If you live in the UK, you'll need to have at least third party insurance to drive a vehicle on UK roads and not doing so could result in a fine and points on your licence. Because car insurance is mandatory, you may be wondering how much car insurance costs and how you can save money on a car insurance policy. In this article, we look at the average cost of car insurance, what affects the cost of car insurance and how to save money on a car insurance policy. We also share the best way to save time and money when buying car insurance and how you can compare quotes from over 120 UK car insurance providers with Quotezone* - you could save up to £523**.

We recommend that you read the article in full, but you can read specific sections of the article using the following links:

- What is car insurance?

- How much does car insurance cost?

- What affects the cost of car insurance?

- How to save money on car insurance

- How to buy car insurance

1 minute summary

- There are three main types of car insurance; fully comprehensive, third party, fire and theft and third party.

- In the first quarter of 2024, the average car insurance policy was £622 per year according to the Association of British Insurers (ABI).

- The amount you pay for car insurance will depend on a number of factors including where you live, your age and the car you drive.

- One of the easiest ways to compare the cost of car insurance is via a comparison site.

- We have partnered with Quotezone* so that you can search and compare quotes from over 120 UK car insurance providers.

What is car insurance?

Depending on the type of policy you choose, car insurance can cover financial loss as a result of damage to your vehicle, someone else's vehicle or both. It can also protect against damage caused to property and injury claims.

There are three main types of car insurance; fully comprehensive, third party, fire and theft and third party. Fully comprehensive insurance offers the most cover but surprisingly isn't always the most expensive, so it is always worth comparing the cost between all policy types. For more information on the different policy types, read our article ‘What are the different types of car insurance?‘

When purchasing a car insurance policy you need to be honest so that you are suitably covered when taking out a policy. This means declaring any unspent convictions and points on your licence as well as being truthful about your occupation and the use of your car. Not being honest could invalidate your car insurance policy.

How much does car insurance cost?

According to the Association of British Insurers (ABI) the average price paid for a motor insurance policy in the first quarter of 2024 was £622. This is however an average figure and the amount you pay for your policy will vary due to your age, where you live and the type of car you drive. Car insurance costs are calculated based on the level of risk you pose. Car insurance providers will consider a number of risk factors before providing you with your car insurance quote.

According to the ABI, £9.9 billion was paid out by private motor insurers in 2023. The table below shows what the majority of the insurance claims were paid out for.

| Vehicle repairs | £6.1 billion |

| Personal injury claims | £2.4 billion |

| Theft | £669 million |

| Replacement vehicles | £597 million |

What affects the cost of car insurance?

The cost of car insurance is based on different levels of risk and so there are numerous factors that are taken into consideration by insurers. Below, we look at how some of the different factors affect the cost of your car insurance policy.

Policy type

The type of car insurance policy you choose will affect how much you pay for your car insurance policy. Fully comprehensive car insurance is the most extensive because, as the name suggests, it offers the most comprehensive cover. Most drivers will assume that fully comprehensive insurance is the most expensive, but that is not always the case. According to data from Compare the Market in September 2024, 51% of their customers were quoted less than £776 per year for fully comprehensive car insurance compared to £1,359 per year for third party, fire and theft and £1,861 per year for third party car insurance. Read our article, ‘What are the different types of car insurance?‘ for more information on car insurance policy types.

Age

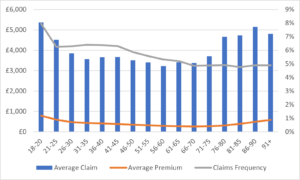

Age will affect the cost of your car insurance policy and younger and more inexperienced drivers can expect to pay more. This is because inexperienced drivers are more likely to claim on their insurance and according to the road safety charity Brake, 1 in 5 drivers crash within the first year of passing their test. The following graph from the ABI shows the relationship between car insurance claims, the cost of car insurance and drivers' age from their 2021 data. Young drivers and drivers over the age of 75 are likely to pay more for their car insurance premiums as they are seen as higher risk.

In addition, comparison site Quotezone shared data on how age affects the cost of car insurance, the table below is based on the average cost of car insurance premiums in May 2024.

| Age | Annual cost |

| 17-24 years old | £2901.91 |

| 25-34 years old | £1606.31 |

| 35-44 years old | £1118.03 |

| 45-64 years old | £659.40 |

| Over 65 years old | £525.78 |

Region

Where you live in the UK is also likely to affect the cost of your car insurance policy. Insurance providers will take a number of factors into consideration such as the type of road you live on as well as the level of crime in your area, increasing the chance of vandalism and theft. In the following comparison table, we highlight how the region can affect the average cost of your car insurance policy. The data has been collected by Quotezone* between January and May 2024.

| Location | Cost |

| South West | £598.86 |

| Northern Ireland | £675.32 |

| Scotland | £675.81 |

| Wales | £690.76 |

| North East England | £715.39 |

| South East England | £746.26 |

| East of England | £747.96 |

| East Midlands | £811.33 |

| Yorkshire | £873.10 |

| North West England | £917.26 |

| West Midlands | £986.39 |

| Greater London | £1,277.34 |

Job

Your job title can affect how much you pay for your car insurance premium as some occupations are seen as higher risk by insurers. For example, data collected by GoCompare between 1st January 2020 and 31st December 2023 suggested that some of the cheapest job titles for an annual car insurance policy were a local government officer, a postman and a paramedic while some of the most expensive job titles include an investment banker, a painter and a barber. We look at how your occupation affects the cost of car insurance in our article, ‘Does your job title affect your car insurance?‘.

Car

The type of car you wish to insure will affect the cost of your car insurance premium as it will be based on the car insurance group that your car falls into. Car insurance groups are ranked 1-50; 1 being the cheapest and 50 being the most expensive. Examples of cheaper cars to insure include a Fiat Panda, Skoda Fabia hatchback, a VolksWagen Polo hatchback and a Vauxhall Corsa hatchback, all falling into car insurance categories 1-10.

Your car will be grouped based on a number of factors including the cost to repair the vehicle, the size of the vehicle and how powerful the car is. The following table shows how your car's insurance group affects the cost of your car insurance premium, according to data collected by MoneySuperMarket in August 2024. To find out the cheapest cars to insure in the UK read our article ‘Which car is cheapest to insure in the UK? ‘.

| Car Insurance Group | Median annual premiums |

| 1 to 10 | £433.80 |

| 11 to 20 | £506.75 |

| 21 to 30 | £584.62 |

| 31 to 40 | £736.27 |

| 41 to 50 | £925.02 |

Find the right Car Insurance for you

Our partner Quotezone will compare quotes from over 120 UK insurance providers

- You could save up to £523**

How to reduce the cost of car insurance?

As car insurance is a mandatory purchase in the UK, there are ways you can save money when it comes to renewing your policy each year. Below we share some top money-saving tips to help you cut back on the cost of car insurance.

- Shop around – One of the easiest ways to save time and money on your car insurance is to shop around and compare quotes with different providers. This is particularly useful if you are due to auto-renew with your existing provider as you can get an idea of other deals that may be available. An easy way to do this is via a comparison site such as Quotezone* or MoneySuperMarket* as you can easily compare multiple insurers at once.

- Pay annually – Paying your car insurance premium annually is a good way to save money as some insurers add a credit charge to monthly payments, although admittedly, not everybody is in a position to pay for their annual car insurance upfront. You could use a budgeting app to help you to manage your money and save for the cost of an annual policy before it is time for you to renew. Find out more in our articles, ‘The best budgeting apps‘ and ‘The best savings apps‘.

- Increase policy excess – The policy excess is the amount payable in the event of a claim and there is usually a voluntary and compulsory excess amount that is payable. In some instances, increasing the voluntary excess amount can decrease the cost of your car insurance policy, however, it is worth remembering that this is the amount payable in the event of a claim and so it needs to be a figure that you can afford.

- Check your job title – As your occupation can affect your car insurance premium, you may be able to save money by amending your job title, as long as it is still an honest reflection of the job you do. For example, a salesperson and sales administrator could be considered the same role but one may be cheaper than the other to insure. We explain more in our article, ‘Does your occupation affect your car insurance?‘

- Drive fewer miles – The number of miles you insure your car for each year will affect how much you pay for your car insurance. If you can try to reduce the number of miles you drive in your car each year you may be able to pay less for your car insurance policy. Don't underinsure yourself though as doing so could invalidate your car insurance policy.

How to buy car insurance

If you're looking to save money on buying or renewing your car insurance policy, one of the easiest ways to do this is via a comparison site. This is because comparison sites allow you to compare quotes from multiple insurers at once to find the best policy for your circumstances. Comparison sites can save you time and effort when searching for car insurance quotes. We have partnered with Quotezone* so that you can search and compare quotes from over 120 UK car insurance providers.

One thing to consider when using a comparison site like Quotezone* to compare insurance quotes is that they are not always whole of market. This means that you may not see a quote from every car insurance provider on the market, particularly as some do not feature on comparison sites, and you could therefore get a better deal by visiting an insurer directly.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses – Quotezone, MoneySuperMarket