We explain how Tembo can help buyers with ways to boost their income or house deposit, ensuring they get a mortgage on the house they wish to purchase. Finally, we explain how much the services costs as well as the pros and cons of choosing Tembo as your mortgage broking service.

About Tembo Money

Tembo is a London-based mortgage broker that focuses on helping first-time buyers onto the property ladder. The founders conceived the idea for Tembo in March 2020 to tackle the problems facing first-time buyers who struggle to get a mortgage. Since then, Tembo has received financial backing from Aviva Ventures, Ascension Ventures and the McPike Family Office among others.

Tembo operates as a digital mortgage broker under the company name, Tembo Money Limited which is authorised and regulated by the Financial Conduct Authority (FCA).

Tembo was awarded ‘Best Newcomer’ at the British Bank Awards in 2022 and followed that success with the '‘Innovation of the Year’ award in 2023. It has also been voted the ‘Best Mortgage Broker’ for three consecutive years at the British Bank Awards in 2022, 2023 and 2024.

Specialist mortgage advice for first-time buyers

Our partner Tembo is a specialist mortgage broker that offers tailor-made mortgage solutions for people with smaller deposits including Guarantor, LTV and first-time buyer schemes.

What does Tembo Money do?

Tembo is a mortgage broker and much like any other mortgage broker, it is able to search the market for the best mortgage deal. Tembo also offers a number of solutions that can help to boost income and affordability for first-time buyers. Tembo can also advise on alternative buying options including shared ownership and guarantor mortgages.

Although Tembo will serve homebuyers looking for a straightforward mortgage solution, it has particular benefits for those who may struggle to meet lenders' qualifying criteria as it has specialist tools to explore boosting your income and house deposit.

What makes Tembo stand out is that it provides customers with access to a number of different types of mortgage. Options include guarantor mortgages, joint borrower-sole proprietor arrangements as well as part rent, part buy schemes.

How does Tembo work?

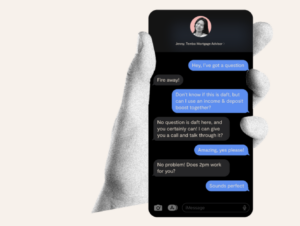

Tembo's online mortgage search tool is simple to use and navigate, making it easy for homebuyers to explore different options from the comfort of their own homes without the need to arrange an appointment with a mortgage broker.

Many alternative homeownership solutions typically require a conversation or a meeting with a mortgage broker; however, with Tembo, you don't have to arrange to speak to someone to get this information. This is extremely attractive in an environment where more and more consumers prefer to explore things online.

Furthermore, parents or other family members can use the service in order to help a family member buy their first home.

How to get a mortgage with Tembo

Step 1

Tembo's mortgage tool* is easy to navigate and will start by asking you:

- The price of the house you wish to buy

- What you earn including bonuses and commissions

- The deposit amount you have saved (if any)

- The amount of credit you owe

- Whether you have any adverse credit activity such as CCJs, bankruptcy

You will need to provide similar information under the section 'Booster information' if you require help from a family member or friend to support your mortgage application.

The process takes no more than a few minutes and you will receive the possible mortgage options within seconds of completing the information.

Tembo will then list the options available to you so that you can see what you can afford with or without additional help.

Step 2

Once you are happy with the option that best suits you, you'll need to complete your Tembo plan online. You will then need to speak with a Tembo mortgage adviser who will check all your information, discuss the options to buy and get started with the application process.

This part of the process can take some time as you will need to collect all of the information required, including details about other buyers or your guarantor if you are using one. The Tembo mortgage adviser will support you through this part of the process until you get a decision in principle which you can use to make an offer on a property to secure it. If you haven't been through this process before you'll find some very useful information in our article, "First-time buyer guide – Everything you need to know about buying your first home".

Home purchase options with Tembo

Tembo gives you a variety of ways in which to buy a property. The options are described below to give you an idea of how they could help you to buy a property. You may wish to visit Tembo* to understand the options fully.

Buying a home on your own

Below are Tembo's options for buying a home.

- Standard mortgage - fixed or variable rate mortgage deals for 60-95% loan-to-value (LTV) to support the purchase of any type of property

- 5.5 times income mortgage - a mortgage solution that could increase your budget by up to 20% for first-time buyers (need to earn £37,000+)

- Professional mortgage - up to 5.5 times your salary can be used if you are a professional such as a nurse, doctor, lawyer and accountant

- Dynamic income boost - co-ownership arrangements with another person such as a sibling or friend allowing you to buy with up to 5 (6 overall) people giving them shared equity

- Deposit unlock - buyers and movers can buy a new build with a 5% deposit (new builds normally require a deposit of 15-25%)

- Armed forces help to buy - offers armed forces personnel the ability to borrow up to 50% of their salary (up to £25,000) towards funding a house purchase

- Skipton track record mortgage - a 100% LTV mortgage that requires no deposit with at least a year's worth of proof of rental payments equivalent to the mortgage payment amount

Guarantor mortgages

'Boosting' is one of Tembo's key features. Boosting means that you'll be using a guarantor's income, cash savings or property equity to enhance your financial position. If you have a family member or friend who is willing to help you to buy a property, you can access the following purchase options.

- Income boost - commonly known as a Joint Borrower Sole Proprietor (JBSP) mortgage where up to 5 guarantor incomes enhance your own to increase your affordability without affecting your first-time buyer stamp duty advantage

- Deposit boost - a way to raise two mortgages allowing a guarantor to release equity from their home to contribute towards the deposit used to fund your main purchase

- Deposit loan - a mortgage that could increase your budget by up to 20% (for first-time buyers that earn upwards of £37,000)

- Savings as security - commonly known as a family guarantor or springboard mortgage where savings are used as security to get a mortgage with as little as zero deposit

- Dynamic income boost - boost your affordability by adding a family member's income to your own with the flexibility to allow them to contribute to the monthly repayments or not

Part buy, part rent

Not all mortgage brokers can offer advice on 'part buy, part rent' schemes, however, Tembo offers a number of schemes that allow you to have a share of the equity in a property while paying rent on the rest. These include:

- Government Shared Ownership - purchase of a home where you will own a part of the equity and you pay rent to the housing association for the government-owned part

- No deposit rent-to-own - options that allow you to pay a fixed rent to live in a property while you build savings towards owning it by buying it at the original price minus the costs incurred by the scheme provider and your rental payments contribute towards the eventual price that you pay too.

- Your Home - you pay 25% or more of the purchase price while 'Your Home' purchases the rest and charges you rent on the rest

- Stride up - a minimum of 15% deposit towards shared ownership of the property (worth up to 6.5 times your income) This option is Shariah-compliant

Remortgage

Options that allow you to remortgage from your existing mortgage deal to get a better rate, switch mortgage provider or change the type of mortgage you have can be difficult to arrange depending on your affordability and house value.

- Standard remortgage - a standard remortgage involves changing from your existing mortgage deal because it has come to an end and you can move your loan to a new contract to avoid going onto the standard variable rate (SVR) with your existing lender

- Income boost remortgage - you can use a guarantor's income in full or part to boost your own income in order to remortgage to a new mortgage deal which may not have been available to you on the basis of your own income due to affordability measures

- Part and part - you can switch to a mortgage that is part interest-only and part repayment as a way to reduce your costs from paying a fully repayment mortgage which allows you to partially reduce your mortgage balance whilst meeting your affordability limits or as a way to start partially repaying your mortgage if you were previously on an interest-only mortgage

- Interest only - switching to an interest-only mortgage will allow you to reduce your monthly mortgage payments - an option that could appeal to a mortgage holder who cannot afford increased mortgage costs

- Product transfer - this option allows the borrower to stay with their current lender but switch to an alternative mortgage deal to avoid going onto the standard variable rate and Tembo compares the mortgage deals available with your existing lender with those available elsewhere before you decide to stick, merely for ease

Tembo Lifetime ISA

Lifetime ISAs are a popular way to build funds towards buying your first home as the amount you save will be boosted by a free government bonus. Tembo's Lifetime ISA currently offers the best non-boosted interest rate available on a Cash Lifetime ISA at 4.75% AER (variable). Aspiring homebuyers aged 18 to 39 years old can save up to £4,000 each year using a Lifetime ISA which will be topped up by 25% by the government, boosting the money you save towards your home deposit. If you are applying for a joint mortgage, you can individually save money into a Lifetime ISA up to the limit and individually receive the government top-up.

How much does Tembo charge?

Exploring your options and building your plan with Tembo won't cost you anything initially, however, you will be required to speak with a Tembo mortgage broker to proceed with any of the suggested solutions on Tembo's website. This ensures that they can apply their expertise as well as make sure that the plan is right and workable for you. As with most mortgage brokers, Tembo charges for the advice provided by a mortgage specialist after you create your Tembo plan online.

Tembo fees

- £499 for arranging a house purchase

- £749 for arranging a house purchase that requires Income Boost or Deposit Boost

The fee that you pay provides you with access to:

- a personalised Tembo plan

- advice from a Tembo mortgage broker

- support with applications for your house purchase

Where you require Income Boost or Deposit Boost, Tembo will need to carry out more work and checks because of the extra people and mortgage products this may involve, which is what makes the charges higher for this type of property purchase.

Who can use Tembo?

Tembo is available to UK residents aged 18 or older. Products include:

- Purchase a property for the first time

- Purchase a property to move to

- Remortgage an existing mortgage deal

- Parents and family members seeking to help someone buy a property

What does Tembo not offer?

Tembo cannot help customers who are currently bankrupt, have an IVA, DMP, an active CCJ or have had a property repossessed. It also doesn’t help with purchases of commercial or overseas properties and you must have a right to remain in the UK.

Alternatives to Tembo

Many mortgage brokers provide similar services but you should check that the mortgage adviser is qualified and has access to a good selection of lenders to get the best mortgage rates; some may only have access to a handful of lenders.

If you would prefer to find a mortgage adviser in your area, you can find one using the services of Vouchedfor*, a directory service that lists a number of vetted financial professionals that you can filter by location. As well as allowing you to read real customer reviews, Vouchedfor will tell you if the mortgage broker is regulated by the Financial Conduct Authority (FCA).

Pros and cons of using Tembo

Pros

- Can explore specialist house-buying solutions before you have to speak to someone

- Could increase your affordability and the amount of deposit you have

- Access to a number of part ownership and shared ownership schemes

- Avoid adverse credit caused by declined mortgage applications made directly to a lender

- Support with applications and the administration involved with your property purchase

Cons

- You will have to pay to use Tembo's services

- Tembo is unable to help homebuyers with a poor or adverse credit history

Tembo customer reviews

Tembo is rated 'Excellent' by independent customer review site Trustpilot and scores 4.9 out of 5.0 stars based on over 1,500 reviews. 98% of the reviews from customers who used Tembo's services awarded it 5 stars and Tembo responded to all reviews that cited any bad experience, which accounted for less than 1% of reviews. The reviews are from a mixture of first-time buyers as well as parents or family members who have used the service to support someone to buy a house.

Is Tembo any good?

If you are looking to buy a property or remortgage your existing mortgage deal and need help navigating all of the options available to you, then Tembo's tools* can help show you your purchase options. Most other mortgage search tools tell you to contact an adviser in order to get further information, but you can get further without speaking to someone using Tembo.

Tembo offers a wide range of mortgage solutions and allows you to explore these while you build your personal plan online. Once you are ready to speak to one of its specialist mortgage advisers, Tembo can provide tailored advice throughout the whole house-buying process, providing options that may not be available through a traditional independent mortgage broker.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - Vouchedfor, Tembo