use website and quick application process

- Whole-of-market advice

Cons

- Some mortgage knowledge required to get started

- Not suitable for those who have had debt issues previously

- Have to scan documents online which is difficult if you don't own a scanner

Habito* takes a lot of the hassle out of applying for a mortgage. It is more flexible as you can do it anywhere you have an internet connection at any time, rather than having to schedule a meeting with a bank or high street broker based on their schedule. There is plenty of choice from the 90 or so lenders it searches, which can beat a mortgage adviser or broker, and you can even talk to an expert if needed.

More importantly, Habito will still tell you if a mortgage from a lender that it doesn't have a commercial arrangement with is still best for you. You are then free to go and speak to that lender directly. All too often online traditional comparison sites will only promote products which they can earn money from. It is refreshing that Habito appears to value customer service above profit.

You need a bit of prior knowledge even before you get to speak with Habito’s* digital and human advisers. Users are expected to select their preference for a fixed or variable rate and mortgage term and in some cases have to give a yes or no answer where it may be that you don’t know or need an adviser to explain an issue. Habito also can’t help those who have had debt issues or have been made bankrupt. It is technically whole of market as its technology scans deals from all lenders. But it will only advise/arrange on those that pay its procurement fees. As I've mentioned borrowers are at least told if there is a better deal that they could get elsewhere but they will have to sort it themselves. It's not a major negative but it would be nice if Habito could deal with every lender but unfortunately, that is beyond its control as some mortgage lenders only deal directly with consumers and not via mortgage brokers.

Conclusion

Habito’s* service is user-friendly and easily accessible, taking much of the administration and jargon out of a mortgage application. I am particularly impressed with the fact that it covers the entire market, even those lenders and products it does not earn money from. This is refreshing in a world where comparison sites often only promote products which they can earn money from.

Habito's service is fast, but getting a mortgage is a big financial commitment and it's vital to get it right so speed isn’t necessarily the most important factor. This is a good service, especially for those with simple cases and if you know what you are looking for. Habito does require borrowers to have more information upfront and so those that have complicated circumstances or require guidance may find a face-to-face meeting with a human broker more beneficial.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses - Habito