You might have more than one tax code if:

- you have two or more jobs at the same time

- income from more than one pension

- income from a combination of pension(s) and job(s)

Understanding tax codes from different jobs and pensions

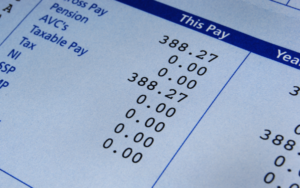

Tax codes tell HMRC how much you can earn before paying tax and as such are extremely important in ensuring that you pay the correct amount of tax using all the allowable earnings threshold that are relevant to you. Here are some of the key things that you should understand about tax codes if you have more than one income stream:

- you should get a separate tax code for each job or pension

- your personal allowance will normally apply to your primary job or pension

- if you pay basic rate tax (20%) you will be given a 'BR' code for your second job or pension and pay basic rate tax on that income

- if you pay higher rate tax (40%) you will be given a 'D0' code for your second job or pension and pay higher rate tax rate (40%) on that income

- if you pay additional rate tax (50%) you will be given a 'D1' code for your second job or pension and you will pay additional rate tax on that income

Avoid paying too much tax by sharing your allowance

- if you are not using up all your allowance on your main job then you should inform HMRC to use what is left on your second job or pension

- failure to do this could result in you paying too much tax

If you want to understand more about tax codes then visit, "Income tax rates and personal allowance".