In this independent Flagstone* savings review, we look at how the Flagstone savings platform works, what savings rates are on offer and how it compares to other savings platforms in the UK. While we suggest you read the article in full, you can find the main sections of our review using the jump links below.

In this independent Flagstone* savings review, we look at how the Flagstone savings platform works, what savings rates are on offer and how it compares to other savings platforms in the UK. While we suggest you read the article in full, you can find the main sections of our review using the jump links below.

- How does the Flagstone savings platform work?

- Which savings products does Flagstone offer?

- Does Flagstone charge a fee?

- Is Flagstone safe?

- Pros and Cons of using Flagstone

- Flagstone customer reviews

- Flagstone alternatives

- Flagstone summary

1 minute summary - Flagstone savings platform review

- Access to hundreds of savings accounts from more than 60 different banking partners

- Manage all of your savings accounts from one secure online login

- Open and individual or joint account* (Minimum £10,000 deposit required)

- Best short-term interest rate – 4.57% (95 days notice)

- Best long-term interest rate – 4.33% (3 year fixed term)

Interest rates correct at 02.01.25

What is Flagstone?

Flagstone describes itself as the ‘UK's leading cash deposit platform' and its company goal is to be “the trusted protector of the UK's cash deposits“. In the midst of the financial crisis, its co-founders, Andrew Thatcher and Simon Merchant, had a vision to upset the status quo by finding a more efficient way to achieve better returns for their clients, while ensuring that their cash was protected.

Flagstone now has over £13bn in assets under administration, and gives its 725,000 clients access to hundreds of savings accounts from more than 60 banking partners.

How does Flagstone work?

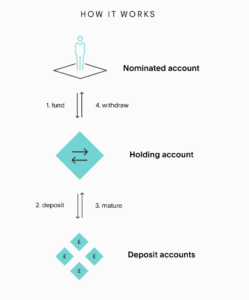

Flagstone is a cash deposit platform where customers can access multiple savings accounts via a single online savings platform. You'll need to be over 18 and be prepared to deposit at least £10,000 in order to open a Flagstone account. Customers can choose to open an individual or joint account and once the funds have been transferred to the Flagstone holding account, customers can browse, open and manage as many savings accounts as they wish.

Flagstone holding account explained

The Flagstone holding account is a secure hub where customer funds are held until you transfer them to your chosen savings accounts. It is provided by HSBC and it is the account to which any withdrawals or matured funds are returned. So, at the maturity of a fixed-term deposit account, or when an instant access account or notice account is closed, the holding account is where the principal sum (plus any interest that has accrued) is returned. Once funds have been returned to the holding account, customers are free to withdraw them to their nominated bank account, or of course, customers can also choose to deposit the money in another savings account of their choosing.

Which savings products does Flagstone offer?

Flagstone features savings products from around 60 partner banks and building societies. At the time of writing, savings products were being offered by the following banks and building societies:

| Al Rayan Bank | Aldermore | Allica Bank | Allied Irish Bank | Alpha Bank | Bank ABC |

| BLME | Cambridge & Counties | Castle Trust Bank | Cater Allen | Charter Savings Bank |

Europe Arab Bank

|

| FCMB Bank UK Ltd | FirstBank UK | Gatehouse | Hampden & Co | Hampshire Trust Bank | ICICI Bank |

| iFast Global Bank Ltd | IsBank | Kent Reliance | Kingdom Bank | Kroo Bank | LHV Bank |

| Mizrahi Tefahot Bank | National Bank of Egypt | Nationwide | OakNorth | Principality | Reliance Bank |

| Sainsbury's Bank | Santander International | Shawbrook | SmartSave | State Bank of India |

The Bank of London

|

At the time of writing, Flagstone offers the following products:

- Instant Access savings account

- 30 days notice account

- 32 days notice account

- 35 days notice account

- 45 days notice account

- 65 days notice account

- 90 days notice account

- 95 days notice account

- 120 days notice account

- 180 days notice account

- 1 month fixed term accounts

- 2 month fixed term accounts

- 3 months fixed term accounts

- 6 months fixed term accounts

- 9 months fixed term accounts

- 12 months fixed term accounts

- 15 months fixed term accounts

- 18 months fixed term accounts

- 2 year fixed term accounts

- 3 year fixed term accounts

- 4 year fixed term accounts

- 5 year fixed terms accounts

- 7 year fixed terms accounts

Users can filter the results either by product type or by rate. The interest rates on offer currently range from 1.10% per annum to 4.60% and the minimum deposit amount ranges from £1,000 to £75,000. Click the link to check out the latest Flagstone interest rates available*.

Does Flagstone charge a fee?

Flagstone does not charge any administration or management fees. Instead, Flagstone receives a share of the interest on each savings account opened (up to a maximum 0.30%). The rates that are displayed on the Flagstone platform are the rates that the customer will receive as these have already had a share of the interest deducted. As with any savings product, the savings rates you qualify for may depend on your personal circumstances and the type of account you choose.

Is Flagstone safe?

One of the benefits of spreading money across multiple savings accounts is that it can maximise your FSCS protection. The Financial Services Compensation Scheme (FSCS) covers money held in regulated UK current accounts, savings accounts and credit unions. This means that if your bank, building society, or credit union goes bust, the money held in the account is protected up to £85,000 per individual, per banking group and up to £170,000 per banking group for joint accounts.

Flagstone is not a bank, however, when you deposit money onto the Flagstone savings platform, it will sit in a holding account operated by HSBC until you are ready to move your money on. This means that eligible funds are still protected under the terms of the FSCS even when being transferred between savings products. Some banks and building societies operate multiple brands under the same banking licence, so make sure that you check where your money is held and how much protection you have. A good example is First Direct and HSBC, as they both share the same banking licence you would only be covered as an individual up to £85,000 across both banks. If you need further guidance, you can check out our article where we explain more about the Financial Services Compensation Scheme. Flagstone Group Ltd is authorised by the Financial Conduct Authority (Reference Number 605504) under the Payment Service Regulations 2017 for the provision of payment services.

Pros and Cons of Flagstone

Pros

- Spread your savings across multiple providers

- Simple set-up process requiring only one login

- Access to hundreds of savings products from 60+ banking partners

- Savings covered under the normal FSCS rules

Cons

- You'll need a minimum £10k to open an account with Flagstone, which is much higher than the likes of Raisin and Hargreaves Lansdown Active Savings

- While there is a lot of choice, Flagstone does not provide access to the whole savings market

- Using a savings platform such as Flagstone does not guarantee access to the best interest rates in the market

- Some savings rates on Flagstone may be lower than if you went to the bank or building society directly

Flagstone customer reviews

Flagstone is rated as ‘Excellent' on independent customer review site Trustpilot, with a total score of 4.5 out of 5.0 from over 2,900 reviews. Many of the positive reviews mention how easy the service is to use and that it takes all of the hassle of having to manage multiple accounts via multiple logins. Some of the negative reviews have mentioned delays in trying to open an account and some processing delays when depositing money with banking partners.

Alternatives to Flagstone

Flagstone is one of a number of cash savings platforms in the UK and so you may wish to check our comparison of the best UK savings platforms, including the likes of Raisin, Hargreaves Lansdown Active Savings, AJ Bell cash savings Hub and finally Saga, a savings platform that is powered by Flagstone.

Alternatively, if you are happy to source the best savings rates yourself then check out our regularly updated summary of the best savings accounts in the UK. Keep in mind that finding and opening savings accounts this way will mean that you will be fully responsible for all of the administration.

Should you use Flagstone to save money?

Flagstone* may suit those looking for a quick and easy way to boost the interest they receive on their cash. The Flagstone savings platform has a straightforward signup process and may be good for those seeking a hassle-free way to manage multiple savings accounts. Customers can browse, open and manage savings accounts via one single login, moving money in just a few clicks.

It is worth keeping in mind that Flagstone does not cover the whole savings market and so there may be better rates available if you're willing to search around. It is possible, therefore, that the rate you get via Flagstone may not be as good when compared to applying to a bank or building society directly. This is because Flagstone shares some of the interest you earn. The rate you see on the Flagstone platform will always be the rate that you receive, so it is easy to check if you are getting the best rate.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers – Flagstone