What is Xero?

What is Xero?

Xero is an online accounting software platform, perfectly suited to small or medium-sized businesses. Whether you are a retailer, manufacturer or startup, Xero can help you take control of your finances and say goodbye to those hours spent poring over paperwork trying to balance the books.

Founded in 2006 Xero now employs over 4,000 people and has 3m business subscribers in more than 180 countries. Xero accounting software is constantly innovating to keep up with the changing world of finance and financial accounting, making life easier for small medium-sized businesses.

Xero features

- Invoicing - easily send and pay invoices online

- Bank connections - connect to your bank accounts

- Login securely - all of your personal business account information is kept secure with extra layers of security

- Project tracking - track the time and money spent on projects

- Inventory - manage stock, invoices and orders

- Pay bills - use Xero to pay bills and reduce office admin

- Mobile app - manage your Xero account when you're not in the office

- Bank reconciliation - keep track of spending with Xero

- Payroll - pay staff, run reports and send payslips

- Dashboard - a central dashboard for all the key information about your business

- Xero Expenses - manage, record, claim and log receipts all in one place

- Quotes - Create professional looking quotes

- Purchase orders - Keep track of orders and purchases

- Business performance dashboard - keep up to date with how your business is performing

- Fixed assets - manage your business' fixed assets

- Reporting - Create financial reports and budgets

- Multi-currency - easily keep on top of multiple currency transactions

- Contacts - have all of your contacts and details in one place

- Search tool - search for any feature you need within Xero

- Accept Payments - accept payments from PayPal and Stripe

- Files - store all of your files in one place

- VAT online - process VAT online

How does Xero work?

Connect to your bank accounts

The first thing to do once registered is to decide on a start date and set up the direct bank feeds from your bank, credit card or PayPal account. This process is simple taking only a few minutes for all of your business transactions to be securely imported each day.

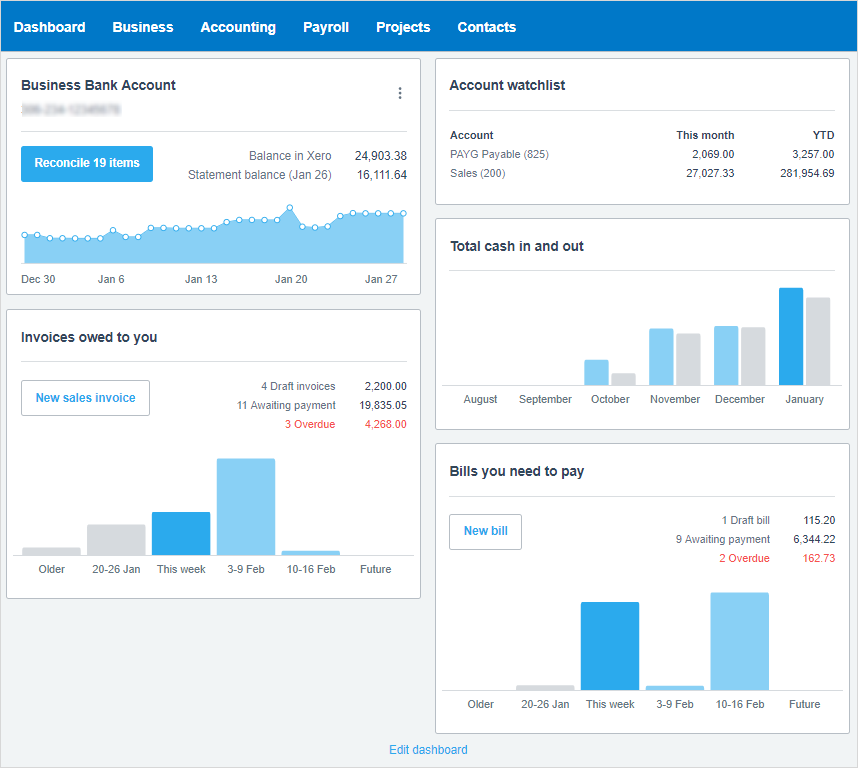

Customise the Xero dashboard

The Xero dashboard is the main hub of the whole Xero accounting software. The Xero dashboard can be customised to show the key areas that are of primary importance to your business.

You can add or subtract any of the following sections in the dashboard.

- Total cashflow or Total cash in and out - cash flowing in and out of your business

- Account Watchlist - you can highlight any account in the watchlist that you want to keep an eye on e.g. sales or general expenses

- Bank Accounts - you can show all or just some of your bank accounts

- Invoices owed to you - summary of the invoices owing to you, and how long they've been outstanding based on the due dates of sales invoices you've sent to your customers

- Bills you need to pay - A graphical snapshot of the bills you need to pay, and when you need to pay them

- Expense Claims - keep track of all expense claims

- Business performance graphs - if any business performance reports are favourited they will show in the main dashboard

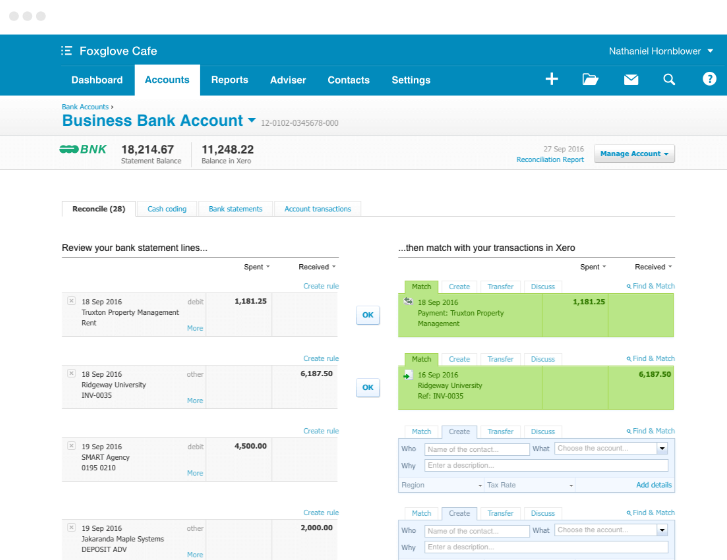

Reconciling transactions

This is the heart of the Xero accounting software where you can reconcile all the transactions in your various bank accounts in minutes.

Once your bank account feeds have been set up, all transactions will appear under the various bank account headings with the name of the source company/individual already showing. You can now reconcile these transactions by either matching them to existing transactions (payments received or invoices sent) or creating a new transaction.

As you reconcile each transaction, it can be allocated to an account. Once done, you can note the tax rate and provide a more detailed description if required. Once all transactions have been reconciled Xero will show a message to this effect under each bank account heading.

Creating invoices

Create invoices with attachments, if required, then email them to customers and keep track of due dates and payments. Once created, you can edit and update invoices at any time, ensuring details are correct and up to date. You can easily adjust the amount due, record a price adjustment or alternatively create a credit note.

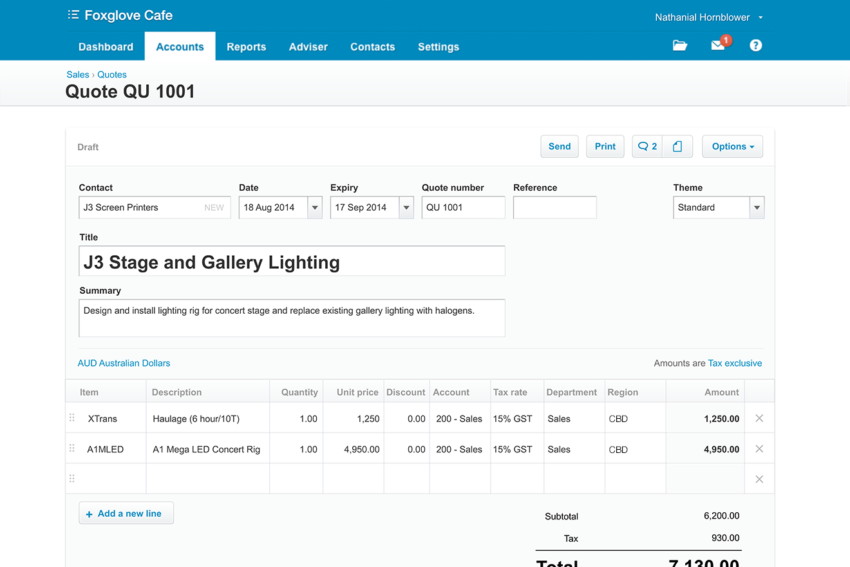

Creating quotes

Creating quotes in Xero accounting software is quick and easy, providing customers with your organisation’s terms of business and full quote details. Attachments can be added easily to provide further details. You can now obtain a report showing all the quotes issued and get an idea of potential income.

What other features are available with Xero?

Inventory management

If your business includes selling a range of items then managing stock is a key part of the success of your business. The inventory management software within Xero will enable you to keep track of stock levels and value on a daily basis. Use Xero to get an up-to-date view on your bestselling product lines and the profit you are making then use this information to make the right decisions about the products to order and how to price them for a profit.

Data security

You can control who has access to your organisation's data and no one can see data unless you invite them into your account. With varying levels of access available, you can restrict individuals on the needs of their job role keeping other data secure.

Each time you log in, you will need to enter a unique code generated by an app on your smartphone.

If you need to access Xero Support you can grant access to your data while they resolve the issue, locking your data back down once they have finished.

Xero mobile app

With the Xero smartphone app you can stay on top of your business while on the move. Most of the functions available in the full version are available through the app giving you day to day management of your business through your mobile phone.

Xero invoice payments

Accept debit card, credit card and direct debit payments straight from Xero payment services like Stripe and GoCardless. Using a payment service with your online invoices adds a 'pay now' button, allowing your customers to pay you instantly online.

Multi-currency accounting

Get paid in over 150 currencies with multi-currency accounting software. Accept payments and receive bills, send invoices, quotes and purchase orders.

All foreign currency transactions are converted into your local currency in real time. With foreign exchange rates updated hourly, you instantly know exactly how gains and losses are affecting your cash flow.

Workplace pensions

Manage your workplace pension via Nest direct through Xero with just a couple of clicks. Download worker communication letters to inform them of enrolment or postponement and opt your employees in or out of the pension scheme.

How can Xero help me run my business?

Once you have your bank feeds working and have reconciled your transactions you are ready to explore all of the reports available to you.

The following reports are just a snapshot of those available:

- Profit & Loss

- Balance Sheet

- Cash Summary

- Account transactions

- Budget Manager

- Statement of Cash Flows

All the reports in the Xero accounting software have a fully customisable feature, enabling you to run a report in seconds for whatever period you need. All reports are printable and can be exported to either Excel, PDF or Google Sheets.

You can also provide your accountant access to Xero giving them the ability to prepare your accounts and returns with minimal involvement from you.

How much does Xero cost?

New businesses opening a Xero account get 50% off any Xero price plan for the first 3 months. The three different plans are explained in the table below.

There are optional extras available with the above accounts and we have provided a summary of the extras available, as well as the associated costs below:

- Payroll - £5 per month for up to 5 employees + £1 per each additional employee.

- Expenses - £2.50 per month + £2.50 per each additional user.

- Projects - £5 per user per month + £5 per each additional user.

- Analytics - £5 per month.

How does Xero accounting software compare with competitors

| Accounting Software Comparison | Xero | Sage | Intuit Quick Books |

| Monthly cost | From £12 + VAT (50% off for the first 4 months) | From £12 + VAT (free for the first 2 months) | From £12 + VAT (90% off for 3 months) |

| Calculate and submit VAT returns | Yes | Yes | Essential & Plus accounts only |

| Self-assessment | No | No | Yes |

| Multi-currency support | Premium plan only | Accounting plan only | Essential & Plus accounts only |

| Importing & exporting data capabilities | Yes | Yes | Yes |

| Payroll | Optional extra | Optional extra | Optional extra |

| Inventory management | Yes | Yes | Plus plan only |

| Cloud based | Yes | Yes | Yes |

What support is offered for Xero accounting software?

Xero has a comprehensive set of support features including FAQ's, video tutorials and online customer support, however it does not currently have a chat function or the ability to speak to somebody on the phone. This means that trying to solve a query can take a few days.

Does Xero accounting software support Making Tax Digital (MTD)?

HMRC's ambition is to become one of the most digitally advanced tax administrations in the world. 'Making Tax Digital' (MTD) is making fundamental changes to the way the tax system works transforming tax administration so that it is:

- more effective

- more efficient

- easier for taxpayers to get their tax right

Many VAT-registered businesses with a taxable turnover above the VAT threshold are now required to use MTD to keep records digitally and use software to submit their VAT Returns.

Xero is fully compliant with the Making Tax Digital programme.

Summary

Xero accounting software is an easy-to-use, flexible accountancy package that can grow with your business. Keeping up to date with transactions on a daily basis takes minutes and the suite of reports available can give you valuable insight into your business.

Giving your accountant access to your accounts through Xero can speed up the preparation of reports and tax submissions thus reducing the cost of their services.