A decreasing term assurance policy is usually the same as a mortgage term assurance policy. It protects a repayment mortgage by mirroring the outstanding balance which reduces over time. In the event that the policyholder dies the insurance payout would be sufficient to clear the outstanding mortgage balance. However, it is not the only solution for protecting your repayment mortgage - other solutions can be more future-proof.

A decreasing term assurance policy is usually the same as a mortgage term assurance policy. It protects a repayment mortgage by mirroring the outstanding balance which reduces over time. In the event that the policyholder dies the insurance payout would be sufficient to clear the outstanding mortgage balance. However, it is not the only solution for protecting your repayment mortgage - other solutions can be more future-proof.

In this article, I explain how a decreasing term life insurance policy works, some alternative solutions and how to get £100 cashback when you buy life insurance.

What is a decreasing term life insurance?

Decreasing term life insurance policies are designed to pay out in the event that you suffer any of the claimable events included within your policy. Normally the claimable event is death including a diagnosis of a terminal illness (a terminal illness is where a medical professional confirms death is likely within the next 12 months) or a claimable event can include a diagnosis of a serious illness too, such as certain types of cancer. If an event that is covered takes place, the policy pays out a lump sum. As the amount of cover within your insurance decreases over time, in line with your mortgage, the amount paid out will depend on when the claim is made.

The way the level of insurance reduces over time mirrors the way that a repayment mortgage reduces - slowly in the early years and slightly faster as you reach halfway through your mortgage term.

Up to £100 cashback on life insurance

Our partner LifeSearch will help you get the best and cheapest life insurance.

- Search the market and all the leading insurers

- Free advice with no obligation to purchase

- Up to £100 cashback for new customers

How does a decreasing term life insurance work?

When you arrange your mortgage, you will arrange it on an interest-only or a repayment basis. You may also choose an offset mortgage where the amount of your savings determines the interest you pay on your mortgage balance. An offset mortgage does not reduce like a repayment mortgage, so it is usually better to treat it like an interest-only mortgage when assessing your life cover requirements. It is important to understand that a decreasing mortgage life insurance policy should only be used in conjunction with a repayment mortgage. It is not suitable for other types of mortgages, such as an interest-only mortgage or offset mortgage.

How does the decreasing term life insurance policy match your mortgage?

A mortgage-reducing term life insurance policy assumes an interest rate that is normally a higher rate than current mortgage interest rates. Often it is between 8% and 10% - but the exact figure can be found on the insurance quotation or policy documents. Some insurance companies will allow you to choose an interest rate that you are comfortable with. Be careful not to choose a low interest rate as this could leave you with a shortfall of insurance compared with your mortgage balance.

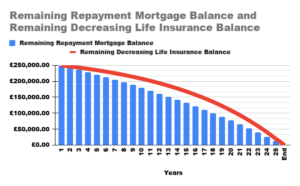

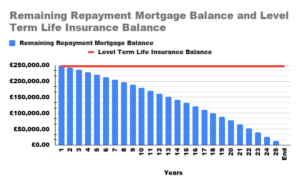

Even with interest rate fluctuations over the years, your mortgage is unlikely to see an average of 8% being applied across the whole term. With a higher interest rate being applied it means that the amount of money that is insured through your insurance policy is reducing roughly in line with your mortgage balance. This creates a little buffer between what is owed on your mortgage balance and what could be claimed from your policy. The first diagram below shows the decreasing term life insurance value compared with the balance of a repayment mortgage over time. You can see that it safely exceeds the mortgage balance at all times. The second diagram shows how a level term life insurance plan would protect a mortgage over time.

How a mortgage reducing term life insurance balance reduces compared with a repayment mortgage balance

The chart below is based on a mortgage value of £250,000 on a repayment basis over 25 years with an average interest rate of 3%. An interest rate of 8% has been assumed for the decreasing term life insurance policy.

How a level term life insurance balance protects a repayment mortgage balance

The diagram below is based on a mortgage value of £250,000 on a repayment basis over 25 years with an average interest rate of 3%. The life insurance cover remains level throughout and pays out the same value if death occurs at any point during the mortgage term. You can see that the level of life insurance far exceeds what is required to repay the mortgage in the later years. This is why a level term insurance policy is usually a more expensive way of insuring a repayment mortgage as it provides a greater amount of cover over time.

Cost of mortgage decreasing term life insurance

The monthly premium is the foremost reason why people choose a reducing term life insurance policy. The monthly premium that you pay for a reducing term life insurance is usually lower, but not always, than the premium for a level term life insurance. This is because the insurance company's level of risk in terms of what it may need to pay out is decreasing over time. Bear in mind that the risk of death and serious illness is greater as we get older. The monthly premium doesn't reduce over time and remains the same throughout the term but it can be cheaper at the outset.

Cost of £250,000 level and reducing life insurance for a repayment mortgage over 25 years for a NON -SMOKER

| Age | Monthly premium for Level Term Life insurance | Monthly premium for Decreasing Term Life insurance |

| 25 years old | £6.15 | £5.27 |

| 35 years old | £11.46 | £7.53 |

| 45 years old | £26.25 | £17.04 |

| 55 years old | £70.12 | £43.31 |

Cost of £250,000 level and reducing life insurance for a repayment mortgage over 25 years for a SMOKER

| Age | Monthly premium for Level Term Life insurance | Monthly premium for Decreasing Term Life insurance |

| 25 years old | £10.22 | £7.38 |

| 35 years old | £22.64 | £13.58 |

| 45 years old | £60.58 | £37.59 |

| 55 years old | £167.72 | £111.40 |

You can see that the level term life insurance is cheaper, on occasion than the decreasing term cover. This is because level-term life insurance is a more popular product bought more often, making it more competitively priced at the lower monthly premium levels. The higher the monthly premium, the greater the difference between the cost of a level and reducing policy. And it is for this reason that you should always ask for a quotation for life insurance on a reducing and a level basis when protecting a repayment mortgage.

The older you are, the more you will pay for your life insurance but adding critical illness insurance can also increase the cost at younger ages.

Cost of £250,000 of life with £100,000 of critical illness insurance over 25 years for a NON-SMOKER - level and reducing

| Age | Monthly premium for Level Term Life insurance |

Monthly premium for Decreasing Term Life insurance |

| 25 year old | £31.48 | £20.54 |

| 35 year old | £69.41 | £44.02 |

| 45 year old | £103.33 | £60.24 |

| 55 year old | £173.46 | £112.73 |

Cost of £250,000 of life with £100,000 of critical illness insurance over 25 years for a SMOKER - level and reducing

| Age | Monthly premium for Level Term Life insurance |

Monthly premium for Decreasing Term Life insurance |

| 25 year old | £31.48 | £20.54 |

| 35 year old | £69.41 | £44.02 |

| 45 year old | £167.15 | £108.86 |

| 55 year old | £312.94 | £208.08 |

Up to £100 cashback on life insurance

Our partner LifeSearch will help you get the best and cheapest life insurance.

- Search the market and all the leading insurers

- Free advice with no obligation to purchase

- Up to £100 cashback for new customers

Checklist - life insurance for your repayment mortgage

Before purchasing a decreasing term insurance policy here checklist of things to run through before making a decision.

- Monthly premium - do ensure that the monthly premium is easily affordable. If buying a level term life insurance pushes your budget then it may be wise to stick to a reducing one.

- Amount - if you wish for the whole mortgage to be repaid in the event of death or a serious illness, ensure that your policy value matches your outstanding debt balance. Protecting a portion of your mortgage is fine as long as you have considered whether the unprotected portion will be manageable for those who are left to fund it.

- Term - try to ensure that the term of the term life insurance policy is the same as the remaining term of your mortgage. This is important whether you choose a level or a reducing type of insurance. Arranging your life insurance over a shorter time period could mean that the value of your reducing insurance will reduce at a faster rate than your mortgage.

- Joint or Single - if you are taking a mortgage on your own and are the only person who is funding it then a single-life policy is normal. But even if you are two people funding the mortgage, it may be worthwhile considering single policies. If you take a single life policy each, you may find the combined monthly premium is not dissimilar to that for a joint life policy. However, a joint life policy will only pay out once and then lapse whereas two single life policies could pay out individually, doubling the level of insurance that you have.

- Trust - arranging a trust around your life insurance whether you choose reducing or level life insurance is almost always a good idea. It allows you to nominate your beneficiaries and any cash sum that is paid out won't get caught up with probate. Ensuring that any insurance payout goes to the right people quickly can prevent financial hardship.

- Critical illness - this option is usually quite expensive to add but that is because you're more likely to claim against it. Suffering a serious illness like a heart attack or cancer can be life-changing and financially difficult. Including some critical illness insurance with your life insurance provides a payment in event that you are diagnosed with a critical or serious illness. The cash sum death benefit could then be used to reduce your mortgage balance and alleviate financial hardship.

- Quotations - ask for a variety of quotes so that you can compare the value of different arrangements. Request single and joint quotes; with and without critical illness insurance; life insurance for the full value with a smaller amount of critical illness insurance and finally, level and reducing options. It is wise to choose the option that provides you with the greatest amount of insurance at a desirable monthly premium.

Should I buy a level or reducing term life insurance to protect my repayment mortgage?

Reasons to choose level term instead of reducing term life insurance for your mortgage

- If the cost of a level policy is almost the same as a reducing term life insurance, it would be unwise to choose the reducing option.

- A reducing term life insurance will protect the mortgage, only paying out a similar amount to your outstanding balance but a level term life insurance will provide extra insurance in time.

Ways that a level term life insurance could add value to your circumstances

- It is easier to build on a level term life insurance if you move house and need to increase your mortgage. Provided the term of the mortgage remains the same, you might keep your original policy which would have been priced at your age and based on your health when you bought it. You would then only have to pay the price at your increased age for the extra amount that you need to protect on your new mortgage. This can be a good bit of forward planning.

- Level term life insurance can be arranged for more than your mortgage value and you may wish to incorporate some family protection within this type of policy by arranging it for a higher sum than your mortgage. This makes a level term insurance policy more versatile for your overall needs if you are considering your mortgage and family.

It may seem like there are a lot of good reasons to choose a level term life insurance policy instead of a reducing one.

However, there are instances where the reducing option is beneficial:

- If you have no other financial concerns beyond your mortgage, it may be best to stick to the reducing term life insurance so long as it is cheaper.

- The lower cost of a reducing policy could leave space in your budget to include some critical illness insurance. It would arguably be better to spend your extra budget to include insurance that will pay out if you become seriously ill rather than upgrading to a level life insurance policy. The incidence of claims for a serious illness diagnosis is significantly higher than that of death.

- If you have other insurance policies in place that already provide sufficient additional life insurance cover

You will find more useful information in our article "What is level term life insurance?"

How to arrange your life insurance for a repayment mortgage

It can often be difficult to work out which type of life insurance is best when assessing your present needs as well as keeping one eye on the future. Life insurance gets more expensive as you get older and if your health deteriorates it can make it even more expensive and in some cases difficult to arrange. Where you can, try to factor in those things that may be in your plans for the future such as a family, a bigger house and a larger mortgage.

At the same time, it is vital that what you arrange remains affordable to you over a long period of time so you shouldn't overcommit yourself.

Speaking to a specialist life insurance adviser can give you a chance to reflect on all your options and benefit from some steer. At Money to the Masses, we have vetted the services provided by a specialist life insurance advice company. The advisers are well trained to understand different circumstances and provide regulated advice on the best options for you. They can help you to use your budget wisely, maximising your insurance and creating some future-proofing within your solution when they present the life insurance quotes. They will also provide you with invaluable guidance to arrange a trust which will ensure that any claim is paid to the right people, speedily.

If you would like to arrange to speak with an adviser, just complete the form* and one will be in touch to start a conversation.

As a Money to the Masses reader, you'll receive up to £100 cashback when you arrange your policy.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses and do not wish to qualify for the cashback referred to in the article - LifeSearch