In this independent review, we take a look at online investment platform IG. We'll explore its key features, fees, and pros and cons. We'll also explain how it compares to alternatives such as Freetrade*, eToro* and Trading 212.

In this independent review, we take a look at online investment platform IG. We'll explore its key features, fees, and pros and cons. We'll also explain how it compares to alternatives such as Freetrade*, eToro* and Trading 212.

What is IG?

Established in 1974, IG is an online investment platform best known for its leveraged trading services including CFD trading and spread betting. It also offers a Stocks and Shares ISA and SIPP where investors can create their own portfolios as well as invest in a number of diversified 'smart' portfolios. It has around 346,000 active clients worldwide and manages around £2.8bn in customer assets.

With IG, you can access more than 17,000 markets and the platform may be a good option for beginner investors with a longer-term outlook as well as traders looking to take higher risks.

What are the key features of the IG investment platform?

- No minimum deposit is required to open an account

- Invest and trade either via desktop or mobile app

- Invest in a Stocks and Shares ISA

- Choose from five ready-made portfolios based on your risk profile

- Open a free demo account to learn the basics of trading and practice with £10,000 in "virtual funds"

- Learn the ins and outs of trading and investments with free courses and webinars hosted on IG Academy

- CFD trading and spread betting (these are high-risk investments; around 70% of retail investors lose money when trading spread bets and CFDs with IG)

- Benefit from negative balance protection when trading CFDs and spread betting

- Pay low or no commission fees if you make a certain number of trades each month

What products and services does IG offer?

IG offers a range of products and services including tools to help customers analyse investments, learn about trading and trade efficiently. Below, we explore key products and services like the free IG Academy and demo account, the extended hours feature, the Stocks & Shares ISA, the SIPP, and share dealing account on offer by IG.

IG Academy

IG Academy is designed to help new investors as well as more advanced traders with a range of free courses and live sessions. The online courses cover a range of topics including the basics covering how financial markets work as well as more niche topics such as the advanced course on using stop and limit alerts to manage risk. There are also interactive exercises and quizzes to help check your knowledge along the way.

IG Academy hosts regular live sessions and webinars where IG's experts share their knowledge and conduct Q&A's.

IG demo account

IG's demo account is a good way to practice what you've learned via the free IG Academy courses. You can create a demo account on the simulated platform in seconds by filling out a simple form via the website.

You'll then be given £10,000 in "virtual funds" to help you learn how to use the platform and place trades in a simulated environment. You can practice CFD trading and spread betting, as well as stock trading and forex trading.

Extended trading hours

IG provides out-of-hours trading for selected markets like indices, shares, and forex. The extended hours on offer depend on the type of market you wish to invest in. For example, if you're looking to make investments on the US stock exchange, then this is normally available from Monday to Friday between 2.30 to 9pm UK time. However, with IG, you can buy and sell shares between 9am to 2.30pm and then 9pm to 1am UK time during the week. You can also trade shares with derivatives outside of normal trading hours. These are referred to as pre-market and post-market trading hours.

Similarly, IG offers extended hours for trading stock market indices. Indices are normally only available to trade during normal index hours. This can be particularly challenging if you're interested in the Hang Seng (Hong Kong Stock Exchange), which is only available between 1.30am and 9am on Monday to Friday, for example. With IG, you can trade major indices 24/7 with some exceptions, for example:

- The FTSE 100 - Available 24/7 except between 10pm on Friday and 8am on Saturday

- S&P500 - Available 24/7 except between 7am on Saturday and 8am on Monday

- Hang Seng - Available 24/7 except between 7am on Saturday to 6am on Monday

These are just a few examples of the extended hours trading available with IG. As you can see, the exact hours will vary depending on the index.

IG Stocks & Shares ISA

IG offers a flexible Stocks & Shares ISA that allows customers to withdraw funds without withdrawals counting towards their £20,000 annual allowance. You can also choose to transfer an existing ISA to the IG Stocks & Shares ISA.

When you set up your ISA with IG, you'll need to choose between the following two investment options:

- Share Dealing ISA - This option allows you to choose your own investment from more than 17,000 stocks and ETFs. US shares are commission-free if you make more than three trades per month, and UK shares cost £3 if you make more than three trades per month.

- IG Smart Portfolio ISA - This option allows you to select an expertly built, ready-made portfolio to invest in. IG Smart Portfolios cost from 0.50% per year and are capped at £250 per account type.

You can also choose to invest some of your allowance in shares of your own choice and the remainder of your allowance in an IG Smart Portfolio. Setting up an IG ISA is free and commissions are in line with IG's general fee structure which is outlined in the fees section below.

IG Self-Invested Personal Pension (SIPP)

IG offers a Self Invested Personal Pension in partnership with Options UK. Once you create your IG account, you'll be able to add a SIPP account through the IG dashboard.

You'll then receive instructions from Options UK to help set up your new SIPP account. You'll need to pay a flat, third-party annual administration fee of £210 to Options UK as part of your subscription.

Much like the IG ISA, you'll be able to build your own portfolio by choosing from more than 13,000 individual shares, funds and investment trusts via an IG Share Dealing SIPP. Alternatively, you'll be able to choose one of IG's ready-made portfolios to get access to a variety of bonds and shares.

IG Share dealing account

If you've exhausted your ISA allowance for the tax year, you may choose to open an online share dealing account with IG. This gives you the same exposure to a wide range of stocks and ETFs, with the same commission structure. However, while the gains you make within an ISA are tax-free, with a share dealing account you'll need to pay taxes on your profit.

What can you invest in with IG?

You can invest in a range of assets and derivatives with IG. Some key markets on offer include:

- Shares

- Forex

- Indices

- Commodities

- ETFs

- Options

- Futures

- Bonds

Below, we'll take a look at the Smart Portfolios and ETFs on offer through IG.

IG Smart Portfolios

IG offers five "smart" ready-made portfolios based on your risk profile. The portfolios are designed by BlackRock but managed by IG. They are designed exclusively using BlackRock's iShares ETFs which have been selected for their long-term growth potential and low fund charges.

The portfolios are also diversified and designed to expose your funds to global markets such as fixed income and equity, for example. They are constantly rebalanced and actively managed by the IG team, however they broadly fall into five risk categories:

- Conservative

- Moderate

- Balanced

- Growth

- Aggressive

The "Conservative" portfolio represents the lowest risk, while the "Aggressive" portfolio represents the highest risk. The table below sums up IG Smart Portfolios' performance over the last five years.

IG Smart Portfolio performance

| Fund name | 2023 | 2022 | 2021 | 2020 | 2019 |

| Conservative | +4.3% | -5.6% | -0.4% | +2% | +3.6% |

| Moderate | +6.0% | -9.4% | +3.4% | +7.4% | +10.0% |

| Balanced | +8.9% | -11.4% | +8.8% | +9.2% | +14.1% |

| Growth | +10.8% | -11.9% | +13.5% | +11.4% | +17.0% |

| Aggressive | +12.5% | -12.2% | +18.2% | +10.9% | +19.4% |

The IG Smart Portfolio fee starts at 0.5% but is capped at £250 per year per account.

Trading with IG

Traders can trade CFDs and partake in spread betting with IG. Both spread bets and CFDs are highly volatile and complex instruments that come with high potential rewards, but more often significant losses. IG states that 71% of retail investors lose money when trading spread bets and CFDs with their platform.

It might be worth opening a demo account to try out CFDs and spread betting in a simulated environment first. Even if you have experience with these instruments, the simulated demo account can help you get used to the platform.

CFD trading

CFD trading allows you to speculate on whether an asset's price will go up or down. You don't need to own the asset, CFD trading is the process of exchanging the difference in price from the point at which the contract is opened to when it is closed. With IG, you can trade CFDs on more than 17,000 different markets, some of which include shares, indices, and forex. IG also offers negative balance protection for trading-related debt, but this is only available to retail investors.

Spread Betting

Spread betting is a speculative type of trading that allows you to bet on whether an asset's price will rise or fall. In the UK, profits derived from spread betting are tax-free. Another key difference to CFD trading is that all spread bets have a fixed expiry date.

With IG, you get other benefits like access to more than 17,000 markets as well as negative balance protection for retail investors. With this type of investment, your balance could theoretically fall below zero, however, IG ensures that this does not happen. Therefore, you'll never lose more than what you've put in.

How much does IG cost?

The tables below provide a breakdown of IG's costs. If you intend to make more than three trades a month, IG's fees fall significantly. For example, traders who make more than three trades a month get commission-free trading on US shares. In addition to this, commissions on UK shares fall from £8 per trade to £3 per trade.

IG Trading Fees

| 0-2 Trades in the previous month | 3+ Trades in the previous month | Deals by phone | |

| UK shares | £8 | £3 | £40 |

| US shares | £10 | £0 | £50 |

| European shares | 0.1% | 0.1% | £50 |

| Australian shares | 0.1% | 0.1% | A$50 |

The table below sums up some of the additional fees you can expect to pay if you choose IG to trade and invest. Making at least three trades per quarter means your custody fees will be waived.

IG Other Fees

| Description | Fee |

| Foreign exchange fee | 0.50% |

| Custody fees | £24 (or £0 if you place at least 3 trades per quarter) |

| Standard bank transfer | Free |

| Same day bank transfer | Free for transfers over £100, or £15 for transfers under £100 |

| IG Smart Portfolio management fee | From 0.50% capped at £250 per year per account |

| Options UK SIPP administration fee (third-party) | £210 |

IG will convert currencies at the time of execution based on the best available exchange rates. In addition, it applies a 'spread' which equates to a fee of 0.5%.

For a more comprehensive look at IG's fees and how they're likely to affect you, check out the fees page on the IG website.

Does IG pay interest on cash held in its accounts?

IG doesn't pay interest on cash held in its accounts. The provider says that the aim is to invest all of your available money quickly meaning that there shouldn't be any cash left in your account for long enough to accrue interest. If you're looking for a provider that pays interest on cash balances, you may want to look at alternatives like Trading 212 where you can earn 5.2% interest on your GBP cash balance or Freetrade which pays as much as 5% on balances up to £3,000.

How to open an IG account

Opening an IG trading account is a fairly straightforward process that should only take a few minutes to complete. From the IG home page, click "create live account" to launch the application form.

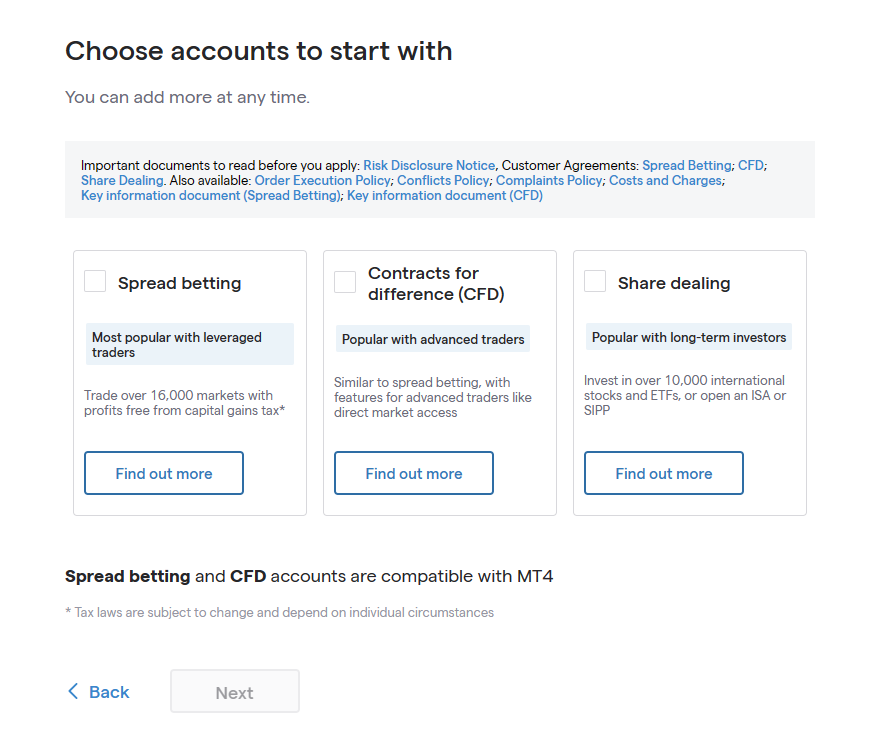

You'll then need to fill out the questions with your personal and contact details. You'll also need to create a username and password. You'll then need to select which live accounts you'd like to apply for. There are three to choose from and they include:

- Spread betting - This option could work well for leveraged traders who are happy to take high risks. 71% of retail investor accounts lose money when trading spread bets with IG. You can trade more than 17,000 markets with a spread betting account.

- Contracts for Difference (CFDs) - This option could work well for advanced traders who are happy to take high risks. 71% of retail investor accounts lose money when trading CFDs with IG. You can trade more than 17,000 markets with a CFD account.

- Share dealing - This option works best for long-term investors who aren't interested in day-to-day trading. With this option, you can invest in more than 10,000 international stocks and ETFs, and you could do so within a SIPP or ISA if you want to benefit from a tax-wrapper account.

The screenshot below shows what the application form looks like. You can apply for all three accounts or if you prefer, you can add other accounts at a later stage.

After you've selected which accounts you'd like to apply for, you'll need to answer a few questions about your tax residency, nationality, and current address. You'll then need to fill out information about your current employment and financial situation, including your gross annual income and any savings and investments you have. You'll also need to explain how you plan on funding your investments.

Then comes the "Experience" section, where you'll need to select how many times you've traded and invested various assets and derivates in the last three years. You'll also be asked whether you've received advice when you've traded these products previously and whether you have any experience or qualifications you've garnered through work, training, or education to help you trade.

Once this step is complete, you'll be asked to agree to the terms and conditions and then you can go ahead and submit your application. Your accounts will be created right away, but then you may need to complete further steps to activate your CFD and Spread bet accounts if you've selected these options.

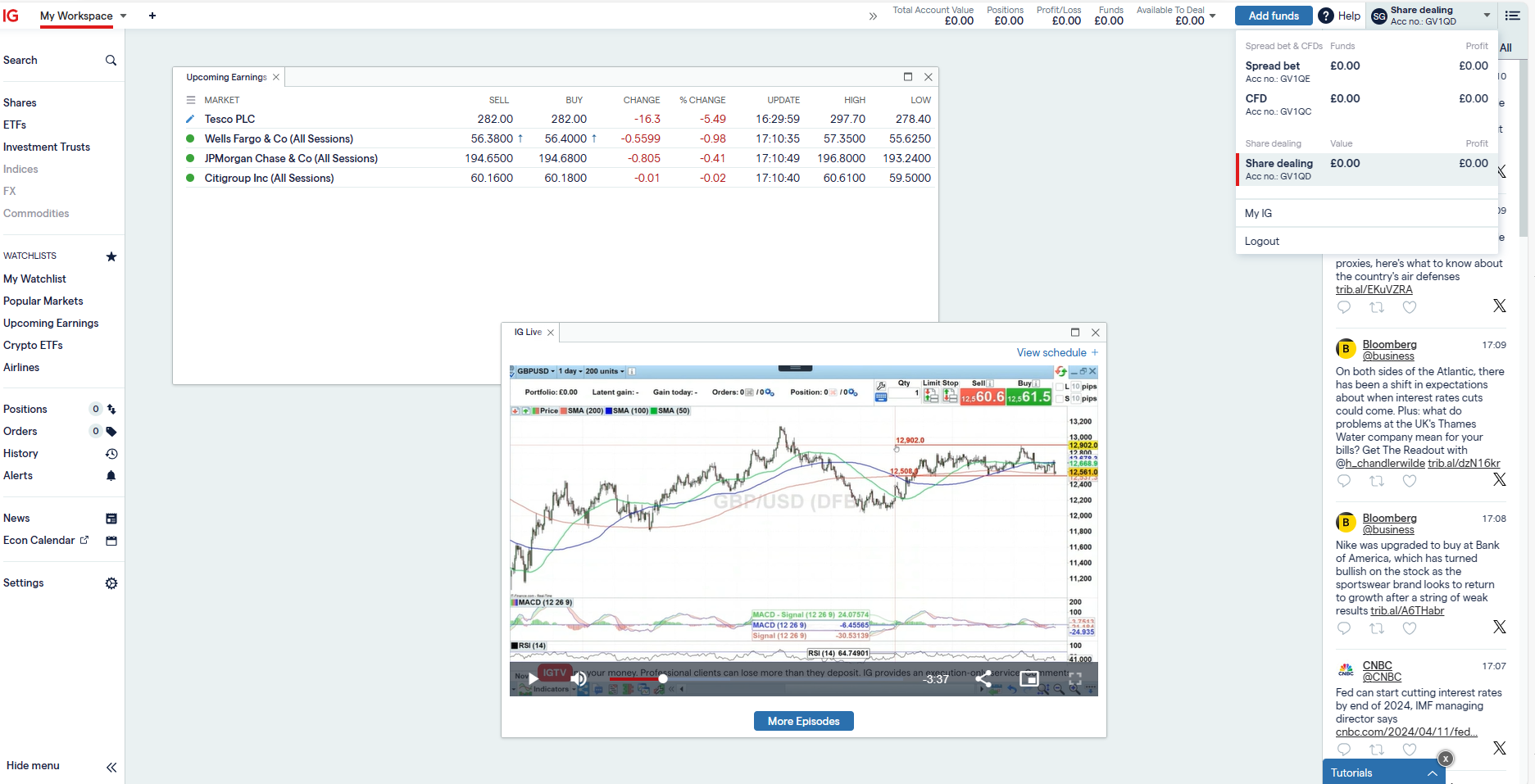

The screenshot below shows what your dashboard will look like once you've applied for your live accounts. As you can see, the Spread bet and CFD accounts are "pending", while the Share dealing account is active.

We also activated demo accounts where we can play around with virtual funds to learn more about CFDs and Spread bets. This can also be seen in the screenshot below.

In order to activate the Spread bet and CFD accounts, you'll need to demonstrate your knowledge. This involves completing free courses via IG and then completing a quiz. If you believe you already have the required knowledge, you can skip straight to the test. You may also need to send through documentation to prove your identity as part of activating your account.

Once you've completed these final steps, you'll be able to access the dashboard by pressing the "open platform" button. You'll then be taken to the main dashboard.

Via the dashboard, you'll be able to keep up to date with the latest news through IG live as well as the X feed. You'll also be able to toggle between your different accounts (Spread bet, CFD, and share dealing).

Alternatives to IG

While IG offers a range of trading options and resources for traders and investors alike, there are plenty of alternatives that you may want to consider before making your decision. Below, we take a look at Freetrade*, Trading 212 and eToro* to see how they compare to IG.

IG vs Freetrade

Freetrade* offers lots of ways to invest, including ISAs, SIPPs, and General Investment Accounts. Its General Investment Account is free and it also offers commission-free trading. Freetrade is best suited to those who wish to invest in stocks and fractional shares. It does not offer CFD trading, so may not be suited to trades looking for this option.

Check out our independent Freetrade review if you want to find out more about this platform.

IG vs Trading 212

Like IG, Trading 212 lets you trade a range of assets and derivatives including CFDs. Unlike IG, Trading 212 is commission-free regardless of how much trading you do. You don't need to meet any minimums to benefit from free trading. In addition, with Trading 212, you can earn 5.2% interest on your uninvested cash. Trading 212 also offers a Stocks and Shares ISA for those who want to hold their investments in a tax wrapper.

Check out our independent Trading 212 review if you want to find out more about this platform.

IG vs eToro

Like IG, eToro* allows customers to trade CFDs among 5,000 other assets and derivatives. Investing in some assets, like stocks and ETFs, is commission-free. For others, like crypto, there's a 1% buy or sell fee. There is also an inactivity fee of $10 per month if your account is inactive for more than a year. However, unique features like CopyTrader that allow you to copy the trades of investors you trust in real time make it a popular choice for some.

Check out our independent eToro review if you want to find out more about this platform.

IG customer reviews

In 2024, IG is rated "average" on Trustpilot with a 3.6 out of 5.0 score based on around 7,000 reviews. Approximately 54% of customers gave IG a 5-star rating, while 18% gave it a 1-star rating. Among those giving IG a 5-star rating, reviewers praise the platform's efficiency and reliability. Others praise the customer service quality at IG. Those giving it a 1-star rating complained about issues with account creation and getting locked out of the platform as a result of technical difficulties. Some complained about the poor level of customer service they experienced.

IG Pros and Cons

Below, we sum up the pros and cons of opening an IG account.

IG Pros

- Free online courses and webinars via the IG Academy feature

- Free demo account with $10,000 virtual funds to practice CFD trading

- Five IG Smart Portfolios for novice or passive investors who prefer a ready-made option

- Opportunity for extended trading with weekend trading and out-of-hours trading

- Negative balance protection for spread betting and CFDs

IG Cons

- No interest is paid on uninvested cash held in your account

- You need to make several trades to benefit from lower (or no) fees

- £24 custody fee unless you make three trades per quarter or have £15,000 invested in an IG Smart Portfolio

Summary

IG offers investors the best of both worlds with passive or inexperienced investors able to opt for ready-made portfolios and more experienced or active investors able to pick their own investments including derivatives like CFDs. If you're a beginner, the IG Academy and demo account are excellent, free resources to help you develop your skills further.

That being said, IG might not be as competitive as other platforms that offer commission-free trading and interest on uninvested cash and so it may be worth checking out Freetrade, eToro or Trading 212 first. Fees are lowered or waived in some cases if a certain trade volume is reached, but this might not appeal to occasional investors who won't rack up the volumes required.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers – eToro, Freetrade.