Following the recent turmoil in financial markets, and the resulting drop in portfolio values, I asked myself the question - Is investing just a sophisticated form of gambling?

Following the recent turmoil in financial markets, and the resulting drop in portfolio values, I asked myself the question - Is investing just a sophisticated form of gambling?

Both these activities can result in big gains as well as big losses; so what's the difference? Below I give my view on what separates an investor from a gambler.

Risk

Risk taking is intrinsic in both gambling and investing. There are a few investments that entail minimal risks, such as fixed annuities and government bonds held to maturity, but even these have inflation risk (unless index-linked) and some would argue that taking a bet on certain sovereign debt is a gamble in itself!

So what is the difference between an investor and a gambler? One difference between the two groups is the participants' willingness to accept risk.

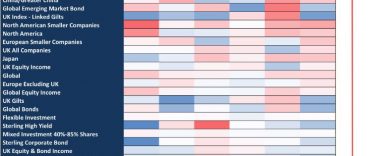

In my view a person placing his money in a well constructed portfolio is investing, whereas a person putting his money into the share of one company is gambling. Both these investments can lose money but the risk is higher for the second person due to his single investment focus.

Term

Investors want to build their wealth over a longer time-frame. They are prepared to weather the ups and downs of their investment over a period of time.

Gamblers, however, are looking for a quick return on their money. If the market turns against them then they immediately look to invest elsewhere.

Review

Investors are confident of their strategy and can ride out the ups and downs without panicking and review their investments every 6-12 months. Gamblers need to keep a close eye on their investments to be ready to move when an opportunity, or disaster, arises and therefore need to monitor things minute by minute.

Approach

An investor will have confidence in their approach over the long term but a gambler will change their approach constantly in the hope of finding a winning formula. Gamblers are compulsive as are their actions.

Leverage

Investors will normally be investing their own capital whereas gamblers frequently use leverage to try and maximise their gains. Leveraged products such as spread betting will allow an individual to take a bigger position in the market than their capital would normally allow. This approach would give a much greater 'upside' to their investment but could wipe out their capital if the markets move against them.

Fundamentals

Investors prefer to understand the fundamentals of the business or fund in which they are investing as they are planning to invest for the long term. Gamblers, on the other hand, tend to favour technical analysis of the product's performance over the short term, relying on the past history to predict the future or even worse just heresay.

So are you an investor or a gambler?

It's vitally important that you can distinguish investment from gambling in your approach to increase your capital. The media is full of advertising for share trading or spread betting products that can help you make money, but these products are a form of gambling. The risks are high and the losses could be massive, damaging or even wiping out your capital; remember Nick Leeson? Investing everything in a single product or asset class is also a risky strategy, you are gambling that your chosen vehicle performs well but could risk everything if does not.

Sound investment is a medium to long term strategy and aims to increase your capital using a 'balanced portfolio' approach. This will protect your investment against poor performance in one asset class, or product, and should produce long term growth. Well that's the theory anyway....