Cancelling any insurance is often relatively straightforward and this is the case when it comes to life insurance and health insurance as you are not usually tied into the contract. However, you should consider your decision carefully before cancelling life or health insurance as it can be difficult to reinstate cover and switching to another insurer may end up costing you more and you may require further medical checks.

In this article, we explain how to cancel a Vitality insurance policy with confidence, so that you are not left without the cover you need. We also explain how you can restructure your life or health insurance to save money as well as how to get up to £100 cashback* when you do.

1 minute summary - Cancelling Vitality insurance

- Cancelling Vitality life insurance, serious illness cover or income protection is simple but you should consider the impact of being without cover as well as the cost of switching

- Cancelling Vitality health insurance could incur a £40 cancellation fee

- If you have claimed rewards such as an Apple Watch, you may have to continue paying for these even after you cancel your insurance.

- Speak to an independent life insurance expert* to discuss switching or cancelling your Vitality life insurance, serious illness cover or income protection policy – you'll get up to £100 cashback if you switch

- Speak to an independent health insurance expert* to discuss switching or cancelling your Vitality health insurance policy – you will get £100 cashback if you switch (Offer ends 31st January 2025)

How to cancel Vitality life insurance

You can simply call Vitality's customer service centre on 0345 601 0072 or email your cancellation request, quoting your plan number to Renewal_Support@

Before you cancel, it is a good idea to speak with an independent life insurance expert* so that you can consider the cost benefits of switching insurer or cancelling your policy.

This will allow you to discuss your circumstances and reasons for cancelling with an expert adviser who can guide you but will not pressure you to keep your policy. If cancelling your Vitality insurance is the right thing to do, the advisers will help you do that conveniently and if you wish to switch to a different insurer they can access new quotes from across all insurers on your behalf. There is no cost for the advice and you are not obliged to follow the recommendations made.

Cancelling your life insurance will mean that you are no longer covered and there is no refund of the premiums that you have paid regardless of any claims. You are not normally charged a cancellation fee but if you arranged your Vitality life insurance through a broker, do check the terms of your contract in case there is a fee payable to your broker. A cooling-off period of 14 days applies when you start your Vitality life insurance so that you can change your mind during this period without paying premiums or incurring any other charges.

Cancelling life insurance is different to cancelling other types of insurance because it isn't an annually renewable contract. Life insurance is commonly arranged over a period that may be in line with your mortgage term, the period over which your children will be dependent on you or until you retire. What this usually means is that your premium is fixed for that duration although Vitality's Optimiser means that depending on how well you engaged with the Vitality programme, your premium could change.

Up to £100 cashback on Vitality insurance

Our partner LifeSearch will help tailor insurance and policy benefits to suit you, your family and your budget

- Talk to an expert that understands Vitality

- Tailor Vitality to suit your budget & maximise benefits

- Compare all the top UK providers

- Free advice with no obligation to purchase

How to cancel Vitality health insurance

You can cancel your Vitality health insurance policy by calling 0345 602 3523 (Monday to Friday – 8 am to 7 pm) or you can email your cancellation request to Renewal_Support@

However, it is a good idea to speak with a health insurance expert* to discuss how to cancel your cover without losing valuable benefits if you plan to switch providers. The advisers have access to a range of health insurance products provided by different insurers including Vitality so you can compare costs and benefits before making your decision. If you switch your insurance and start a new policy, you will receive £100 cashback (offer ends 31st January 2025).

Vitality health insurance policies are annually renewable contracts so you could be charged an administration fee of around £40 if you decide to cancel mid-contract. If you come to the end of your contract, you can shop around and either renew your Vitality health insurance policy or switch to another provider without paying the cancellation fee. You will usually be able to carry forward the terms of your cover as you can qualify for ‘continued cover' based on the fact that you have held a health insurance contract without any break in cover.

What is quite important to note if you decide to cancel a Vitality health insurance policy is that you will be unable to rejoin as a Vitality health insurance customer for at least 6 months after you cancel.

Like most insurance contracts, you do have a cooling-off period during which you can cancel your Vitality health insurance without any cost and you will be refunded any premiums that may have been collected. Vitality's cooling-off period for health insurance is 14 days so you can cancel your Vitality health insurance within this period and you won't be charged a cancellation fee.

What you should consider before you cancel Vitality life insurance

Switching or reinstating life insurance could cost more due to age and health changes because your premium will be based on your age at the time of the application. Additionally, if your health has worsened, you may be charged an even higher premium.

If your circumstances have changed and you need more or less cover you should speak with a life insurance expert*. You may have moved home and increased your mortgage or downsized and reduced your mortgage balance prompting a review of your life insurance. There are some situations where may be better to cancel your existing insurance and replace it with another.

Vitality premiums feel expensive

Vitality life insurance is rarely the cheapest product on the market but customers who actively engage with the healthy living rewards and discounts can often offset the additional cost.

If you feel your monthly premium is too expensive it can be helpful to look at restructuring your insurance before you cancel as this could reduce your monthly cost without the need to reapply elsewhere.

Lack of engagement with the rewards and benefits

You may have bought into Vitality insurance intending to enjoy a discounted gym membership, free coffees or even a new Apple Watch. However, some policyholders find that they struggle to engage with the Vitality programme and the level of savings or rewards they initially expected don't transpire. Furthermore, the cost of your insurance will normally start to creep up each year if you do not maintain or improve your vitality status through healthy living habits.

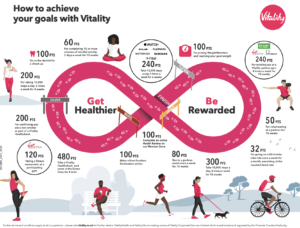

Most Vitality customers don’t realise how simple it can be to reach silver, gold and platinum status due to the complexity of the rewards program. Below, you will find a very useful infographic that details how to achieve the points you need to maintain or improve your vitality status.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses and do not wish to qualify for the cashback referred to in the article – LifeSearch, Howden Life and Health