Flexibility is key when it comes to planning your retirement, but what happens if you want to invest in - or inadvertently end up having - more than one Self Invested Personal Pension (SIPP)? Whether you are looking for different investment options, cheaper fees or perhaps you want to take advantage of a sign-up offer with a specific SIPP provider, the idea of having multiple SIPPs could be attractive. In this article, we'll explain whether it's possible, including the pros and cons you should consider before making a decision.

What is a SIPP and how does it work?

A SIPP or Self Invested Personal Pension gives you control over how your pension savings are invested. The difference between a SIPP and a traditional personal pension is that with a SIPP you can make your own investment decisions whereas with a personal pension you are limited to investing in the pension company's own funds.

What can I invest in with a SIPP?

With a SIPP you can invest in funds, unit trusts, shares and Open-Ended Investment Companies (OEIC) with your investments growing free of UK income tax and Capital Gains Tax (CGT).

Will I get tax relief on my contributions to a SIPP?

A SIPP or self-invested personal pension is a tax-efficient way to start saving for your retirement. SIPPs give you control over how your pension savings are invested and your savings generally grow free of UK income and capital gains tax. Any contributions to a SIPP (up to the annual allowance of £60,000 or 100% of your earnings, whichever is lower) will receive basic rate tax relief from the government of 20%. The effect of this tax relief is to increase the contributions to your SIPP. Higher or additional rate taxpayers can claim an extra 20% or 25% more tax relief through their annual tax return.

Who can contribute to a SIPP?

Contributions to a SIPP can be made by yourself, an employer or someone else on your behalf and you can also transfer existing pensions to a SIPP.

You must be under the age of 75 to make contributions to a SIPP and if you do not have any earnings, you can still contribute up to £2,880 net each year (and receive up to £720 tax relief). A parent or guardian can start a Junior SIPP for the benefit of a child and can contribute up to a maximum of £2,880, again, attracting tax relief up to £720, however, they will not be able to access this pension until they are 55. To read more about Junior SIPPs, check out our article 'What is a Junior SIPP: Children's pensions explained'.

How much can I contribute to a SIPP?

Anyone who is a UK resident or their spouse or civil partner can contribute up to 100% of their annual income into a SIPP each year, up to the maximum annual allowance of £60,000 (until the age of 75). Pension benefits can be accessed from the age of 55 and all pension benefits (apart from 25% of the fund which is tax-free) are taxed at the recipient's marginal rate of tax.

Can I have more than one SIPP?

Yes, you can have more than one SIPP and many people have a SIPP or multiple SIPPs alongside a workplace pension. Below we provide the pros and cons of having more than one SIPP.

Pros and Cons of having multiple SIPPs

Pros

- access to another provider with a different charging structure, available investments or tools to help with investment decisions

- it may also be that you feel more comfortable from a security viewpoint if you have your investments across more than one provider

Cons

- there are management charges and other fees associated with a SIPP so having multiple SIPP accounts will mean more fees which will have an effect on your pension investments over a number of years

- having multiple SIPP accounts will increase the admin you will have to do in order to keep track of your investments, allowances and overall performance.

How much should I contribute to a SIPP?

The level of your contributions will depend on your age, when you want to retire and the income you want in retirement.

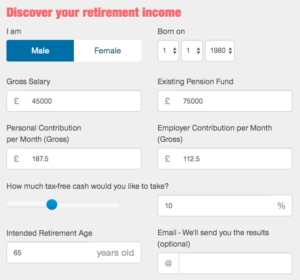

We have created this handy retirement income calculator that can help you work out the amount you need to save to reach your retirement goals.

How do I choose the best SIPP for me?

Our article, 'The best & cheapest SIPPs' is essential reading if you want to find the best SIPP for you. It explains SIPPs in more detail, as well as a detailed list of UK SIPP providers including the features and fees that will enable you to make an informed choice.

We have also created a SIPP Best Buy Table which provides the details of the main SIPP providers in the UK.